Transfers Lien Note For Property

Description

How to fill out Assignment Of Promissory Note And Liens?

- If you're a returning user, sign in to your US Legal Forms account and select the required form template. Ensure your subscription is currently active to download without issues.

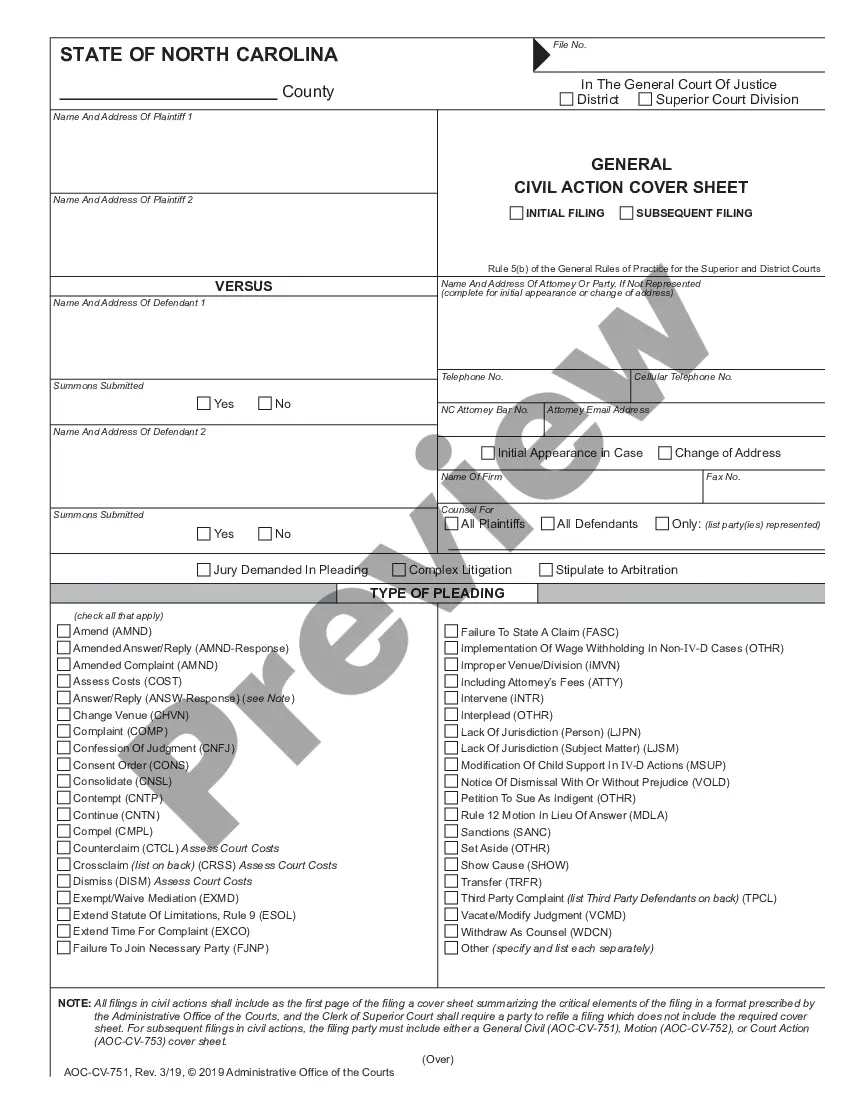

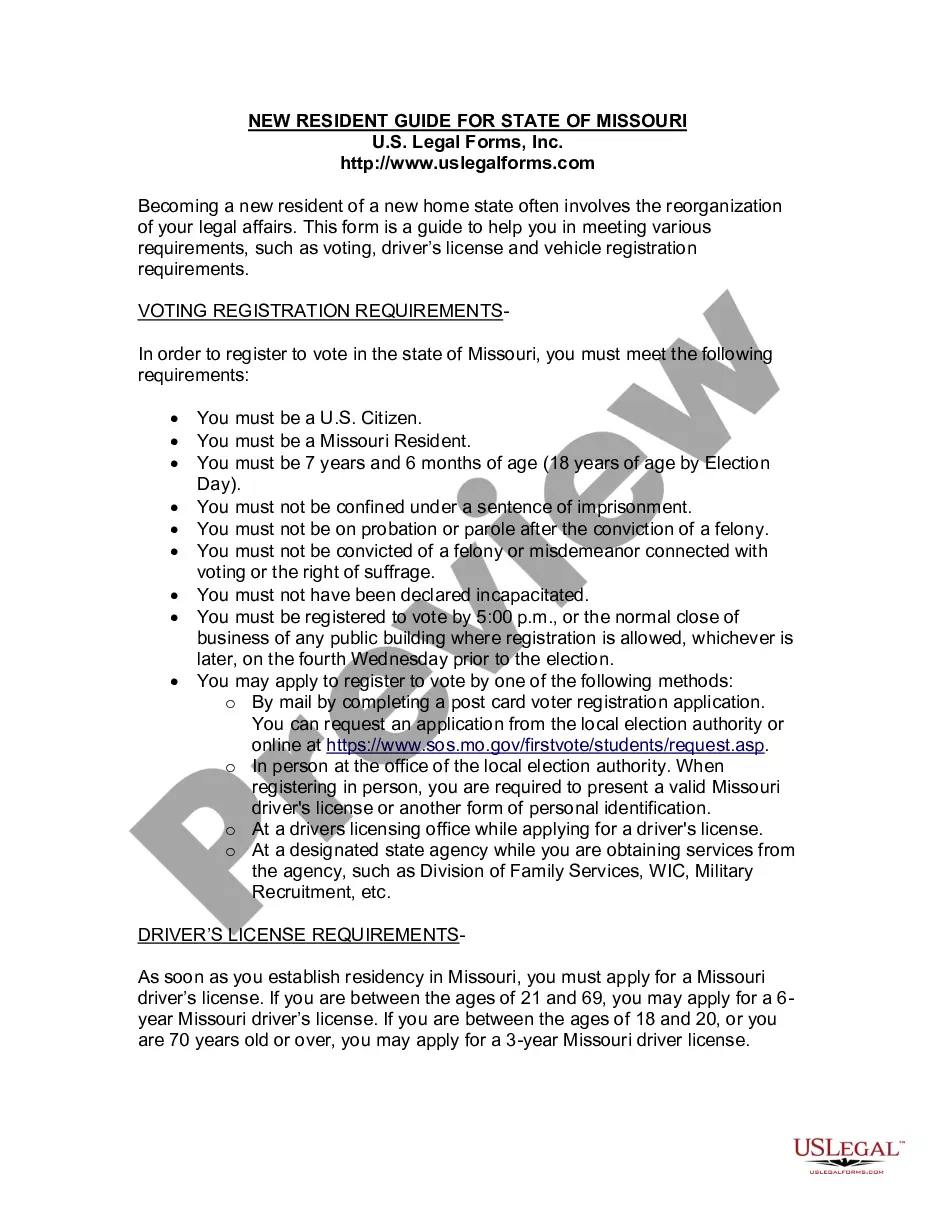

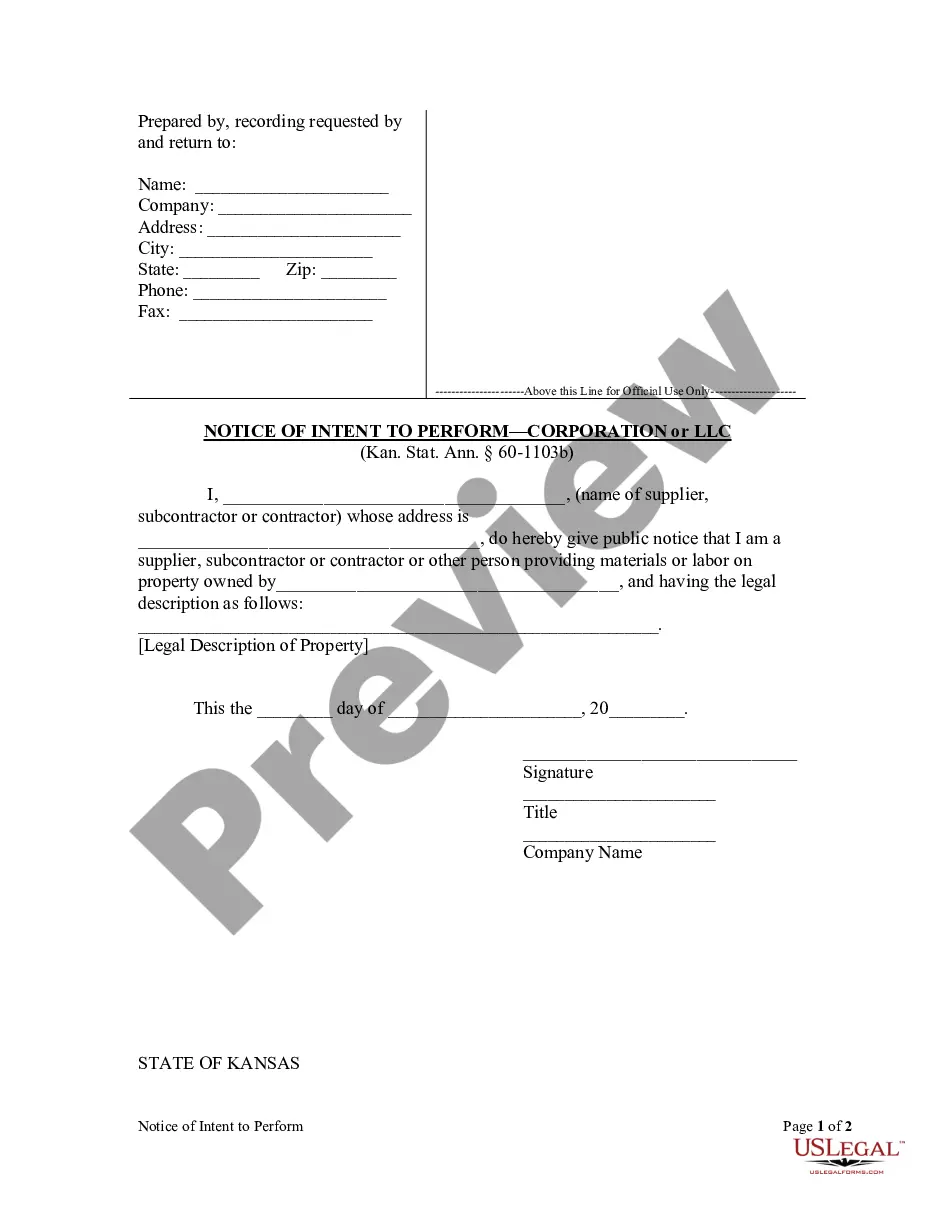

- For first-time users, begin by reviewing the form description and preview mode to confirm it fits your needs and complies with local jurisdiction standards.

- If you need a different template, utilize the search function above to locate the appropriate document. Confirm it meets your requirements before proceeding.

- Purchase the document by clicking the 'Buy Now' button. Choose your preferred subscription plan and create an account to access the extensive library.

- Complete your transaction by entering your payment details, either through credit card or PayPal.

- Download the form to your device for completion. You can also access your downloaded documents later from the 'My Forms' section in your profile.

In conclusion, utilizing US Legal Forms not only simplifies the process of obtaining legal documents but also ensures you have access to a robust collection of forms and expert assistance. Take control of your legal needs today.

Visit US Legal Forms now to get started on your legal document journey!

Form popularity

FAQ

To transfer property title between family members, it is advisable to use a formal deed that meets state requirements. This deed should be executed correctly to prevent complications later on. Always be aware of any liens associated with the property, as they can affect the transfer process. Uslegalforms can provide guidance to ensure that your transfers lien note for property is handled properly, making the process seamless for your family.

Filling out a lien affidavit involves collecting specific information about the lien and the property in question. You will need to include details like the property address, the nature of the lien, and the involved parties. Ensure you provide accurate information to avoid any future disputes. Resources on uslegalforms can assist you in addressing transfers lien note for property and other details you need to include.

To write a deed of transfer, you should start by clearly identifying the property and the parties involved in the transaction. Include pertinent information such as the property description, the names of the grantor and grantee, and the date of transfer. Always ensure the deed is signed and notarized to make it legally binding. Following the correct steps will help you address any transfers lien note for property concerns.

The best way to transfer a property to a family member is through a properly executed deed. This deed should include the necessary details to ensure a smooth transfer. It is important to also consider any existing liens or obligations tied to the property, especially if you want to avoid complications. Utilizing platforms like uslegalforms can streamline the process and help you manage the transfers lien note for property effectively.

To buy a property with a lien, start by verifying the lien's details and amount. You should negotiate with the seller to address the lien prior to closing or factor it into your buying costs. Additionally, conducting a title search ensures you are aware of any liens affecting the property. uslegalforms provides tools and forms to help you navigate these transactions securely.

Buying a house with a lien can complicate your transaction. You may end up responsible for settling the lien, potentially leading to significant costs. It's crucial to understand the type of lien involved and seek legal advice before proceeding. Using platforms like uslegalforms can help you navigate these complexities effectively.

In Tennessee, property liens can be placed for various reasons, such as unpaid debts or disputes over property improvements. If a creditor registers a lien, it can affect your property rights and marketability. It is essential to address any liens promptly to avoid complications in real estate transactions. Utilizing platforms like uslegalforms can help you manage transfers of lien notes for property efficiently.

In Rhode Island, a lien typically remains on your property for a period of ten years. However, this duration may vary depending on the type of lien. To remove the lien, you must satisfy the underlying debt or seek a lien release. Understanding these timeframes is crucial when managing your property and planning transfers of lien notes.

If someone places a lien on your house, start by reviewing the legal documents to understand the grounds for the lien. It is vital to communicate with the lienholder to resolve any outstanding issues. You might negotiate a payment plan or settlement. Resolving this early can help you maintain your property rights as you consider transferring a lien note for property.

To obtain a lien release letter, contact the lienholder and request the document. You must provide evidence that the debt associated with the lien has been satisfied. Once the lienholder confirms payment, they will issue the release letter. This process is essential when you plan to transfer a lien note for property, ensuring clear ownership.