S Corporation Statement With One Shareholder

Description

How to fill out Small Business Startup Package For S-Corporation?

Creating legal documents from the ground up can occasionally feel somewhat daunting.

Certain situations may require extensive research and substantial financial investment.

If you're searching for a more straightforward and economical approach to producing an S Corporation Statement With One Shareholder or any other official documents without unnecessary complications, US Legal Forms is continually available for you.

Our online collection of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously crafted by our legal professionals.

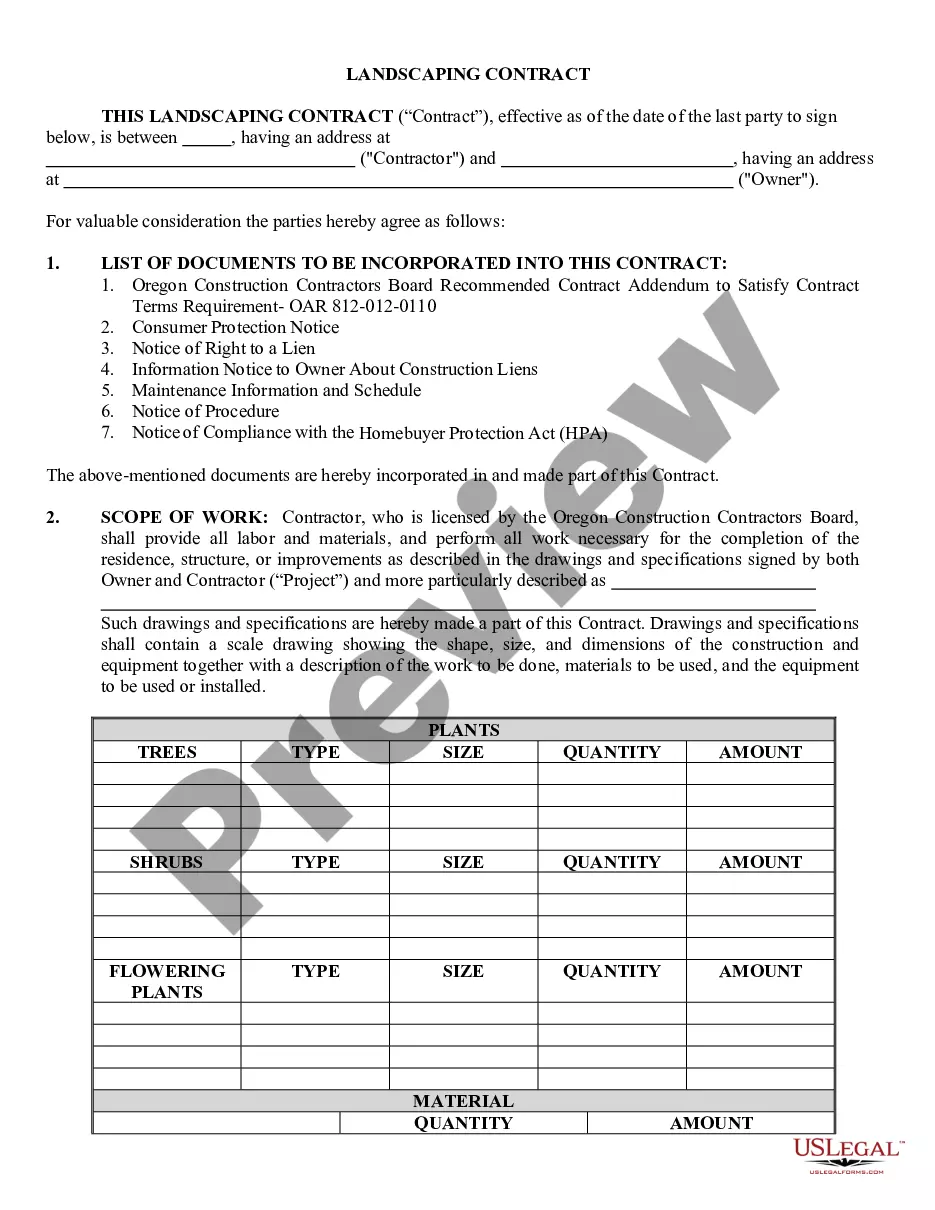

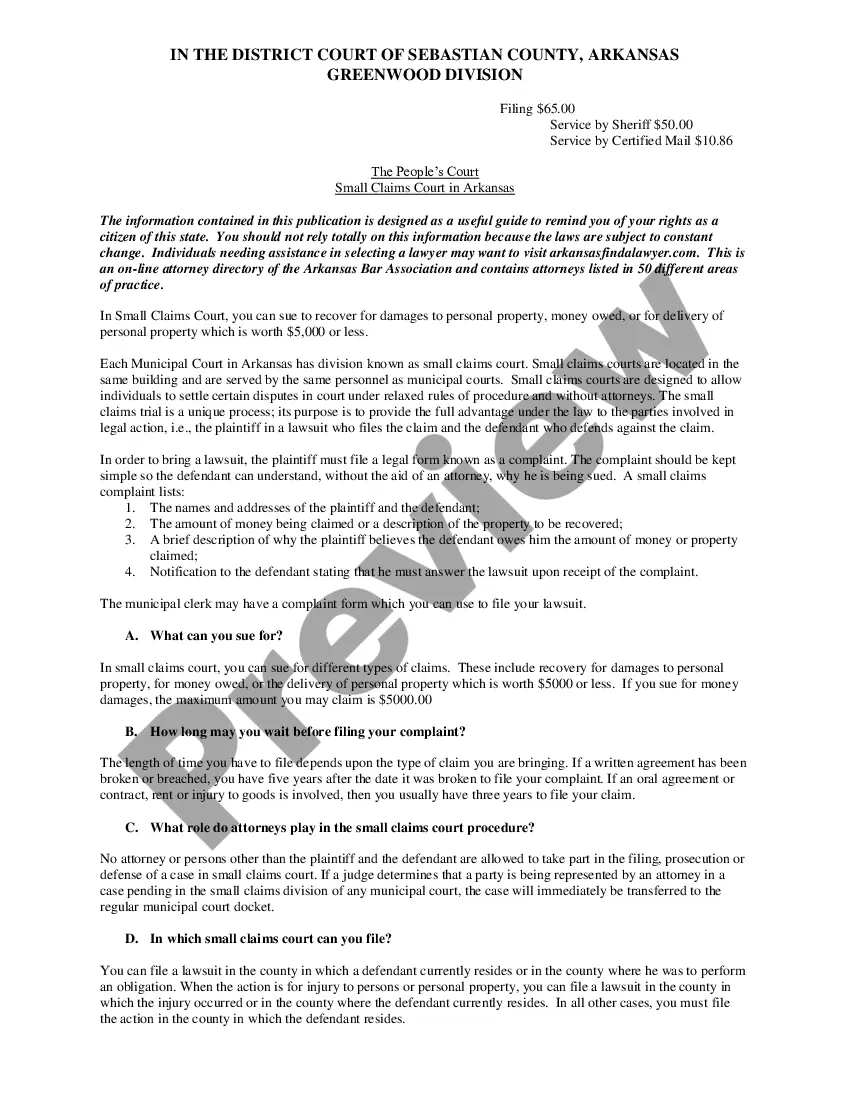

Examine the document preview and details to make sure you have located the form you need.

- Utilize our website whenever you need a dependable service that allows you to quickly locate and download the S Corporation Statement With One Shareholder.

- If you're familiar with our site and have previously established an account with us, just Log In to your account, find the form and download it or retrieve it anytime later from the My documents section.

- Don't have an account? No problem. Setting it up and browsing the catalog only takes a few minutes.

- However, before proceeding to download the S Corporation Statement With One Shareholder, please consider the following suggestions.

Form popularity

FAQ

The 2% rule for S corporations relates to the deduction of employee benefits for shareholders owning more than 2% of the corporation. According to this rule, these shareholders must report certain benefits, such as health insurance, as taxable income. Understanding the 2% rule can help you make informed decisions about your compensation and benefits as you manage your S corporation statement with one shareholder.

Yes, a corporation can have just one shareholder, especially when it is classified as an S corporation. The S corporation statement with one shareholder allows a single individual to enjoy the tax benefits and limited liability that come with this business structure. This setup can simplify management and decision-making, making it an attractive choice for solo entrepreneurs.

Certain individuals and entities are restricted from being shareholders in an S corporation statement with one shareholder. For example, non-resident aliens cannot hold shares. Additionally, other corporations, partnerships, and certain trusts may not qualify as shareholders. Understanding these restrictions can help you navigate the options available for your S corporation.

In the context of an S corporation statement with one shareholder, a husband and wife can indeed be treated as a single shareholder for tax purposes. This means that they can collectively hold shares and benefit from the advantages of being an S corporation, such as pass-through taxation. However, it is essential to ensure proper documentation and compliance with IRS regulations. For accurate guidance and to simplify the process, you can explore the resources available on the US Legal Forms platform.

Yes, an S corporation can have only one shareholder, making it an ideal choice for solo entrepreneurs. This structure allows for pass-through taxation and limited liability protection. With an S corporation statement with one shareholder, you can enjoy the benefits of corporate status while simplifying your business operations. To establish this, consider utilizing resources from uslegalforms for guidance and compliance.

To prove ownership of an S corporation, you need to maintain accurate records of stock ownership. This typically includes stock certificates, a stock ledger, and an S corporation statement with one shareholder if applicable. You may also need to provide documentation such as tax returns and financial statements to demonstrate your ownership in the corporation. Using a platform like uslegalforms can help you create and manage these documents efficiently.

An S corporation can have individual shareholders who are U.S. citizens or residents. Additionally, certain trusts and estates may also be shareholders. However, S corporations cannot have partnerships, corporations, or non-resident aliens as shareholders. Therefore, if you are considering forming an S corporation statement with one shareholder, ensure that the shareholder meets these criteria.

An S corporation can indeed have only one shareholder. This flexibility makes it an attractive option for single-owner businesses. With an S corporation statement with one shareholder, you gain both the advantages of limited liability and favorable tax treatment. If you need assistance setting up your S corporation or completing the necessary forms, platforms like USLegalForms can provide valuable resources.

Yes, you can have an S corporation with one shareholder. In fact, this structure is quite common for solo entrepreneurs and small business owners. The S corporation statement with one shareholder allows you to enjoy the benefits of pass-through taxation while maintaining liability protection. This setup can be a great choice for individuals looking to formalize their business operations.

While it's not mandatory to hire an accountant to file Form 2553, it can be beneficial. An expert can help ensure that your S corporation statement with one shareholder meets all requirements and is submitted correctly. They can also guide you through the tax implications and other necessary paperwork. For those unfamiliar with the process, consulting a professional can save time and reduce errors.