Title: Understanding Profit: A Detailed Explanation and Template with Google Sheets Introduction: Profit is a crucial financial metric that reflects the overall financial success of a business or individual. It measures the surplus or excess income earned after deducting all expenses and costs. This detailed description aims to provide an in-depth understanding of profit, its significance, and how to create a profit template using Google Sheets. Additionally, we will touch upon different types of profit commonly encountered in business. I. What is Profit? Profit is the financial gain realized after subtracting all expenses, costs, and taxes from the total revenue generated. It represents the surplus funds available to a business or individual, indicating their financial health and performance. Profit enables businesses to reinvest, expand, provide dividends to shareholders, and rewards entrepreneurs for their efforts. Different Types of Profit: 1. Gross Profit: Gross profit is the initial surplus calculated by subtracting the cost of goods sold (COGS) from total revenue. It presents a snapshot of a company's ability to generate revenue and cover direct production costs. 2. Operating Profit (Operating Income/Earnings): Operating profit is derived by deducting operating expenses, such as rent, utilities, salaries, and marketing expenses, from the gross profit. It reflects a business's core operational performance. 3. Net Profit (Net Income/Bottom Line): Net profit is the ultimate profit metric, obtained by subtracting all expenses, including taxes and interest, from the operating profit. It portrays the overall financial success of a business after all costs have been accounted for. Creating a Profit Template with Google Sheets: Google Sheets provides a versatile platform to create, manage, and analyze profit calculations effectively. By utilizing formulas and templates, you can automate the process and track financial performance effortlessly. Here's a simple profit template in Google Sheets: 1. Set up Columns: — Revenue: Enter the total revenue earned within a specific time period. — Cost of Goods Sold (COGS): Input the direct production costs associated with goods or services. — Gross Profit: Calculate by deducting COGS from revenue. — Operating Expenses: List out all operating expenses. — Operating Profit: Calculate by subtracting operating expenses from gross profit. — Taxes and Interest: Include taxes and interest expenses if applicable. — Net Profit: Calculate by deducting taxes and interest from operating profit. 2. Apply Formulas: — Gross Profit: Use the formula "= Revenue — COGS"— - Operating Profit: Utilize the formula "= Gross Profit — Operating Expenses"— - Net Profit: Apply the formula "= Operating Profit Takexe— - Interest". 3. Use Charts and Graphs: Visualize profit trends using bar charts, pie charts, or line graphs integrated into Google Sheets. This will help you gain insights into your business's financial performance over time. Conclusion: Understanding profit is crucial for any business or individual seeking financial success. By comprehending the different types of profit, such as gross profit, operating profit, and net profit, businesses can make informed decisions and strategize effectively. Utilizing Google Sheets' customizable templates and formulas simplifies profit calculations, enabling users to track and analyze their financial performance efficiently.

Profit And Template With Google Sheets

Description

How to fill out Profit And Template With Google Sheets?

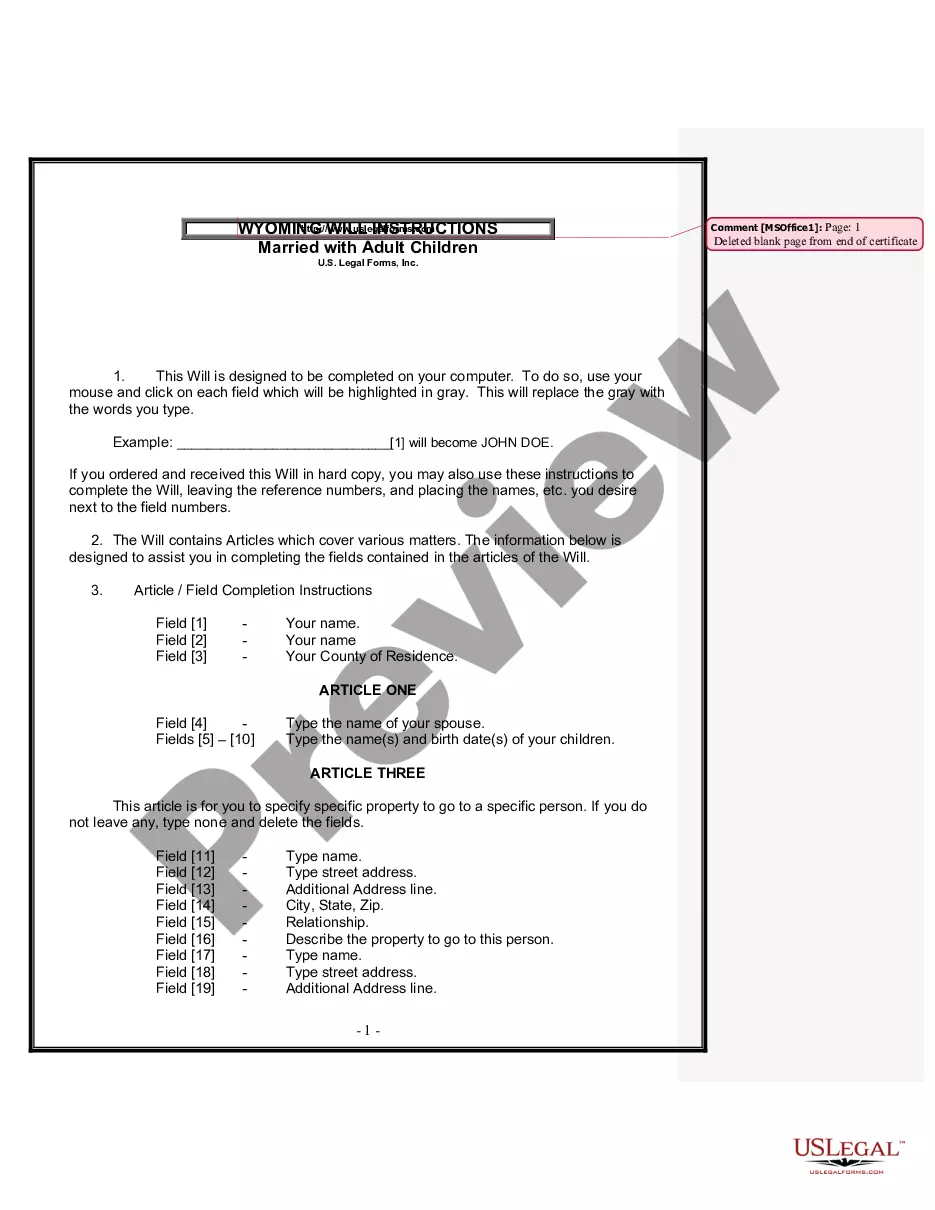

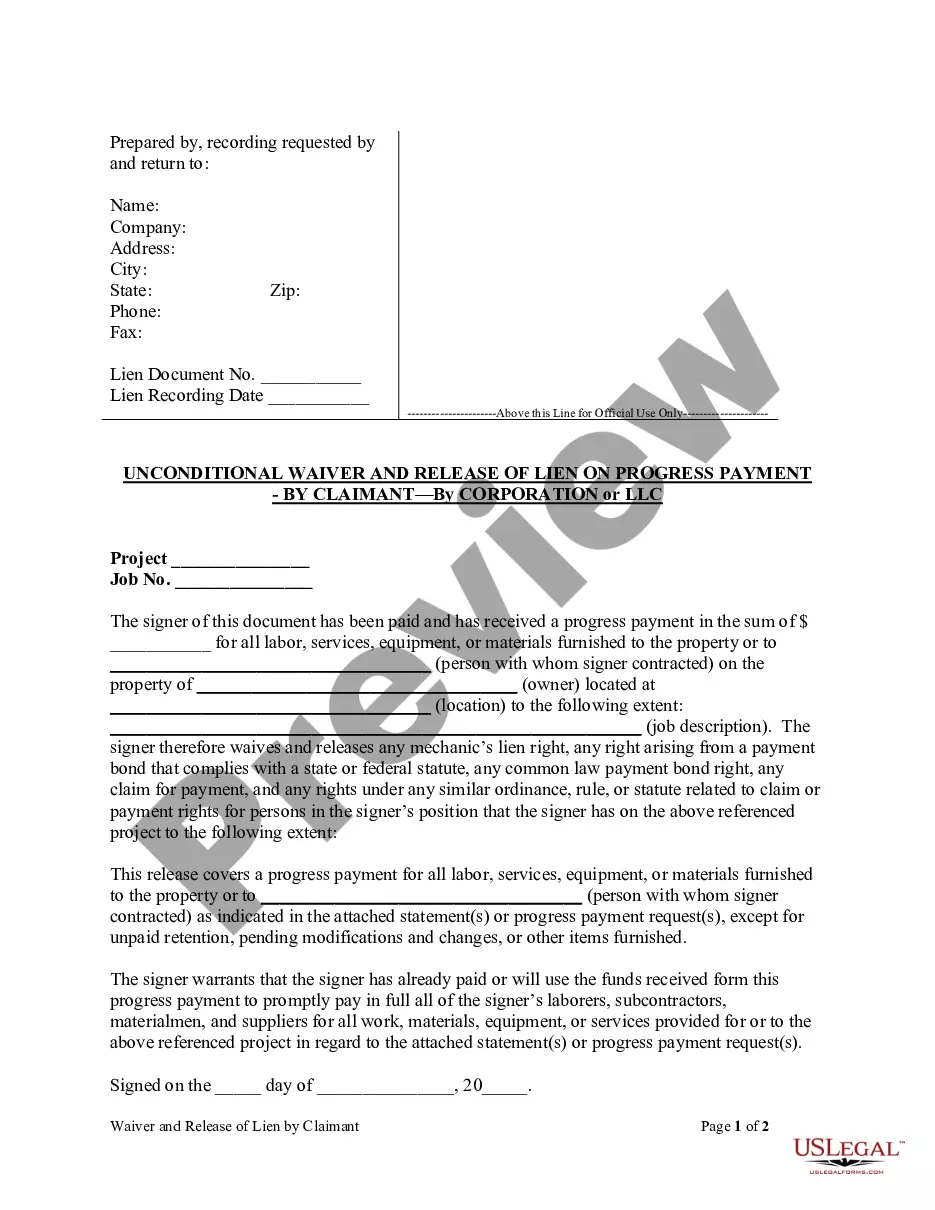

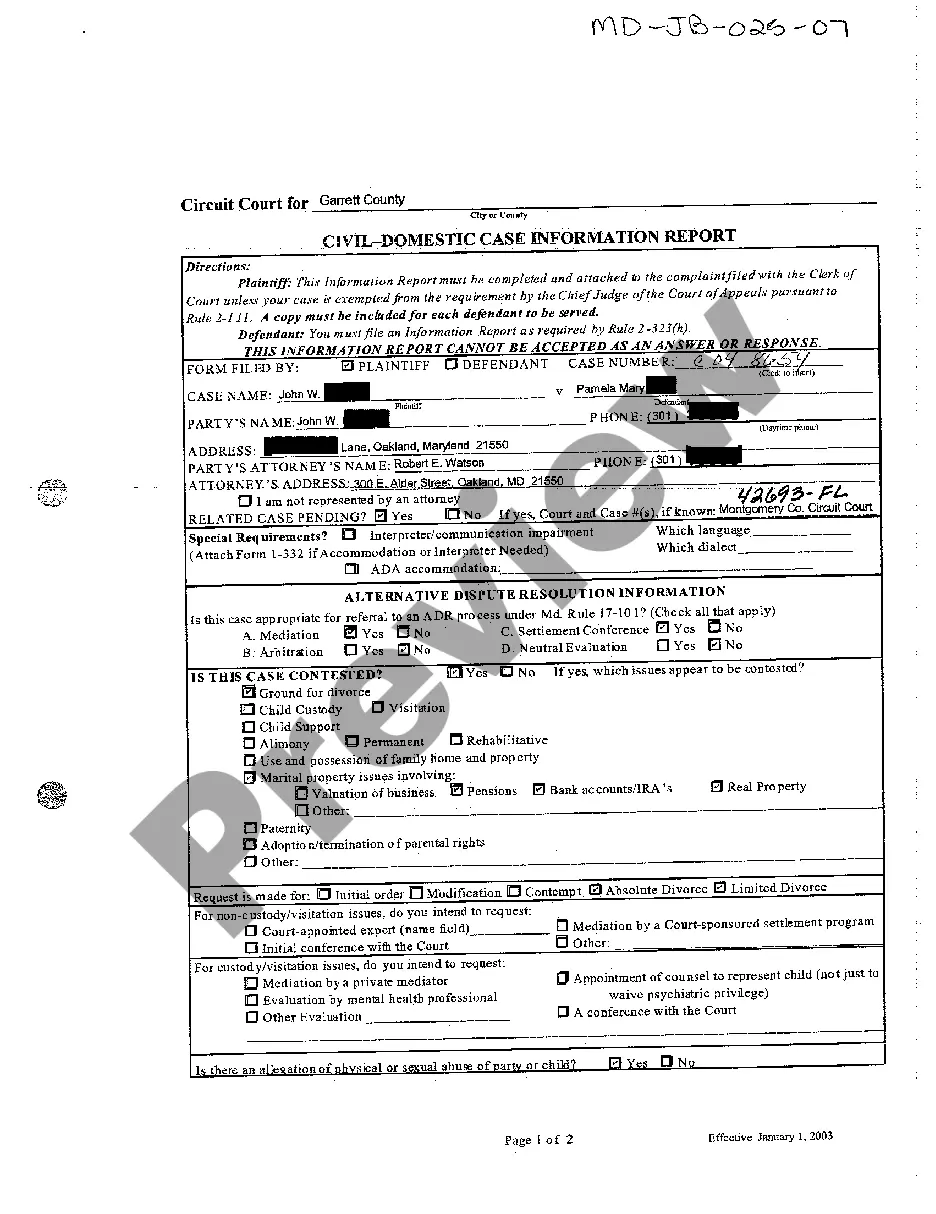

Accessing legal templates that meet the federal and regional regulations is a matter of necessity, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the right Profit And Template With Google Sheets sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any business and life case. They are simple to browse with all papers arranged by state and purpose of use. Our specialists stay up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Profit And Template With Google Sheets from our website.

Obtaining a Profit And Template With Google Sheets is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

- Examine the template utilizing the Preview option or through the text outline to make certain it meets your requirements.

- Locate a different sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Profit And Template With Google Sheets and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Analyzing Net Profit and Loss with SUM Function in Google Sheets. The net profit or loss is the ultimate measure of a company's financial performance. To calculate net profit or loss, subtract the total operating expenses from the gross profit.

About the Profit and Loss Report for Google Sheets Open the Extensions menu at the top of your Google Sheet. Choose Tiller Community Solutions > Reports > Profit & Loss. Configure the report to meet your needs. Click Create Report.

Yearly Profit and Loss Statement - free Google Sheet Template - 10062846. Make life easier by using a profit and loss template to track your company's income and expenses.

You can create a regular sheet that you want to use as a template, and name it something like "Template." Once you create it, go to File -> Make a Copy, then rename it as a new sheet. When you want to use it again as a template, just open it, and "Make a Copy" and go from there.