Affidavit Nonpayment Withholding

Category:

State:

Multi-State

Control #:

US-OG-012

Format:

Word;

Rich Text

Instant download

Description

The Affidavit of Nonpayment of Delay Rentals is a legal document used by lessors in the context of oil and gas leases. This affidavit serves as a sworn statement confirming that the lessee has failed to make required delay rental payments as stipulated in the lease agreement. Key features of this form include sections for the affiant to provide their name, age, and details about the lease, such as the date, recorded location, and lands covered. It also requests specific monetary amounts due and clarifies that no payments have been received to date. Additionally, the affiant must affirm that there is no ongoing drilling, exploration, or production activity on the leased lands. This form can be essential for lessors seeking to document noncompliance by lessees and may be necessary for legal actions or lease termination. Attorneys, paralegals, and legal assistants should ensure that all requisite fields are accurately filled out and that the affidavit is signed and acknowledged as per legal requirements. Clarity and completeness in the form's details are vital to uphold its legal integrity.

How to fill out Affidavit Of Nonpayment Of Delay Rentals - Lessor's Affidavit Regarding Nonpayment By Lessee?

Bureaucracy necessitates exactness and correctness.

If you do not engage with completing documents like Affidavit Nonpayment Withholding regularly, it may lead to certain misunderstandings.

Choosing the appropriate sample from the outset will guarantee that your document submission proceeds seamlessly and avert any hassles of re-sending a file or undertaking the same task entirely from scratch.

Obtaining the correct and current samples for your documentation is a matter of a few minutes with an account at US Legal Forms. Eliminate the bureaucratic worries and enhance your efficiency with forms.

- Acquire the template by utilizing the search bar.

- Ensure the Affidavit Nonpayment Withholding you’ve found is pertinent to your state or district.

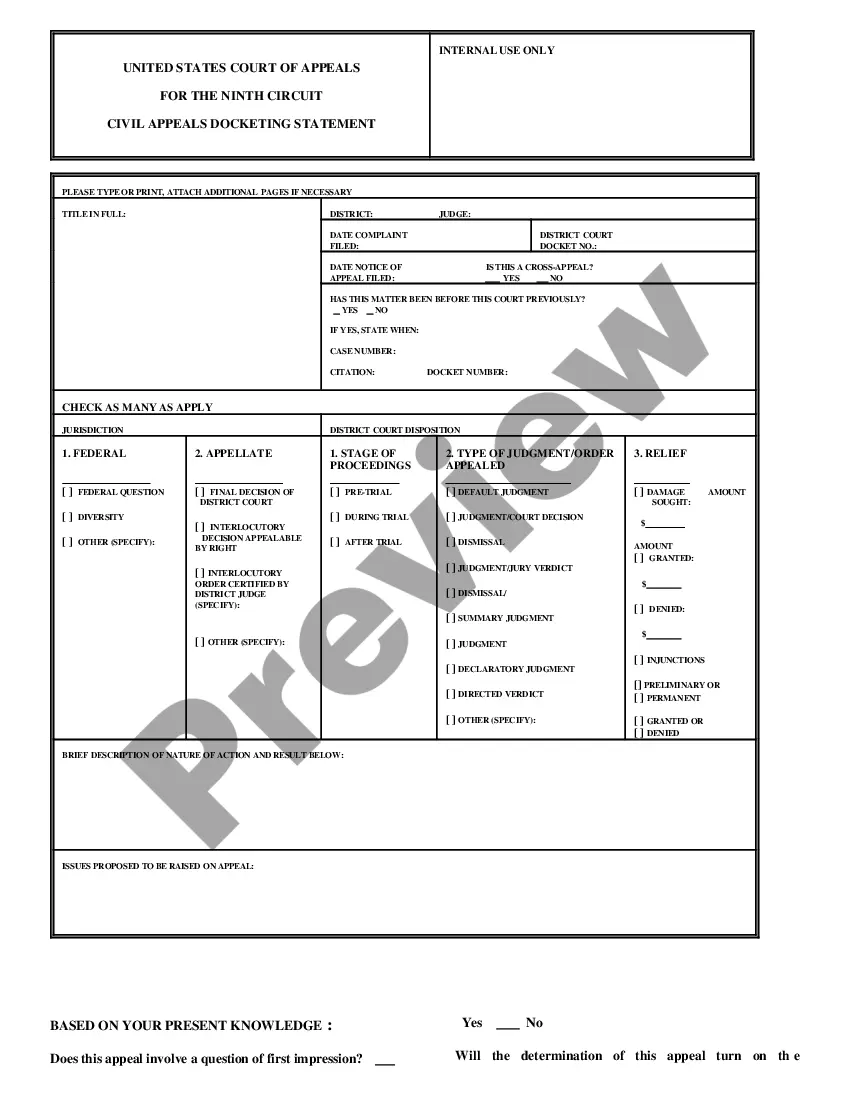

- Review the preview or examine the description containing the details regarding the use of the template.

- If the result meets your criteria, click the Buy Now button.

- Choose the appropriate option among the proposed pricing plans.

- Log In to your account or create a new one.

- Finalize the purchase by utilizing a credit card or PayPal payment method.

- Download the document in the file format of your preference.