Agreement Deed Trust For Property

Description

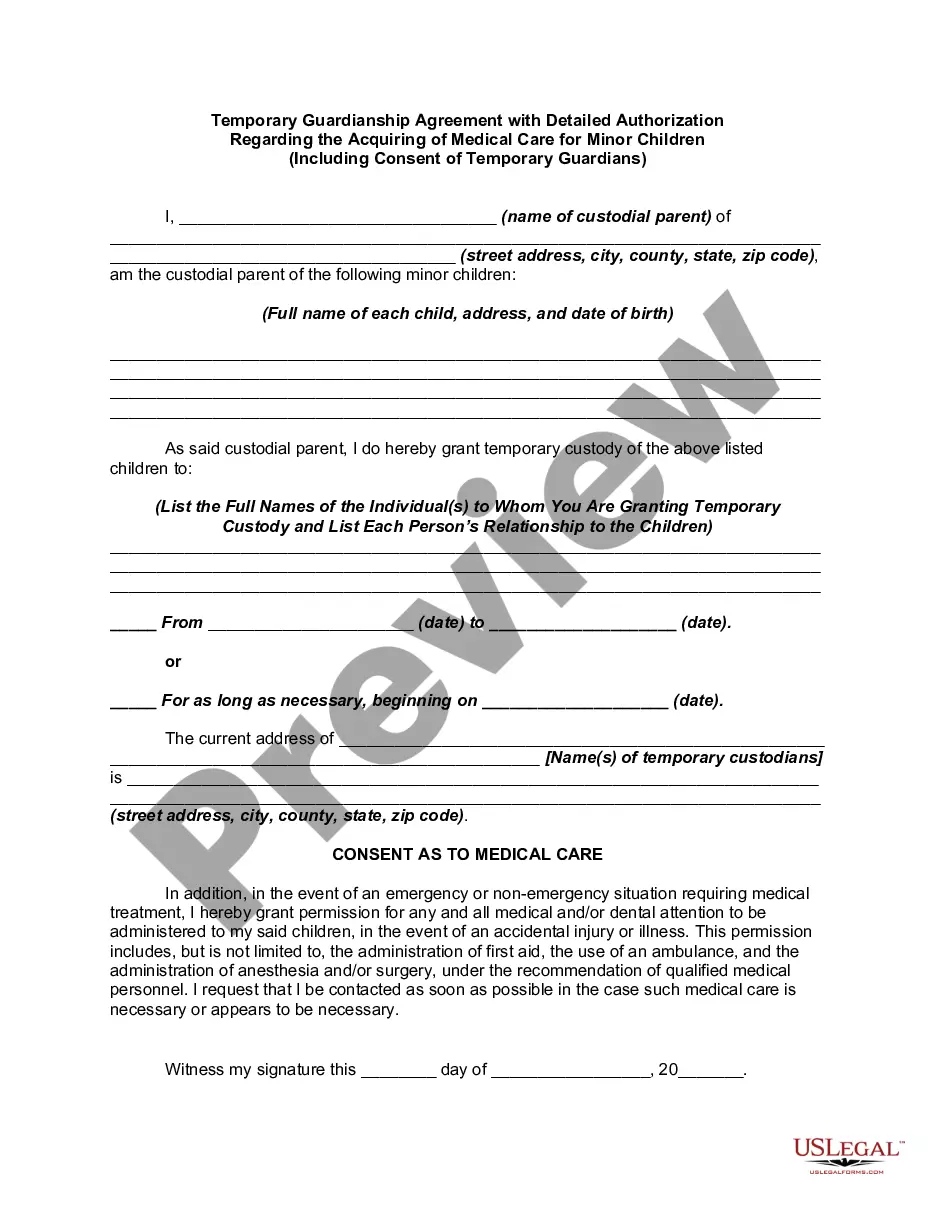

How to fill out Agreement For Rights Under Third Party Deed Of Trust?

Working with legal papers and procedures might be a time-consuming addition to the day. Agreement Deed Trust For Property and forms like it typically need you to search for them and understand the best way to complete them properly. Consequently, whether you are taking care of financial, legal, or individual matters, using a comprehensive and practical online library of forms on hand will help a lot.

US Legal Forms is the number one online platform of legal templates, featuring over 85,000 state-specific forms and numerous resources to assist you to complete your papers quickly. Discover the library of pertinent papers open to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered by any time for downloading. Shield your papers management procedures using a high quality services that lets you put together any form in minutes with no extra or hidden fees. Just log in to the profile, find Agreement Deed Trust For Property and download it right away within the My Forms tab. You may also gain access to previously downloaded forms.

Would it be your first time using US Legal Forms? Sign up and set up your account in a few minutes and you will get access to the form library and Agreement Deed Trust For Property. Then, follow the steps listed below to complete your form:

- Be sure you have the correct form using the Preview feature and reading the form information.

- Select Buy Now as soon as all set, and choose the subscription plan that meets your needs.

- Press Download then complete, eSign, and print the form.

US Legal Forms has 25 years of expertise assisting users manage their legal papers. Discover the form you want today and streamline any process without breaking a sweat.

Form popularity

FAQ

Trust Deed Disadvantages You will be unable to obtain credit. ... They are not appropriate for secured obligations. ... They can cause issues for business owners. ... Your trustee has the authority to claim new assets.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

A deed of trust is often used when state law requires it or when a traditional lending service (like a bank) is not involved in the transaction. Whether you have a deed of trust or a mortgage, they both ensure that the borrower repays the loan, either to a lender or an individual person.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Trust deeds are an alternative to mortgages in certain states. Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee.