Transfer Real Estate Property Form (pt-61)

Description

How to fill out Deed Transfer Questionnaire?

Whether for business purposes or for personal affairs, everybody has to manage legal situations sooner or later in their life. Filling out legal paperwork needs careful attention, starting with picking the correct form template. For instance, if you select a wrong edition of a Transfer Real Estate Property Form (pt-61), it will be turned down once you send it. It is therefore crucial to have a trustworthy source of legal papers like US Legal Forms.

If you need to obtain a Transfer Real Estate Property Form (pt-61) template, follow these simple steps:

- Get the sample you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it fits your case, state, and region.

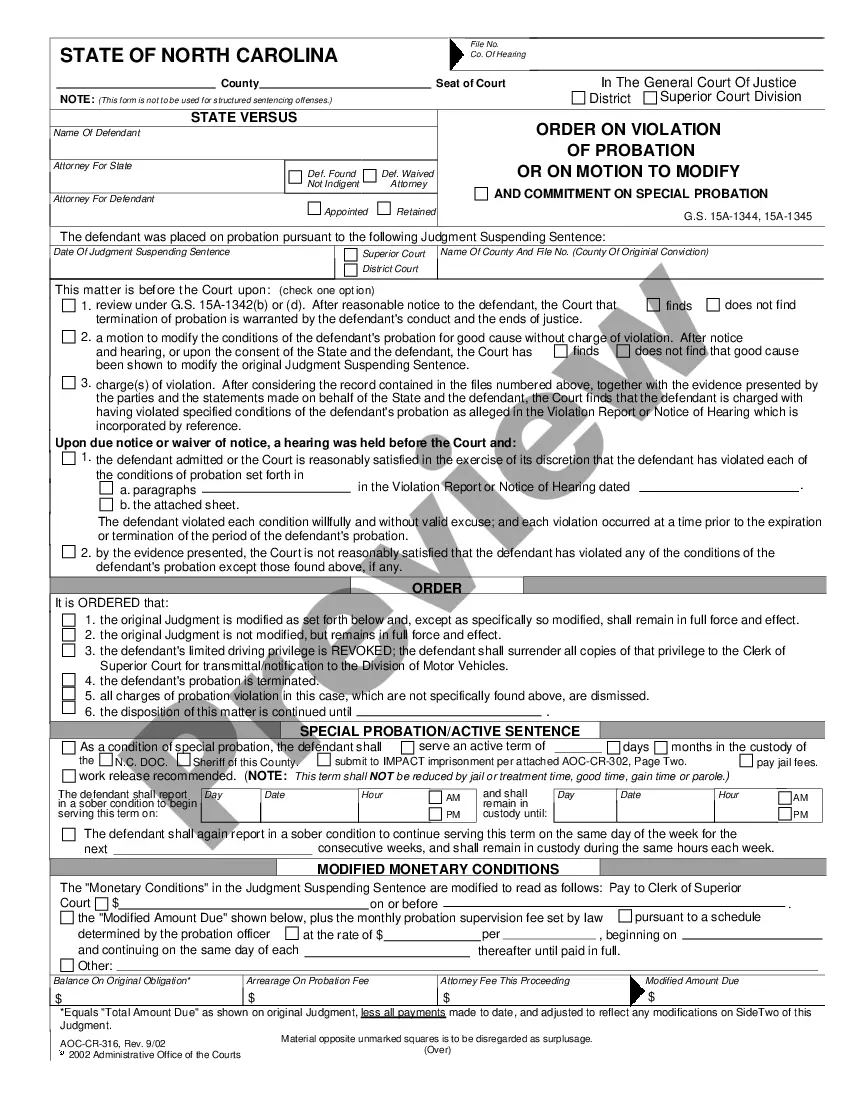

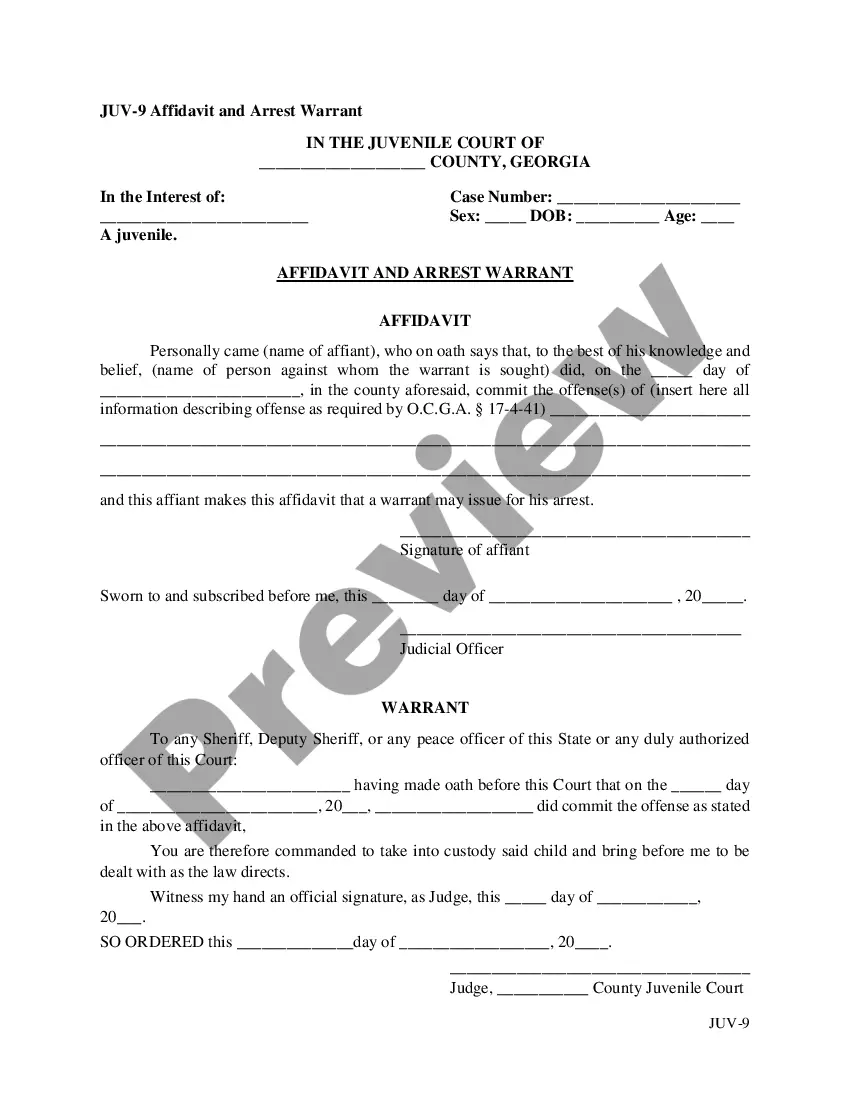

- Click on the form’s preview to examine it.

- If it is the incorrect form, get back to the search function to locate the Transfer Real Estate Property Form (pt-61) sample you require.

- Get the template if it meets your needs.

- If you already have a US Legal Forms profile, simply click Log in to access previously saved templates in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Transfer Real Estate Property Form (pt-61).

- Once it is saved, you are able to complete the form by using editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you don’t have to spend time searching for the right sample across the internet. Use the library’s simple navigation to get the right template for any occasion.

Form popularity

FAQ

The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each additional $100 or fractional part of $100.

EFiling Information. PT-61 eFiling It is an excise tax on transactions involving the sale of real property where title to the property is transferred from the seller to the buyer.

Hear this out loud PauseThere are no stamp taxes in Georgia.

Hear this out loud PauseIn general, Georgia imposes tax on the retail sales price of tangible personal property and certain services.

There is imposed a tax at the rate of $1.00 for the first $1,000.00 or fractional part of $1,000.00 and at the rate of 10? for each additional $100.00 or fractional part of $100.00 on each deed, instrument, or other writing by which any lands, tenements, or other realty sold is granted, assigned, transferred, or ...