Independent Contractor Accounting Without Business License

Description

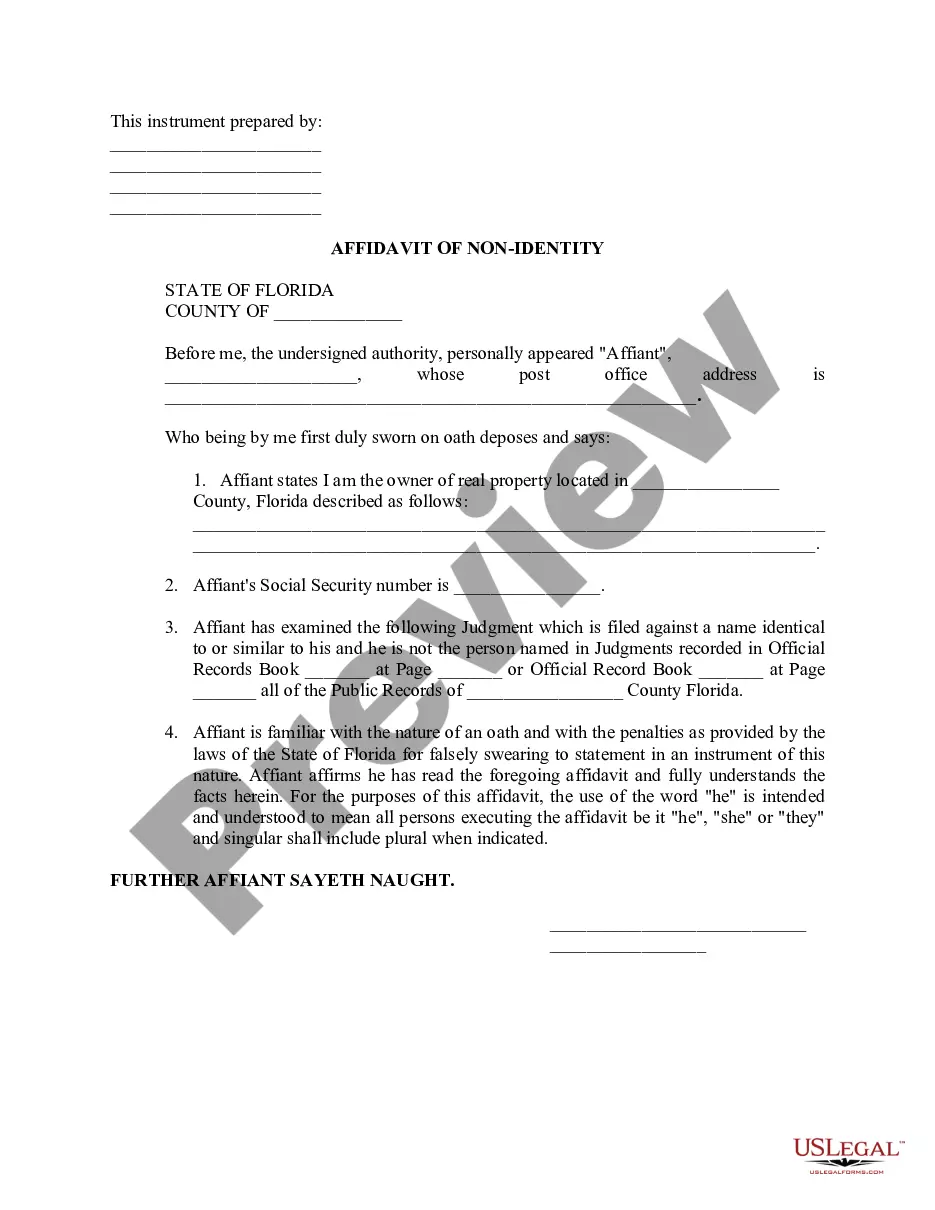

How to fill out Accounting Agreement - Self-Employed Independent Contractor?

Bureaucracy demands exactness and correctness.

Unless you manage completing documents such as Independent Contractor Accounting Without Business License on a daily basis, it can lead to some misunderstanding.

Selecting the appropriate template from the outset will guarantee that your document submission proceeds smoothly and avoid any hassles of resending a file or executing the same task entirely from the beginning.

If you are not a subscribed user, locating the needed template would require a few additional steps: Find the template using the search bar. Ensure the Independent Contractor Accounting Without Business License you've found is applicable to your state or region. Review the preview or check the description that includes the details on the use of the template. If the outcome aligns with your search, click the Buy Now button. Choose the suitable option from the suggested pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal payment method. Save the form in your preferred format. Locating the appropriate and current samples for your documentation is a matter of mere minutes with an account at US Legal Forms. Sidestep the bureaucratic issues and enhance your efficiency when working with forms.

- You can always secure the correct template for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms that provides over 85 thousand samples across various domains.

- You can access the latest and most pertinent version of the Independent Contractor Accounting Without Business License by simply searching for it on the site.

- Locate, save, and download templates within your account or refer to the description to confirm you have the right one available.

- With an account at US Legal Forms, you can conveniently obtain, keep in one place, and navigate the templates you retain to reach them in a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, proceed to the My documents page, where your documents are organized.

- Browse through the descriptions of the forms and download the necessary ones whenever you wish.

Form popularity

FAQ

An individual is an independent contractor in California only if they meet all three (3) requirements of the test:The worker remains free from managerial direction and control related to the worker's performance.The worker performs duties outside the scope of the company's course of business.More items...?

4. Business Registration. In some cases, independent contractors do not have to register as businesses with federal or provincial authorities. However, if you sell taxable goods or services, you must register for a sales tax account with the CRA once your revenues exceed $30,000 per year.

Any business owner must obtain a general business license in the city in which your business is located. Some California cities refer to a business license as a business tax certificate. Businesses that are operated in unincorporated sections of the state must obtain their license or tax certificate on a county basis.

Many California counties require businesses to obtain a business operating license before doing business in the county. This requirement applies to all businesses, including one-person, home-based operations.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.