Transfer Of Real Estate Fort Myers

Description

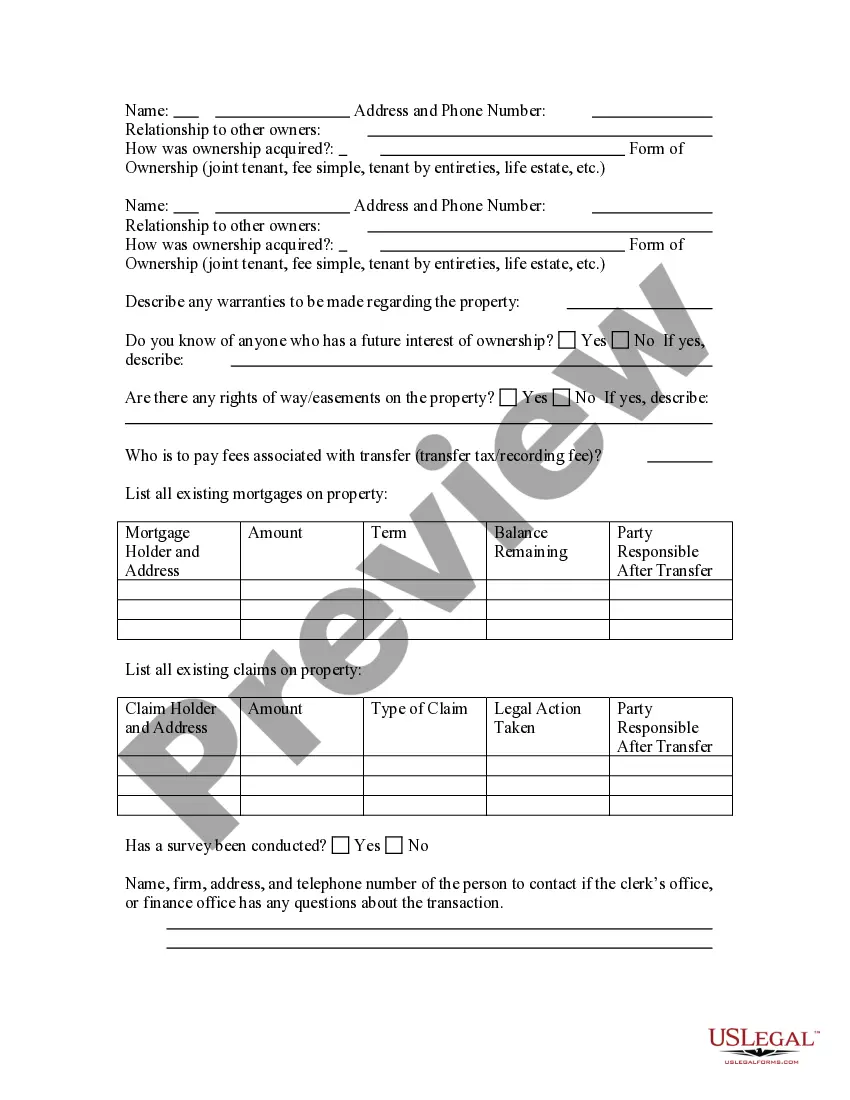

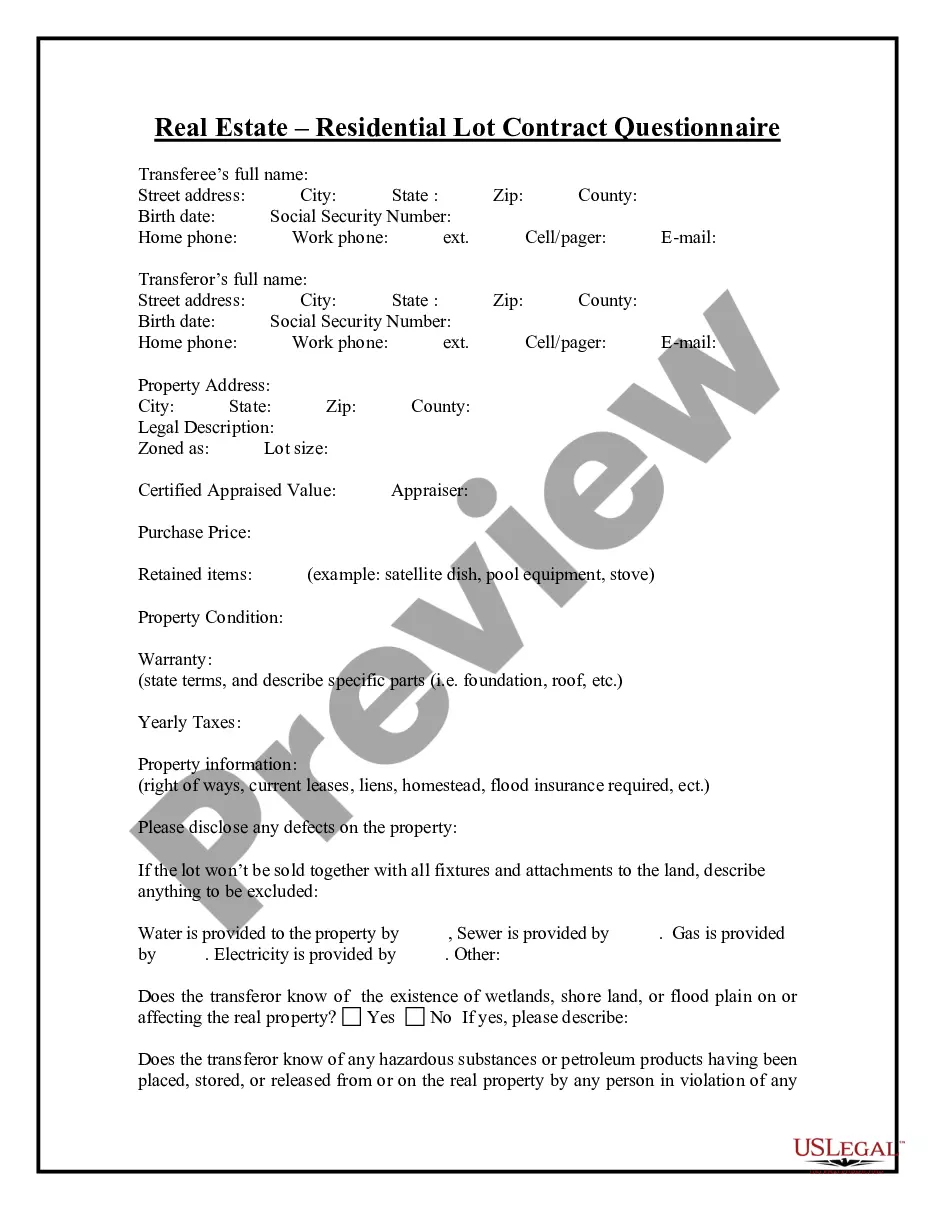

How to fill out Deed Transfer Questionnaire?

Utilizing legal documents that align with federal and state regulations is crucial, and the web provides many alternatives to choose from.

However, what's the benefit of spending time searching for the properly created Transfer Of Real Estate Fort Myers template online when the US Legal Forms digital library already compiles such documents in one location.

US Legal Forms is the premier online legal repository featuring over 85,000 editable templates crafted by legal professionals for various business and personal needs. They are easy to navigate as all documents are categorized by state and intended use.

Explore for another template using the search tool at the top of the page if necessary. Click Buy Now when you identify the correct document and select a subscription plan. Create an account or sign in and pay using PayPal or a credit card. Choose the format for your Transfer Of Real Estate Fort Myers and download it. All templates accessible through US Legal Forms can be reused. To redownload and complete previously acquired forms, access the My documents tab in your account. Benefit from the most comprehensive and user-friendly legal documentation service!

- Our specialists keep abreast of legal modifications, ensuring your form is current and compliant when obtaining a Transfer Of Real Estate Fort Myers from our platform.

- Acquiring a Transfer Of Real Estate Fort Myers is straightforward and swift for both existing and new users.

- If you possess an account with an active subscription, Log In and download the template you need in the desired format.

- For new users, follow these steps.

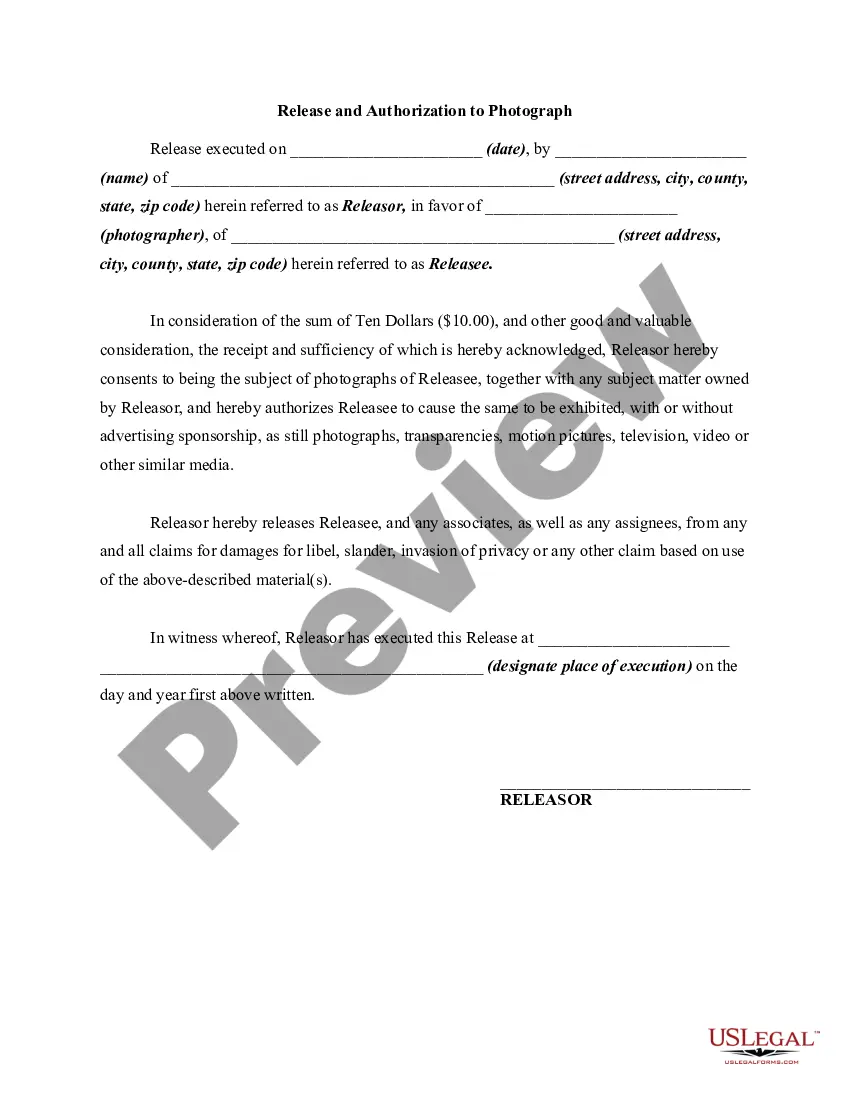

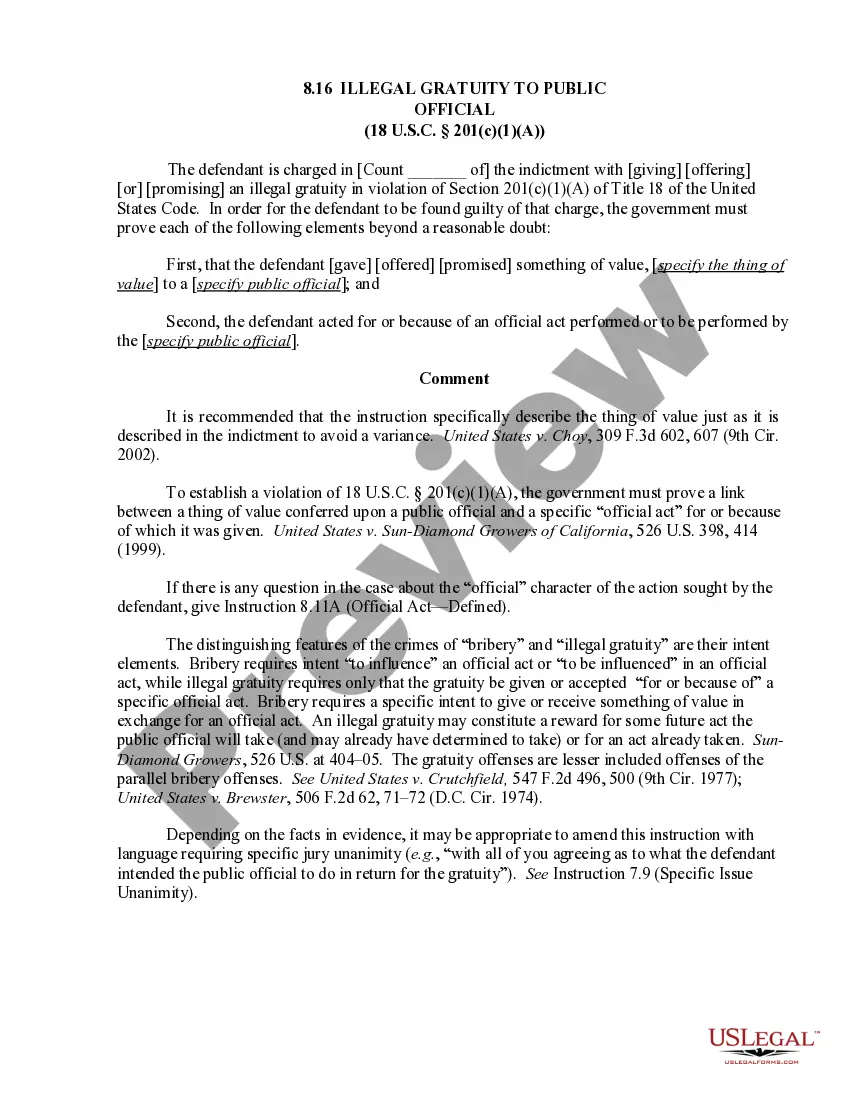

- Examine the template using the Preview feature or the text outline to confirm it suits your requirements.

Form popularity

FAQ

Although you can make a quitclaim deed yourself, we suggest hiring a real estate lawyer to ensure your deed is done right and meets the legal and filing requirements for Flordia and the local country recorders office where the property is located.

For a small percentage of properties in Florida, a Documentary Stamp Tax is required at a rate of $0.70 per $100 owed on any existing mortgage. You may be required to pay the Documentary Stamp Tax if your transfer is not exempt. We will contact you if additional fees are required.

When you transfer title and ownership of real estate in Florida, you sign a deed conveying or transferring the property to the new owner. In most real estate closings, the seller is responsible for providing the deed that is signed at closing.

You will need to have a new deed prepared if you want to remove a name from the existing deed of record. If a document meets the requirements to be recorded, we will record it. The Clerk's office does not provide forms or legal advice.

The tax rate for documents that transfer an interest in real property is $. 70 per $100 (or portion thereof) of the total consideration paid, or to be paid, for the transfer. An exception is Miami-Dade County, where the rate is $. 60 per $100 (or portion thereof) when the property is a single-family residence.