Development Lease Agreement With Two Tenants

Description

How to fill out Reasonable Development?

Bureaucracy necessitates exactness and correctness.

Unless you manage completing documents like Development Lease Agreement With Two Tenants on a daily basis, it may lead to some misinterpretations.

Choosing the appropriate sample from the outset will ensure that your document submission goes seamlessly and avoids any hassles of resending a document or doing the same task entirely from the beginning.

Obtaining the correct and current samples for your documentation can be accomplished in just a few minutes with an account at US Legal Forms. Evade the bureaucracy dilemmas and simplify your paperwork.

- Find the sample using the search field.

- Verify the Development Lease Agreement With Two Tenants you’ve found is suitable for your state or area.

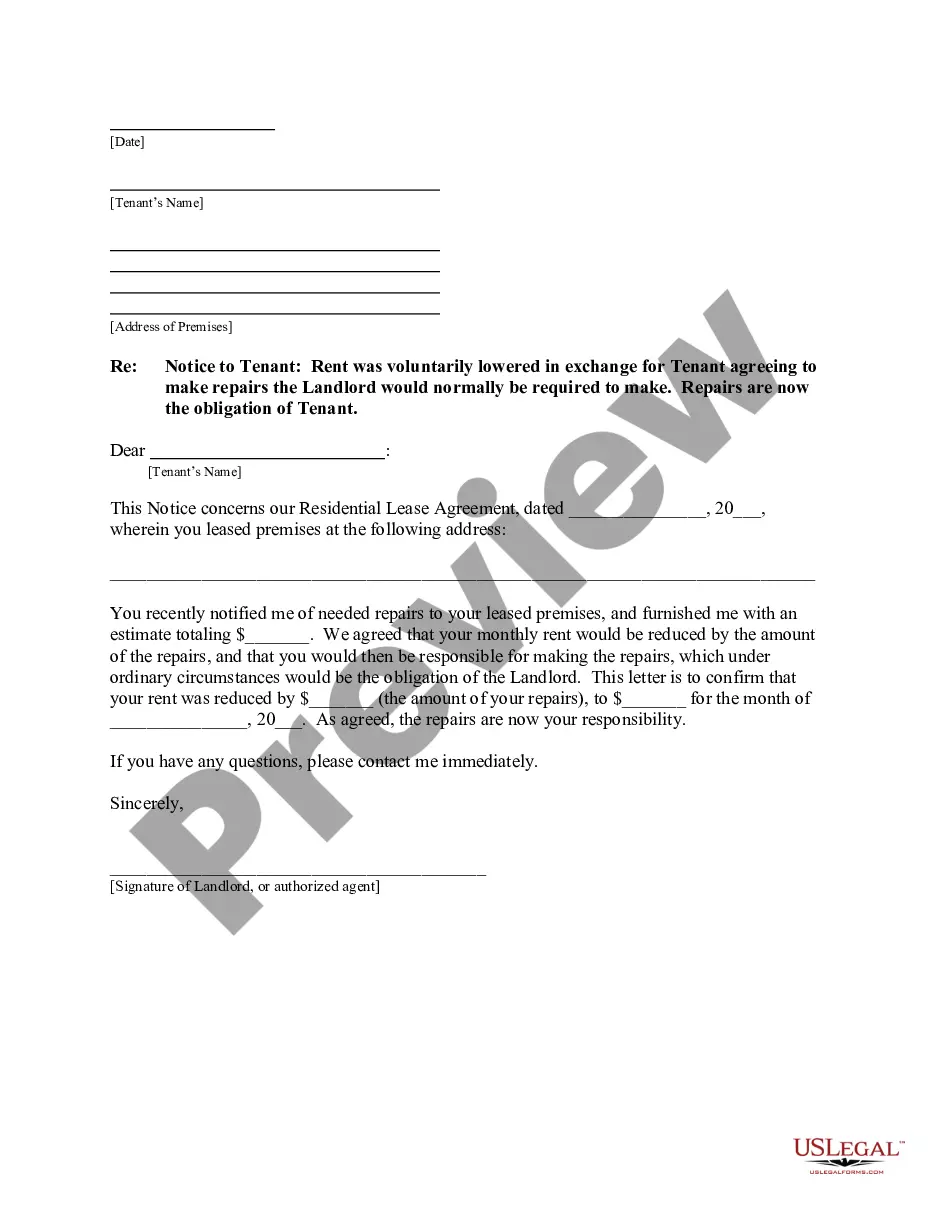

- Examine the preview or review the description detailing the specifics on the use of the template.

- If the result matches your search, click the Buy Now button.

- Select the appropriate option from the suggested subscription plans.

- Log In to your account or create a new one.

- Finalize the purchase using a credit card or PayPal payment method.

- Download the form in the file format you prefer.

Form popularity

FAQ

NNN stands for net, net, net. It means that the tenant pays most of the expenses. They pay the rent fees plus property taxes, property insurance, and CAM, or common area maintenance.

Example of Calculating Monthly Rent in a NNN Lease The estimated operating expenses (aka NNN) are $10 per square foot per year. The total yearly rent you would pay equals $40 sf per year. So if you are leasing 3,000 sf then your yearly rent would be $120,000 or $10,000 per month.

The most obvious benefit of using a triple net lease for a tenant is a lower price point for the base lease. Since the tenant is absorbing at least some of the taxes, insurance, and maintenance expenses, a triple net lease features a lower monthly rent than a gross lease agreement.

A triple net lease (triple-net or NNN) is a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These expenses are in addition to the cost of rent and utilities.

Triple net lease (NNN)A type of commercial real estate lease under which you typically pay the base rent, plus property taxes, building insurance and utilities, as well as other operating and maintenance costs. The landlord assumes no costs, other than those for structural repairs.