Employee Form Employment Withholding

Description

Form popularity

FAQ

A workplace form refers to any document used in an organizational setting to manage information and processes. This can include forms for employee onboarding, performance reviews, and reporting workplace incidents. By utilizing effective workplace forms, companies can streamline operations and maintain better records. Employing platforms like US Legal Forms helps organizations create and manage these workplace forms, ensuring compliance and efficiency.

Employees are typically given various forms, including the employee form for employment withholding and benefits enrollment documents. These forms help gather necessary information to process payroll accurately and ensure tax compliance. Employers may also provide forms for health insurance, direct deposit, and emergency contact details. Having these forms readily available aids in smooth and organized employment administration.

The employee action form is used to document significant changes in an employee's status, such as promotions, demotions, or terminations. This form captures critical information that may affect employment withholding and benefits. It ensures that all changes are recorded properly, helping employers maintain accurate payroll and HR records. By using an employee action form, organizations can enhance their administrative efficiency and transparency.

The common short form for employee is 'Emp.' This abbreviation is often used in various contexts, including reports, forms, and employment discussions. By using 'Emp.', you can streamline communication while still referring to individuals who are part of a workforce. This concise notation helps save space on documents like the employee form employment withholding.

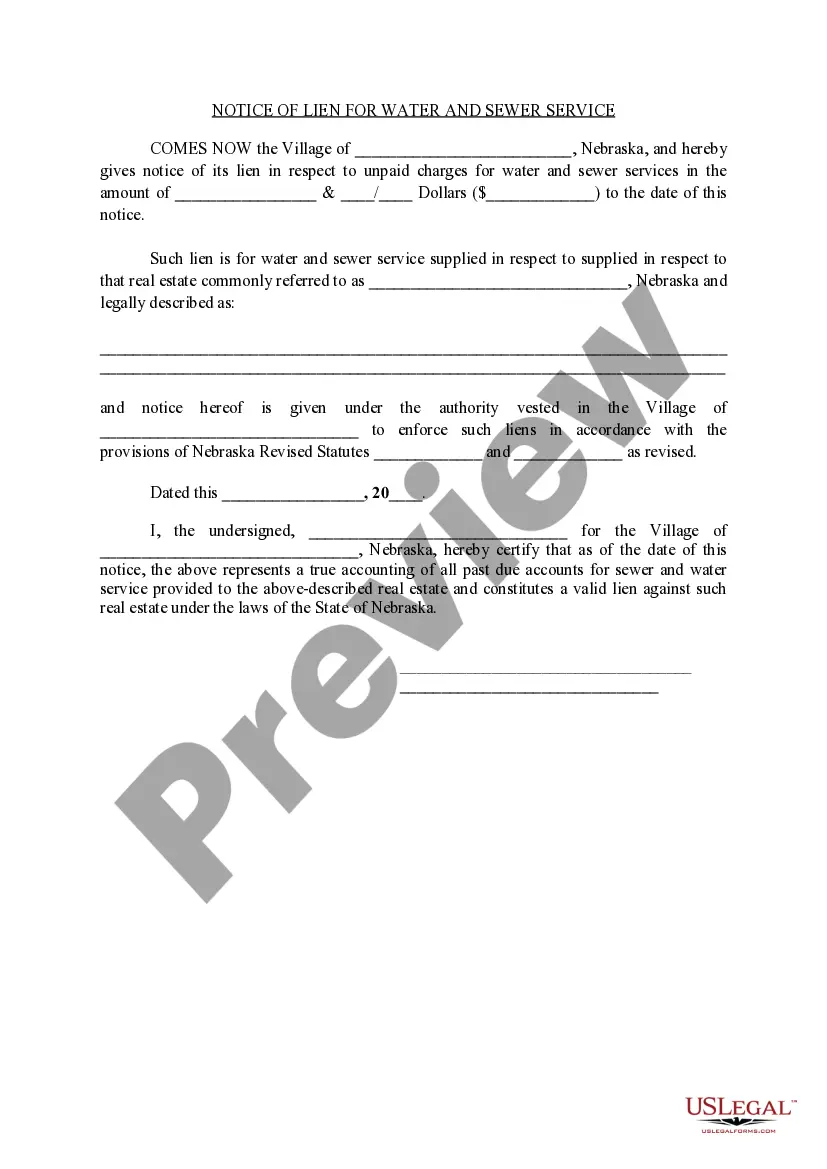

The employee form is a critical document that employers use to collect essential information from new hires. It typically includes personal details, tax information, and employment withholding preferences. By completing the employee form, employees ensure that their data is accurately processed for payroll and tax purposes. This form plays a central role in the employment process, making it vital for compliance and effective record-keeping.