Conservatorship New York Withholding

Description

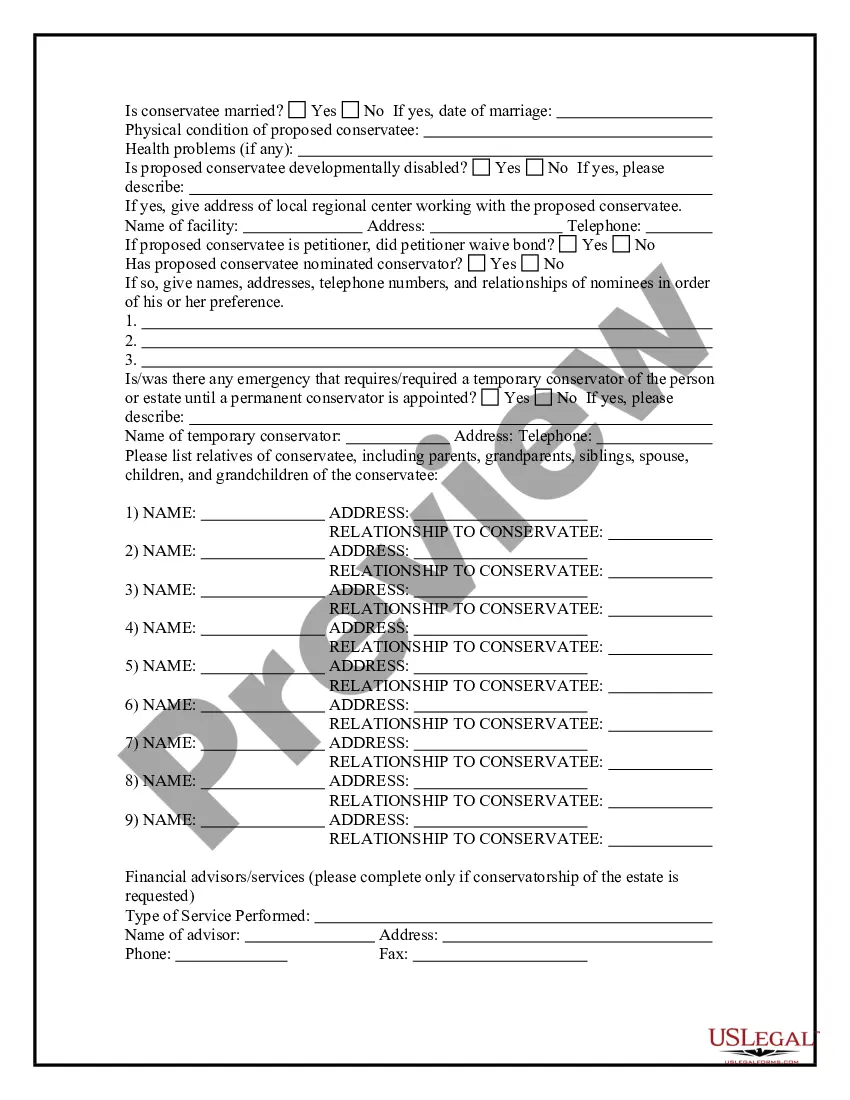

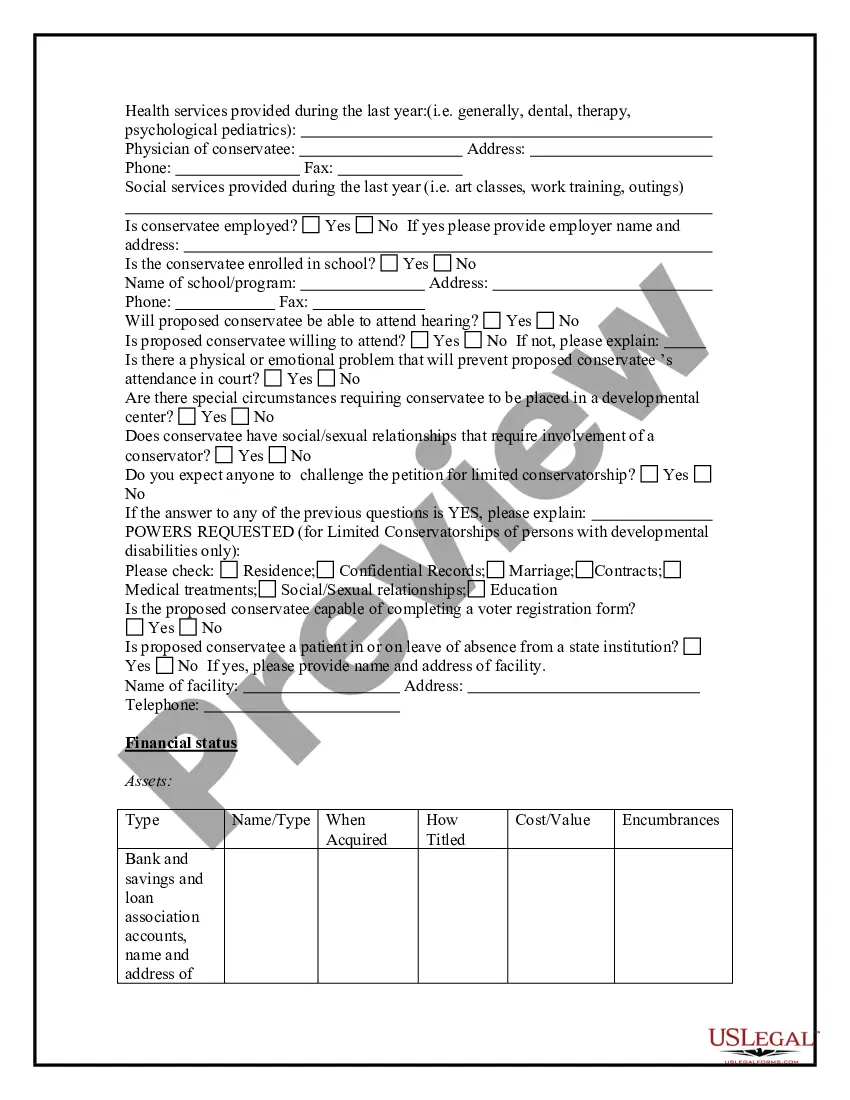

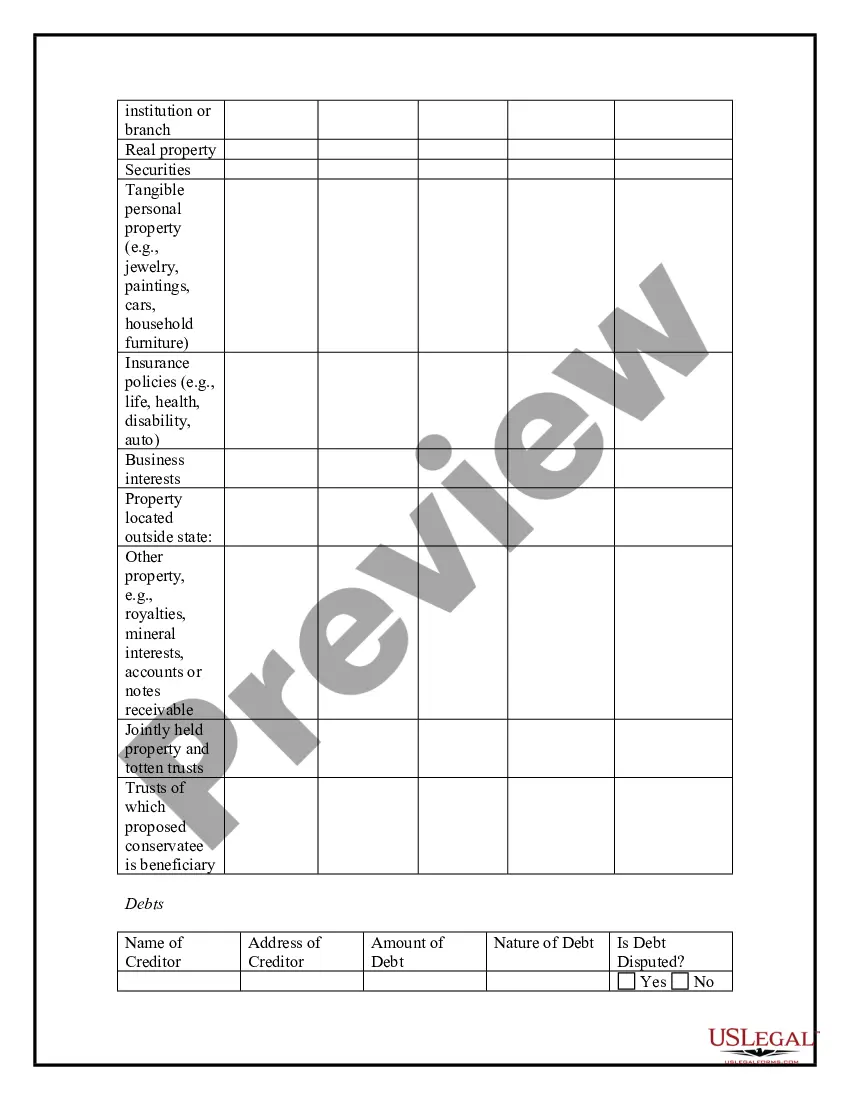

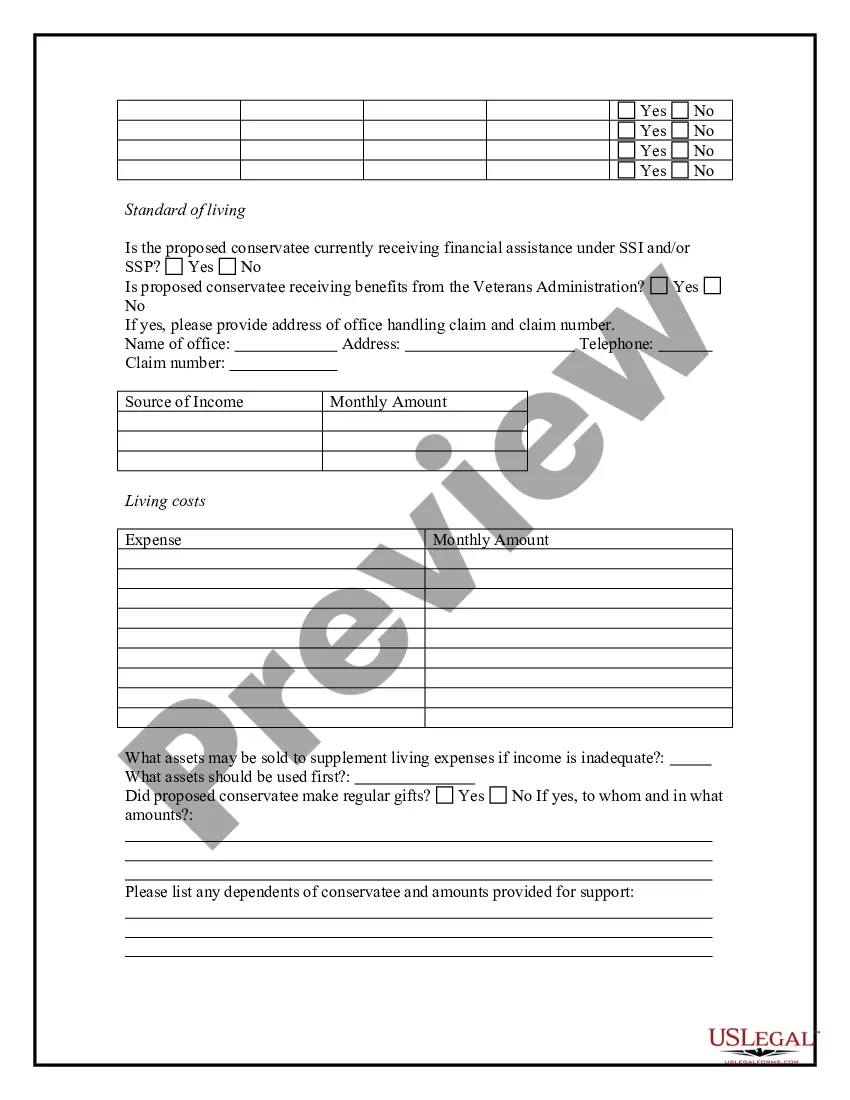

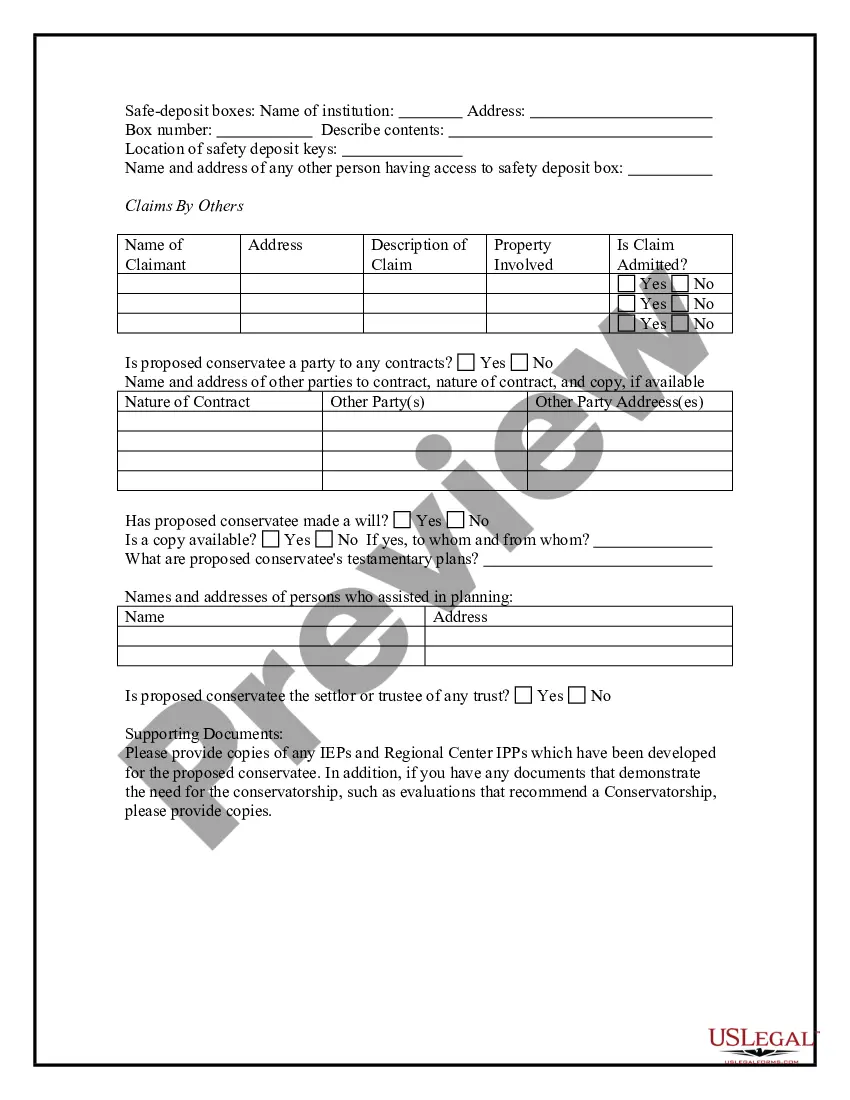

How to fill out Conservatorship Questionnaire?

Whether for business purposes or for individual affairs, everyone has to deal with legal situations at some point in their life. Completing legal paperwork requires careful attention, starting with choosing the appropriate form template. For example, if you pick a wrong version of the Conservatorship New York Withholding, it will be turned down once you send it. It is therefore crucial to get a trustworthy source of legal files like US Legal Forms.

If you have to get a Conservatorship New York Withholding template, stick to these easy steps:

- Get the sample you need using the search field or catalog navigation.

- Examine the form’s information to make sure it fits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong document, go back to the search function to find the Conservatorship New York Withholding sample you need.

- Get the template when it matches your requirements.

- If you already have a US Legal Forms account, just click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Choose the document format you want and download the Conservatorship New York Withholding.

- When it is downloaded, you can complete the form by using editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time seeking for the right sample across the web. Make use of the library’s easy navigation to find the proper form for any occasion.

Form popularity

FAQ

First, you'll fill out your personal information including your name, address, social security number, and tax filing status. You can choose from single, married filing separately, married filing jointly, qualifying widow(er), or head of household.

You'll most likely get a tax refund if you claim no allowances or 1 allowance. If you want to get close to withholding your exact tax obligation, claim 2 allowances for yourself and an allowance for however many dependents you have (so claim 3 allowances if you have one dependent).

Is it better to claim 1 or 0 allowances? The higher the number of allowances, the less tax taken out of your pay each pay period. This means that opting for one rather than zero allowances results in less of your paycheck being sent to the Internal Revenue Service (IRS).

To increase income tax deductions, the employee must fill out revised TD1 forms. Learn more: Get the completed TD1 forms from the individual.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax.