S Corporation Statement With Text

Description

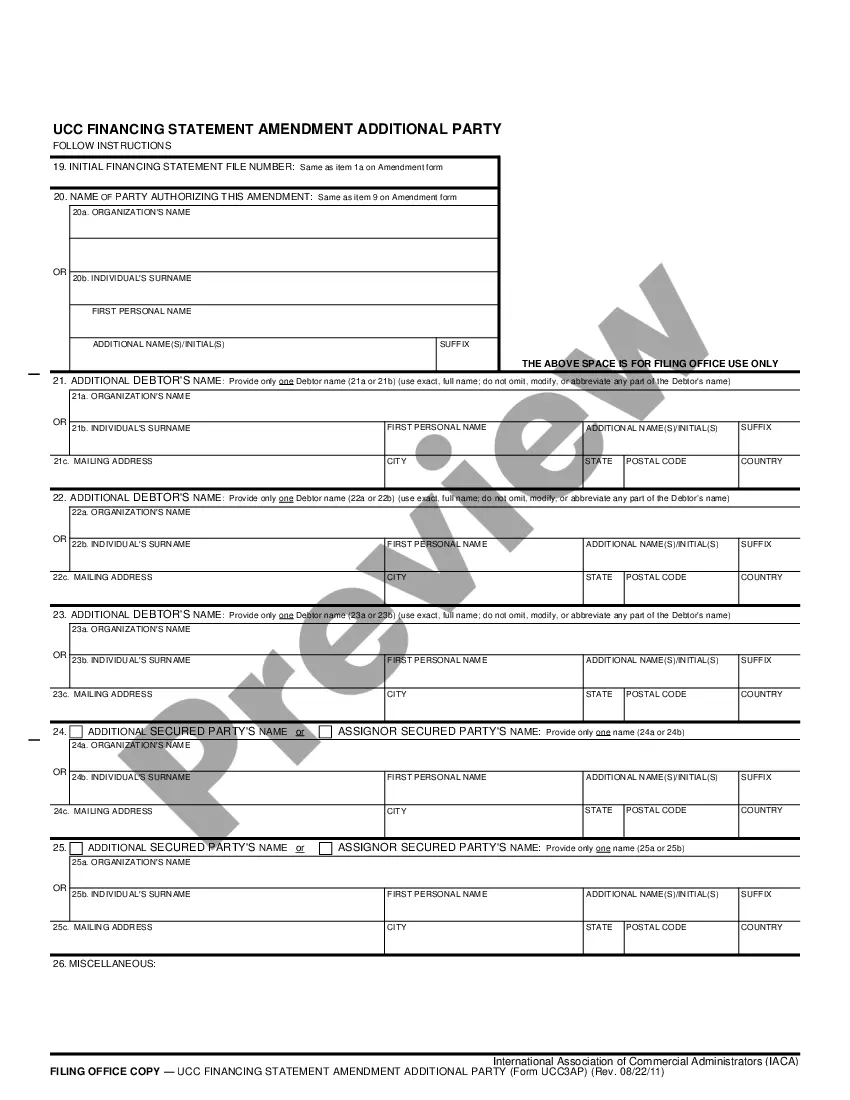

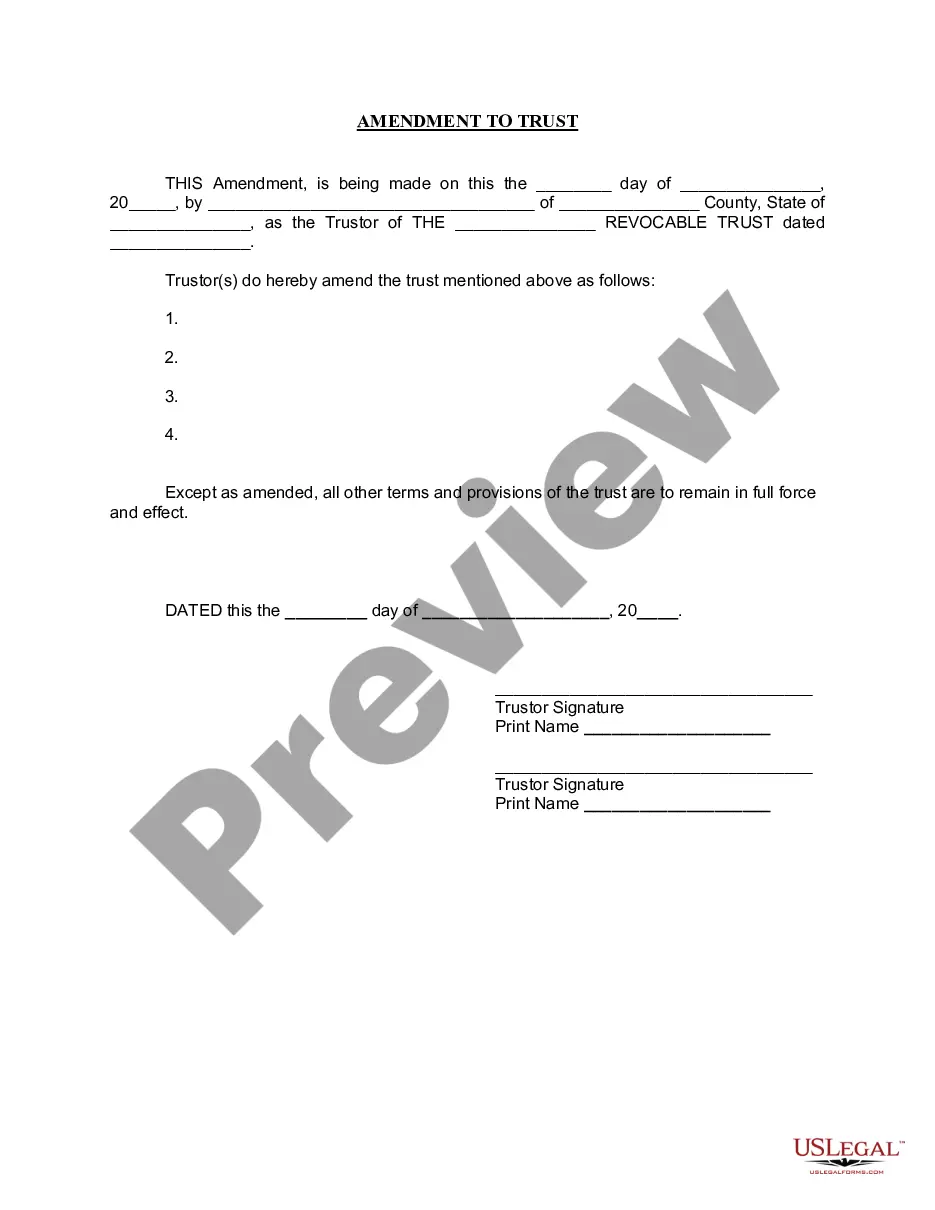

How to fill out Small Business Startup Package For S-Corporation?

Managing legal documents can be perplexing, even for seasoned experts.

If you're seeking an S Corporation Statement With Text and haven't had the opportunity to search for the correct and up-to-date version, the process can become taxing.

With US Legal Forms, you can.

Access legal and business forms tailored to specific states or counties. US Legal Forms meets any needs you might have, ranging from personal to business documentation, all in one centralized location.

If you're new to US Legal Forms, create a free account for unlimited access to all the platform's perks. Here are the steps to follow after obtaining the form you need.

Ensure it’s the correct document by previewing and reviewing its description.

Confirm that the template is valid in your state or county.

- Utilize sophisticated tools to complete and oversee your S Corporation Statement With Text.

- Access a collection of articles, guides, and resources related to your circumstances and requirements.

- Save time and energy searching for the documents you require, and leverage US Legal Forms’ advanced search and Review function to find the S Corporation Statement With Text and download it.

- If you hold a membership, Log In to your US Legal Forms account, locate the form, and download it.

- Review your My documents section to view the documents you’ve previously downloaded and organize your folders as needed.

Click Buy Now when you're set.

Select a monthly subscription option.

Choose the file format you prefer, then Download, complete, sign, print, and send your paperwork.

Benefit from the US Legal Forms online library, supported by 25 years of experience and trustworthiness. Streamline your document management process today.

- An extensive online form repository may transform the experience for anyone aiming to handle these matters efficiently.

- US Legal Forms is a frontrunner in the field of web legal forms, boasting over 85,000 state-specific legal forms available at any time.

Form popularity

FAQ

The frequency of filing a statement of information for an S corporation varies by state, but generally, it is required annually or biennially. It's essential to stay informed about your specific state's requirements to avoid any penalties. Keeping track of these deadlines will help maintain your business's good standing. You can rely on USLegalForms to help you set reminders and provide the necessary forms.

To submit your statement of information, you can typically complete the required form online or through a paper application, depending on your state regulations. The statement usually includes essential details about your S corporation, such as the business address and contact information. After filling out the form, you will need to submit it to the appropriate state agency, ensuring that you meet the submission deadlines. For ease of use, check out the tools on USLegalForms that can assist you in this process.

An S corporation must file Form 1120S, which is the U.S. Income Tax Return for an S Corporation. Additionally, each shareholder receives a Schedule K-1 that reports their share of the corporation's income, deductions, and credits. It is crucial to ensure these forms are completed accurately to maintain compliance and benefit from the S corporation status. For more guidance, consider utilizing the resources available on the USLegalForms platform.

The 2% rule in taxes allows taxpayers to deduct expenses that exceed 2% of their adjusted gross income. This rule applies to various deductions, including business expenses for S Corporation shareholders. To take advantage of this, ensure your expenses are well-documented and reflect accurately in your S corporation statement with text for easier tax filing.

An S Corporation is not strictly required to maintain a balance sheet unless it meets specific criteria, such as having significant assets or being a publicly traded company. However, having a balance sheet is a good practice as it provides a clear picture of the company's financial health. This information can enhance your S corporation statement with text, making it easier to attract investors or secure loans.

A real example of an S Corporation could be a small consulting firm where the owner operates as both the sole shareholder and employee. By electing S Corp status, the owner enjoys the benefits of limited liability while also having the flexibility of pass-through taxation. This structure allows for effective tax planning and can be clearly outlined in your S corporation statement with text.

You can legally reduce your income with an S Corporation by utilizing various deductions available to business owners, such as retirement contributions, health insurance premiums, and business expenses. Moreover, the S corporation structure allows profits to pass through to shareholders, potentially lowering your overall taxable income. It's beneficial to consult your S corporation statement with text to ensure compliance and maximize your deductions.

The 2% rule for S Corps allows shareholders to deduct expenses related to their business, but only if these expenses exceed 2% of their adjusted gross income. This rule can impact how you report income and expenses on your tax return. Keeping detailed records and utilizing your S corporation statement with text can help clarify what qualifies for these deductions.

The S Corp 2% rule refers to a tax provision that allows S corporation shareholders to deduct certain expenses, but only up to 2% of their income. This rule is significant because it can influence your overall tax liability. To navigate this effectively, consider consulting your S corporation statement with text to ensure you're maximizing your deductions.

To prove you are an S Corporation, you need to provide your S corporation statement with text from the IRS Form 2553, which indicates your election to be taxed as an S corporation. Additionally, maintain your Articles of Incorporation and any state filings that confirm your status. These documents serve as official proof of your S Corp designation and help establish your business’s credibility.