Chase Mortgage Late Payment Forgiveness

Description

How to fill out Mortgage Demand Letter?

Legal papers management can be overpowering, even for the most knowledgeable experts. When you are searching for a Chase Mortgage Late Payment Forgiveness and don’t get the a chance to spend in search of the right and up-to-date version, the operations could be demanding. A strong web form library can be a gamechanger for anybody who wants to deal with these situations effectively. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any demands you may have, from individual to organization papers, all in one location.

- Utilize innovative resources to accomplish and manage your Chase Mortgage Late Payment Forgiveness

- Gain access to a resource base of articles, instructions and handbooks and resources connected to your situation and needs

Help save effort and time in search of the papers you will need, and make use of US Legal Forms’ advanced search and Review feature to find Chase Mortgage Late Payment Forgiveness and download it. For those who have a monthly subscription, log in in your US Legal Forms account, search for the form, and download it. Review your My Forms tab to see the papers you previously downloaded and to manage your folders as you can see fit.

If it is your first time with US Legal Forms, make an account and obtain limitless use of all advantages of the library. Here are the steps for taking after accessing the form you want:

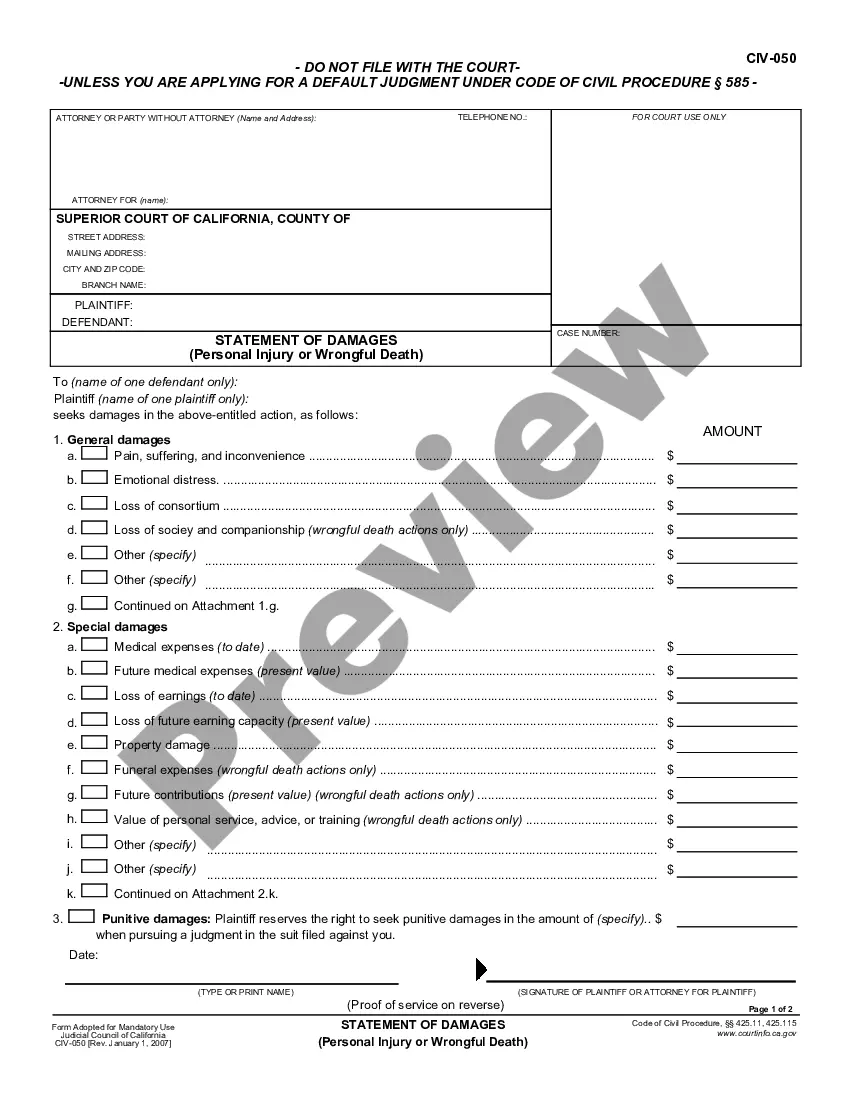

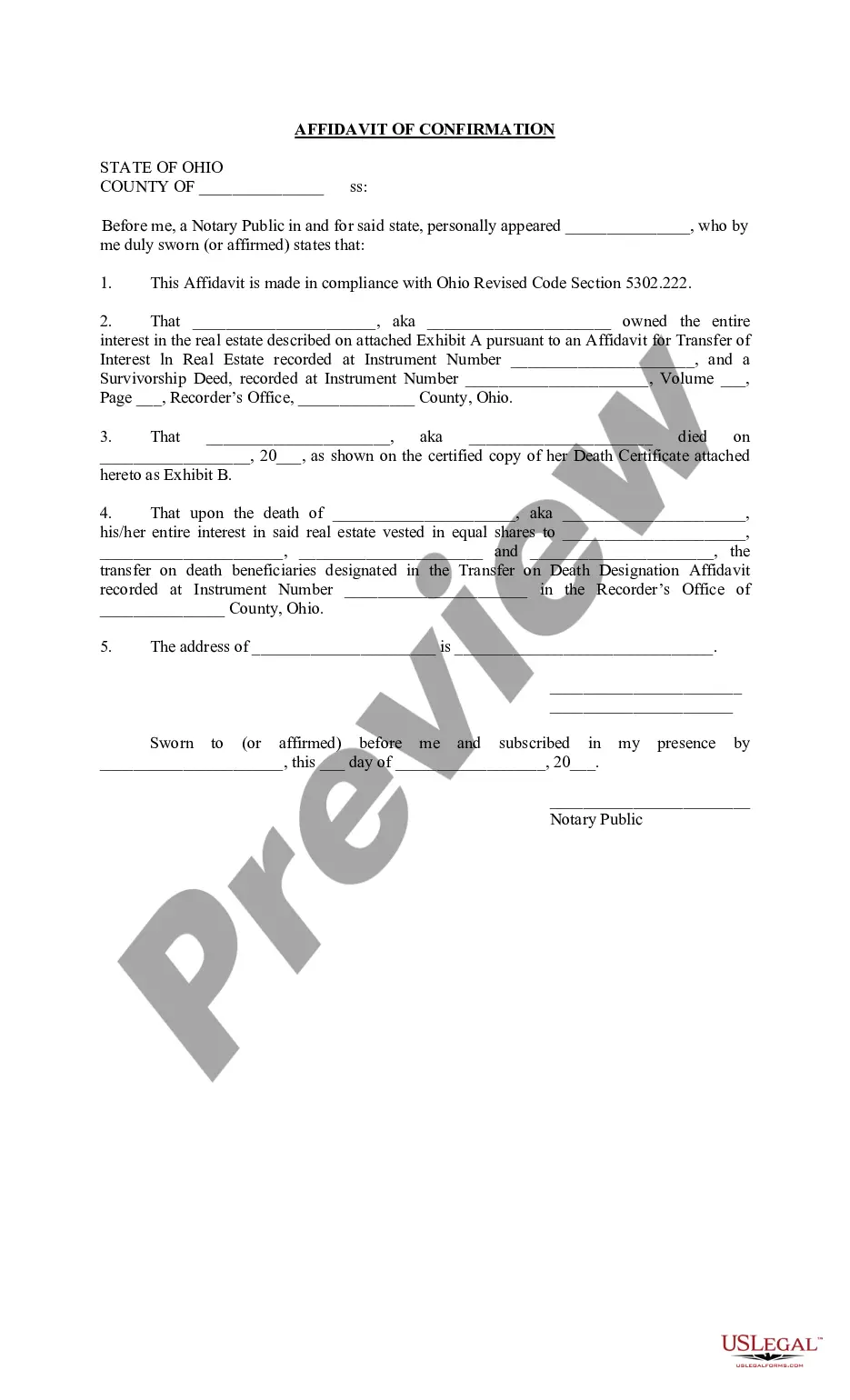

- Verify it is the proper form by previewing it and looking at its description.

- Ensure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are ready.

- Select a monthly subscription plan.

- Find the format you want, and Download, complete, eSign, print out and send your document.

Enjoy the US Legal Forms web library, supported with 25 years of expertise and trustworthiness. Enhance your daily document managing in a easy and easy-to-use process right now.

Form popularity

FAQ

If you accidentally pay less than the minimum required payment or you miss your Chase credit card due date entirely, you can always ask customer service to waive the late fee by calling (800) 945-2000.

The basic premise of this explanation letter is to address: The situation you were in which caused you to pay late was beyond your control. The situation has changed and your financial footing is solid again. The steps you are taking to make sure any future challenge will not impact your ability to pay.

If you haven't made your payment within 30 days of the due date, this is typically when issuers will report a late payment to the credit bureaus.

Can you make a goodwill or courtesy adjustment and remove it from my credit report? The information we report is required to be complete and accurate. Because of this, we don't make goodwill or courtesy credit report adjustments. We understand that you may be concerned about the potential impact of a late payment.

Hear this out loud PauseThe grace period on Chase credit cards may vary but it is at least 21 days from the end of the monthly billing cycle until your due date. Note: some Chase business credit cards may have a slightly shorter grace period of 20 days.