Transfer Mortgage Lender With Mortgage

Description

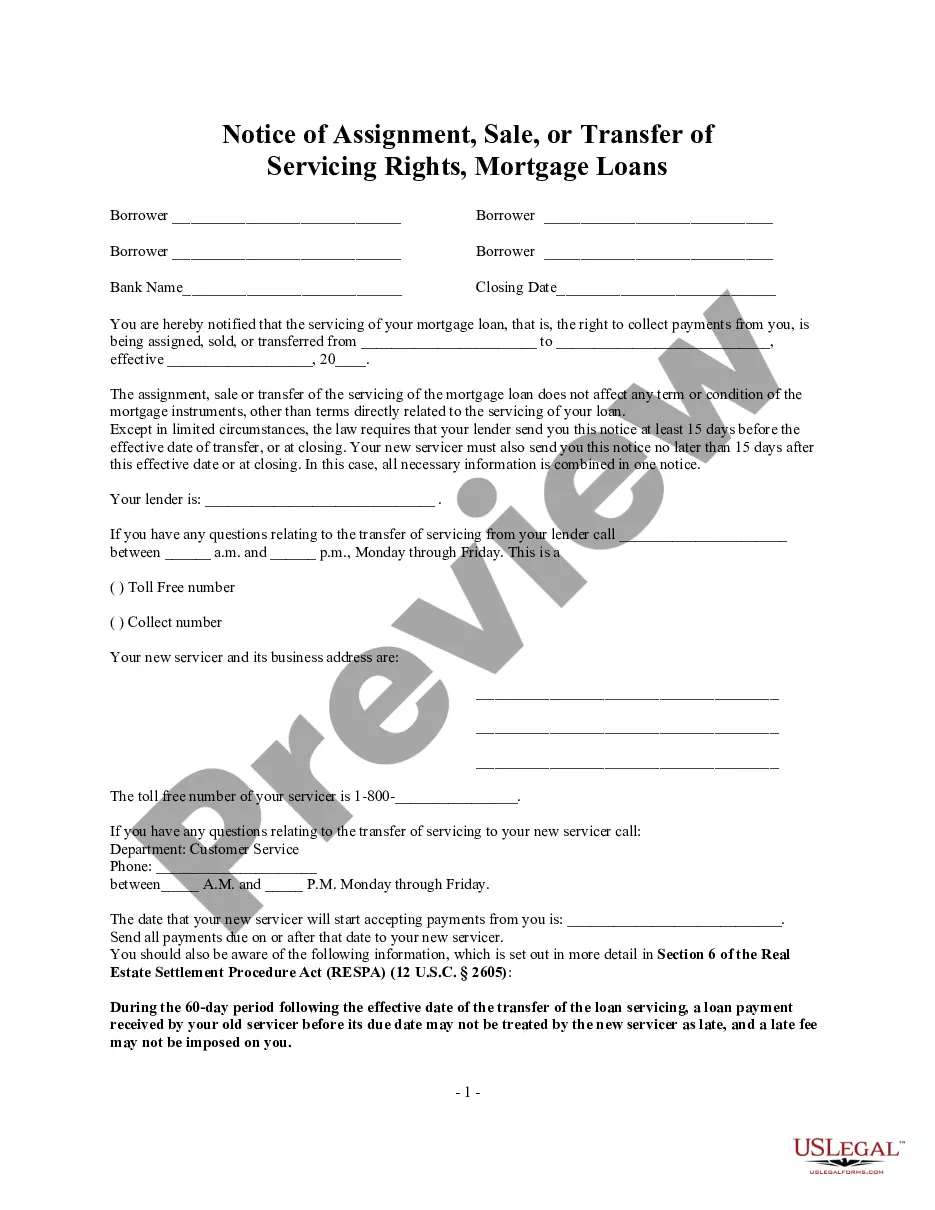

How to fill out Notice Of Assignment - Sale Or Transfer Of Servicing Rights - Mortgage Loans?

It’s clear that you cannot transform into a legal expert in a single night, nor can you swiftly comprehend how to efficiently organize Transfer Mortgage Lender With Mortgage without possessing a specialized education.

Assembling legal paperwork is a labor-intensive endeavor that necessitates specific training and expertise. Therefore, why not entrust the development of the Transfer Mortgage Lender With Mortgage to the specialists.

With US Legal Forms, one of the most extensive legal template repositories, you can access anything from court documents to templates for internal organizational correspondence. We recognize how vital compliance and adherence to federal and local laws and regulations are.

You can re-access your documents from the My documents tab at any moment. If you’re a current client, you can simply Log In, and locate and download the template from the same tab.

Regardless of the intention behind your documents—whether financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Locate the form you require using the search bar at the top of the page.

- Preview it (if this option is available) and read the supporting description to confirm whether Transfer Mortgage Lender With Mortgage is what you need.

- Start your search again if you're in need of any additional form.

- Establish a complimentary account and choose a subscription plan to acquire the template.

- Select Buy now. Once the transaction is finalized, you can download the Transfer Mortgage Lender With Mortgage, complete it, print it, and send or forward it by mail to the necessary parties or organizations.

Form popularity

FAQ

Your mortgage servicer may transfer the mortgage servicing rights for your loan to another company to service your loan. If your mortgage servicing rights are transferred to a new servicer, you will need to start sending your monthly payments to the new servicer after a certain date.

A transfer of mortgage is the reassignment of an existing mortgage, usually on a home, from the current holder to another person or entity. Not all mortgages can be transferred; if they are, the lender has the right to approve the person assuming the loan.

Mortgage Porting In order to port a mortgage, the borrower will have to sell the old home at the same time he or she is purchasing a new one. The terms of the loan will stay the same, so the amount of the mortgage must be enough to pay for the new home.

Yes. Federal banking laws and regulations permit banks to sell mortgages or transfer the servicing rights to other institutions. Consumer consent is not required. However, the bank or new servicer generally must comply with certain procedures notifying you of the transfer.

You can typically expect the mortgage switching process to take around one to two months. This can be longer, depending on any complications surrounding your existing mortgage. If you're switching mortgages with the same provider, you can usually expect it to take less time.