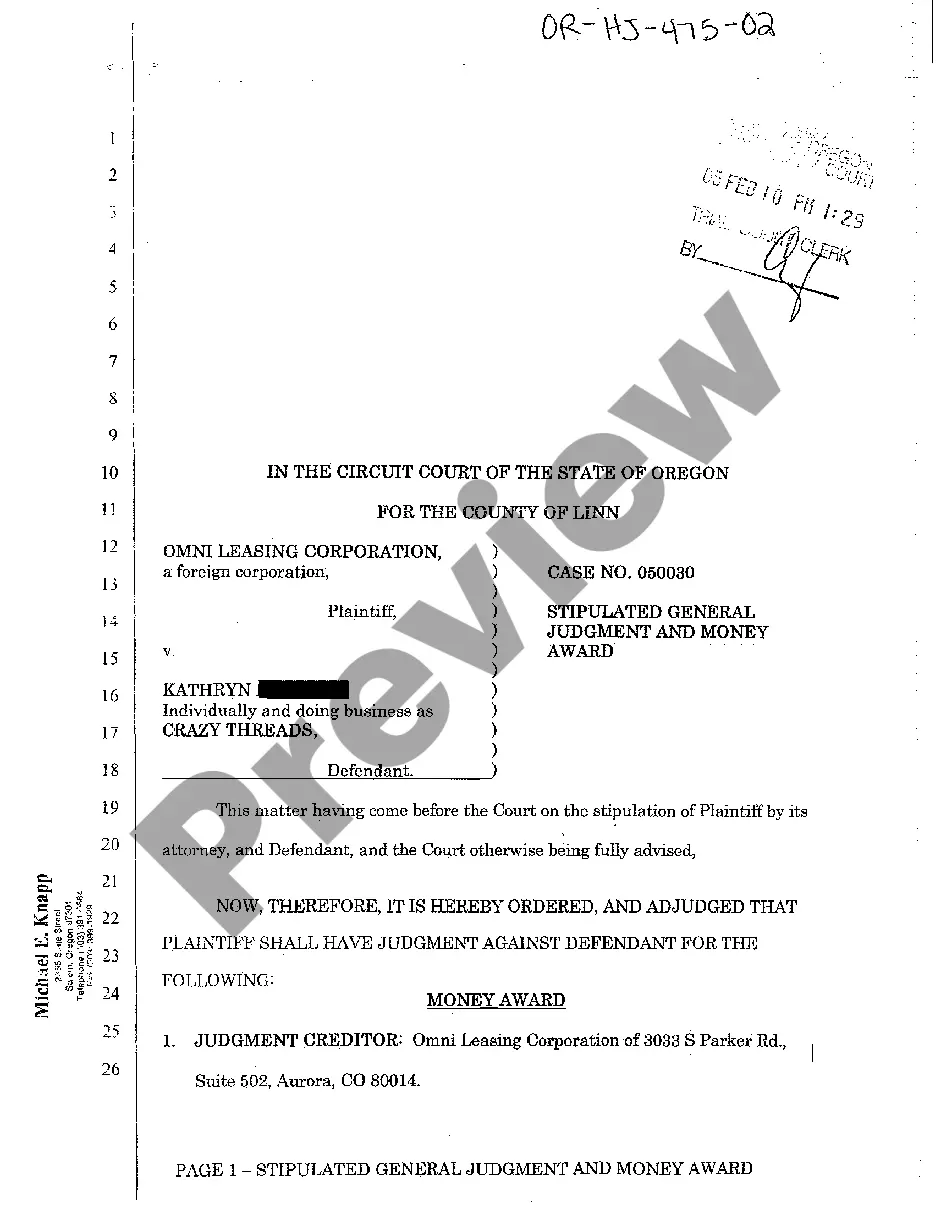

Title: Understanding Independent Contractor Not Paid for Work: Types and Detailed Description Introduction: In today's dynamic work environment, independent contractors play a significant role in various industries. However, instances where these contractors are not paid for their services are not uncommon. This article aims to provide a comprehensive understanding of what it means when an independent contractor is not compensated for their work, highlighting different types of non-payment scenarios. 1. Non-payment of Independent Contractors: Non-payment refers to situations where independent contractors do not receive the agreed-upon compensation for their services. Several factors can contribute to this issue, including contractual disputes, financial instability, or unethical practices by employers. 2. Types of Independent Contractor Non-Payment: a. Payment Delay: Payment delays occur when clients or employers fail to meet the agreed-upon payment timeline, often due to administrative or financial challenges. Contractors may experience frustration and financial difficulties when their payment is postponed, affecting their ability to manage personal finances. b. Partial or Underpayment: Partial or underpayment happens when contractors are compensated for only a portion of their work or receive less than the initially agreed-upon amount. This may result from misunderstandings, miscalculations, or intentional withholding by the employer. c. Non-Payment Without Justification: Non-payment without justification refers to instances where the contractor provides the agreed-upon services but is not paid at all. This type of non-payment is often due to employers' financial difficulties, bankruptcy, or unethical practices, leaving contractors with no compensation for their work. d. Scope Creep: Scope creep occurs when an employer expands the project's requirements or expectations without a corresponding increase in compensation. Contractors might find themselves working on additional tasks without receiving additional pay, which can negatively impact their overall income and work-life balance. 3. Legal Rights and Remedies: Independent contractors facing non-payment situations have legal rights and potential remedies to pursue. The actions they can take include: — Contractual Review: Reviewing the contract terms and engaging in clear communication with the hiring party to address any discrepancies or unpaid portions. — Legal Assistance: Seeking legal guidance to understand their rights, obligations, and recourse options in case of non-payment. — Collection Agencies: Engaging collection agencies to recover unpaid fees, depending on local laws and regulations. — Small Claims Court: Filing a lawsuit in small claims court to settle disputes involving relatively smaller amounts of money. — Negotiation and Mediation: Attempting to negotiate a settlement or seeking mediation as an alternative dispute resolution method to avoid litigation. Conclusion: It is crucial for both independent contractors and employers to have a clear understanding of the types of non-payment scenarios that can occur. By doing so, parties can proactively mitigate issues, ensure fair compensation for services rendered, and maintain a positive professional relationship. Contractors should familiarize themselves with their legal rights and seek appropriate remedies when faced with non-payment situations.

Independent Contractor Not Paid For Work

Description

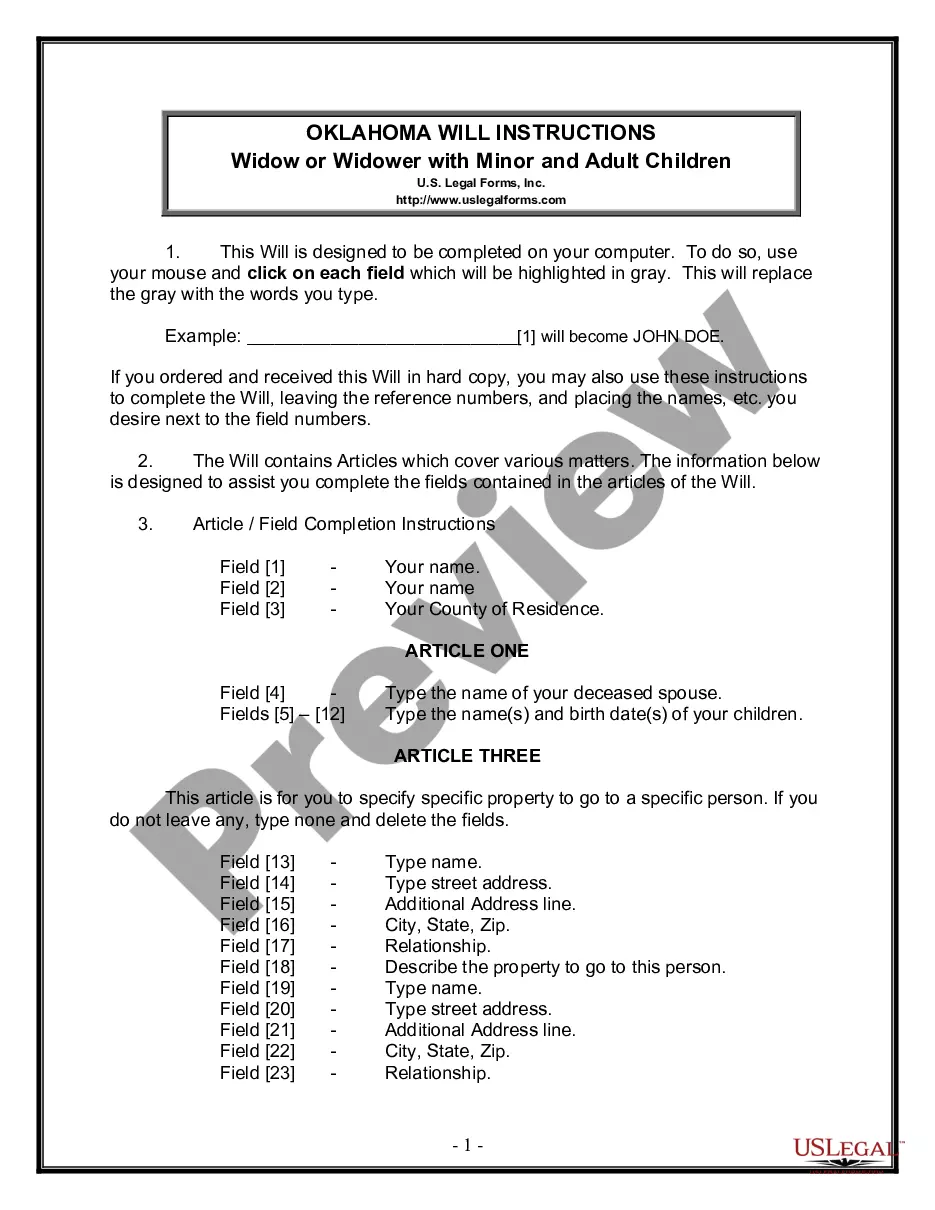

How to fill out Independent Contractor Not Paid For Work?

The Independent Contractor Not Compensated For Labor you see on this page is a versatile legal template crafted by expert attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal experts with more than 85,000 authenticated, state-specific documents for any commercial and personal scenario. It’s the quickest, easiest, and most trustworthy way to obtain the paperwork you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Select the format you prefer for your Independent Contractor Not Compensated For Labor (PDF, DOCX, RTF) and download the example to your device.

- Explore the document you require and examine it.

- Search through the file you specified and preview it or evaluate the form description to confirm it meets your requirements. If it doesn’t, use the search feature to find the suitable one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Choose the pricing option that fits your needs and create an account. Utilize PayPal or a debit/credit card to make an immediate payment. If you're already a member, Log In and review your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

The Federal Fair Debt Collection Practices Act (FDCPA) and the Alaska Unfair Trade Practices and Consumer Protection Act prevent debt collectors from using unfair and deceptive practices when collecting a debt. These laws do not, however, forgive any legitimate debt you may owe.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Statute of limitations on debt for all states StateWrittenOpen-endedAlaska6 years3Arizona5 years3Arkansas6 years3California4 years446 more rows ? 19-Jul-2023

What are the provisions of the FDCPA? Call Time Restrictions. ... Honoring Workplace Opt-Outs. ... Honoring Home Phone Opt-Outs. ... Restrictions Against Harassment. ... Restrictions Against Unfair Practices. ... Restrictions Against False Lawsuit Threats.

How to Request Debt Verification. To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

The statute of limitations on debt in Alaska is generally three years (i.e., a breach of contract). Collection of medical bills also has a three year statute of limitations, unless the medical provider put a lien against you for the medical bills.