Lost Wage Verification Form With Progressive

Description

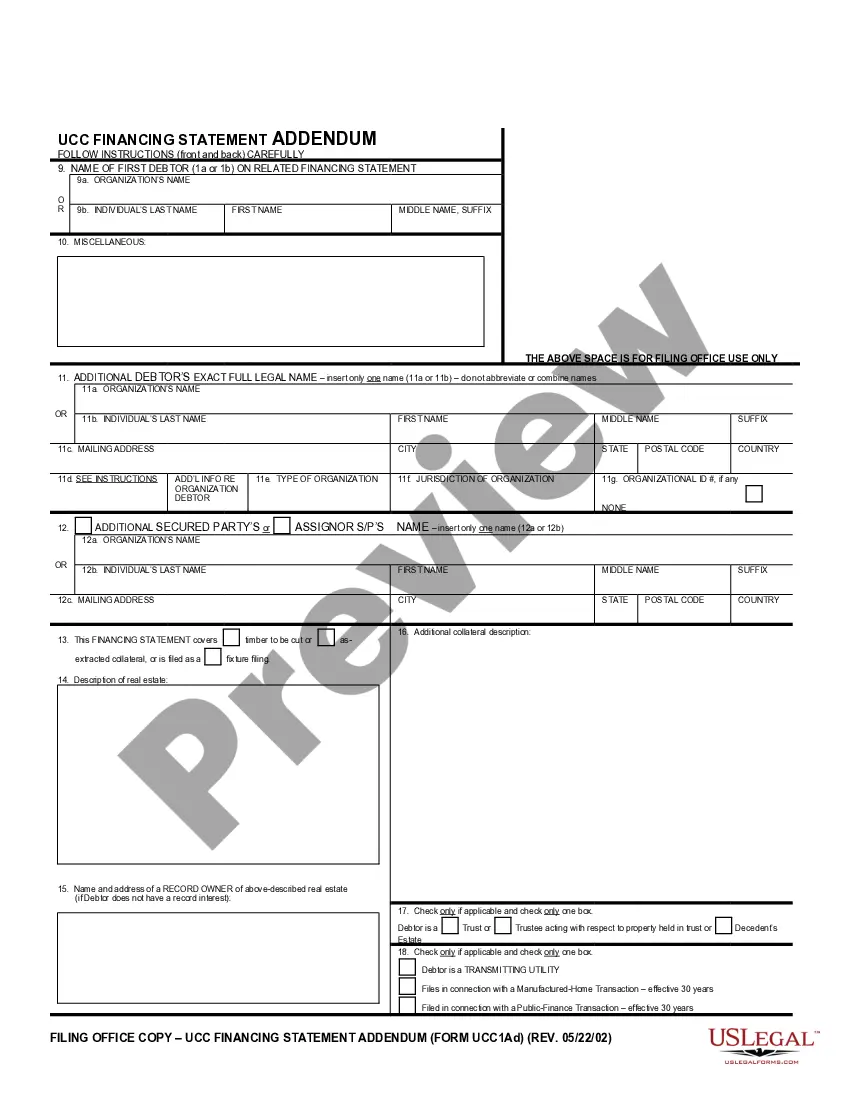

How to fill out Wage And Income Loss Statement?

Obtaining legal document samples that meet the federal and state regulations is a matter of necessity, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the correctly drafted Lost Wage Verification Form With Progressive sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any business and life case. They are simple to browse with all files arranged by state and purpose of use. Our experts stay up with legislative changes, so you can always be confident your paperwork is up to date and compliant when obtaining a Lost Wage Verification Form With Progressive from our website.

Getting a Lost Wage Verification Form With Progressive is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the steps below:

- Analyze the template using the Preview feature or through the text outline to ensure it meets your requirements.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Lost Wage Verification Form With Progressive and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

We're sorry for any confusion; you can also email it to upload@email.progressive.com.

The insurance company performed similarly in the J.D. Power 2022 U.S. Auto Claims Satisfaction Study?, with 861 out of a possible 1,000 points ? the average was 873.

Insurers may not drop a customer after their first one or two incidents. The first step is often to increase your car insurance rate. From there, if a customer has another accident or files more claims, the insurer may send a notice that they won't be renewing the policy at the end of its term.

Progressive is decent at paying claims compared to the average insurance company, ing to J.D. Power's latest claims satisfaction survey. Progressive scored 861 out of 1,000 for their claims process, compared to the industry average of 873 out of 1,000.

Other ways to prove loss of income in a personal injury claim is with your past W-2 statement or with a Loss of Wages letter from your employer. This letter should include your job title, pay rate, the accident date, time missed and how many hours you work each week.