Copyright Search Database With Multiple Users

Description

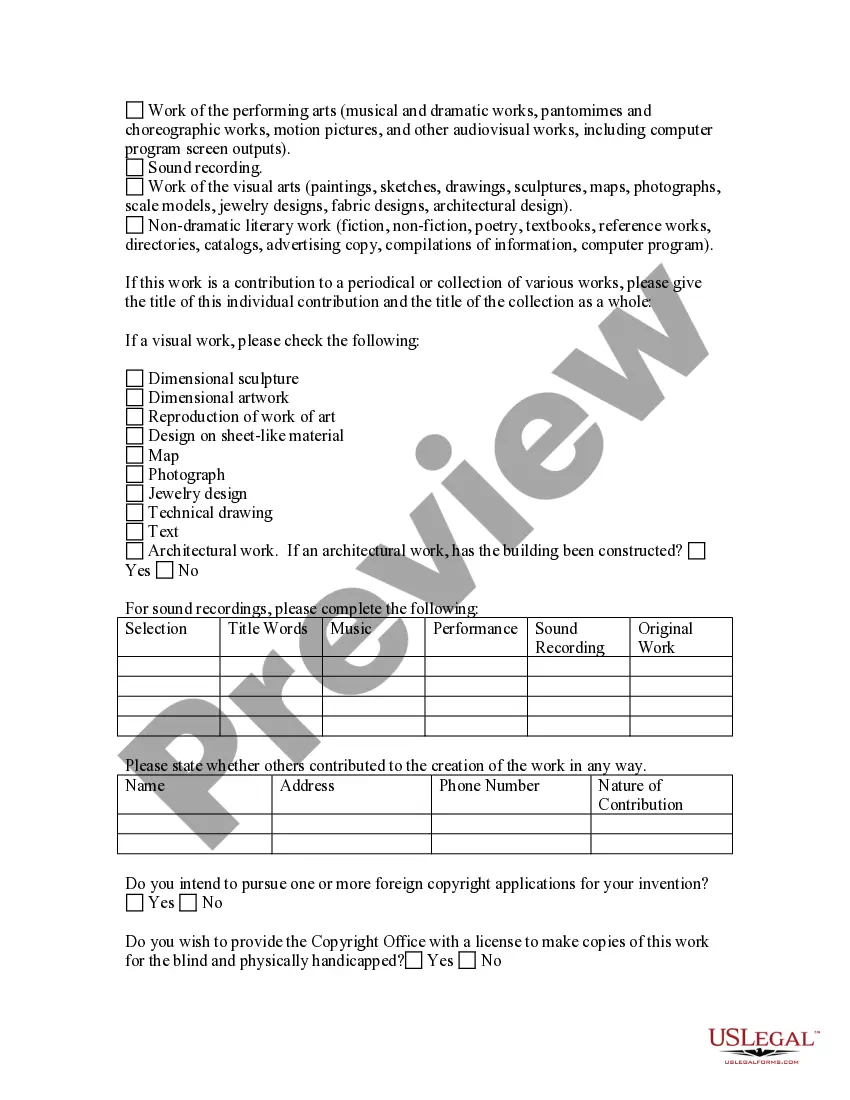

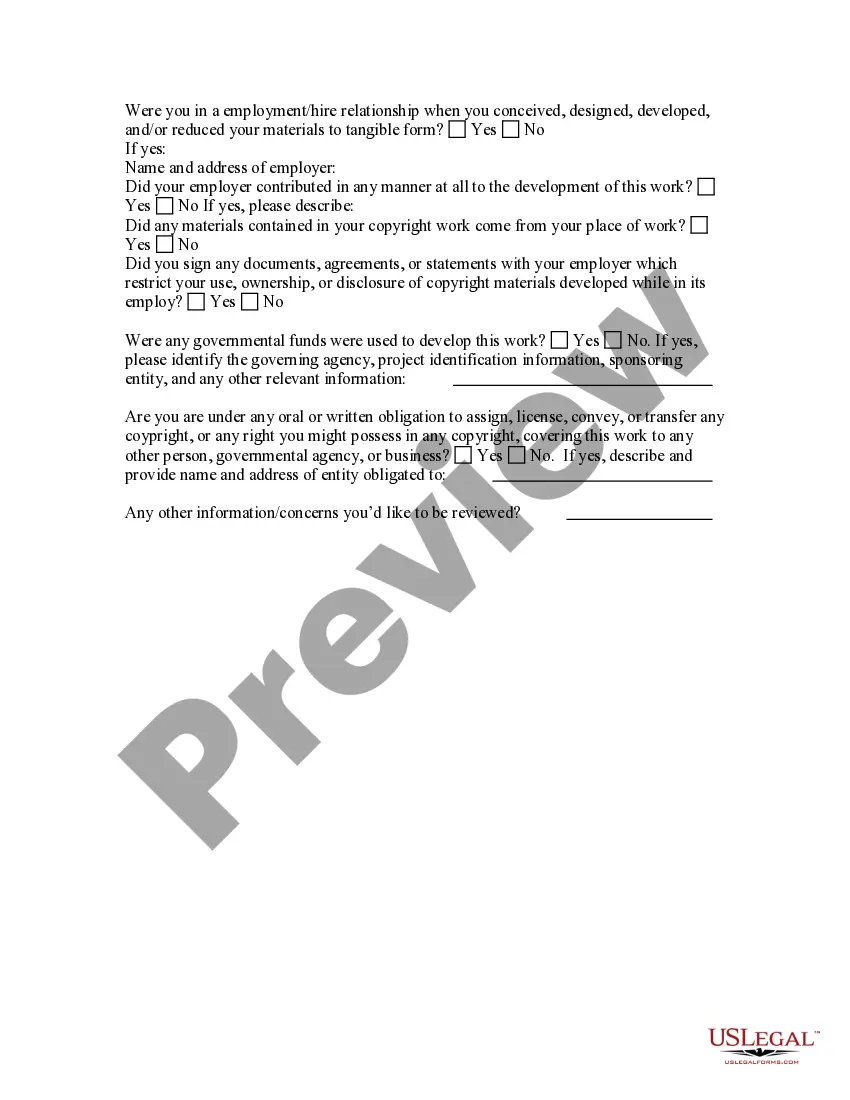

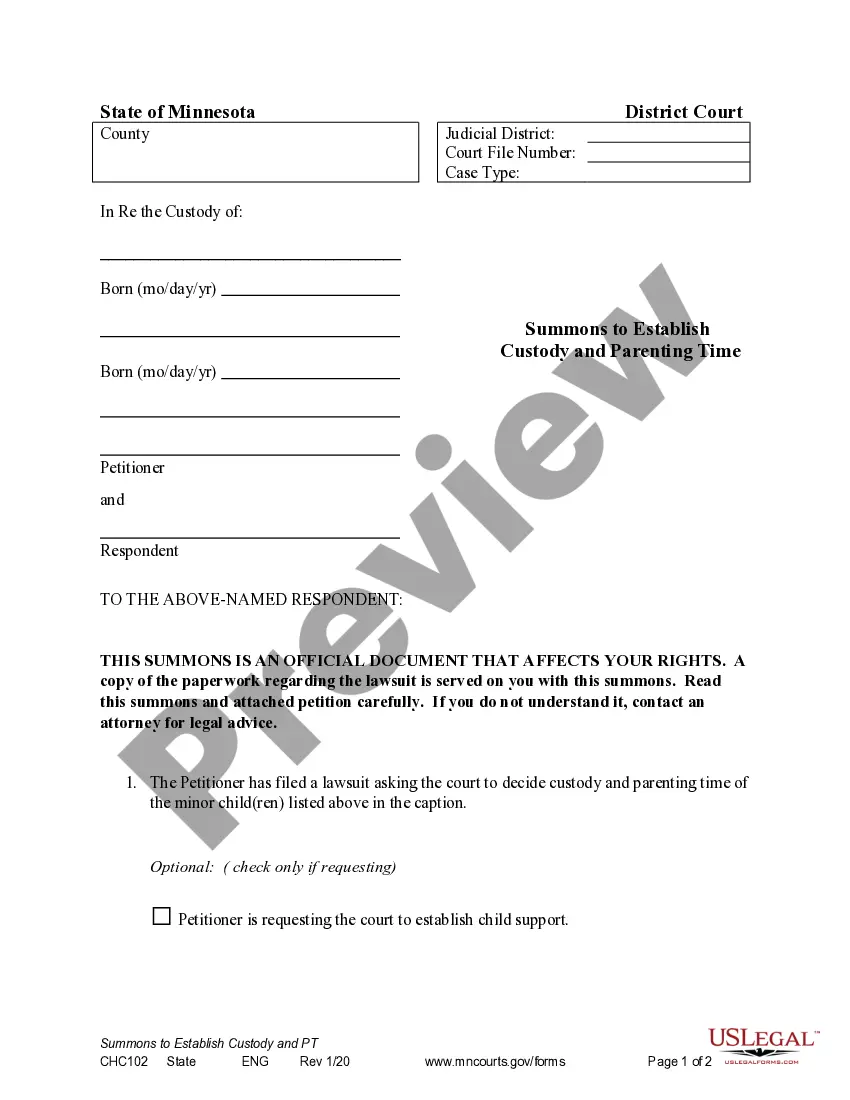

How to fill out Copyright Questionnaire?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may require extensive research and substantial expenses.

If you’re seeking a more straightforward and cost-effective method for producing Copyright Search Database With Multiple Users or any other documentation without unnecessary hurdles, US Legal Forms is always accessible to you.

Our online repository of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly retrieve templates that comply with state and county regulations, meticulously prepared for you by our legal professionals.

Check the form preview and descriptions to ensure you are on the correct form for your needs. Ensure the template you select aligns with the regulations of your state and county. Choose the appropriate subscription plan to purchase the Copyright Search Database With Multiple Users. Download the document. Then complete, sign, and print it out. US Legal Forms proudly holds a pristine reputation and boasts over 25 years of expertise. Join us today and transform form execution into a simple and efficient process!

- Utilize our website whenever you require trusted and dependable services through which you can effortlessly locate and obtain the Copyright Search Database With Multiple Users.

- If you're familiar with our website and have established an account, simply Log In to your account, select the template, and download it right away or re-download it at any time later in the My documents section.

- Not yet signed up? No problem. Setting it up takes only a few minutes, allowing you to explore the library.

- However, before proceeding with the download of Copyright Search Database With Multiple Users, adhere to these guidelines.

Form popularity

FAQ

In this article, ?debt validation letter? means the initial notice a debt collector must send you under federal law, and ?debt verification letter? means a letter you send to the debt collector to request more information and/or to dispute the debt.

Vermont's Statute of Limitations on Debt The State of Vermont has a six-to-eight-year statute of limitations on written contracts, while oral contracts and collection of debt on accounts each have a six year statute of limitations. Judgements carry an eight-year statute of limitations.

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

However, they're required to send a debt validation letter within five days of first contacting you. If you don't receive a debt validation letter within 10 days of initial contact, you can submit a complaint to the Consumer Financial Protection Bureau.

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

A debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. The right to know how the debt was incurred is guaranteed to all consumers through the Fair Debt Collection Practices Act. The letter must be sent within 30 days of receiving notice of the attempt to collect.

If you don't receive a validation notice within 10 days of the first contact, request one from the debt collector the next time you're contacted. Ask for the debt collector's mailing address at this time as well, in case you decide to request a debt verification letter.