Assignment Overriding Royalty Interest With Monthly Contributions

Description

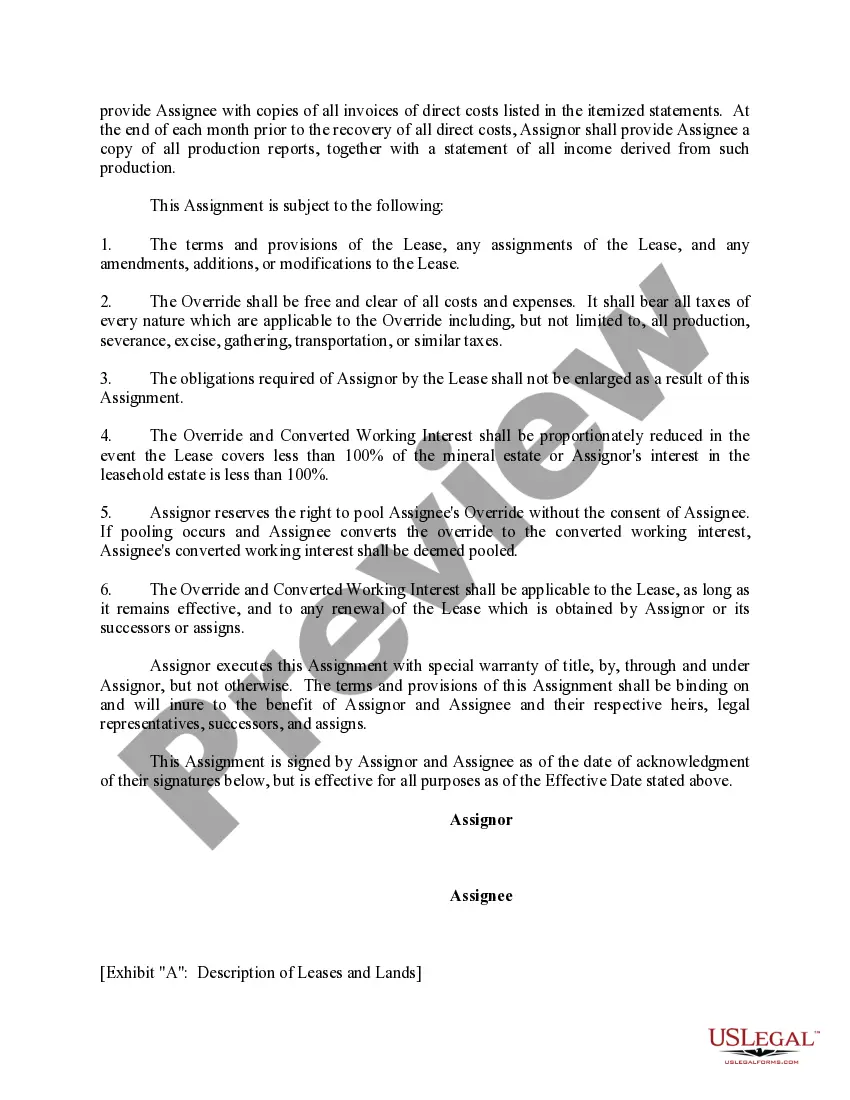

How to fill out Assignment Of Overriding Royalty Interest Convertible To A Working Interest At Assignee's Option?

There's no longer a necessity to spend countless hours searching for legal documents to meet your local state requirements.

US Legal Forms has compiled all of them in a single location and made them accessible.

Our website offers over 85,000 templates for any business and personal legal needs categorized by state and area of usage.

Utilize the search bar above to look for another sample if the previous one does not suit your needs. Click Buy Now next to the template name when you identify the correct one. Select your preferred subscription plan and register for an account or Log In. Pay for your subscription using a card or PayPal to proceed. Choose the file format for your Assignment Overriding Royalty Interest With Monthly Contributions and download it to your device. Print your form to fill it out manually or upload the template if you prefer working with an online editor. Completing official paperwork under federal and state laws is quick and easy with our platform. Experience US Legal Forms today to keep your documentation organized!

- All forms are expertly crafted and verified for legitimacy, so you can be confident in acquiring an updated Assignment Overriding Royalty Interest With Monthly Contributions.

- If you are acquainted with our platform and already possess an account, you must confirm your subscription is active before downloading any templates.

- Log In to your account, choose the document, and click Download.

- You can also retrieve all saved documents at any time by accessing the My documents tab in your profile.

- For those unfamiliar with our platform, the process requires a few additional steps to complete.

- Here's how new users can find the Assignment Overriding Royalty Interest With Monthly Contributions in our collection.

- Carefully review the page content to ensure it contains the sample you require.

- To assist with this, utilize the form description and preview options if available.

Form popularity

FAQ

An overriding royalty is calculated by taking the gross production revenue and multiplying it by the royalty rate specified in the lease or agreement. This calculation provides an owner's share of the revenue without deducting production costs. For those interested in Assignment overriding royalty interest with monthly contributions, understanding this method helps to ensure accurate financial planning and investment decisions. Platforms like uslegalforms can guide you through the necessary paperwork for these calculations.

Calculating royalty interest involves determining the total production revenue and the percentage of interest owned. You would take the total income from sales and multiply it by your percentage of ownership for a straightforward figure. This method allows you to estimate potential earnings from an Assignment overriding royalty interest with monthly contributions effectively. Understanding this calculation can help you project your financial benefits.

An overriding royalty interest is a share of the revenue generated from oil and gas production. Typically, it is carved out of the working interest and does not incur expenses for the production. This means that owners can benefit from the income without direct involvement in the operational costs. If you're exploring options like Assignment overriding royalty interest with monthly contributions, this structure can provide consistent returns.

An overriding royalty interest is not classified as a working interest. Instead, it is a separate type of interest that allows the owner to receive a portion of the revenue generated from oil or gas production without bearing the responsibility for expenses related to production. In the case of an assignment overriding royalty interest with monthly contributions, the owner can benefit from a steady stream of income while other parties manage the operational costs. Understanding these distinctions can help you make informed decisions about your investments in the energy sector.

An example of a working interest is the ownership share an individual or company has in an oil well. This interest means they are responsible for their proportionate share of costs and are entitled to a share of the profits from production. If you’re evaluating investment opportunities, knowing about working interests is vital when discussing assignment overriding royalty interest with monthly contributions. This knowledge enables you to strategize your involvement in oil and gas ventures effectively.

Working interest refers to the ownership stake in a property that allows one to participate in the exploration and production of oil and gas. In contrast, overriding royalty interest grants the owner a share of the production revenues without bearing costs associated with operations. Understanding these differences is essential, especially when considering an assignment overriding royalty interest with monthly contributions. By grasping these concepts, you can make informed decisions about your investments and royalties.

An example of overriding royalty interest can be found when a landowner leases their land to an energy company but retains a 5% overriding royalty in the production revenue. This means the owner will earn a portion of the revenue generated from the extracted resources, independent of any lease royalties. By recognizing this relationship, you can better navigate the complexities of assignment overriding royalty interest with monthly contributions.

An example of overriding royalty interest includes a situation where an investor holds a 2% interest in the production of oil from a well without owning the underlying mineral rights. This investor receives their percentage directly from the operator of the well. These arrangements are crucial in understanding assignment overriding royalty interest with monthly contributions, as they dictate how and when payments occur based on production levels.

An assignment of overriding royalty interest is a document that legally transfers rights to receive royalty payments from mineral production to another party. This assignment outlines the specific terms of the royal interest and the responsibilities of both parties involved. If you need assistance, services like USLegalForms can simplify the process of managing your assignment overriding royalty interest with monthly contributions.

The assignment of overriding royalty interest refers to the legal process of transferring an existing overriding royalty interest from one party to another. This process often involves drafting an assignment agreement that specifies terms, conditions, and any applicable royalties. With guidance from resources such as USLegalForms, you can streamline this process while ensuring compliance with assignment overriding royalty interest with monthly contributions.