Credit Add Report For Rental

Description

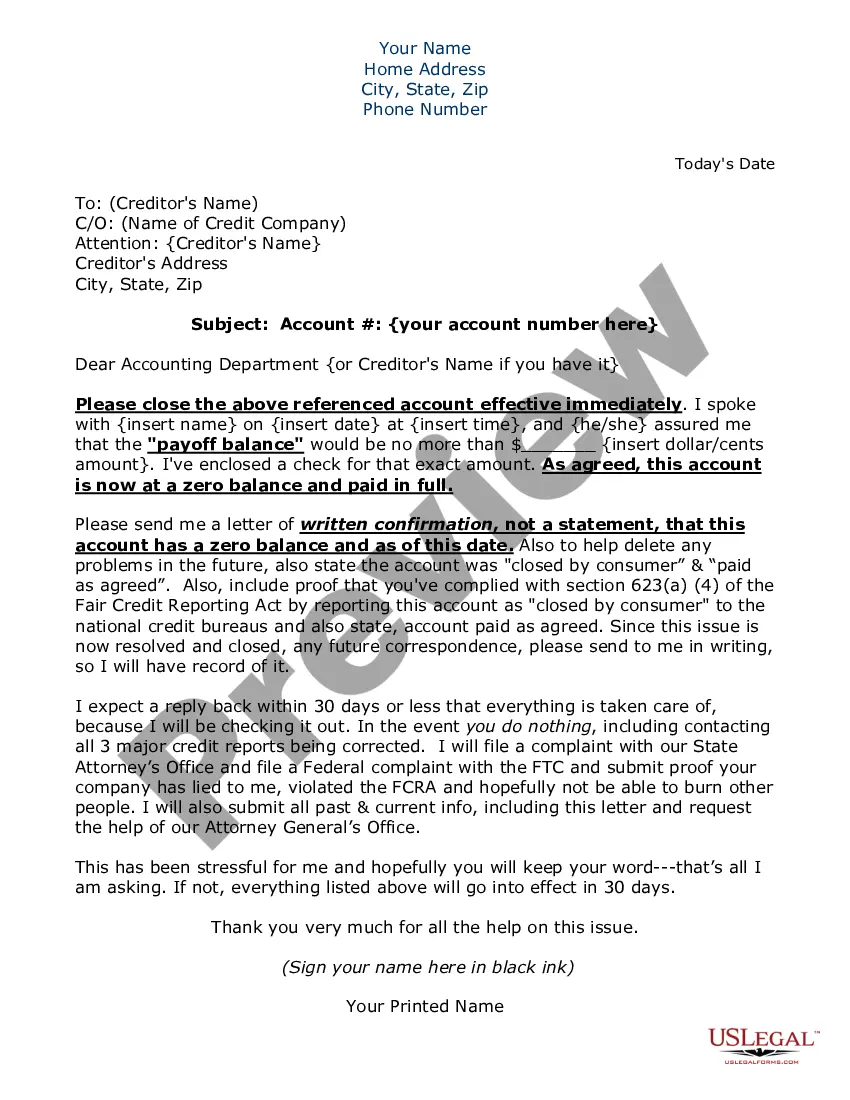

How to fill out Statement To Add To Credit Report?

Using legal document samples that meet the federal and local laws is crucial, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the appropriate Credit Add Report For Rental sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and personal scenario. They are easy to browse with all files grouped by state and purpose of use. Our professionals stay up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Credit Add Report For Rental from our website.

Obtaining a Credit Add Report For Rental is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, follow the instructions below:

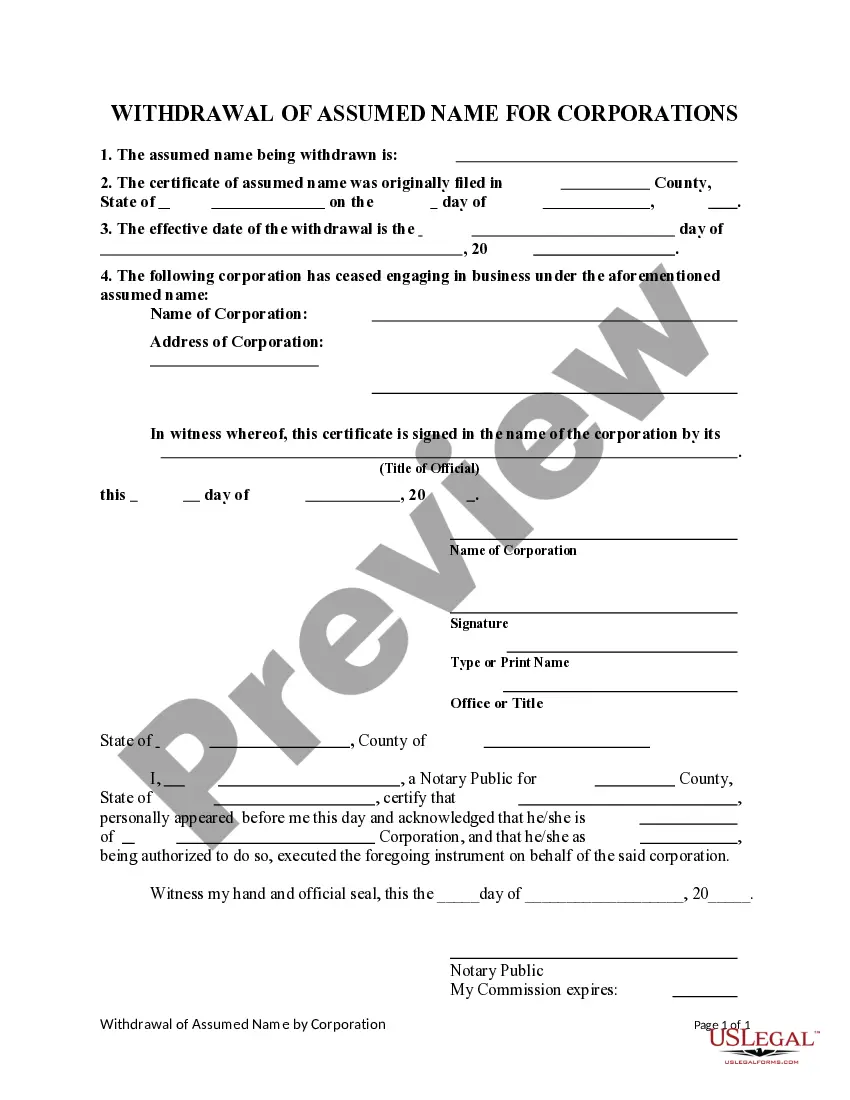

- Take a look at the template utilizing the Preview feature or through the text outline to make certain it meets your needs.

- Look for a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Credit Add Report For Rental and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

You can also use a private rent reporting service to have payments added to your credit reports with all three credit bureaus: Experian, TransUnion and Equifax. You may need to ask your landlord to enroll with one of these services to report your information if they don't use a service already.

Credit references should be businesses that can provide positive details about a financial relationship you've maintained. For example, credit references may include a bank that you have a credit card or loan with, a company whose bills you regularly pay, or even previous landlords.

Missing a rent payment by a few days won't hurt your credit. But if you leave your rent unpaid by 30 days or more, it could damage your credit if your landlord reports the delinquency to one or more credit reporting agencies.

When should you report rent to credit bureaus? If you pay your rent on time every month, reporting your rent to credit bureaus can be a safe way to add positive payment behavior to your credit report.

If you are using a rent-reporting service on your own or one that is managed by your landlord, then yes, missing a rental payment will negatively affect your credit score when your missed payment is reported to the credit bureaus. However, don't let this stop you from signing up for rent-reporting.