Legal Documents Format For Cheque Bounce

Description

How to fill out Legal Documents Package For Authors And Publishers?

Legal documents management can be daunting, even for the most proficient professionals.

When you seek a Legal Document Format for Check Bounce and lack the time to spend finding the correct and updated version, the process can be frustrating.

Tap into a resource pool of articles, guides, and materials pertinent to your circumstances and needs.

Save time and energy searching for necessary documents, utilizing US Legal Forms’ enhanced search and Preview function to locate the Legal Document Format for Check Bounce and obtain it.

Ensure that the template is accepted in your jurisdiction. Select Buy Now when you are prepared. Choose a monthly subscription plan, select your preferred file format, and Download, complete, sign, print, and submit your document. Benefit from the US Legal Forms online catalog, backed by 25 years of experience and reliability. Transform your everyday document management into a straightforward and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, find the form, and download it.

- Check the My documents section to view your previously saved documents and manage your files as you desire.

- If it is your first experience with US Legal Forms, create an account and enjoy unrestricted access to all the platform's benefits.

- Here are the steps to follow after downloading the desired form.

- Confirm this is the correct document by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to all your needs, ranging from personal to corporate paperwork, in one centralized location.

- Utilize advanced tools to complete and manage your Legal Document Format for Check Bounce.

Form popularity

FAQ

Proving misuse of a cheque involves gathering substantial evidence. Primarily, you need to establish that the cheque was not meant for the purpose claimed by the drawee. Documentation such as bank statements, transaction records, and any relevant correspondence can support your case. Adhering to the correct legal documents format for cheque bounce is crucial, and uslegalforms provides templates to assist you in this process.

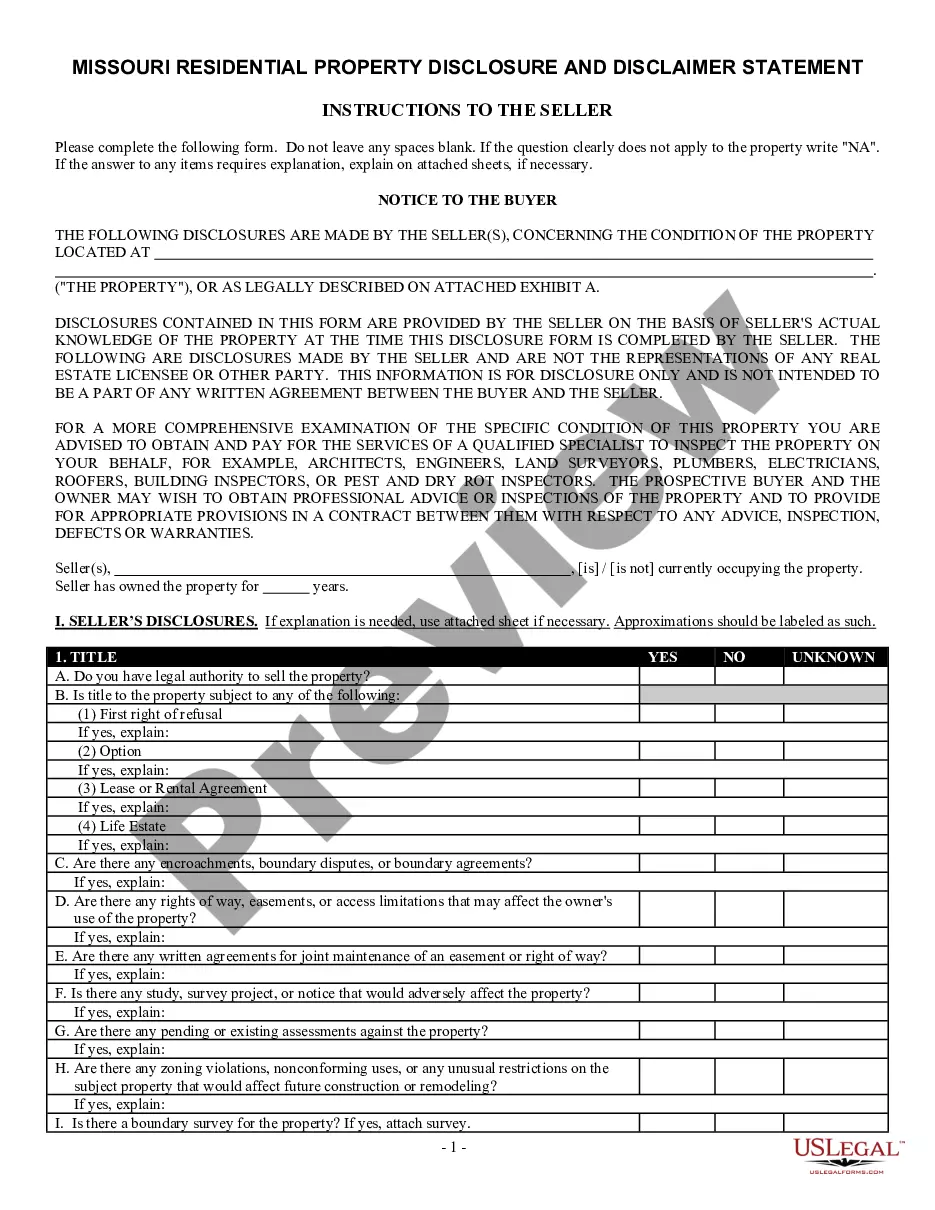

To pursue a cheque bounce case, you will need several important documents. Typically required are the bounced cheque, a formal notice sent to the drawer, and any proof of service for that notice. Maintaining these legal documents in the appropriate format for cheque bounce is essential for a successful case. Utilize uslegalforms to access ready-made templates that suit your needs.

The format of a cheque return message typically includes several key details. It should clearly state the reason for the cheque bounce, such as insufficient funds or a stop payment. Additionally, it must include identifying information from both the payer and the payee. You can find specific examples of the legal documents format for cheque bounce on platforms like uslegalforms.

Writing a letter for a cheque bounce is straightforward. Start by addressing the recipient and clearly state that their cheque has bounced due to insufficient funds or other reasons. Include relevant details such as the cheque number, date, and amount. Use a legal documents format for cheque bounce to ensure your letter is formal and effective, and be sure to request payment promptly while maintaining a professional tone.

The legal procedure for a bounced cheque typically begins with sending a formal demand notice to the cheque issuer, citing the legal documents format for cheque bounce. If the issuer fails to respond or settle the debt, you may escalate the matter to court. Understanding this procedure helps ensure that you follow necessary steps to protect your rights and recover your dues.

To make a cheque bounce case strong, gather all relevant evidence, such as the bounced cheque, communication records, and any notices sent. It's crucial to utilize the legal documents format for cheque bounce when documenting your case, as this ensures compliance with legal requirements and strengthens your position. Being organized and thorough increases the likelihood of a favorable outcome.

If someone pays you with a cheque that bounces, promptly contact the issuer to inform them of the situation. You can also consider using the legal documents format for cheque bounce to send a formal notice, urging them to settle the debt. Taking these steps helps protect your financial interests and maintain a clear record of the transaction.

The new rules for cheque bounce cases include stricter penalties and faster resolution methods. These rules ensure that individuals face consequences for issuing cheques without sufficient funds, encouraging responsible financial behavior. It is paramount to utilize the legal documents format for cheque bounce to correctly document the case and enforce your rights.

If a cheque bounces, the first step is to notify the issuer and give them an opportunity to rectify the situation. You may also decide to draft a formal notice, adhering to the legal documents format for cheque bounce, to initiate further action if necessary. This process ensures that you follow legal protocols and protect your rights.

The new rule for cheque bounce focuses on streamlining the legal process and increasing accountability for individuals issuing cheques. This rule emphasizes the importance of maintaining sufficient funds and adhering to the legal documents format for cheque bounce to avoid penalties. It aims to protect both parties involved in a transaction by providing clearer guidelines.