Limited Partnership Foreign Hybrid

Description

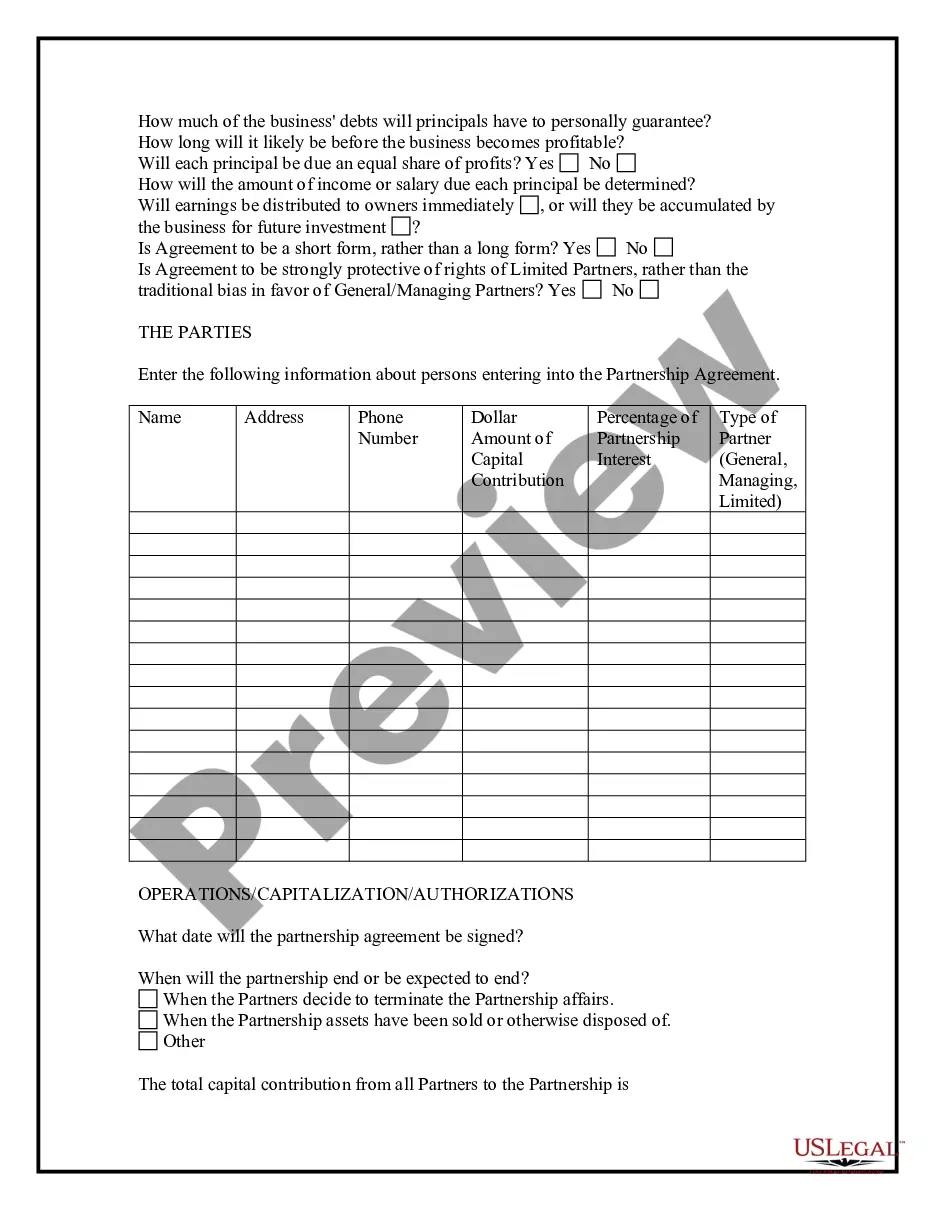

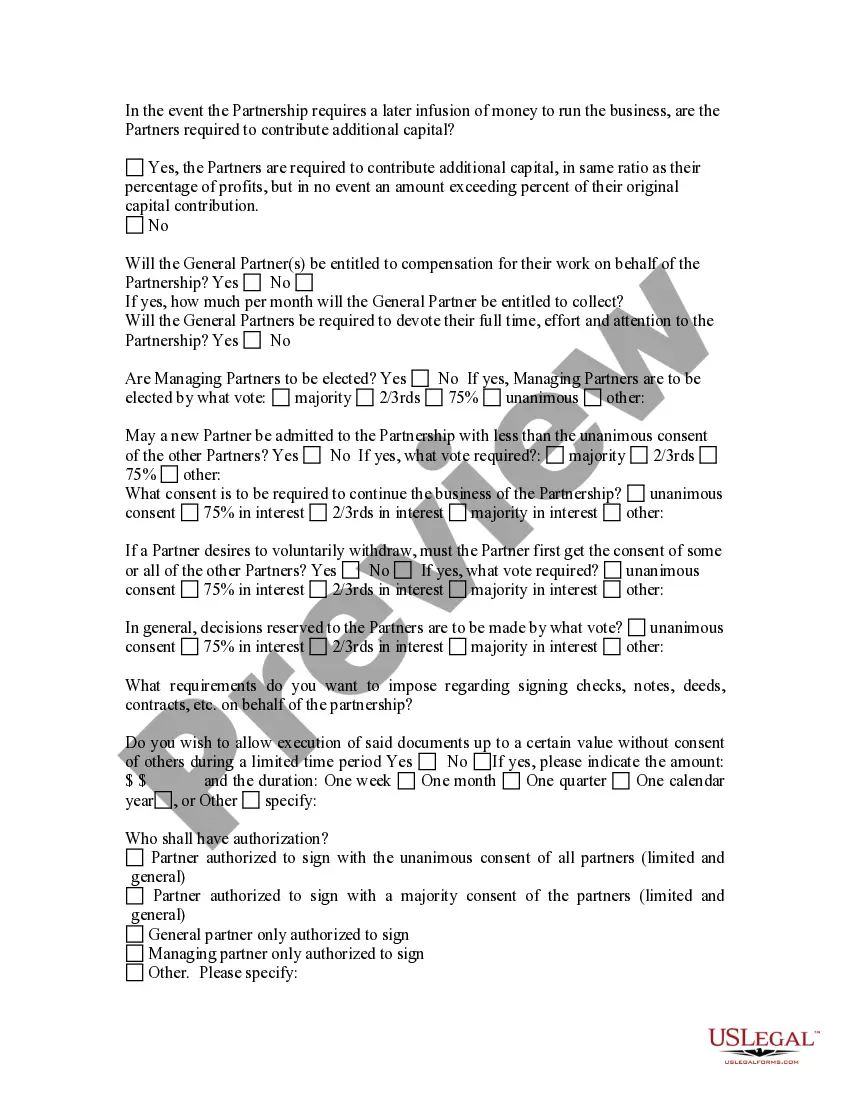

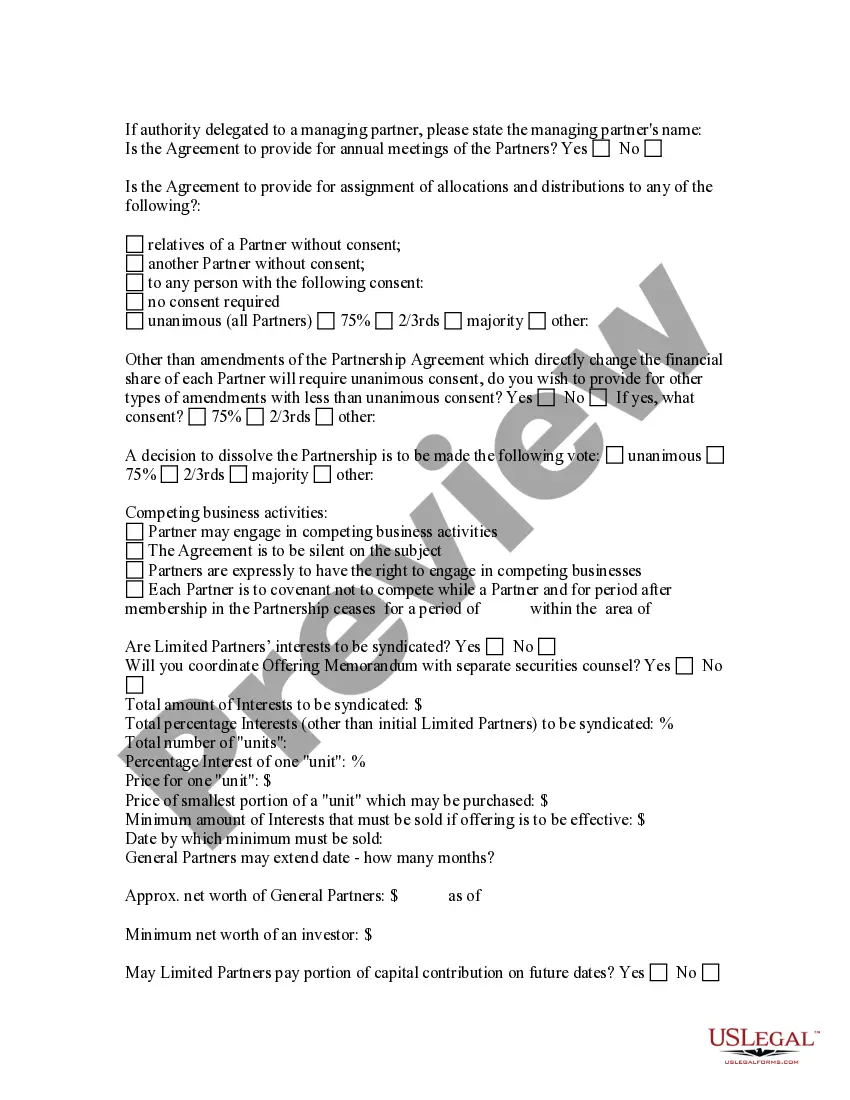

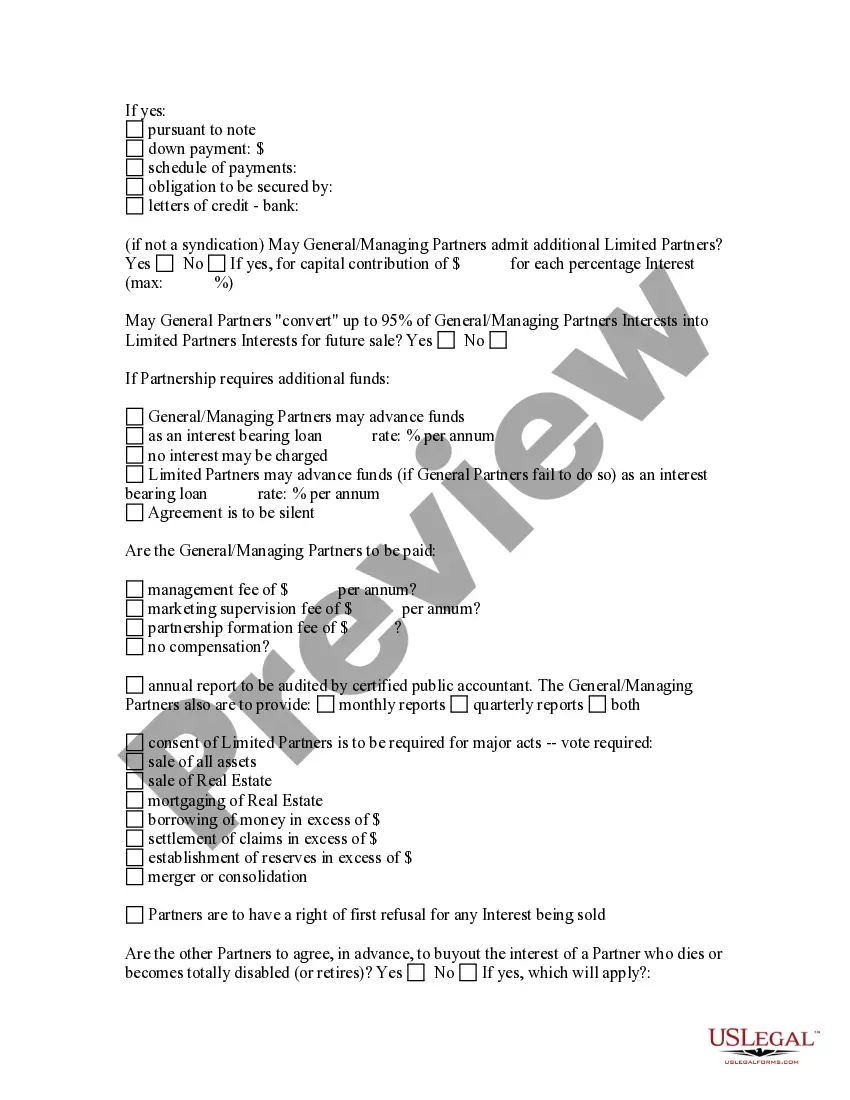

How to fill out Limited Partnership Formation Questionnaire?

Legal administration can be overwhelming, even for seasoned professionals.

When you are looking for a Limited Partnership Foreign Hybrid and do not have the time to dedicate to finding the right and updated version, the processes can be anxiety-inducing.

US Legal Forms addresses any needs you may have, from personal to business documents, all in one location.

Utilize advanced tools to complete and manage your Limited Partnership Foreign Hybrid.

Here are the steps to follow after downloading the form you require: Verify that it is the correct form by previewing it and reviewing its description.

- Access a resource base of articles, tutorials, and guides related to your situation and requirements.

- Conserve time and effort searching for the documents you need, and take advantage of US Legal Forms’ advanced search and Review tool to find Limited Partnership Foreign Hybrid and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, locate the form, and retrieve it.

- Check your My documents tab to view the documents you previously saved and to organize your folders as you see fit.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the platform's benefits.

- A solid web form library could be a game changer for anyone who wants to manage these circumstances effectively.

- US Legal Forms is a frontrunner in online legal forms, with more than 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can access state- or county-specific legal and business forms.

Form popularity

FAQ

To report a foreign partnership to the IRS, you need to use Form 1065 and attach Schedule K-1 for each partner, including foreign partners. This process ensures complete compliance with tax regulations regarding limited partnership foreign hybrids. It's vital to accurately report income and distributions to avoid issues. USLegalForms offers the necessary templates and guidance to simplify this reporting process.

Absolutely, a U.S. partnership can have foreign partners, and this scenario often occurs with limited partnership foreign hybrids. Including foreign partners can broaden the partnership's scope and resources. However, both the U.S. partnership and the foreign partners must recognize specific tax obligations. To navigate these complexities, consulting USLegalForms can provide clarity and necessary documentation.

Yes, foreign partnerships classified as limited partnership foreign hybrids must file Form 1065 if they have income effectively connected with a U.S. trade or business. This is crucial for accurately reporting the partnership's income and expenses. Failing to file can lead to penalties, so it's essential to understand your obligations. For seamless compliance, consider using USLegalForms to ensure you have the right forms and guidance.

Individuals involved in a Limited partnership foreign hybrid must complete Form 8865 if they meet certain criteria. This includes partners who have invested in a foreign partnership or those who have a stake in a foreign entity categorized under U.S. tax law. By filing this form, you help the IRS understand the income and tax obligations tied to your foreign investments. Using the US Legal Forms platform simplifies this process, offering clear guidance and the necessary documents for your compliance.

Yes, a limited partnership foreign hybrid combines elements of both partnerships and corporations. In this structure, you have general partners who manage the business and limited partners who invest without taking part in daily operations. This combination offers flexibility and can provide liability protection for limited partners. Exploring the advantages of a limited partnership foreign hybrid can be beneficial, especially when using a platform like USLegalForms to ensure proper formation and compliance.

Yes, a foreign individual can become a partner in a U.S. partnership. This inclusion opens doors for international collaboration and investment opportunities. The limited partnership foreign hybrid structure further simplifies participation, allowing foreign partners to share in profits while managing their risks effectively.

A foreign limited partnership is an investment structure formed under the laws of one country that operates in another. It allows individuals or entities from outside the U.S. to engage in business activities while limiting their liability. By establishing a limited partnership foreign hybrid, investors can navigate legal requirements while optimizing their business operations in the U.S.

Yes, a non-U.S. citizen can be a partner in a Limited Liability Company (LLC). This inclusive approach allows foreign individuals or entities to invest and participate in U.S. business ventures. They can enjoy the same protections and benefits as U.S. citizens, contributing to the growing trend of limited partnership foreign hybrids.

A foreign hybrid limited partnership is a unique business structure that allows foreign investors to participate in U.S. markets. It combines elements of both foreign and domestic partnerships, providing flexibility in management and operations. This type of partnership often benefits from favorable tax treatment, making it appealing for international investors looking to engage in U.S. business activities.