Liability Company Online For Dummies

Description

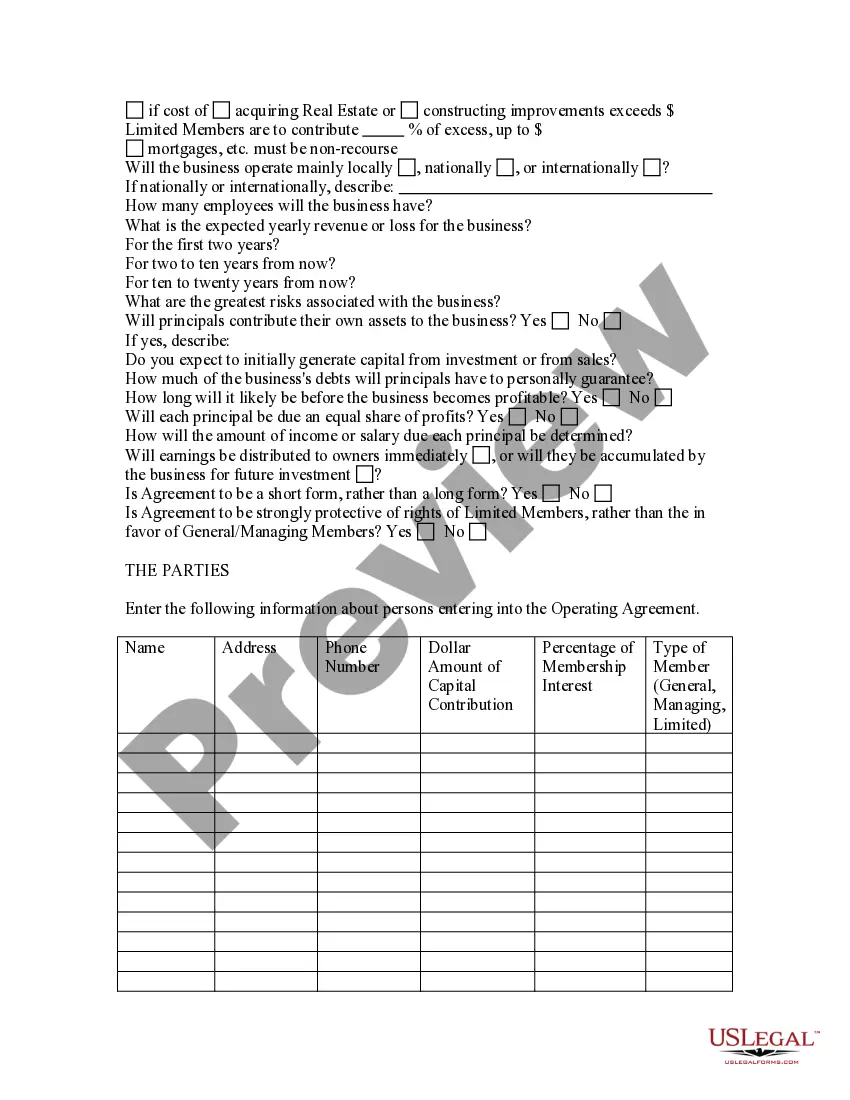

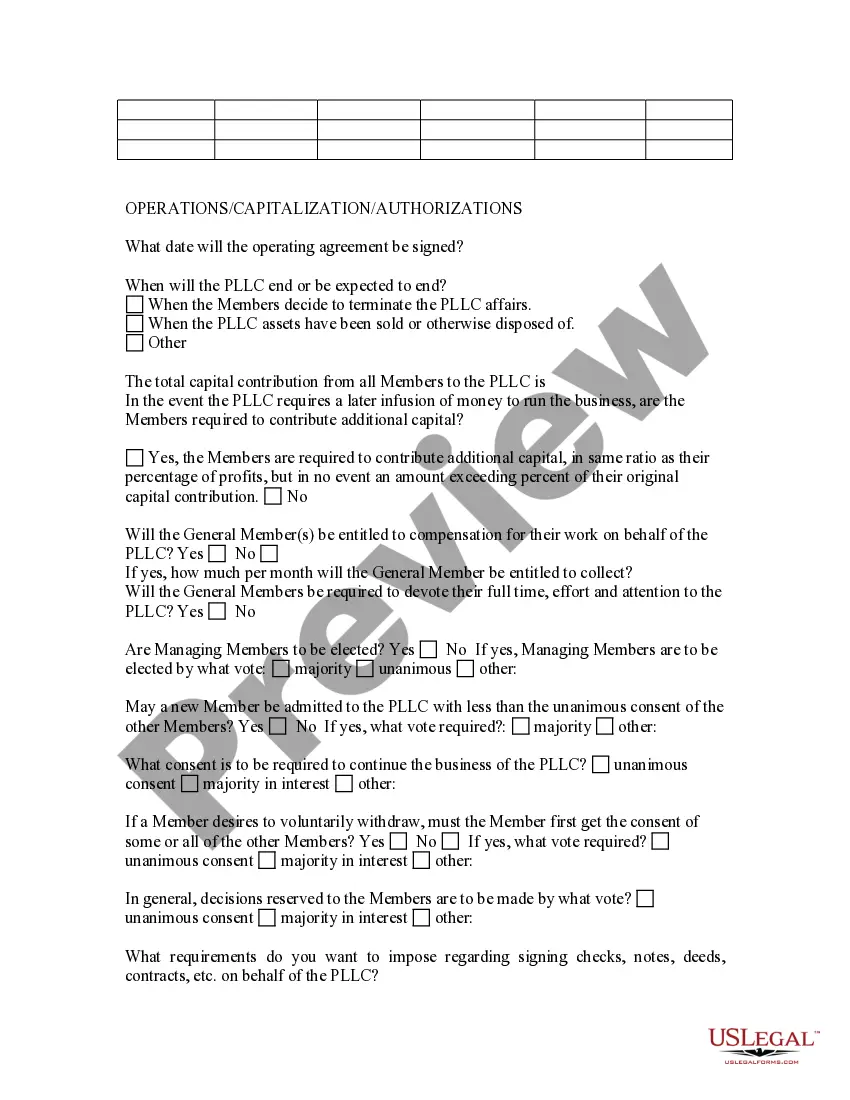

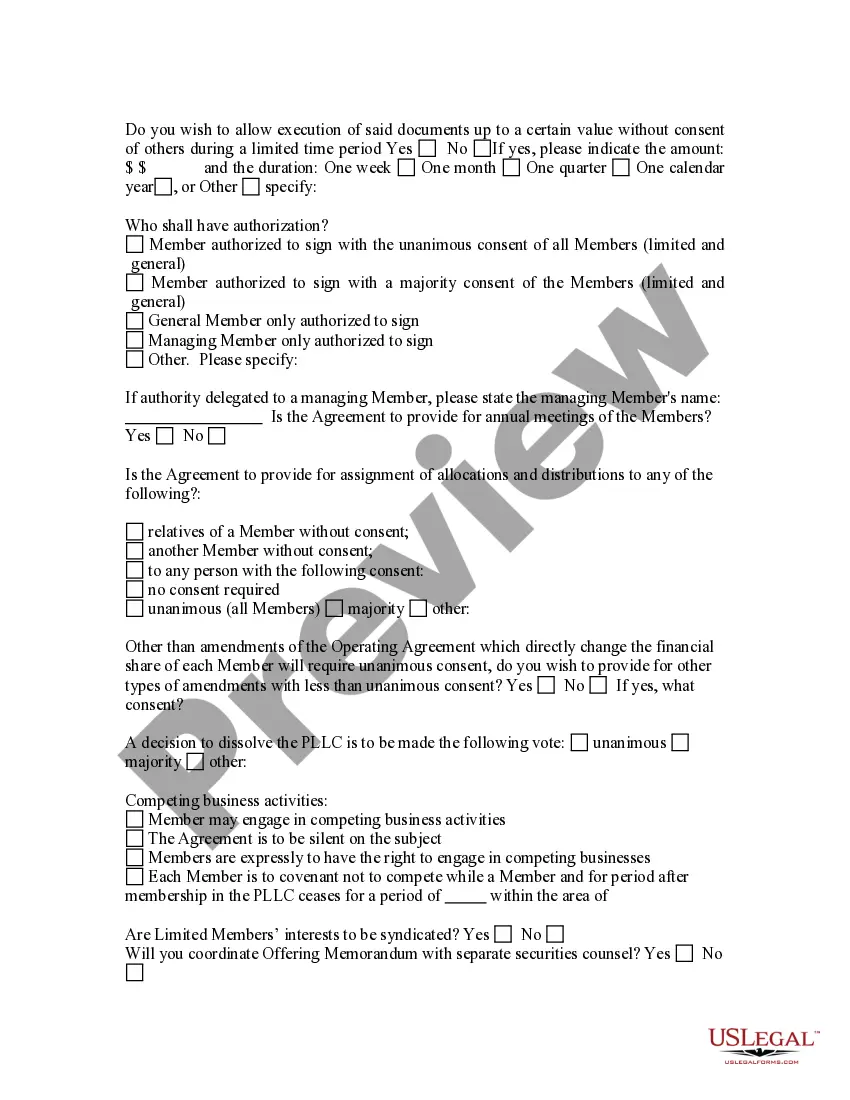

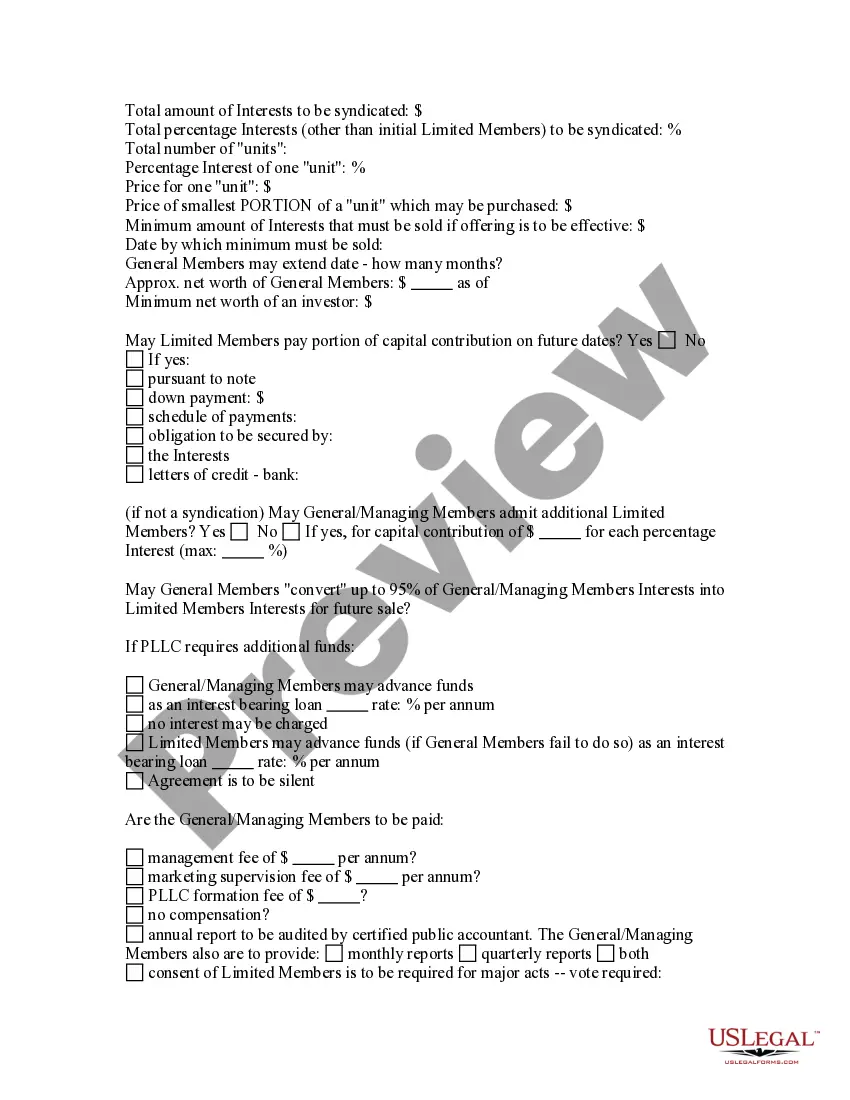

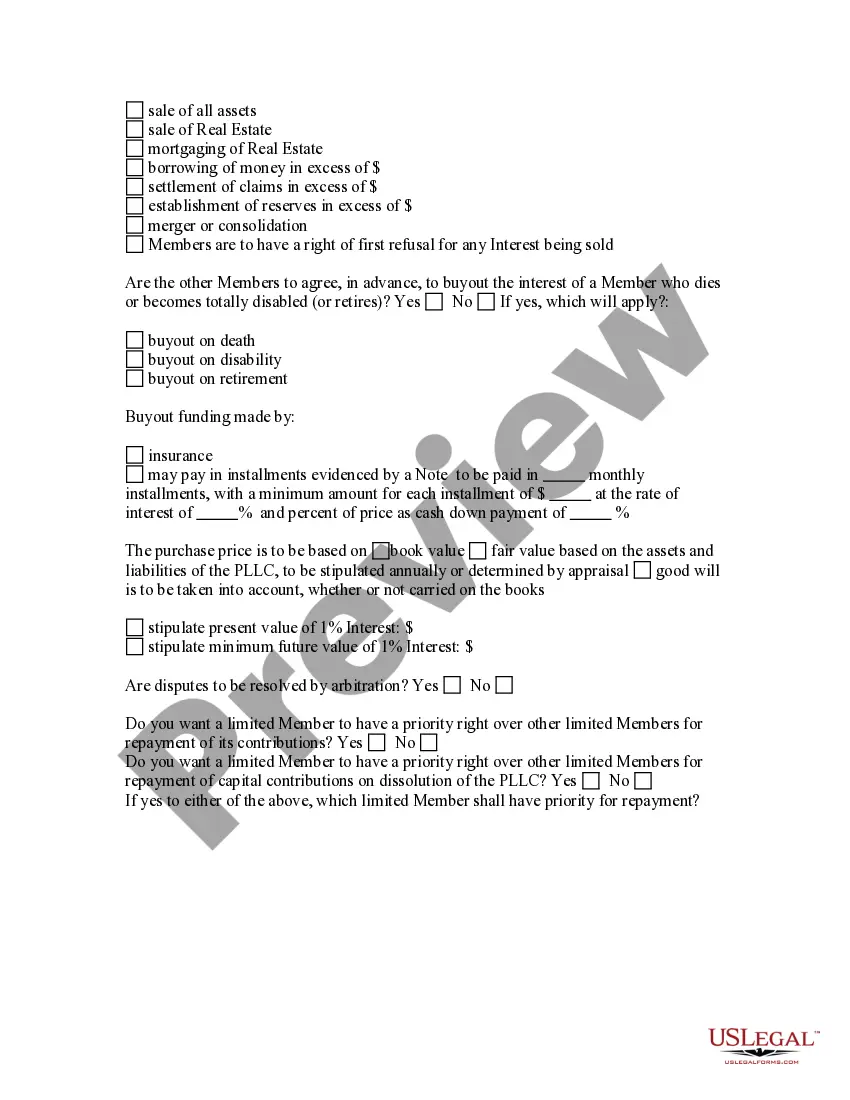

How to fill out Professional Limited Liability Company - PLLC - Formation Questionnaire?

It’s no secret that you can’t become a law expert immediately, nor can you learn how to quickly prepare Liability Company Online For Dummies without the need of a specialized background. Creating legal documents is a time-consuming process requiring a certain training and skills. So why not leave the preparation of the Liability Company Online For Dummies to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and get the form you need in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Liability Company Online For Dummies is what you’re looking for.

- Begin your search over if you need any other form.

- Register for a free account and select a subscription option to purchase the template.

- Pick Buy now. Once the payment is through, you can download the Liability Company Online For Dummies, fill it out, print it, and send or mail it to the designated people or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

In business, limited liability is about reducing your personal exposure to financial risk. If your business fails (or is sued) then the amount of money for which you are liable is limited by the business structure. There are a number of different forms that this 'safety net' can take.

The Top 10 Disadvantages of LLC are listed below. Limited liability has limits. Self-employment tax. Consequences of member turnover. Personal liability protection. Corporate taxes are usually bypassed. Difficult to transfer ownership. Self-Employment Taxes. Confusion About Roles.

LLC, there are minor differences, but they are largely the same. LLCs and Ltds are governed under state law, but the primary difference is Ltds pay taxes while LLCs do not. The abbreviation ?Ltd? means limited and is most commonly seen within the European Union and affords owners the same protections as an LLC.

Limited liability companies are one of the most flexible business entities. They allow you to choose how to distribute the profits, decide who manages the day-to-day business affairs, and decide how the profits will be taxed. They also offer a lot in terms of liability protection.

Steps to Start an LLC Choose a Name for Your LLC. Appoint a Registered Agent. File Your Articles of Organization. Decide Whether Your LLC Should Be Member-Managed or Manager-Managed. Create an LLC Operating Agreement. Comply With Tax and Regulatory Requirements. File Your Annual Reports. Register to Do Business in Other States.