S Corporation Form Document For Sale

Description

How to fill out Small Business Startup Package For S-Corporation?

Utilizing legal document examples that adhere to federal and state regulations is essential, and the web provides numerous options to choose from.

However, what is the benefit of squandering time searching for the appropriately prepared S Corporation Form Document For Sale example online if the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for any professional and personal situation.

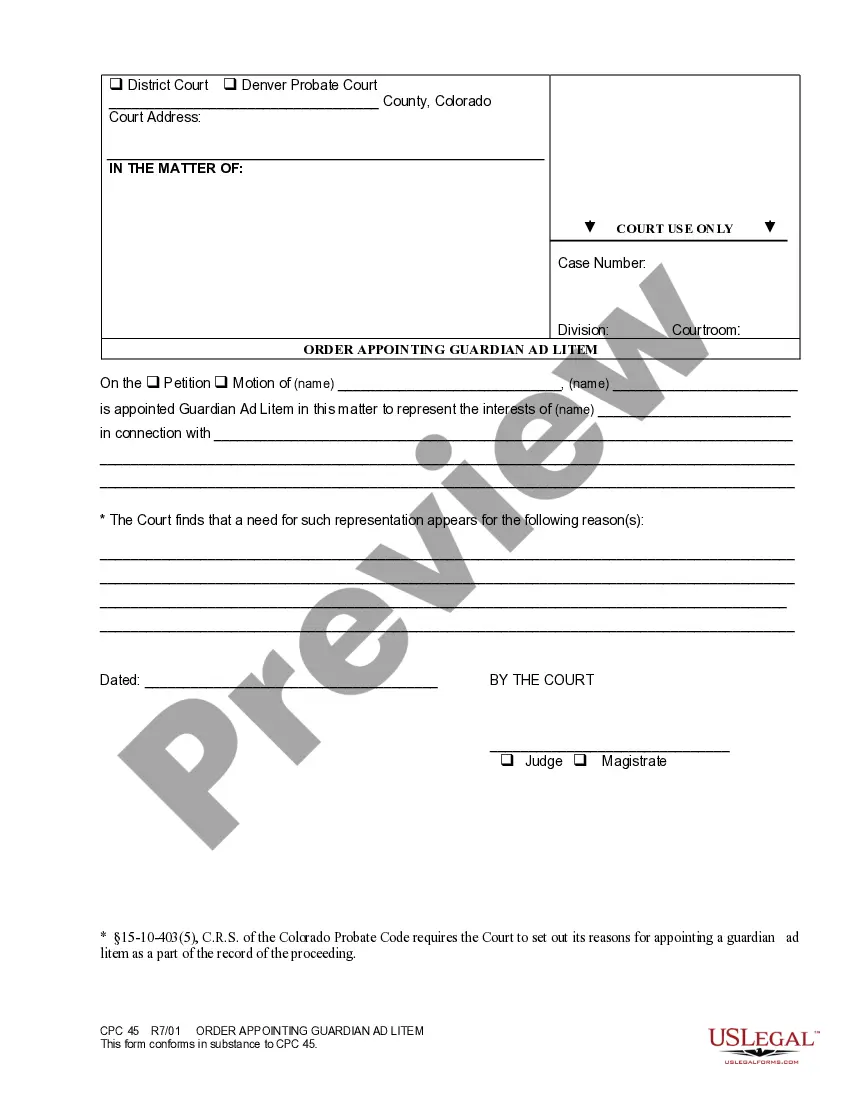

Review the template using the Preview feature or the text outline to confirm it fits your needs.

- They are easy to navigate with all documents categorized by state and purpose.

- Our experts stay updated with legal changes, ensuring that your form is always current and compliant when acquiring a S Corporation Form Document For Sale from our platform.

- Obtaining a S Corporation Form Document For Sale is straightforward and quick for both returning and new users.

- If you already possess an account with an active subscription, Log In and save the required document sample in the appropriate format.

- If you are a newcomer to our site, follow the instructions below.

Form popularity

FAQ

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.

An S corporation is a corporation that elects to be taxed as a pass-through entity. Income, losses, deductions, and credits flow through to the shareholders, partners or members. They then report these items on their personal tax return. IRS approval is required for the S election status.

Schedule D (Form 1120-S), Capital Gains and Losses and Built-in Gains. Corporations that elect to be S corporations use Schedule D (Form 1120-S) to report: Capital gains and losses. Sales or exchanges of capital assets.

Steps Call 1-800-829-4933 (the ?business and specialty tax line?). Press option 1 for English. Press option 7 for "Other Questions". Press option 2 for "Submitted forms or Tax History". Press option 1 for "Questions about Corporate". The IRS agent will ask a few security questions to confirm you own your LLC.

Here is a brief overview of the tax forms a typical S corporation needs to file with the IRS. Form 2553 ? S Corporation Election. ... Form 1120S ? S Corporation Tax Return. ... Schedule B ? Other Return Information. ... Schedule K ? Summary of Shareholder Information. ... Schedule K-1 ? Individual Shareholder Information.