File For Business Card

Description

How to fill out USLegal Pamphlet On Doing Business As DBA Filing Or Registration?

Securing a reliable source to obtain the latest and pertinent legal templates is a significant part of managing bureaucratic processes.

Locating the correct legal documents requires precision and carefulness, which is why it's crucial to source File For Business Card samples exclusively from reputable providers, such as US Legal Forms.

Eliminate the challenges associated with your legal documents. Navigate the vast US Legal Forms library to discover legal templates, verify their applicability to your situation, and download them immediately.

- Use the catalog navigation or search bar to find your template.

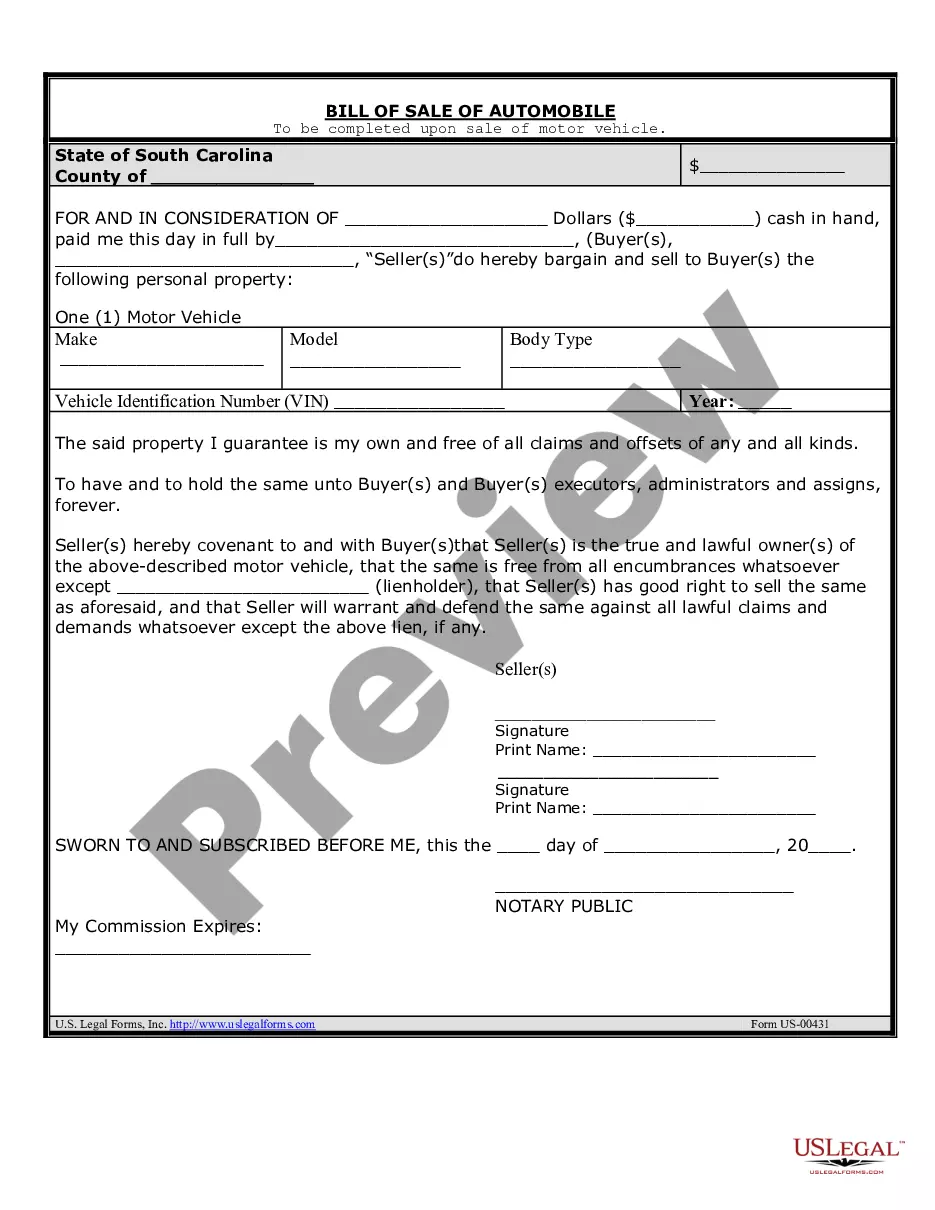

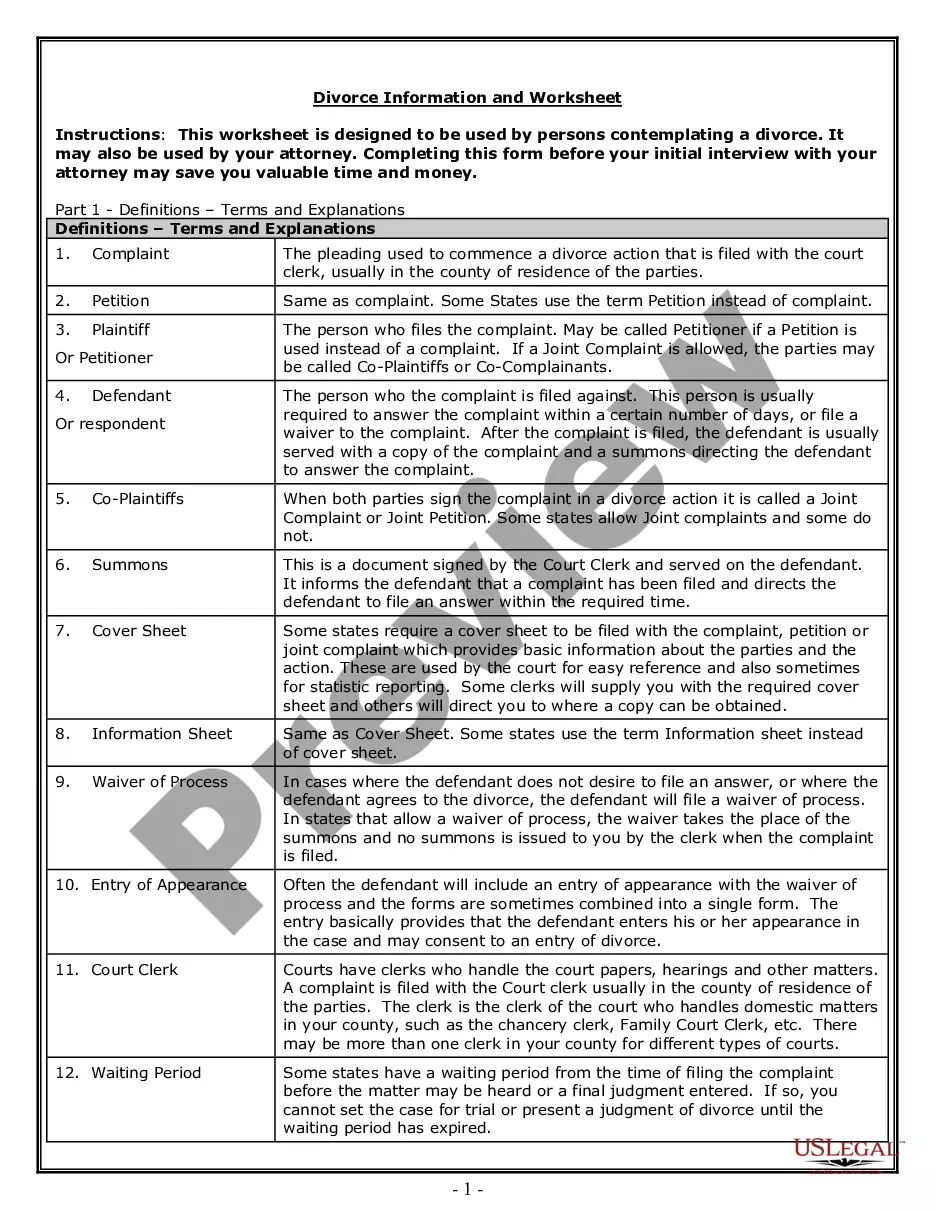

- Review the description of the form to ensure it meets the criteria of your state and locality.

- Examine the form preview, if available, to verify that the form is indeed what you require.

- Return to the search for the proper document if the File For Business Card does not satisfy your requirements.

- When you are confident about the form’s appropriateness, download it.

- If you are a registered user, click Log in to verify your identity and access your selected forms in My documents.

- If you don't have an account yet, click Buy now to acquire the template.

- Select a pricing plan that aligns with your preferences.

- Proceed to the registration process to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading File For Business Card.

- After obtaining the form on your device, you can modify it using the editor or print it out to complete it by hand.

Form popularity

FAQ

Here are some of the details a demand letter needs to include: Your information and the debtors' information (contact details, address etc.) The date when the debt began and the amount of money owed. Details and dates of any disputes relating to this payment.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

Except as otherwise provided by statute, the Alaska statute of limitations for open accounts, written and oral contracts, is three years in duration.

Include your full name, company name, and mailing address. Address the letter to your client by their full name. State the problem: Specify and provide proof of the debt in question. Reference the original contract or agreement that states the services the client owes you for.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

The key is to be thorough in your request for debt verification. In your letter, ask for details on: Why the collector thinks you owe the debt: Ask who the original creditor is and request documentation that verifies you owe the debt, such as a copy of the original contract.

Start with a polite reminder or enquiry about the bill, as overdue payment may not be any fault of the customer, and then follow up as necessary. Try one or more of the follow-up tactics below: Personal visit ? a face-to-face encounter can often solve the issue or ensure you get priority treatment.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.