Conservatorship Bank Account Withdrawal

Description

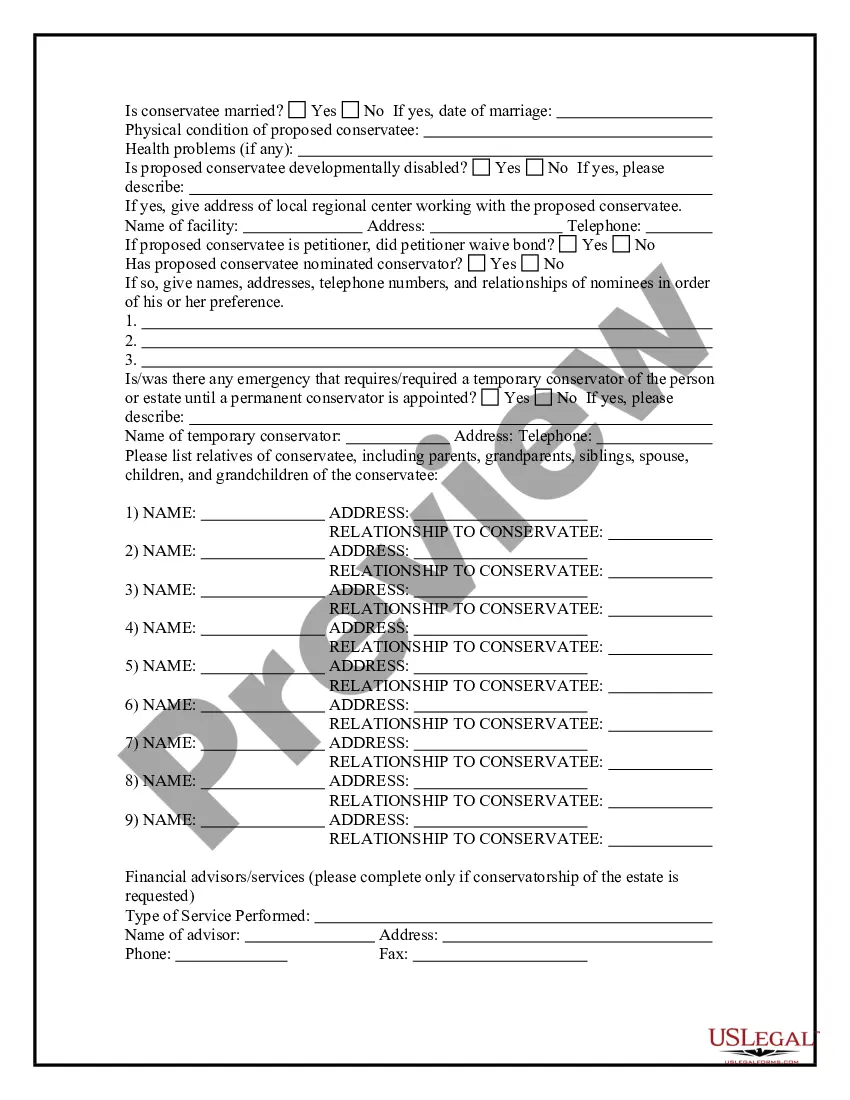

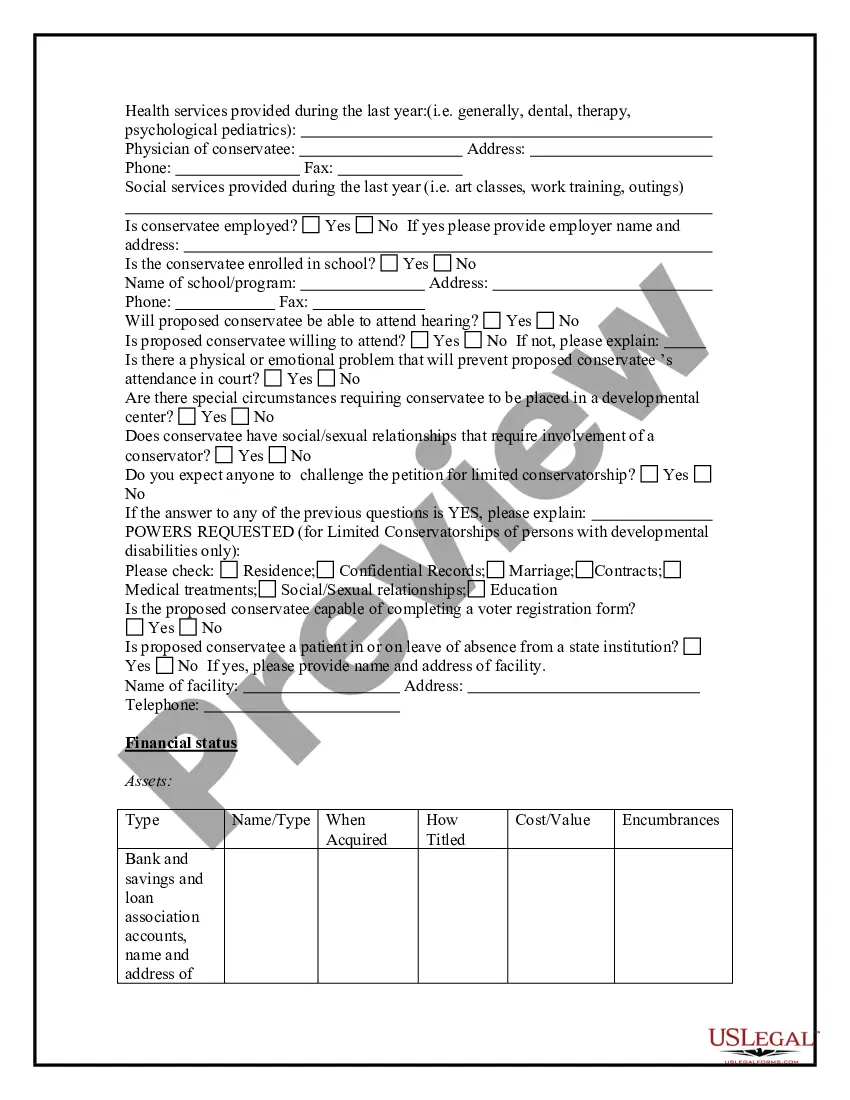

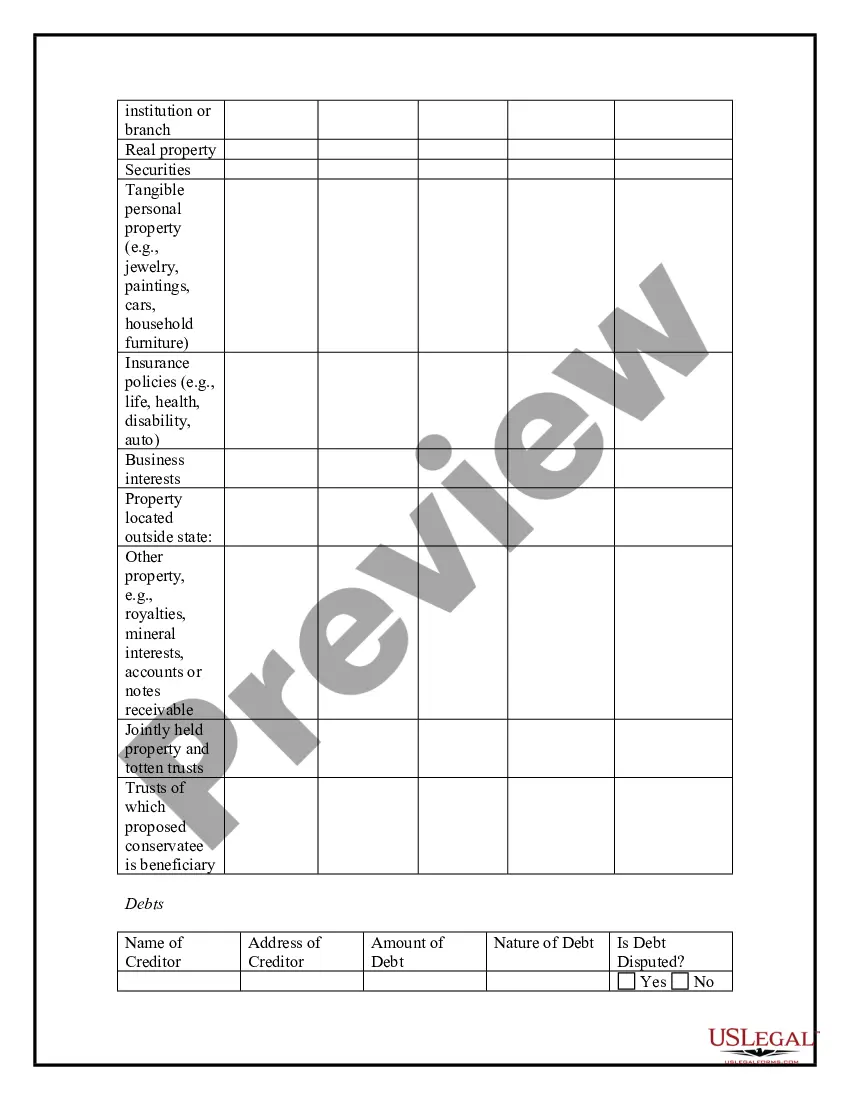

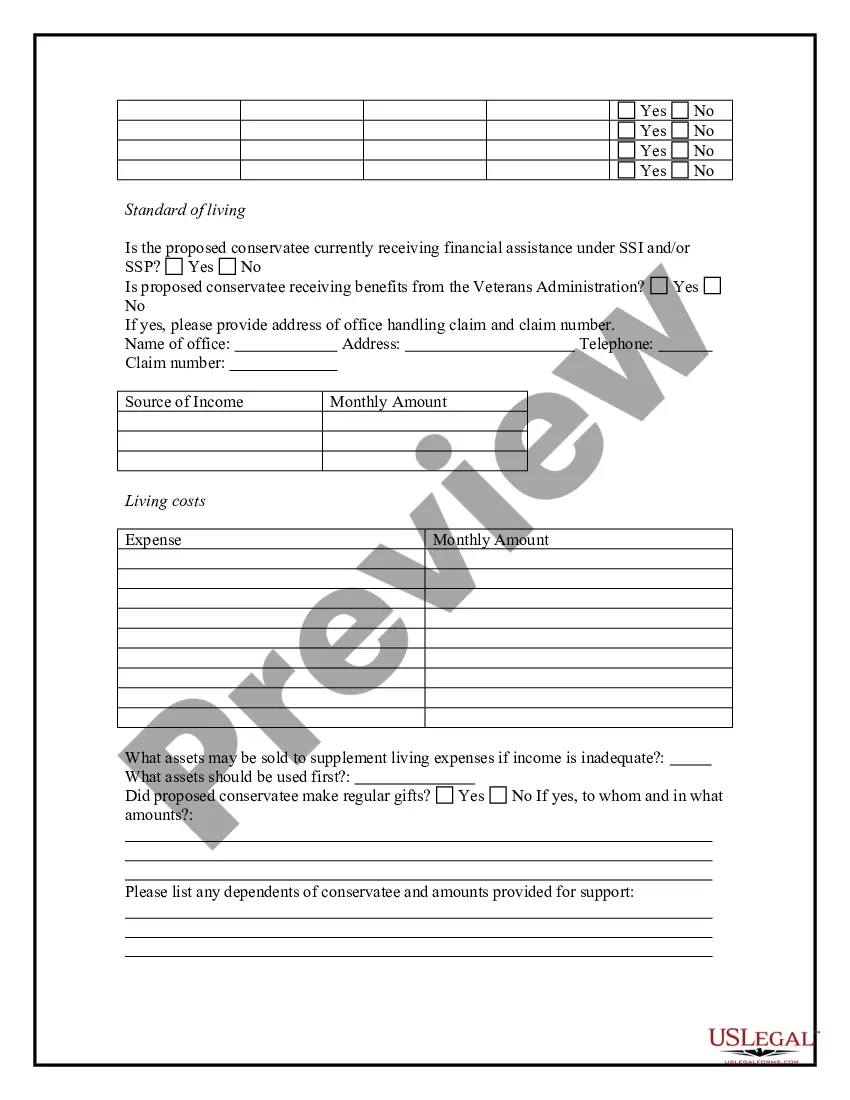

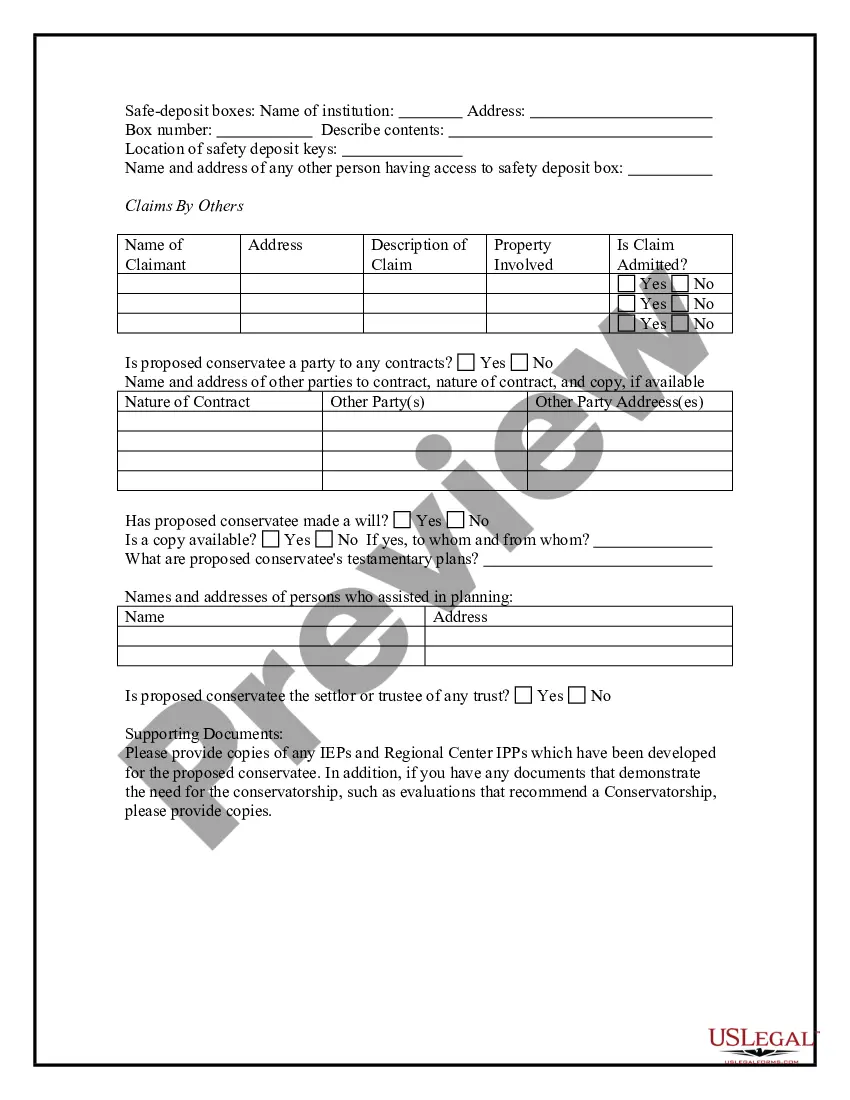

How to fill out Conservatorship Questionnaire?

The Conservatorship Bank Account Withdrawal presented on this page is a reusable formal template crafted by experienced attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authentic, state-specific documents for any business and personal situation.

Choose the format you desire for your Conservatorship Bank Account Withdrawal (PDF, DOCX, RTF) and download the template to your device.

- Search for the document you require and examine it.

- Browse through the sample you looked for and preview it or read the form description to ensure it meets your needs. If it doesn’t, use the search feature to find the correct one. Click Buy Now when you have located the template you need.

- Register and Log In.

- Select the pricing option that fits you and create an account. Utilize PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the fillable template.

Form popularity

FAQ

A conservator can manage the financial affairs of the ward, including handling bank accounts, making payments, and overseeing investments. They have the authority to make conservatorship bank account withdrawals to ensure the ward's needs are met. It's vital for conservators to keep accurate records of all transactions to maintain transparency and accountability.

Power of attorney allows an individual to act on behalf of another person regarding financial matters, including managing bank accounts. This authority enables the agent to make deposits, withdrawals, and other transactions as specified in the power of attorney document. It’s important to ensure that the bank recognizes this document to facilitate any conservatorship bank account withdrawals smoothly.

To title a guardianship bank account, start by including the ward's name followed by the phrase 'by' and then your name as the guardian. This clearly indicates that you manage the account on behalf of the ward. For example, it could read, 'John Doe, by Jane Smith, Guardian.' This setup is crucial for managing funds and making conservatorship bank account withdrawals.

As mentioned above, a general conservatorship will end upon a court order or the protected person's death.

To complete a termination of conservatorship, you will need the following: Petition to Terminate Minor's Conservatorship and Release Funds (Form G/C-506); Order Terminating Minor's Conservatorship and Releasing Funds (Form G/C-507).

A conservatorship is a protective proceeding initiated in the Probate Division of a local Superior Court to protect, or ?conserve,? the funds and other assets of an incapacitated adult or a minor and to ensure that a person's financial obligations are being met.

While they both concern the legal authority to care for a minor or an incapacitated adult, there's actually an important distinction between the two. Guardians are appointed to make important health and welfare decisions, and conservators are appointed to handle someone's assets and financial affairs.

The court will need to see evidence that the guardian is remiss in their responsibilities, and the judge will only release the guardian if doing so is in the best interests of the ward. If the ward is still incapacitated, then the court will need to appoint a substitute guardian.