S Corporation Facts

Description

How to fill out Small Business Startup Package For S-Corporation?

Managing legal documents can be perplexing, even for seasoned experts.

If you're searching for S Corporation Facts and lack the opportunity to find the appropriate and current version, the tasks may be burdensome.

US Legal Forms meets all your needs, from personal to business paperwork, all consolidated in one location.

Utilize cutting-edge tools to complete and manage your S Corporation Facts.

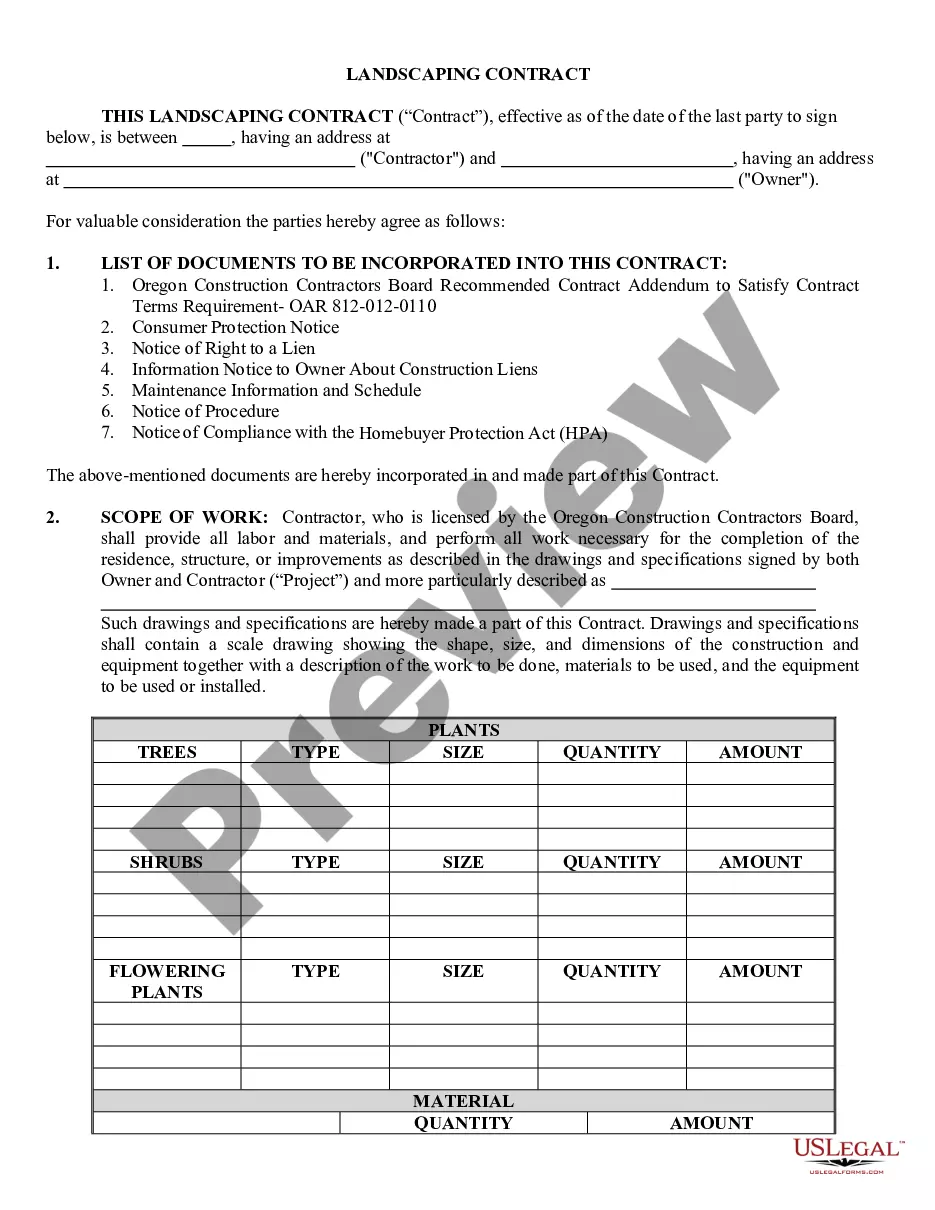

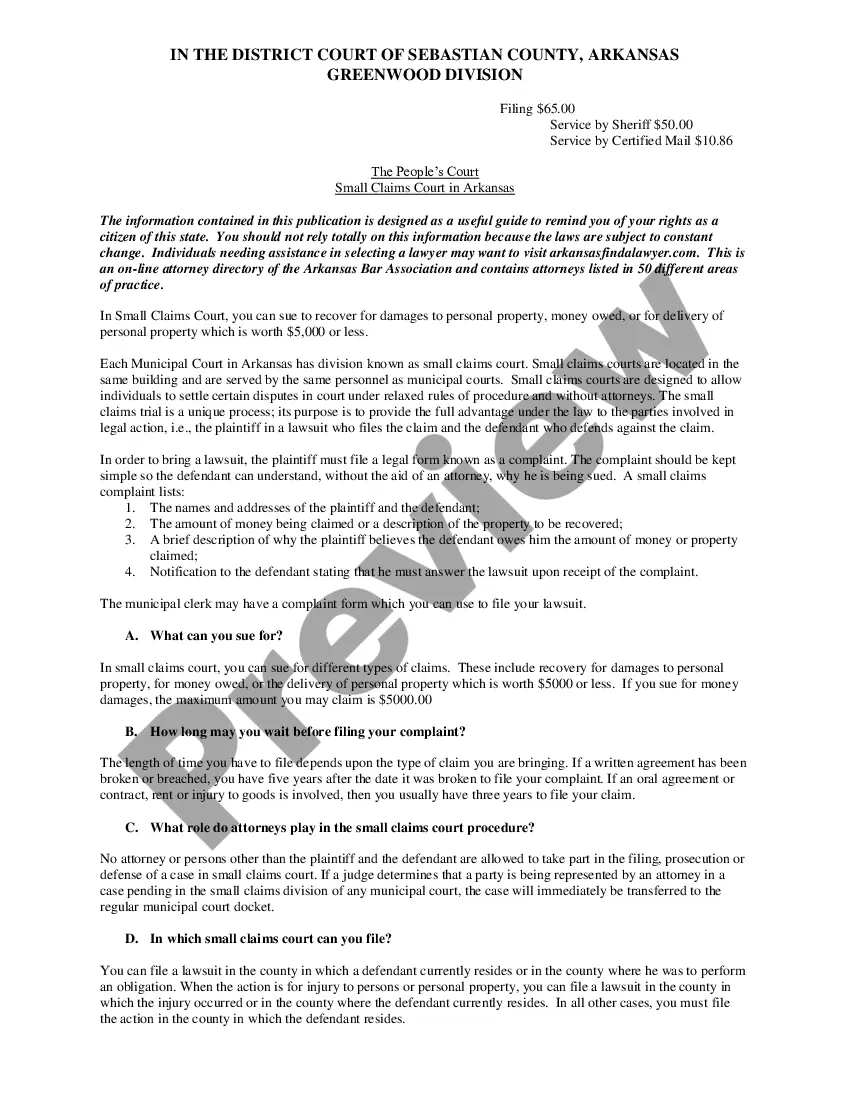

Here are the steps to follow after selecting the form you need: Confirm that this is the correct document by previewing it and reviewing its details.

- Access a valuable collection of articles, guides, and materials relevant to your circumstances and requirements.

- Save time and energy in your search for the necessary documentation, making use of US Legal Forms’ sophisticated search and Review tool to find and download S Corporation Facts.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Check the My documents tab to see the documents you’ve previously downloaded and organize your folders as needed.

- If you are new to US Legal Forms, register for a free account and enjoy unlimited access to all the platform’s features.

- A comprehensive online form library can be transformative for anyone aiming to navigate these scenarios effectively.

- US Legal Forms stands as a frontrunner in online legal documents, offering over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can access tailored legal and business documents specific to your state or county.

Form popularity

FAQ

Yes, you can file an S-corp yourself, especially if you are familiar with the necessary forms and requirements. However, it's important to ensure that you understand the tax implications and comply with all regulations. Resources like US Legal Forms can assist you in navigating this process, providing templates and instructions tailored for S corporations.

You should file Form 2553 to elect S corporation status for your business. Form 8832 is used to elect a different type of tax classification, which is not applicable if you are specifically seeking S corporation facts. Filing Form 2553 is crucial for ensuring your business enjoys the tax benefits associated with S corporations.

Yes, you can set up an S Corp on your own, but you will need to follow specific steps to do it correctly. This includes filing articles of incorporation, obtaining an EIN, and submitting Form 2553 to elect S corporation status. Platforms like US Legal Forms can provide you with the necessary documents and guidance to make this process smoother.

While it's possible to set up an S Corp on your own, having an accountant can simplify the process significantly. An accountant can help ensure that you complete all necessary paperwork correctly and comply with state and federal regulations. This can save you time and help you avoid mistakes, making it an investment worth considering.

The 5 year rule for S corporations refers to the period during which an S Corp must meet specific requirements to maintain its status. If an S corporation fails to meet these requirements for five consecutive years, it may lose its S Corp status. Understanding this rule is essential for all S corporation facts, as it influences the long-term tax benefits you can receive.

Yes, you can file S Corp taxes yourself, especially if your financial situation is straightforward. However, understanding the specific tax rules associated with S corporations can be complex. If you're uncertain, consider using resources or platforms like US Legal Forms to guide you through the process.

When filing your S-corp taxes, you typically need Form 1120S, which is the tax return for S corporations. Additionally, you should gather all relevant financial statements, including your income statement and balance sheet. It's also helpful to have records of any distributions and shareholder information, as these S corporation facts will be crucial for accurate reporting.

To obtain S Corporation status, you need to first establish your business as a corporation or LLC and then file Form 2553 with the IRS. This form must be submitted within 75 days of your business formation or by the 15th day of the third month of the tax year. Additionally, you must meet specific eligibility criteria related to shareholders and type of corporation. Understanding these S corporation facts will guide you through the necessary steps to achieve this status.

S Corporations are classified as private entities because they cannot issue stock to the public. Instead, they can only have up to 100 shareholders, all of whom must be U.S. citizens or residents. This structure allows S Corps to enjoy certain tax benefits while maintaining a level of privacy in their operations. Knowing these S corporation facts is crucial for deciding if this business structure aligns with your goals.

Yes, S Corporations are generally considered public records, as they must file certain documents with the state where they are incorporated. These documents may include your Articles of Incorporation, annual reports, and other filings, which are accessible to the public. However, specific financial details may remain private unless disclosed in public filings. Understanding these S corporation facts can help you navigate privacy concerns.