Defendant Protection Order Withdrawal

Description

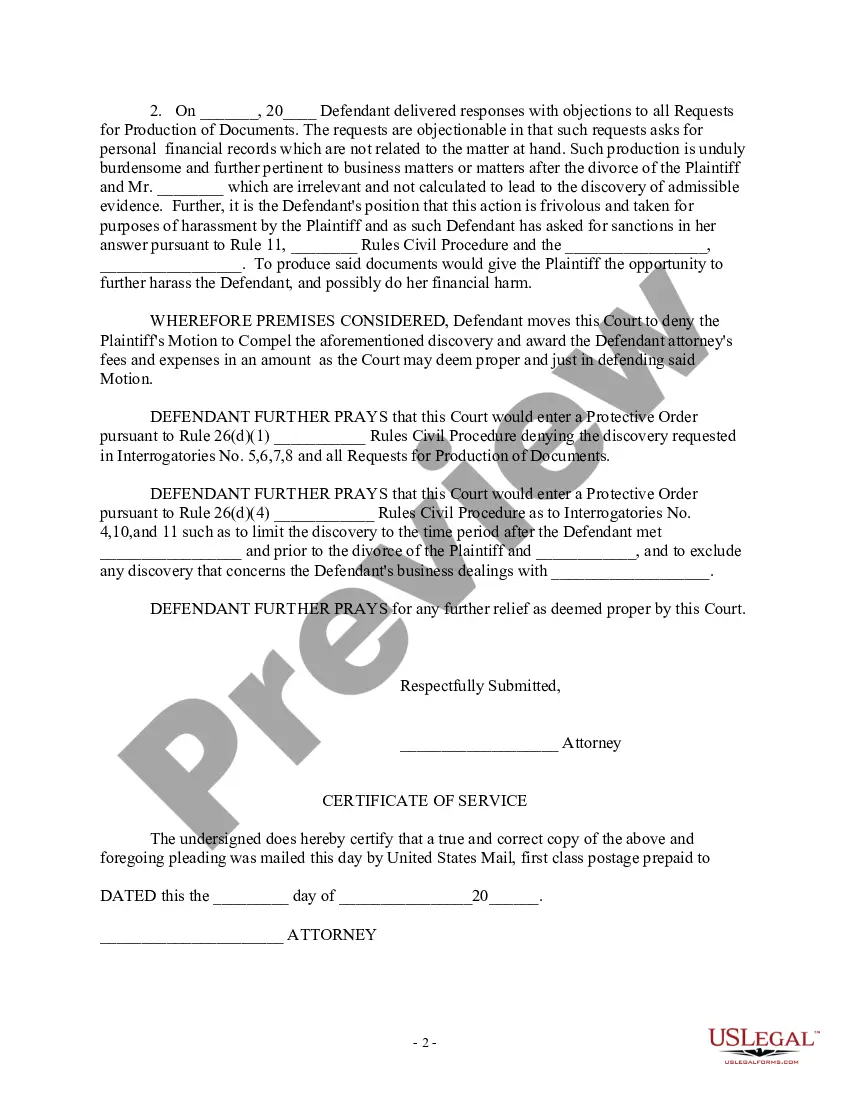

How to fill out Defendant's Motion For Protective Order And Response To Plaintiff's Motion To Compel?

Regardless of whether it's for corporate reasons or personal matters, everyone must deal with legal issues at some stage in life.

Filling out legal forms demands meticulous care, starting with selecting the appropriate template.

Choose the document format you prefer and download the Defendant Protection Order Withdrawal. After saving it, you can fill out the form using editing software or print it and complete it manually. With a comprehensive catalog from US Legal Forms, you will not have to waste time searching for the suitable template online. Utilize the library's straightforward navigation to locate the correct template for any situation.

- For instance, if you select an incorrect version of the Defendant Protection Order Withdrawal, it will be rejected upon submission.

- Thus, it is crucial to acquire a trustworthy source of legal documents like US Legal Forms.

- If you need to secure a Defendant Protection Order Withdrawal template, adhere to these straightforward steps.

- Obtain the required template by using the search bar or browsing through the catalog.

- Review the form’s details to confirm it suits your circumstances, state, and county.

- Click on the form’s preview to view it.

- If it turns out to be the incorrect document, return to the search feature to find the Defendant Protection Order Withdrawal sample you need.

- Download the file once it satisfies your requirements.

- If you possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you have yet to create an account, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: either use a credit card or PayPal account.

Form popularity

FAQ

Wyoming does not levy state and business taxes on LLCs. This is helpful for Wyoming residents since they won't have to pay double taxes. Being one of the zero-income tax states, Wyoming remains appealing to many LLC owners. It also implements zero corporate tax, franchise tax, and stock tax.

An LLC generally requires less business formalities than a corporation. An LLC may be managed directly by members and there is no need to have a separate board of directors, annual shareholder meetings or periodic directors meetings with minutes.

Wyoming does not have any state taxes, as such has no need for S Corporations. If you want S Corporation status, you must file Form 2553 with the IRS, which is included in the corporate kit we send you, within 75 days from the date of formation of the company or by March 15th of any given tax year.

Why Incorporate in Wyoming? Wyoming is a popular corporate haven due to its lack of taxes and endemic privacy concerns. These factors drive many new incorporations. Wyoming also has the added benefit of allowing you to hold your shares in a Wyoming LLC or a Wyoming Trust for additional asset protection.

How to Reinstate a Wyoming LLC. To revive a Wyoming LLC, you'll need to file the Reinstatement Form with the Wyoming Secretary of State. You'll also have to fix the issues that led to your Wyoming LLC's dissolution.

You can form a Wyoming LLC even if you don't live in Wyoming. Residency in the state, or the USA, is not required to form a company. A majority of LLCs are formed by non-residents. Forming an LLC in Wyoming as a non-resident is the same process as for a resident.

Wyoming's charging order protection laws are effective for members to protect their LLC assets and ownership from creditors. However, that protection does not extend outside of Wyoming. Members living out of state will have to deal with different laws protecting their LLC assets from garnishment by creditors.