Add Credit Report For Rental

Description

How to fill out Add Credit Report For Rental?

When you want to complete Add Credit Report For Rental that adheres to your local state's laws, there may be numerous choices available to select from.

There’s no requirement to verify every document to guarantee it meets all the legal specifications if you are a US Legal Forms member.

It is a reliable service that can assist you in acquiring a reusable and current template on any topic.

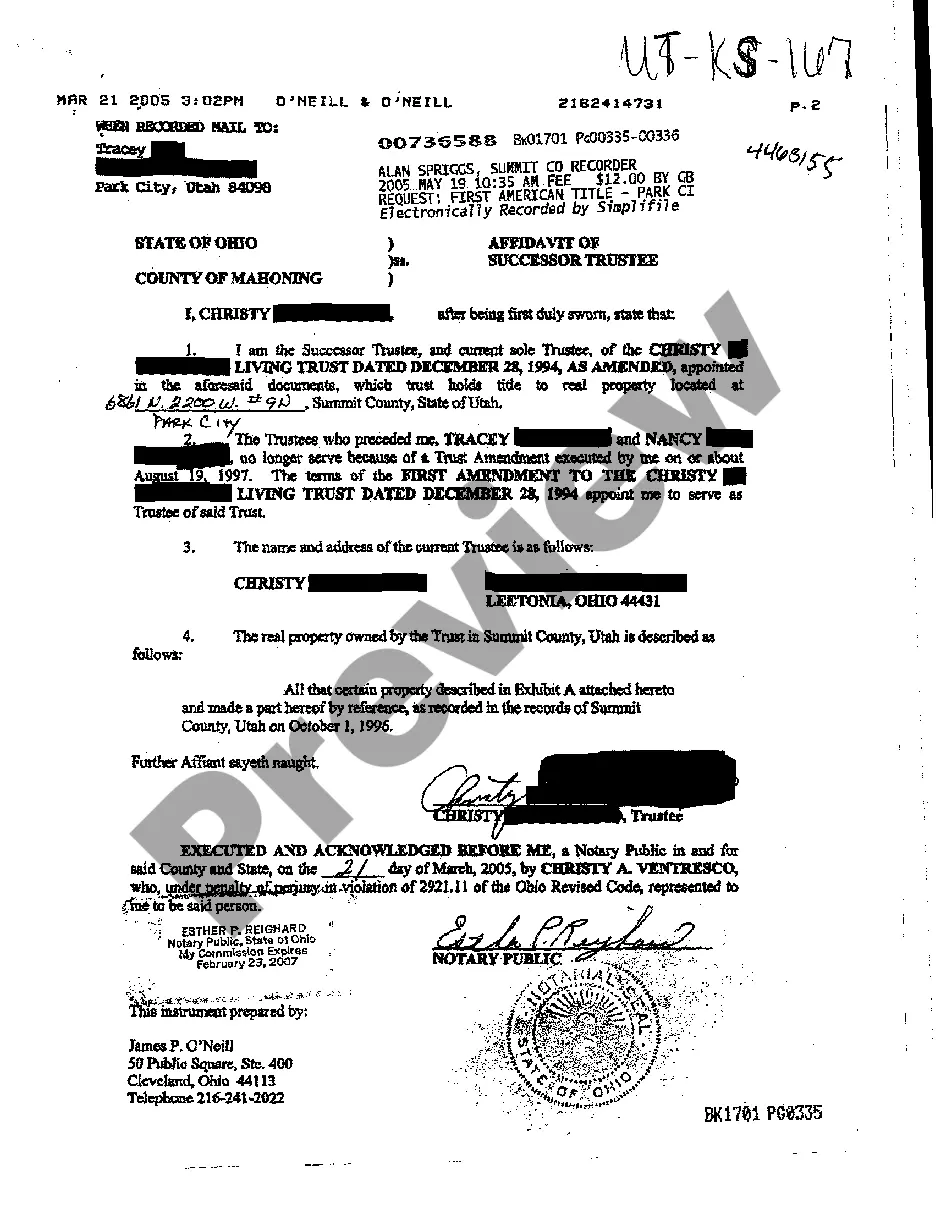

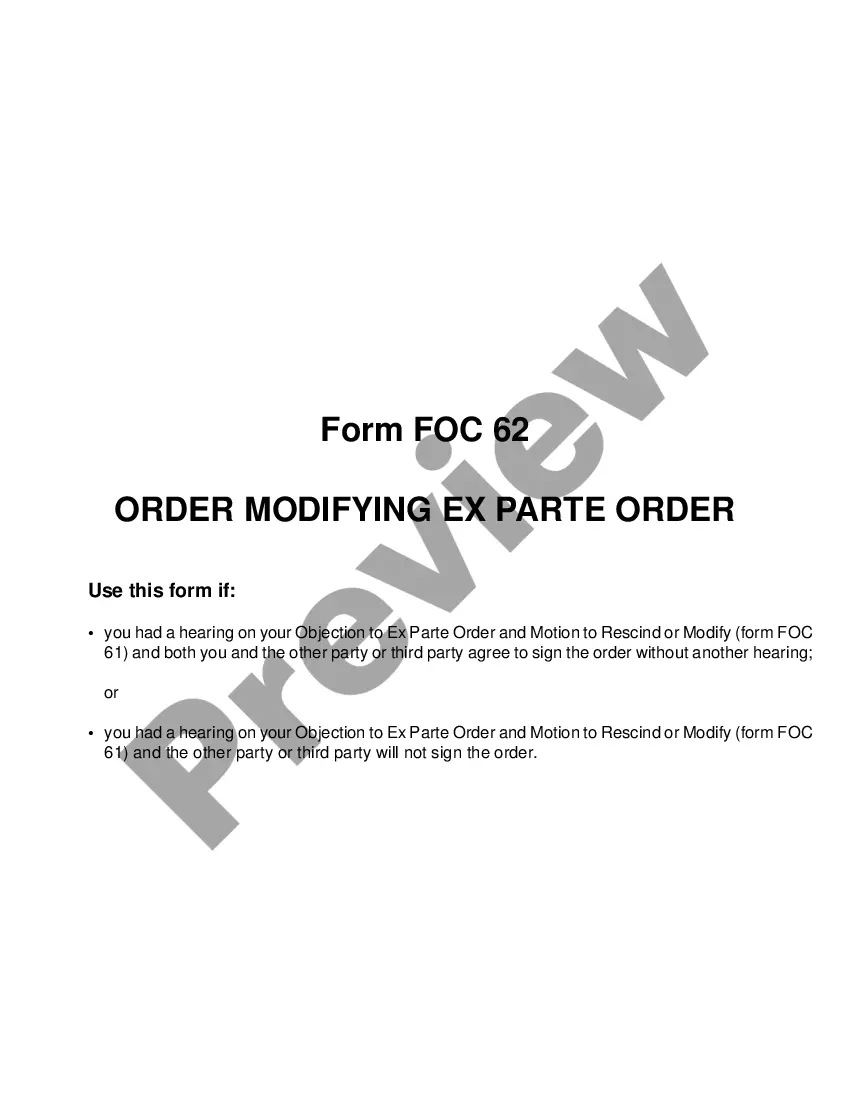

Utilize the Preview mode and examine the form details if available.

- US Legal Forms is the most extensive online repository with a compilation of over 85k ready-to-use forms for business and personal legal matters.

- All templates are validated to conform to each state's regulations.

- Consequently, when downloading Add Credit Report For Rental from our site, you can be assured that you possess a legitimate and current document.

- Obtaining the required template from our platform is quite straightforward.

- If you already have an account, just Log In to the system, verify that your subscription is active, and save the chosen file.

- In the future, you can navigate to the My documents tab in your profile and gain access to the Add Credit Report For Rental whenever you need it.

- If it’s your initial experience with our website, please adhere to the instructions below.

- Browse through the recommended page and ensure it aligns with your needs.

Form popularity

FAQ

The minimum credit score to rent a property usually hovers around 600, although this varies among landlords. By adding your rental history to your credit report, you can build a stronger credit profile, increasing your chances of securing your ideal rental.

The minimum credit score to buy a house typically starts at around 620. If you're looking to improve your creditworthiness, consider ways to add credit report for rental, which not only enhances your score but also strengthens your mortgage application.

To add rent to your credit report, you can use services that report your rent payments to credit bureaus. Many platforms, like USLegalForms, simplify the process and help you add credit report for rental, showcasing your positive rental history.

A 570 credit score is generally considered poor, which might limit your options when renting. However, by taking steps to add credit report for rental, you can demonstrate responsible behavior to improve your score and attract better rental opportunities.

Most landlords accept a minimum credit score of around 620, but this can vary. If you want to improve your chances of securing a rental, consider using methods to add credit report for rental, showing landlords your consistent payment history.

Passing a credit check for renting in the UK typically depends on your credit history and score. A strong credit report can increase your chances of approval when you add credit report for rental, thus demonstrating your reliability as a tenant.

Yes, rentals can show up on a credit report, particularly if the landlord reports rental payment history. By using services that allow you to add credit report for rental, you can ensure your timely rent payments contribute positively to your credit history.

To get your payment history on your credit report, you must first ensure your landlord or creditors report your payments. If they do not, consider using specialized reporting services that can help you include your payment history in your credit profile. By doing this, you can strengthen your credit score and overall financial standing. Access tools provided by platforms such as US Legal Forms to easily add credit report for rental.

Payment history significantly impacts your credit score, accounting for about 35% of your total score. Maintaining a good payment history can potentially improve your score by many points, depending on the overall credit profile. This means timely payments on rent and bills contribute positively. Effectively managing these will enhance your ability to add credit report for rental.

To add monthly bills to your credit report, you should ensure that your service providers report payments to the credit bureaus. If they do not, you can utilize third-party services that allow you to report utility and phone bill payments yourself. By consistently reporting these payments, you help strengthen your credit profile. This is an excellent way to add credit report for rental and everyday bills.