Personal Loan Document Form With Collateral

Description

How to fill out Personal Loan Agreement Document Package?

Legal documents management can be overwhelming, even for experienced professionals.

If you are looking for a Personal Loan Document Form With Collateral and lack the time to search for the appropriate and current version, the process can be challenging.

Access a repository of articles, guides, and resources related to your situation and requirements.

Save time and energy searching for the documents you require, and use US Legal Forms’ advanced search and Preview functionality to locate the Personal Loan Document Form With Collateral and download it.

Select Buy Now when you are prepared. Choose a monthly subscription plan. Select your desired file format, then Download, fill it out, sign, print, and send your documents. Take advantage of the US Legal Forms online library, backed by 25 years of expertise and reliability. Streamline your daily document management into a simple and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the document, and download it.

- Check your My documents section to review the documents you have previously downloaded and manage your folders as desired.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the benefits of the library.

- Follow the steps after obtaining the document you need.

- Confirm it is the correct document by previewing and examining its description.

- Ensure the template is valid in your state or county.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you may have, from personal to commercial paperwork, all in one location.

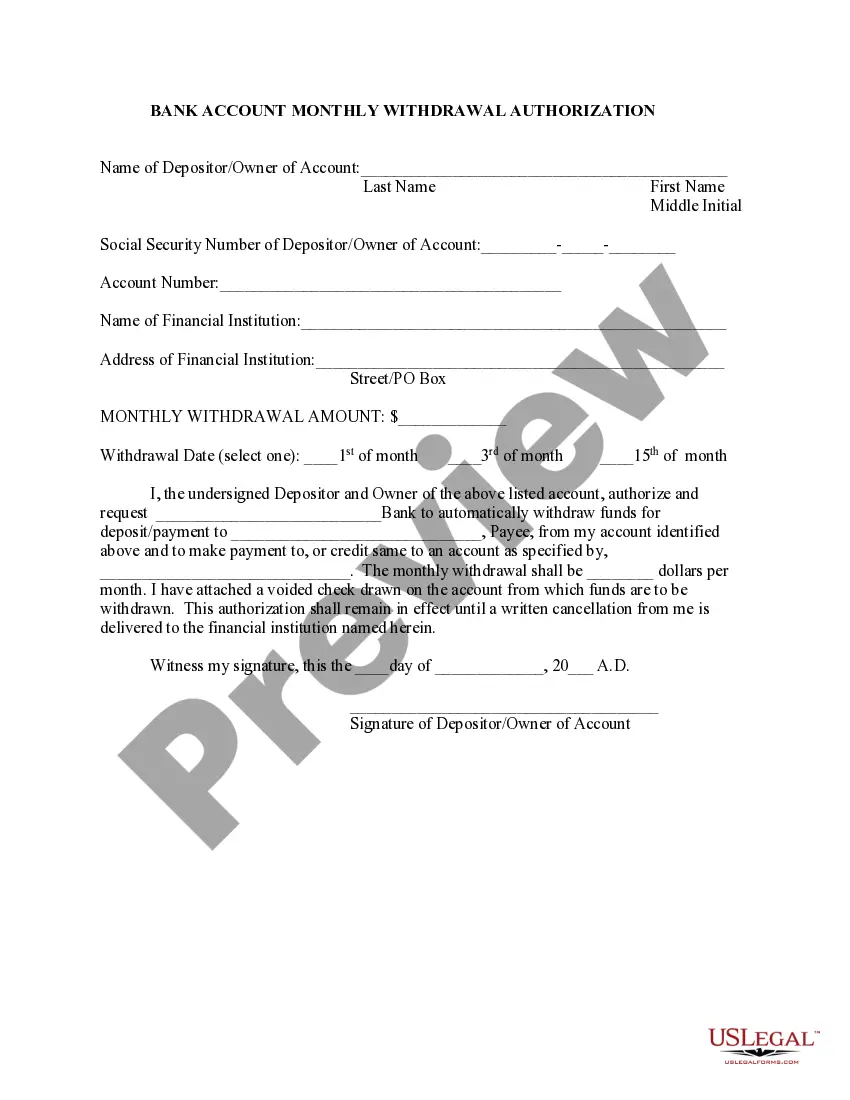

- Utilize innovative tools to complete and manage your Personal Loan Document Form With Collateral.

Form popularity

FAQ

The North Dakota Department of Human Services says they recommend a child must be at least 9 years old before he or she is left alone. North Dakota says ages 0-8 must not be left alone under any circumstances.

In North Dakota, custody is called ?parental rights and responsibilities.? When a judge makes an order for parental rights and responsibilities, s/he will decide two basic things: ?decision-making responsibility? and ?residential responsibility.?

Contrary to common belief, in Minnesota there is no particular age at which a child gets to decide which parent he wants to live with.

In Minnesota, there is not set age limit on when a child can decide which parent to live with. The court will consider the child's wishes to the extent that the child is sufficiently mature to express reasoned and independent preferences as to the parenting time schedule.

A court hearing is not required for name changes in North Dakota, but if the court decides that one is necessary for your case, you will need to attend it with copies of all your documents. If your petition is approved, the judge will sign your Order Granting Name Change.

A confidential information form lists the full protected information that isn't allowed to appear in other documents filed with the court. This form is a part of the court record that isn't seen by the public.

There are no hard-and-fast rules as to the age at which a child is considered mature enough to testify as to a preference regarding residential responsibility. A court might find a ten year old in one case mature enough to express a preference, but find otherwise regarding a thirteen year old in another case.

Contact information for clerks of district court is available at ndcourts.gov/court-locations. File your completed name change documents with the Clerk of District Court in the North Dakota county where you have resided for at least 6 months before filing the Petition. Note: You'll be asked to pay an $80.00 filing fee.