Business Startup Form Sample With Cost

Description

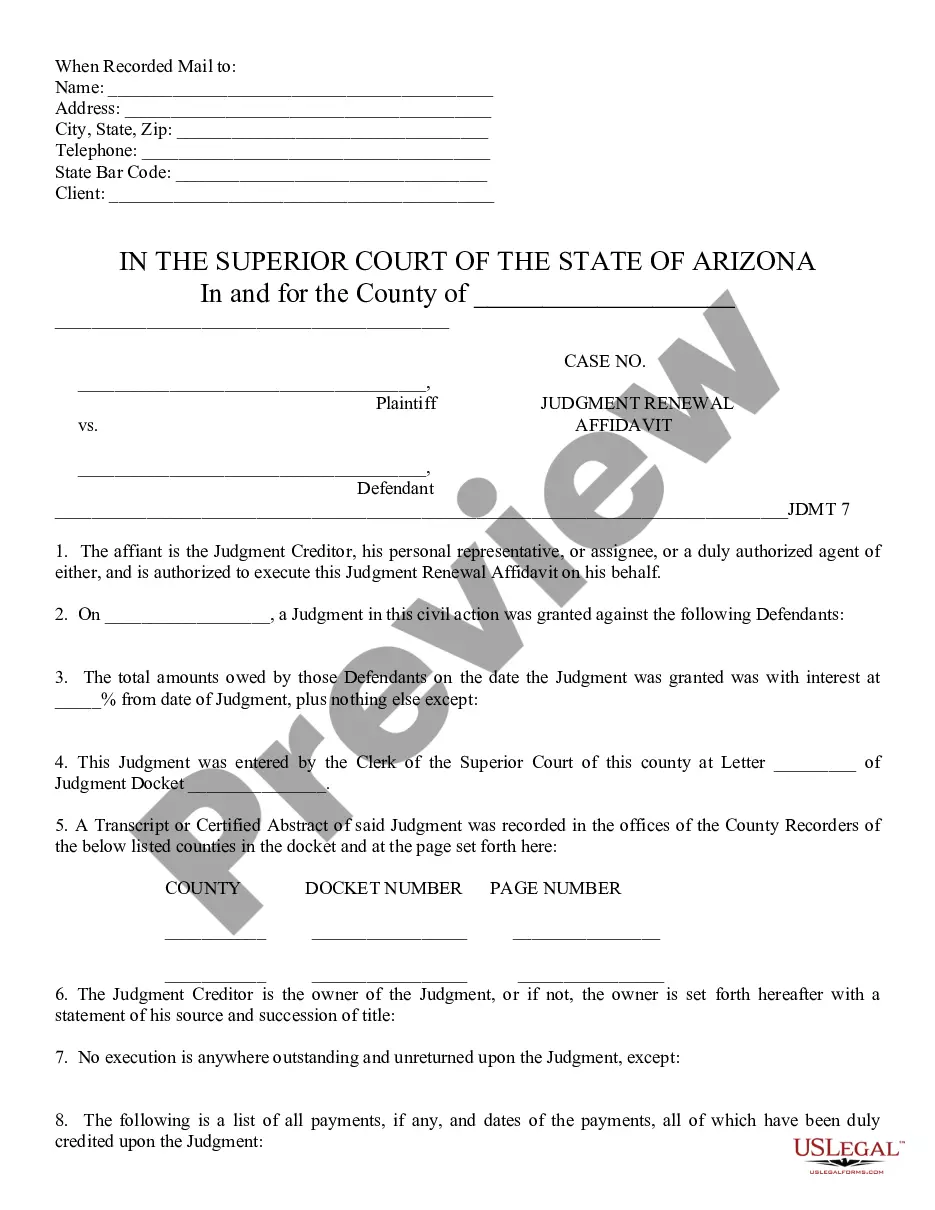

How to fill out Small Business Startup Package For S-Corporation?

Locating a reliable source for the most up-to-date and suitable legal templates is a significant part of managing bureaucracy.

Selecting the correct legal documents requires accuracy and careful consideration, which is why it's essential to obtain samples of Business Startup Form Sample With Cost exclusively from trustworthy providers, such as US Legal Forms. An incorrect template could squander your time and delay your current situation. With US Legal Forms, your concerns are minimal. You can access and verify all the information regarding the document’s applicability and relevance for your circumstances and in your jurisdiction.

After you have the form on your device, you can edit it with the editor or print it out and complete it by hand. Eliminate the complications that come with your legal documentation. Browse the vast US Legal Forms library where you can discover legal templates, assess their relevance to your situation, and download them instantly.

- Use the catalog navigation or search bar to locate your template.

- View the form’s description to confirm if it aligns with the standards of your state and locality.

- Check the form preview, if available, to ensure the form is indeed the one you need.

- Return to the search to find the correct document if the Business Startup Form Sample With Cost does not meet your requirements.

- Once you are confident about the form’s applicability, download it.

- If you are a registered client, click Log in to verify and access your chosen templates in My documents.

- If you don't have an account yet, click Buy now to acquire the template.

- Select the pricing option that suits your needs.

- Proceed to the registration to complete your acquisition.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Business Startup Form Sample With Cost.

Form popularity

FAQ

To expense startup costs, keep detailed records of all your expenditures from the beginning. Use a business startup form sample with cost to categorize these expenses effectively. This documentation is crucial for tax purposes, as many startup costs can be deducted. Staying organized not only helps in managing your finances but also supports your business's growth as you move forward.

An example of a startup cost includes expenses like business registration fees, marketing materials, or initial inventory. Utilizing a business startup form sample with cost can help you identify and estimate these expenses accurately. By understanding your startup costs, you can create a realistic budget that supports your business goals. Tracking these costs ensures you remain on target as you launch your venture.

While $3,000 may seem limited, it can be sufficient to start a small business if you plan wisely. Use resources like a business startup form sample with cost to estimate your initial expenses and prioritize essential needs. By strategically focusing on low-cost marketing tactics and essential tools, you can establish a solid foundation for your business. Remember, creativity and smart budgeting can stretch your funds further.

The best business form for a startup often depends on your specific needs and goals. Common forms include sole proprietorships, partnerships, and LLCs. A business startup form sample with cost can guide you in selecting the right structure based on liability, taxation, and administrative requirements. Assessing these factors helps ensure that you choose the best form that aligns with your vision.

Yes, you can start a business with $3,000, but your success depends on your planning and resourcefulness. A business startup form sample with cost can help you outline how to allocate your budget effectively. Focus on essential expenses, like registering your business and creating a basic marketing strategy. Remember, careful management of your funds can lead to growth even with a limited budget.

To write off business startup costs, you need to categorize your expenses correctly. First, you can deduct $5,000 in the first year if your total costs are below $50,000. For higher expenses, the remainder can be amortized over 15 years. A business startup form sample with cost can guide you through this process efficiently.

The $5,000 tax credit is designed to encourage new business formation by allowing you to deduct certain startup costs. This deduction applies if your total startup expenses do not exceed $50,000. If your expenses are higher, the deduction may decrease. Using a business startup form sample with cost can simplify the process of claiming this credit.

Startup costs can include many expenses incurred before your business begins operations. Common examples are market research, advertising, and professional fees for legal or consulting services. These costs are crucial to establishing your business foundation. A business startup form sample with cost can help you track these important expenditures.

You can write off various expenses in your first year of business. Generally, the IRS allows you to deduct up to $5,000 in startup costs if your total startup expenses are $50,000 or less. For amounts over that, the deduction may be phased out. Utilizing a business startup form sample with cost can help you organize and identify these deductible expenses.