Estate Questionnaire With Scoring

Description

How to fill out Estate Planning Questionnaire?

Regardless of whether it is for commercial objectives or personal matters, everyone must handle legal issues at some point in their lives.

Completing legal documents necessitates meticulous focus, beginning with selecting the appropriate form template.

Once it is saved, you can fill out the form with editing software or print it out and complete it by hand. With an extensive US Legal Forms catalog available, you don’t have to waste time searching for the correct sample online. Utilize the library’s easy navigation to find the suitable template for any occasion.

- For example, if you choose an incorrect version of an Estate Questionnaire With Scoring, it will be rejected upon submission.

- Thus, it is essential to obtain a trustworthy source of legal documents such as US Legal Forms.

- If you need to obtain an Estate Questionnaire With Scoring template, follow these simple steps.

- Use the search bar or browse the catalog to find the sample you require.

- Review the form’s details to ensure it aligns with your circumstances, state, and area.

- Click on the form’s preview to review it.

- If it is not the correct document, return to the search tool to find the Estate Questionnaire With Scoring template you need.

- Obtain the template if it meets your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the registration form for the account.

- Select your payment method: you can use a credit card or a PayPal account.

- Choose the file format you wish and download the Estate Questionnaire With Scoring.

Form popularity

FAQ

Suze Orman emphasizes the importance of trusts for protecting your assets and ensuring they are distributed according to your wishes. She advocates for clear communication and proper planning to avoid future disputes. Incorporating an estate questionnaire with scoring can help you align your trust setup with Orman's advice, leading to a more secure financial future.

The 5 and 5 rule is a principle that allows a beneficiary to withdraw up to 5% of the trust's assets each year, but not more than the total value of the trust over a five-year period. This rule helps manage distributions while preserving the trust for future needs. An estate questionnaire with scoring can clarify how this framework impacts your overall estate planning strategy.

The 5 by 5 rule allows beneficiaries of a trust to withdraw up to 5% of the trust’s value each year, up to a maximum of 5 years’ worth of withdrawals. This rule can provide flexibility while also ensuring that the trust maintains its value over time. When using an estate questionnaire with scoring, you can easily determine how these rules apply to your specific situation.

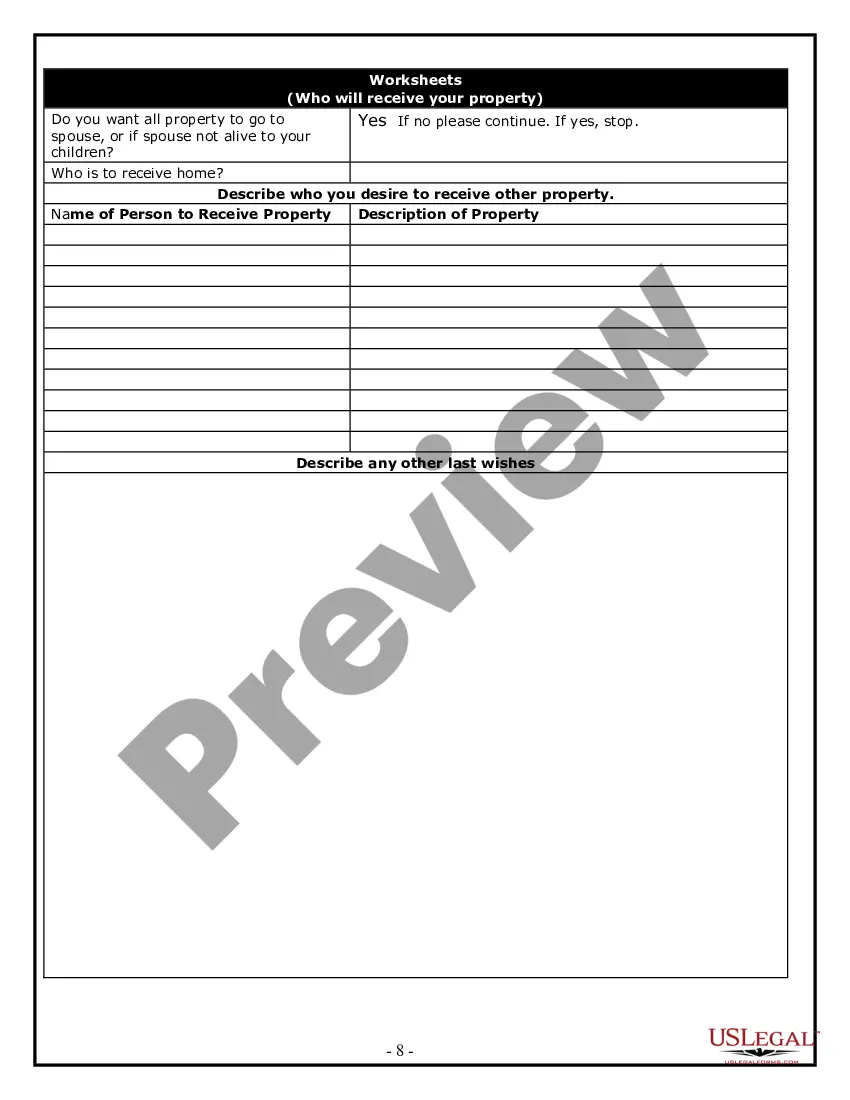

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define the terms and conditions. This can lead to confusion and disputes among beneficiaries. Utilizing an estate questionnaire with scoring can guide you through the process, ensuring you cover all essential details and avoid common pitfalls.

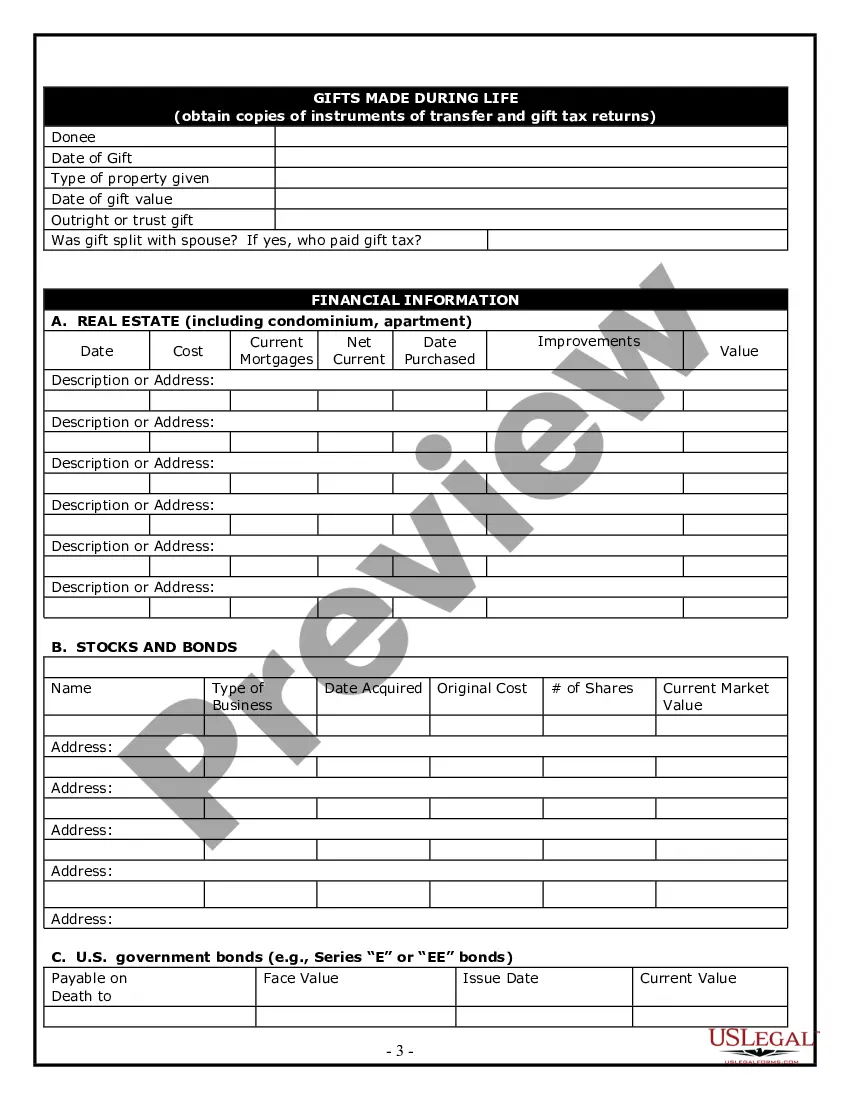

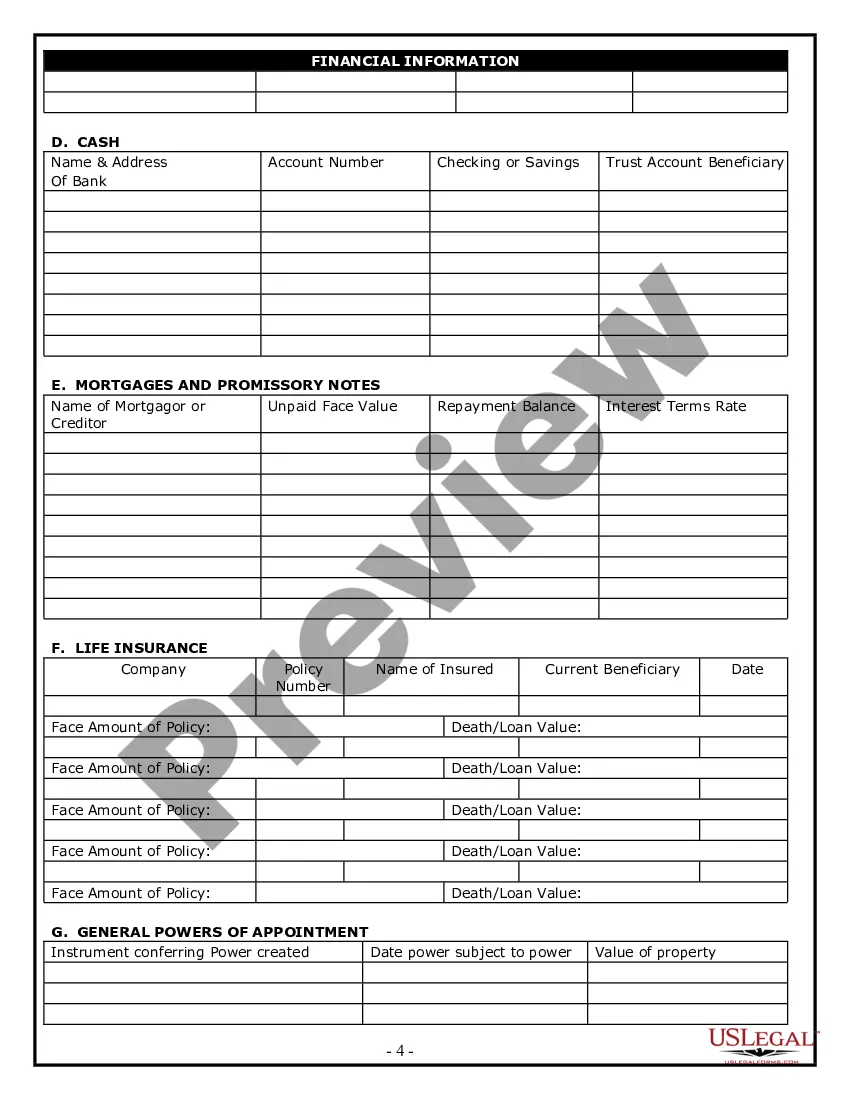

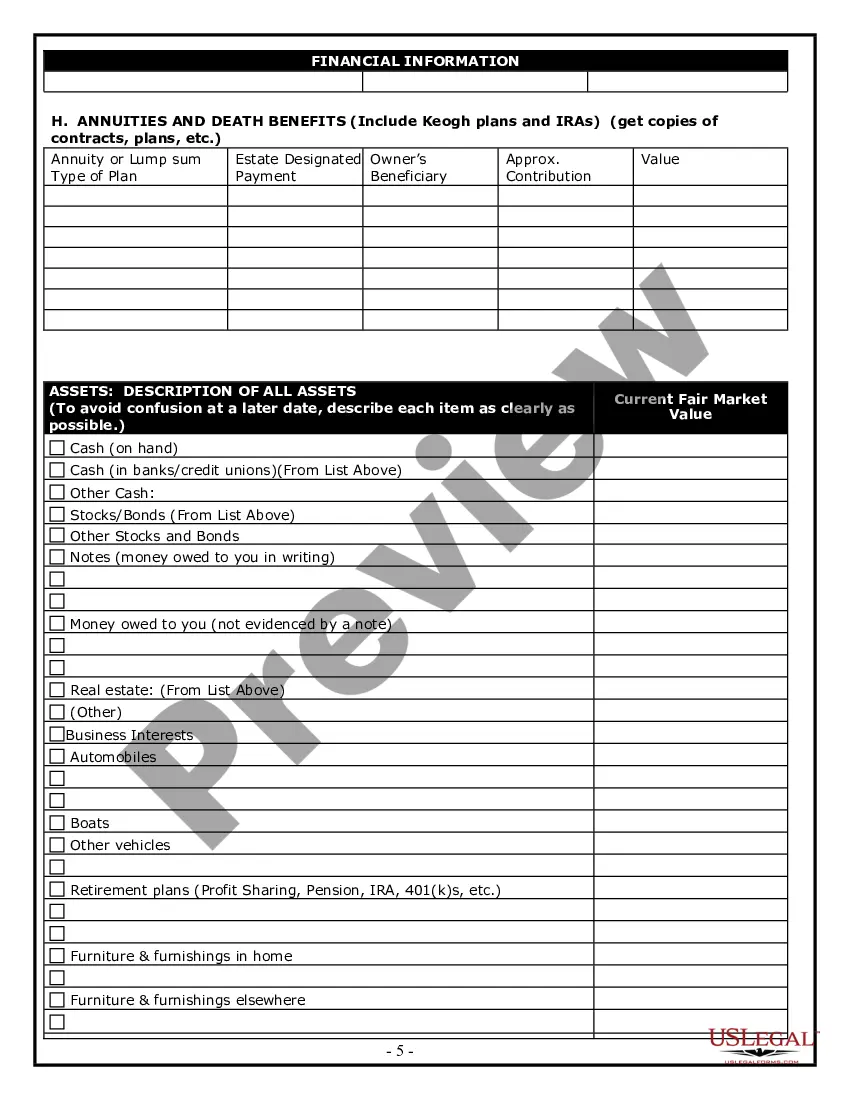

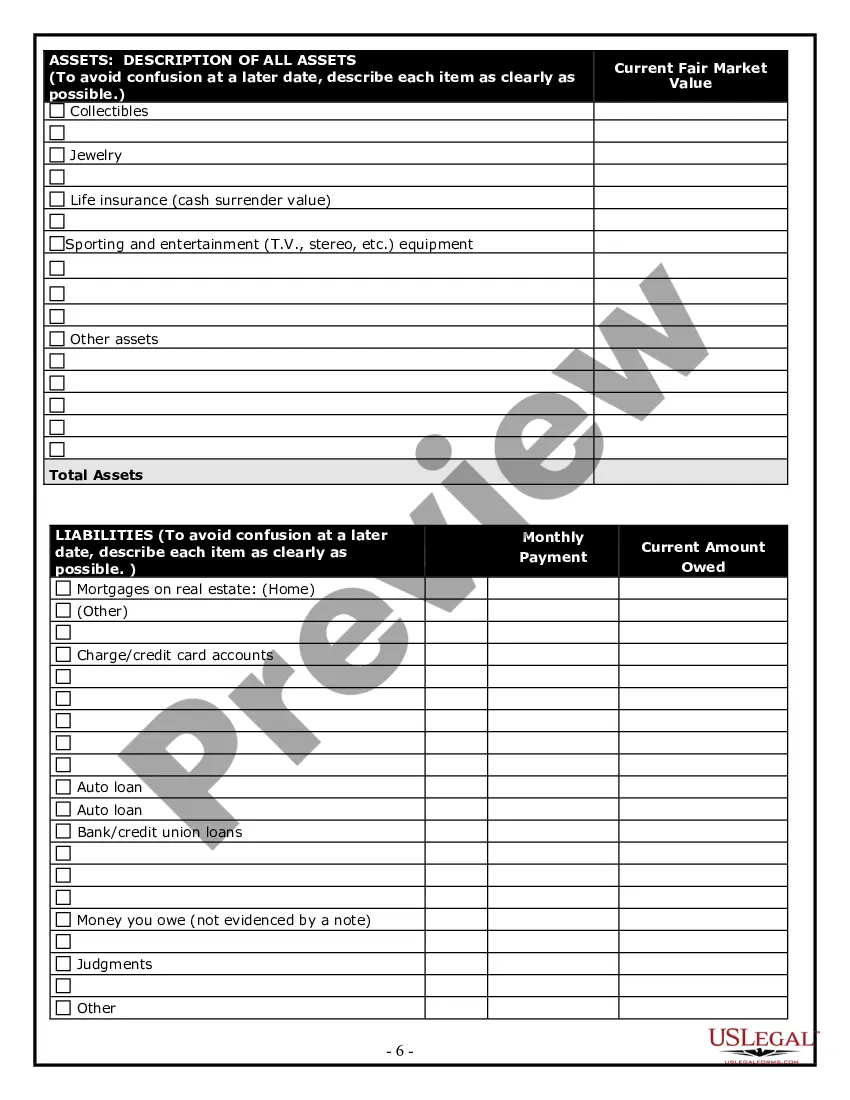

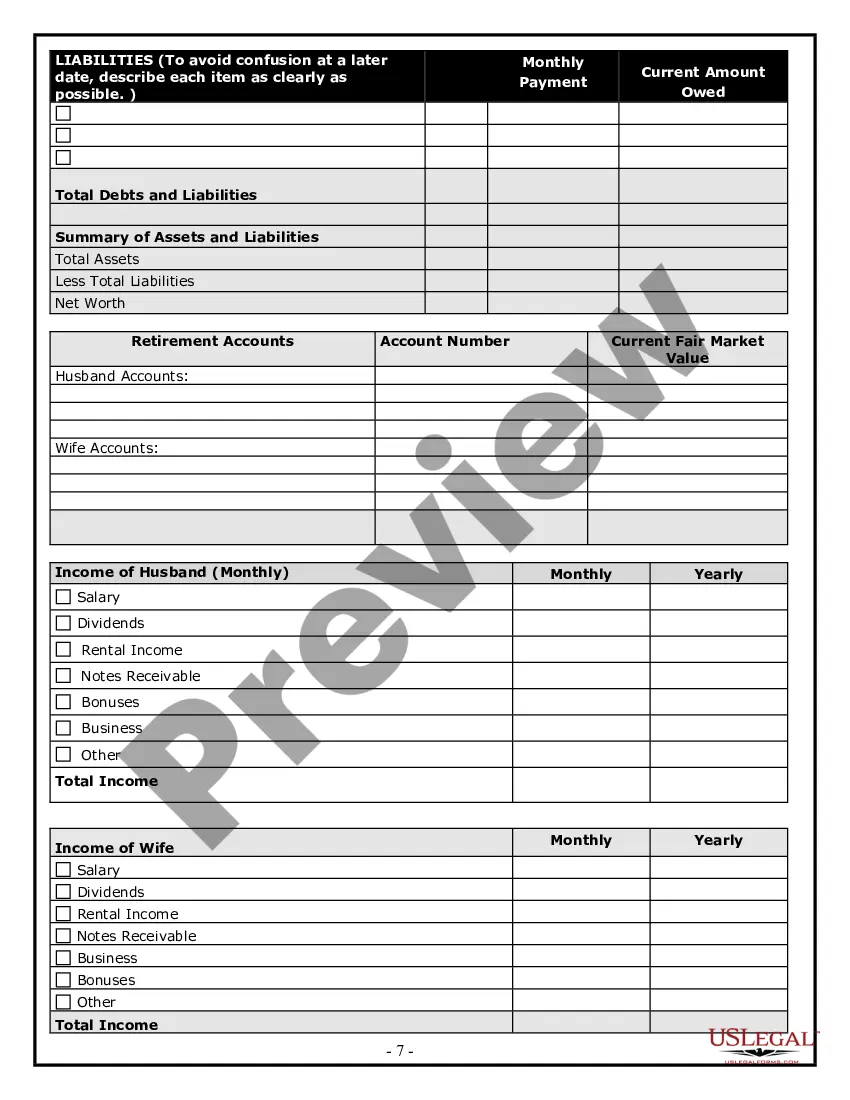

To calculate the value of your estate, start by listing all your assets, including real estate, vehicles, investments, and personal property. Next, assess the current market value of each item, subtract any outstanding debts, and consider liabilities. Using an estate questionnaire with scoring can help you organize this information efficiently, providing a clearer picture of your total estate value.

The outcome questionnaire is scored by analyzing the responses to each question and summing their assigned values. In the context of the estate questionnaire with scoring, this process reveals your overall readiness for effective estate planning. The resulting score can highlight strengths and weaknesses in your current plan. By understanding your outcomes, you can take proactive steps to enhance your estate strategy.

To score a questionnaire, first, tally the numerical values assigned to each response based on the chosen rating scale. For the estate questionnaire with scoring, this means calculating the total score to evaluate your situation. This score can indicate areas that need attention or improvement in your estate planning process. Scoring allows you to prioritize your next steps and make more informed decisions.

To determine the value of a deceased person's estate, you need to conduct a thorough inventory of all assets and liabilities. This includes real estate, bank accounts, investments, and personal property. You may also want to consult professionals for appraisals to ensure accuracy. Understanding the estate's value is crucial for effective estate planning and can be facilitated by using the estate questionnaire with scoring.

Scoring in a questionnaire involves assigning numerical values to your responses based on the rating scale. In the estate questionnaire with scoring, each response corresponds to a specific score, which you can then total to gauge your overall position. This process helps you quantify your thoughts and feelings regarding estate planning. By scoring your answers, you can better understand where you stand and what steps to take next.

The 5-point rating scale questionnaire is a simplified version of the estate questionnaire with scoring, offering five response options ranging from 'strongly disagree' to 'strongly agree.' This scale provides a clear way to assess your feelings about different aspects of your estate plan. It streamlines the evaluation process and makes it easier for you to identify key areas that need attention. Ultimately, this approach leads to a more effective estate planning experience.