Agree Use Business With Personal Account

Description

How to fill out Small Business Startup Package For S-Corporation?

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re looking for a a more straightforward and more cost-effective way of preparing Agree Use Business With Personal Account or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of more than 85,000 up-to-date legal documents addresses almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific forms carefully put together for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can easily find and download the Agree Use Business With Personal Account. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and navigate the library. But before jumping directly to downloading Agree Use Business With Personal Account, follow these tips:

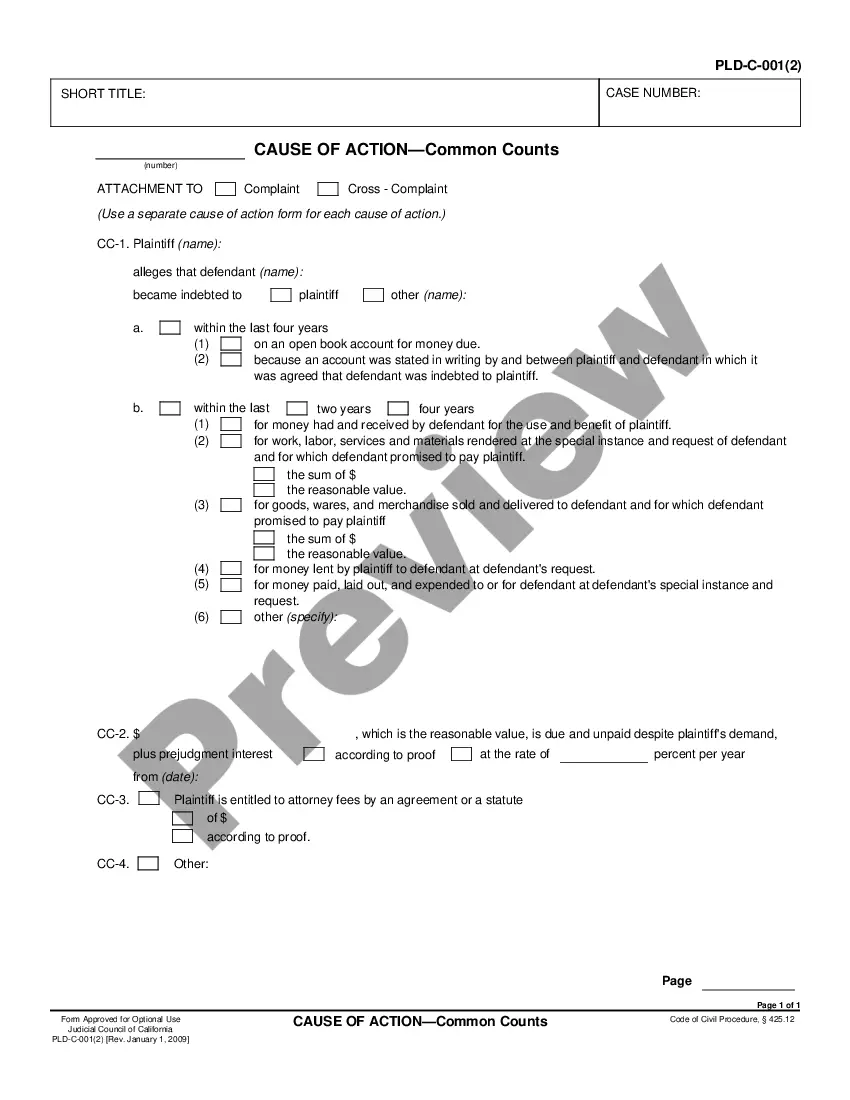

- Check the form preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the template you select complies with the requirements of your state and county.

- Choose the right subscription option to buy the Agree Use Business With Personal Account.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us now and turn form execution into something easy and streamlined!

Form popularity

FAQ

While it's technically possible to use a personal bank account for business transactions as a sole trader, it's advisable to open a separate business bank account. This separation ensures compliance with tax regulations, facilitates financial clarity, helps build your business credit and simplifies auditing processes.

Do you need a business bank account? If you are a sole trader, you are not legally required to have a separate business account and you can usually use your personal bank account to manage your business and non-business finances.

If you're only using one bank account for both personal and business activities it will end up costing you more in bookkeeping fees as additional entries have to be processed. It also takes more time for your accountant to sift through all the activity on your bank statement.

The answer is that, in Canada, the Canada Revenue Agency frowns upon the mixing of personal and business transactions. Especially if your company is incorporated. In that situation, all business-related transactions should be handled through a business bank account opened in your business's name.

Maintaining separate bank accounts for your business and personal expenses is crucial for accurate financial reporting and seamless tax compliance.