Lien Attorney Fees

Description

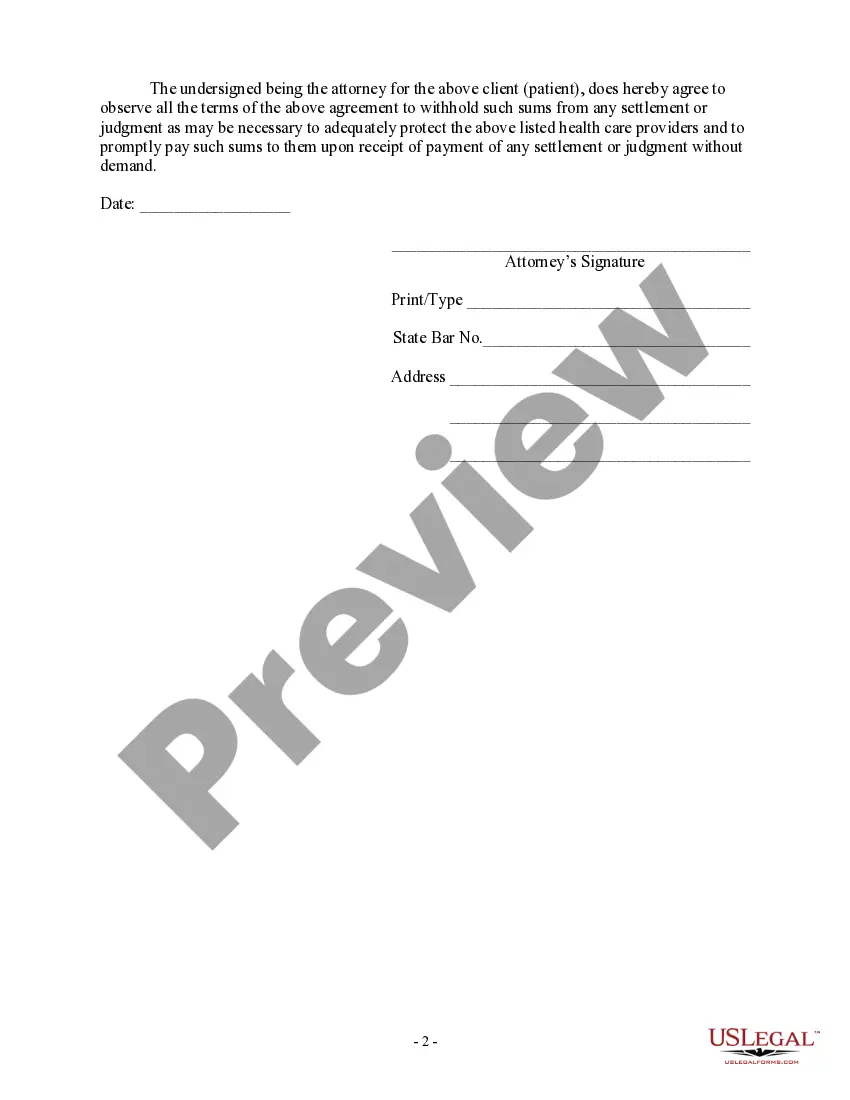

How to fill out Patient - Attorney Medical Lien Agreement?

Regardless of whether it is for corporate reasons or personal matters, everyone must confront legal challenges at some point during their lives.

Filling out legal documents demands meticulous focus, starting with selecting the correct form template.

With an extensive catalog from US Legal Forms available, you will no longer need to waste time searching for the correct sample online. Utilize the library’s straightforward navigation to find the right template for any circumstance.

- Acquire the sample you need through the search function or catalog browsing.

- Review the form’s description to confirm it aligns with your case, state, and area.

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to find the Lien Attorney Fees sample you need.

- Obtain the template if it satisfies your criteria.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously stored documents in My documents.

- If you do not yet have an account, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: credit card or PayPal account.

- Choose your desired file format and download the Lien Attorney Fees.

- Once downloaded, you can fill out the form using editing applications or print it and complete it by hand.

Form popularity

FAQ

A lien in Louisiana remains valid for 10 years, after which it may expire unless renewed. This time frame is essential for both creditors and debtors to understand when dealing with liens. By consulting with an attorney, you can manage your obligations effectively, including understanding any applicable lien attorney fees.

In Louisiana, a lien typically lasts for 10 years, provided it is not renewed or satisfied. This duration gives creditors time to pursue collection of the owed debts. Engaging with an attorney familiar with lien matters can assist you in understanding the implications of lien attorney fees within this timeframe.

The 3 year rule in Louisiana refers to the time limit for filing a lawsuit based on a written contract. After this period, a creditor may lose the legal right to enforce the contract. Consulting with a lien attorney helps clarify how this rule, alongside lien attorney fees, affects your financial matters.

In Louisiana, a debt typically becomes uncollectible after a period of ten years, known as the prescription period. Once this time has passed, a creditor usually cannot pursue legal action to collect the debt. It’s important to note that understanding lien attorney fees is crucial in addressing debt-related issues effectively.

The time it takes for a lien to go away varies based on the state and the type of lien. Generally, a lien can be removed once the debt is settled or after a specified period. However, understanding the specific settlement process and associated lien attorney fees can expedite this timeline.

Yes, you can file a lien without a lawyer, but it’s advisable to seek legal advice to navigate the process effectively. Understanding the specific requirements and documentation needed can be challenging without proper guidance. Filing a lien can protect your claim for lien attorney fees but ensure you follow local laws and procedures correctly. USLegalForms offers helpful templates and information for those looking to manage this independently.

Collecting unpaid attorney fees often involves several steps, starting with a clear invoice and communication with the client about the outstanding balance. If informal attempts do not yield results, you may consider filing a lien to secure your right to payment. Documenting all communication can strengthen your case in pursuing lien attorney fees. For more structured strategies, legal services offered through platforms like USLegalForms may provide valuable resources.

In Virginia, the time frame to file a lien is generally limited to 60 days after the attorney's services are rendered. This deadline is vital to ensure that the lien can be enforced properly and that your rights regarding lien attorney fees remain protected. It is important to act promptly to preserve your claims in case of any disputes. Utilizing resources like USLegalForms can assist in understanding the nuances of this process.

To establish a lien, specific conditions must be met, including a valid agreement between the attorney and the client regarding fees. Additionally, the attorney must have provided services that directly relate to the client's case. As a client, it is essential to understand these conditions to avoid disputes over lien attorney fees later on. Clear communication with your attorney can help delineate these terms effectively.

In Illinois, the attorney lien statute allows attorneys to claim a lien against a client's recovery for unpaid attorney fees. This lien serves as a legal safeguard, ensuring that attorneys receive compensation for their services in the event of recovery. Understanding this statute is crucial for both clients and attorneys when navigating financial disagreements. If you have concerns about lien attorney fees, consider researching through platforms like USLegalForms for detailed guidance.