Transfer Of Real Estate Fort Worth

Description

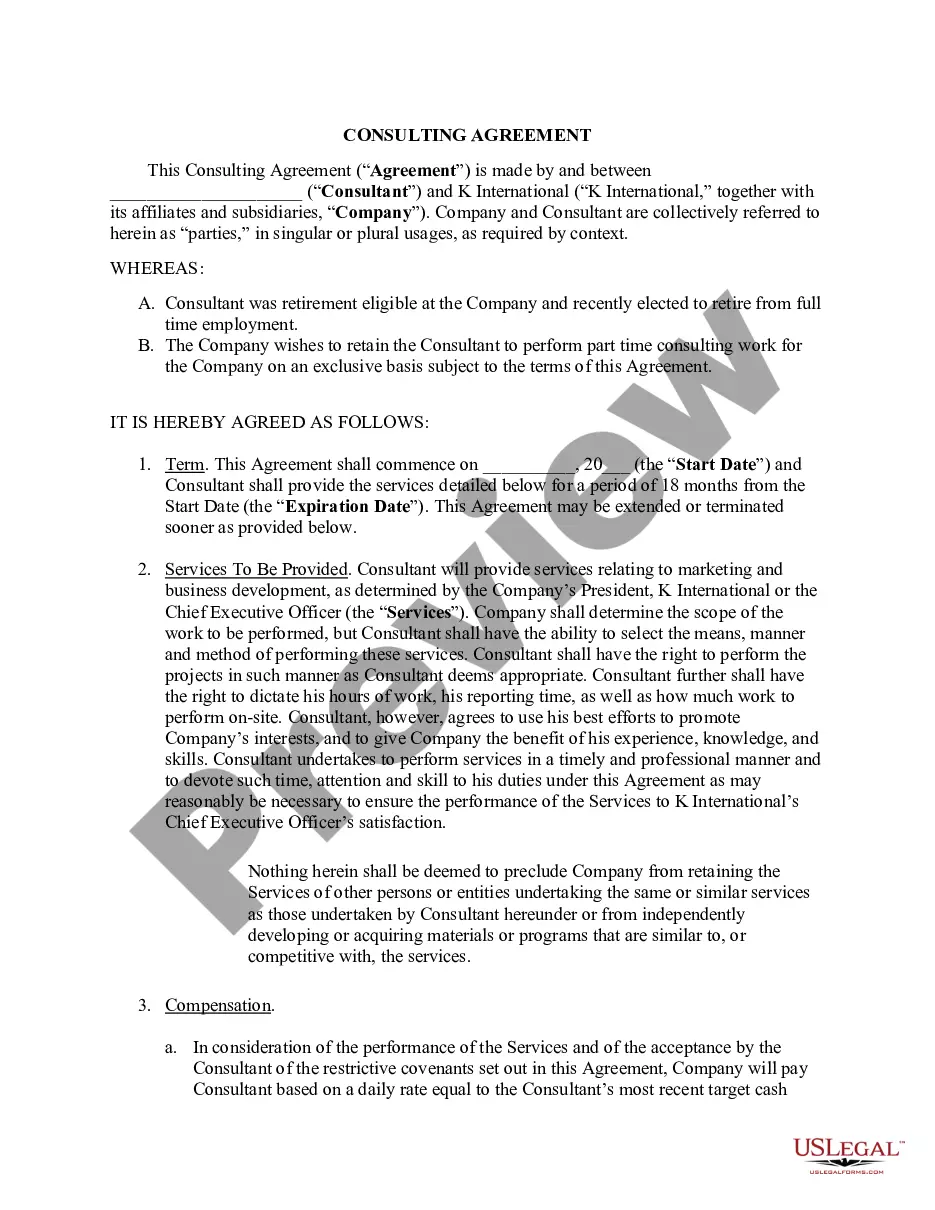

How to fill out Deed Transfer Questionnaire?

Legal documents handling can be perplexing, even for the most seasoned specialists.

If you are looking into a Transfer Of Real Estate Fort Worth and lack the time to search for the accurate and current version, the processes can be stressful.

US Legal Forms accommodates any needs you might have, ranging from personal to business documents, all in one location.

Utilize advanced tools to fill out and manage your Transfer Of Real Estate Fort Worth.

Here are the steps to follow after downloading the necessary form: Verify it is the correct form by previewing it and reading its description. Ensure that the template is accepted in your state or county. Select Buy Now when you are set. Choose a subscription plan. Opt for the format you need, and Download, complete, sign, print, and submit your documents. Leverage the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your routine document management into an easy and user-friendly activity today.

- Access a valuable resource library of articles, guides, and materials related to your situation and needs.

- Conserve effort and time by finding the documents you require, and employ US Legal Forms’ sophisticated search and Review tool to locate and download the Transfer Of Real Estate Fort Worth.

- If you hold a subscription, Log In to the US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to browse the documents you have previously saved and manage your folders as desired.

- If you are new to US Legal Forms, create a free account and gain unlimited access to all the platform’s advantages.

- A comprehensive online form directory could be a pivotal resource for anyone aiming to manage these matters effectively.

- US Legal Forms is a leader in online legal documents, boasting over 85,000 state-specific legal forms accessible at any moment.

- With US Legal Forms, you can access specialized legal and business forms by state or county.

Form popularity

FAQ

A deed must be in writing. You cannot use an oral agreement to transfer real estate. The grantor must sign the deed in front of a notary or two credible witnesses. A grantor can only transfer their own rights to property.

Notarization: In order to be recorded in the register of deeds, a quitclaim deed must have been executed before a notary public.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

Good to know: To be valid and enforceable, the transfer must be in writing and signed by the owner. The document should be filed with the County Clerk for the County in which the property is located. For example, you cannot simply say that your grandfather said he wanted you to have the property.

A General Warranty Deed or Special Warranty Deed may be used, however, the most common deed used after a divorce is a Special Warranty Deed. The spouse whose name is to be removed from the title will need to sign the deed in front of any notary.