Employee Option Agreement For Payroll Deduction

Description

How to fill out Employee Stock Option Agreement?

Steering through the red tape of official paperwork and formats can be daunting, particularly when one does not engage in that professionally.

Even selecting the appropriate format for an Employee Option Agreement For Payroll Deduction will require a considerable amount of time, as it must be both legitimate and exact to the last numeral.

Nevertheless, you will need to invest considerably less time sourcing a suitable format from a source you can rely on.

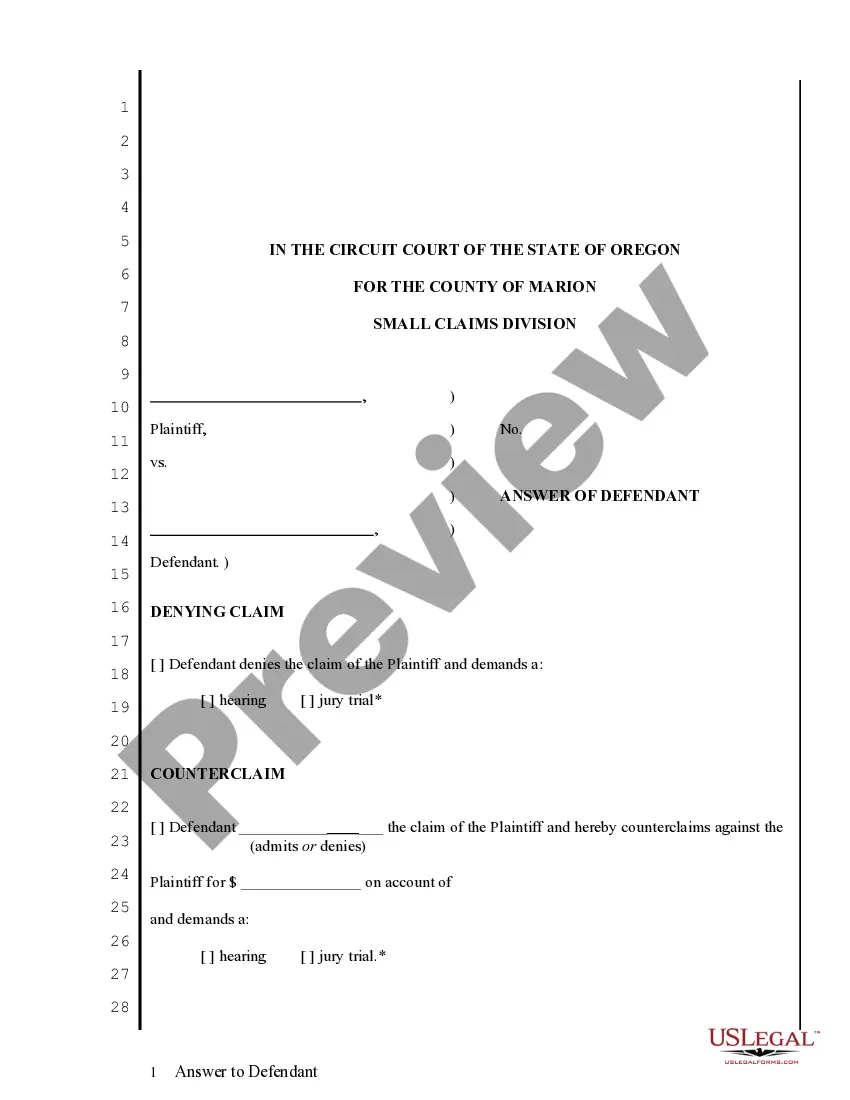

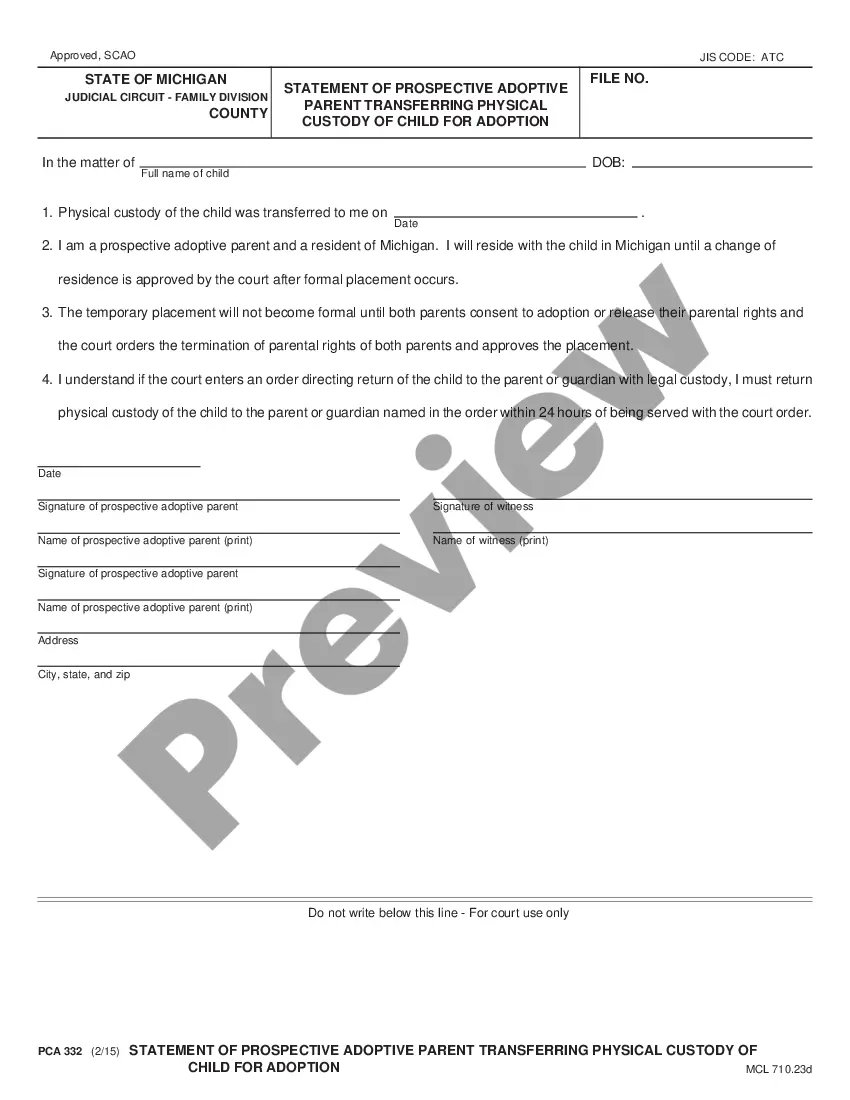

Obtain the correct form in a few straightforward steps: Enter the document name in the search box. Identify the appropriate Employee Option Agreement For Payroll Deduction from the results. Review the sample description or open its preview. If the template meets your needs, click Buy Now. Move on to select your subscription plan. Use your email and create a secure password to register an account at US Legal Forms. Choose a payment method via credit card or PayPal. Save the template document onto your device in your preferred format. US Legal Forms can help you conserve time and energy verifying whether the form you found online meets your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that eases the process of locating the correct forms online.

- US Legal Forms is a singular site you require to acquire the latest document samples, verify their usage, and download these samples for completion.

- It serves as a repository with over 85,000 forms applicable in diverse sectors.

- When searching for an Employee Option Agreement For Payroll Deduction, you won’t need to question its authenticity as all forms are validated.

- Having an account at US Legal Forms guarantees you have all necessary samples readily available.

- You can save them in your history or add them to the My documents collection.

- Access your saved forms from any device by simply clicking Log In on the library website.

- If you don’t have an account yet, you can always search for the template you require.

Form popularity

FAQ

What are payroll deductions?Income tax.Social security tax.401(k) contributions.Wage garnishments.Child support payments.

Payroll deductions are the specific amounts that you withhold from an employee's paycheck each pay period. There are two types of deductions: voluntary deductions, such as health insurance and 401(k) deductions, and mandatory deductions (those required by law), such as federal income taxes and FICA taxes.

Payroll deduction agreements are agreements where employers deduct payments from taxpayer's wages, and mail them to the Internal Revenue Service. Direct debit installment agreements allow the IRS to debit taxpayers' bank accounts.

How Do I Show a General Journal Entry for Company Deductions From Employee Payroll?Debit "Wages Expense" for the full amount the company must pay for the pay period.Credit "Net Payroll Payable" and any deductions required.Add the total number of debits and then add the total number of credits.More items...

Some common voluntary payroll deduction plan examples include: 401(k) plan, IRA, or other retirement savings plan contributions. Medical, dental, or vision health insurance plans. Flexible spending account or pre-tax health savings account contributions.