Irrevocable Assignment Form For Omaha

Description

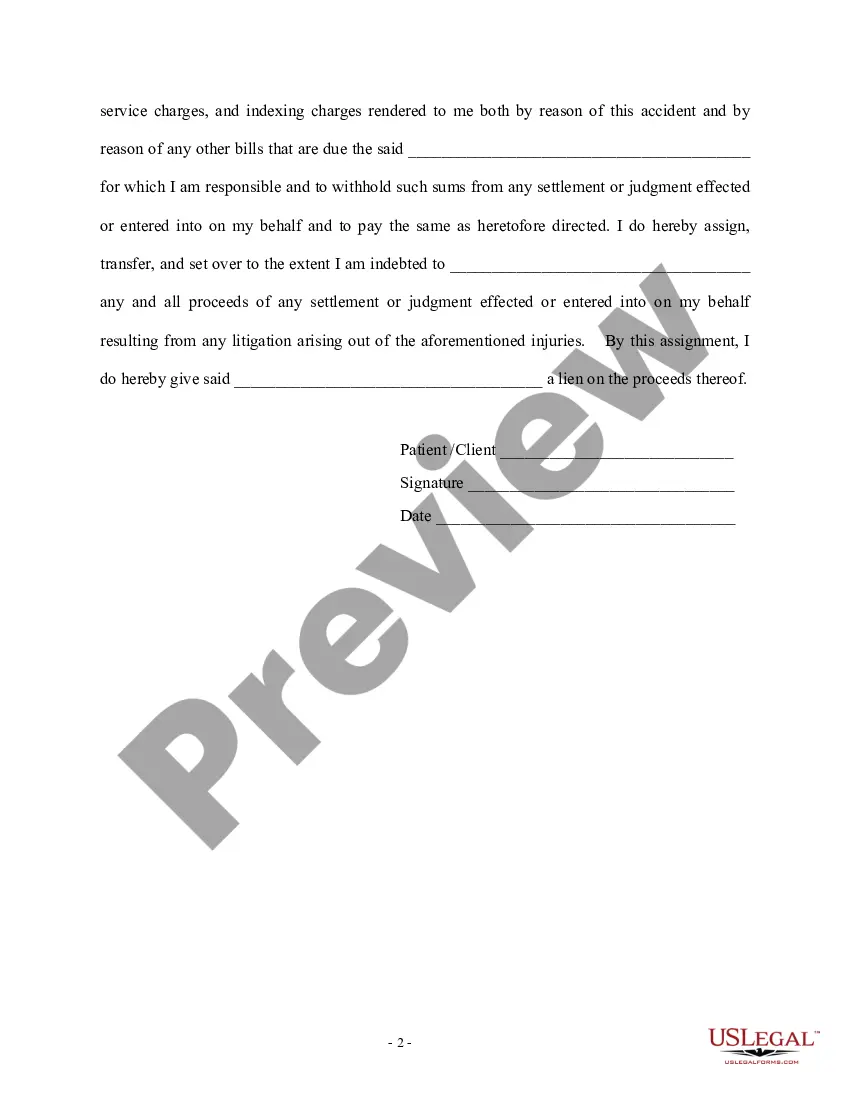

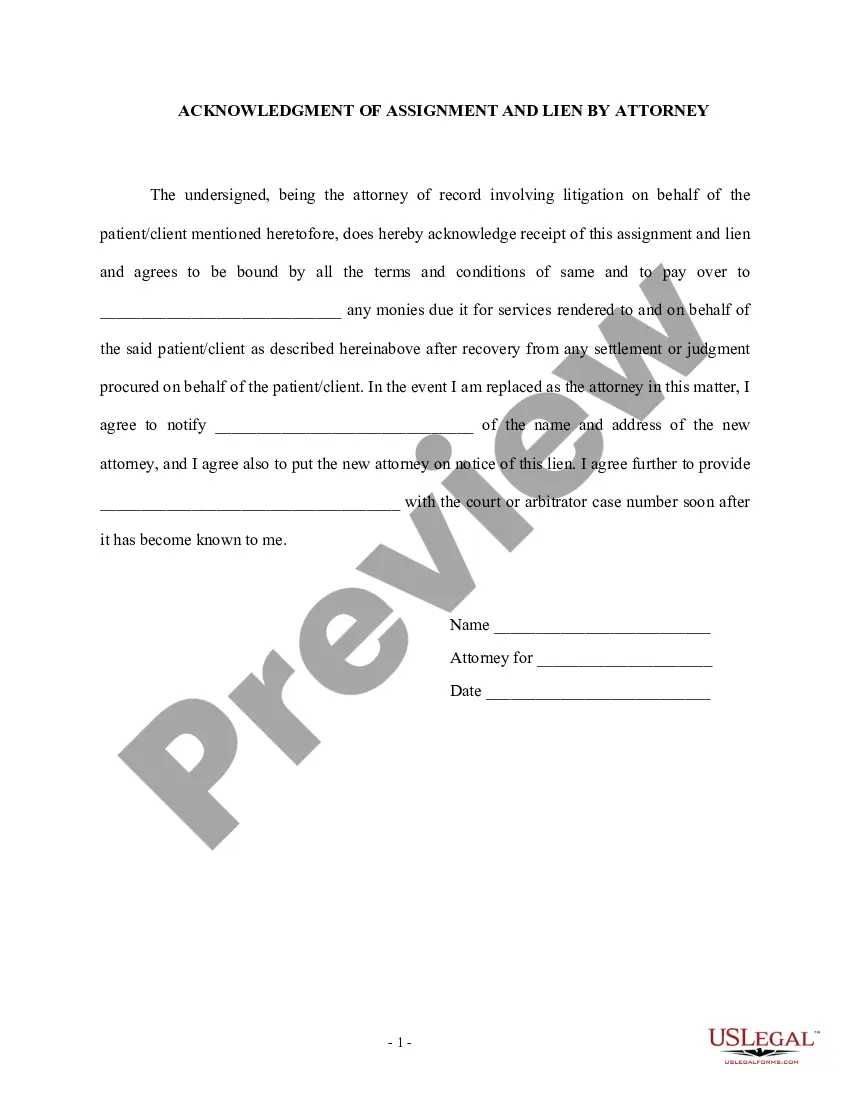

How to fill out Letter Regarding Irrevocable Assignment And Lien?

Drafting legal documents from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more affordable way of preparing Irrevocable Assignment Form For Omaha or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual catalog of more than 85,000 up-to-date legal documents covers virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific forms carefully prepared for you by our legal experts.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly locate and download the Irrevocable Assignment Form For Omaha. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to register it and explore the catalog. But before jumping directly to downloading Irrevocable Assignment Form For Omaha, follow these recommendations:

- Review the document preview and descriptions to make sure you are on the the document you are searching for.

- Make sure the template you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to get the Irrevocable Assignment Form For Omaha.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

All beneficiary change requests must be approved by the owner of the contract. Approval is subject to the terms of the Settlement Agreement. This form is included in the event your Settlement Agreement allows for a change in named beneficiary.

Whole life and universal life are both forms of permanent life insurance, so they are similar in many respects. They both offer a death benefit that lasts throughout your lifetime as well as cash value. However, whole life has a fixed coverage amount and a fixed premium payment that will never increase.

Policies can be cashed out at any time ? meaning it isn't only payable in the event of death. So, it's not only an insurance option to protect your loved ones, but it can be used for long-term savings or retirement. Any policy withdrawals, loans and loan interest will reduce policy values and benefits.

United of Omaha Life Insurance Company, which is Mutual of Omaha Insurance Company's main subsidiary, focuses on providing individual life and annuity products to its customers. Mutual of Omaha has been committed to helping their customers through insurance and financial products for more than a century.

The policy owner is the only person who can change the beneficiary designation in most cases. If you have an irrevocable beneficiary or live in a community property state you need approval to make policy changes. A power of attorney can give someone else the ability to change your beneficiaries.