Agreement Investment Company With Lowest Fees

Description

How to fill out Form - Stock Purchase Agreement Providing For Strategic Investment In A Public Company?

Bureaucracy necessitates exactness and correctness.

Unless you manage the completion of forms like Agreement Investment Company With Lowest Fees regularly, it can lead to some misunderstanding.

Selecting the appropriate template from the outset will guarantee that your document submission proceeds smoothly and avert any hassle of resubmitting a document or repeating the entire task from the beginning.

Acquiring the correct and current templates for your documentation takes only a few minutes with an account at US Legal Forms. Eliminate bureaucratic worries and enhance your efficiency with forms.

- Find the right template by utilizing the search feature.

- Ensure that the Agreement Investment Company With Lowest Fees you've found is suitable for your state or region.

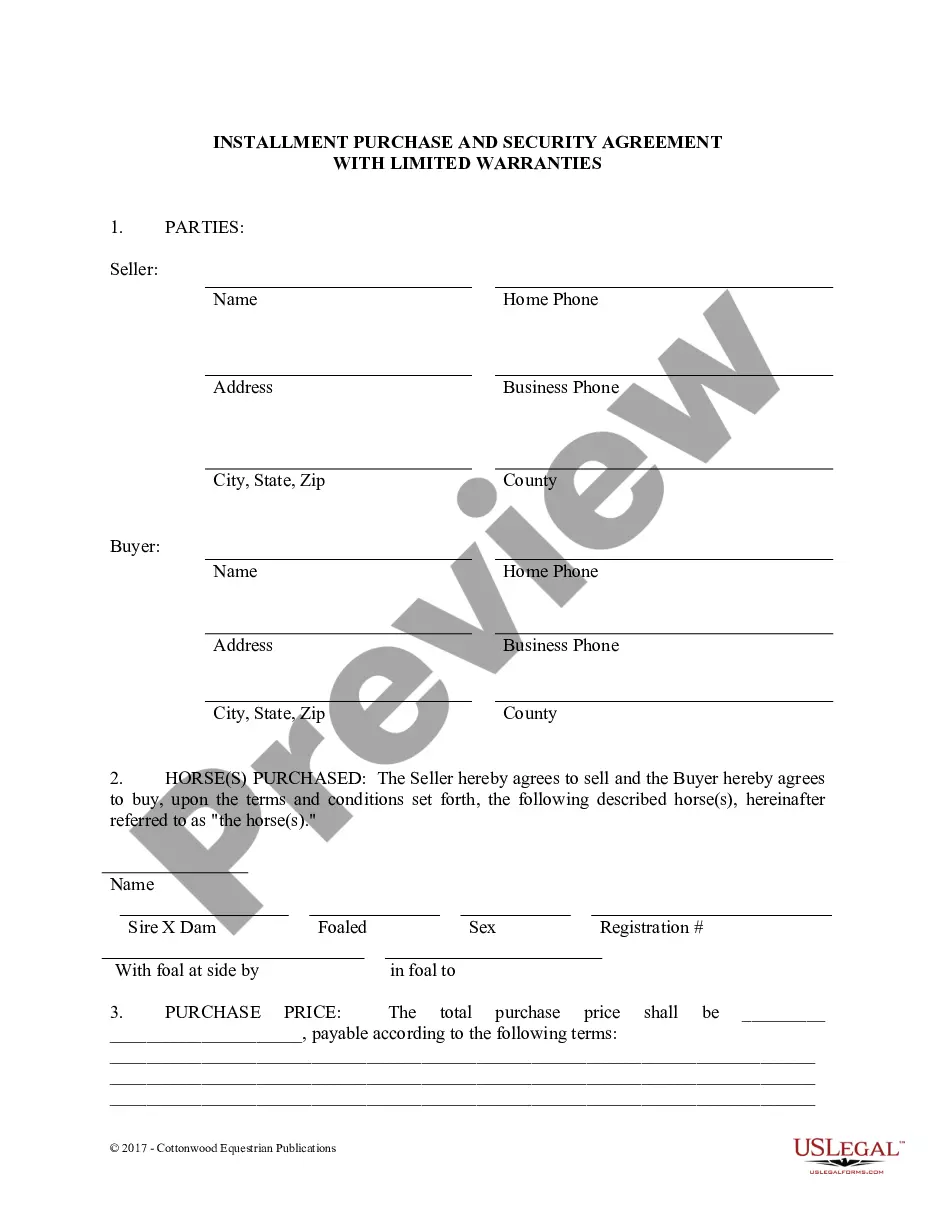

- Examine the preview or review the description containing the particulars on the usage of the template.

- When the result corresponds with your inquiry, click the Buy Now button.

- Choose the appropriate option from the proposed subscription plans.

- Log In to your account or create a new one.

- Complete the transaction using a credit card or PayPal account.

- Receive the document in your preferred file format.

Form popularity

FAQ

That's no accident. Fidelity, Schwab and Vanguard each have specific qualities that appeal to investors, which I'll discuss shortly. But they're the best overall because they charge minimal fees, including $0 commissions on stocks, mutual funds, exchange-traded funds (ETFs) and options.

What Is the Average Fee for a Financial Advisor? The average fee for a financial advisor generally comes in at about 1% of the assets they are managing. The more money you have invested, however, the lower the fee goes.

A unit investment trust does not charge a management fee. The portfolio is fixed and there is no investment adviser since unit investment trusts are supervised, not managed.

Ways to Reduce Fees & Costs in Your Investment PortfolioStart With a Commission-Free Brokerage.Choose Free Bank Accounts.Pick a Low-Cost HSA.Invest in Low-Cost Index Funds.Look for No-Load Mutual Funds.Scrutinize Your 401(k) for Hidden Fees.Don't Try to Time the Market.Use a (Free) Robo-Advisor.More items...

Common investment and brokerage feesTrade commission: Also called a stock trading fee, this is a brokerage fee that is charged when you buy or sell stocks. You may also pay commissions or fees for buying and selling other investments, such as options or exchange-traded funds.