Self Employed Bookkeeper Fort Worth Tx

Description

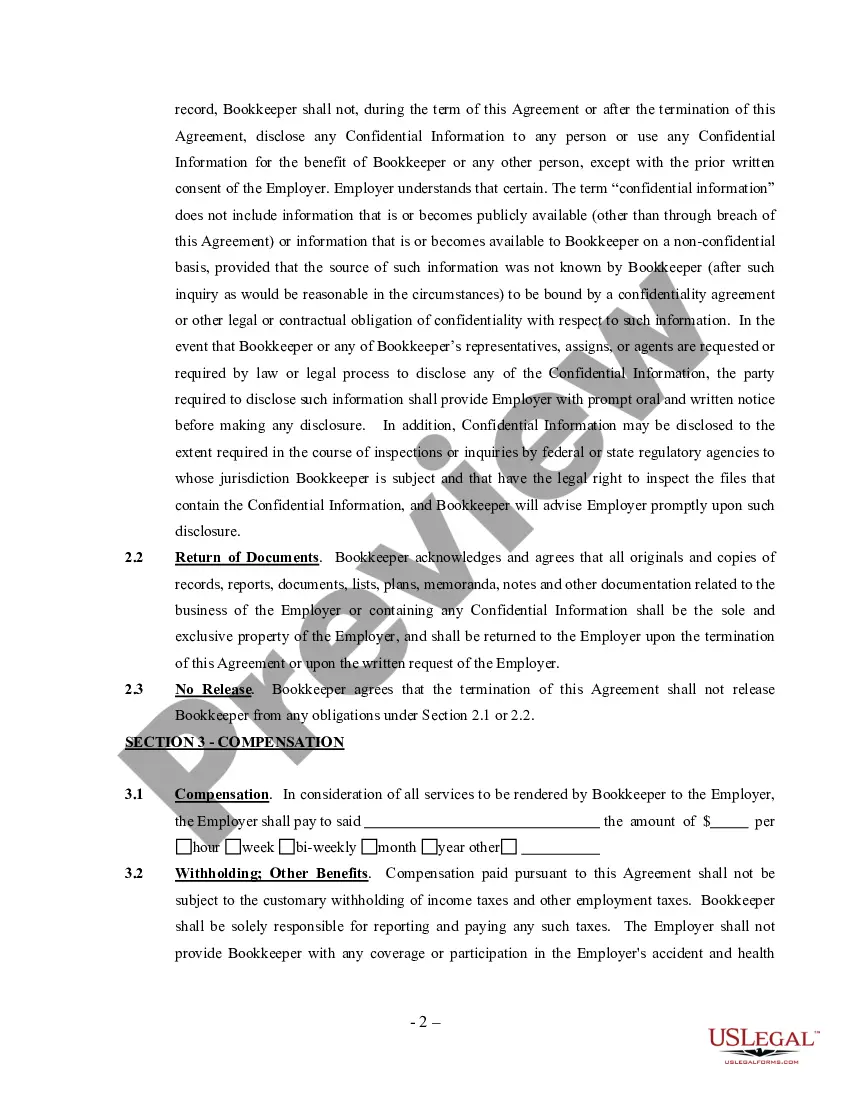

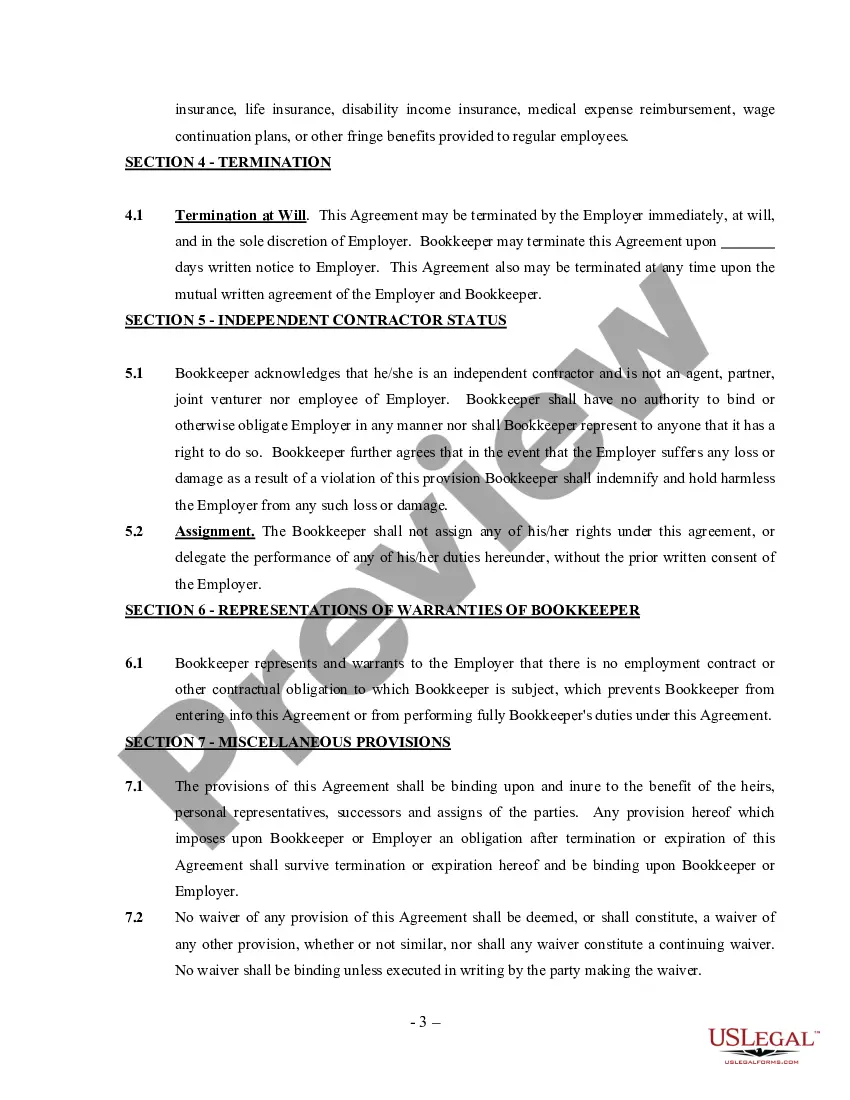

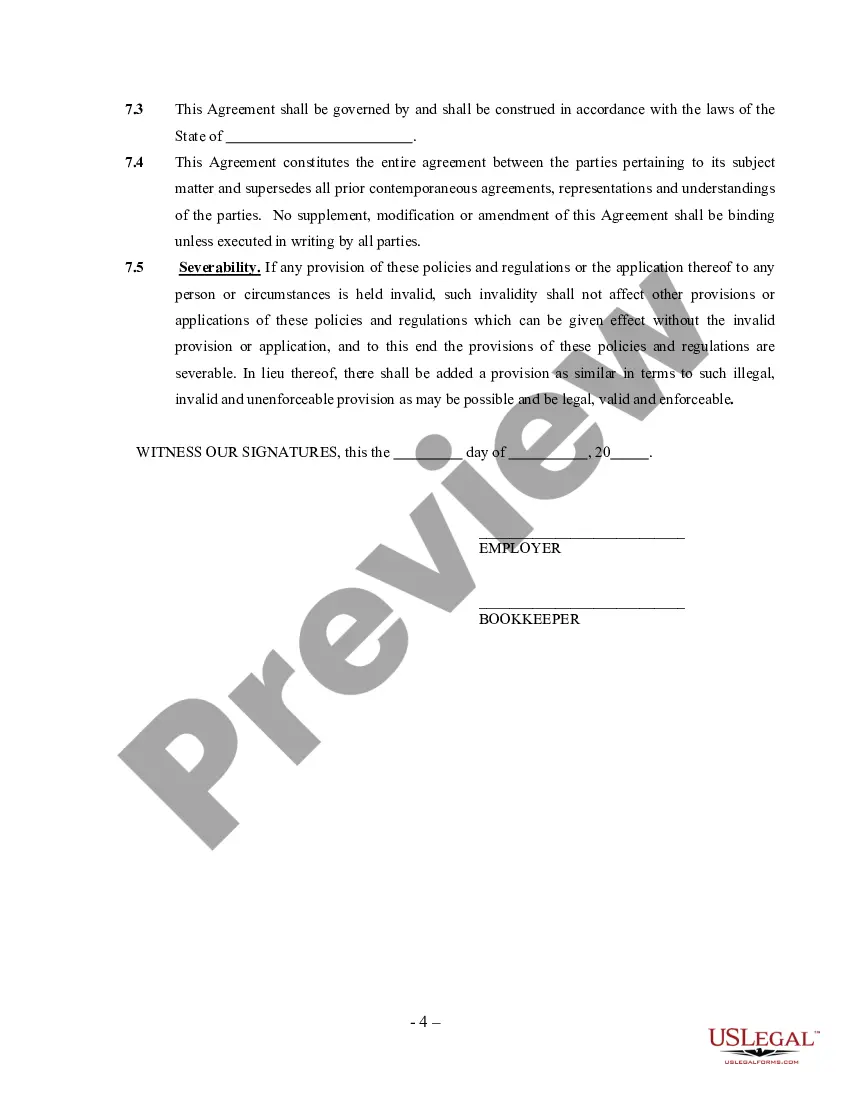

How to fill out Bookkeeping Agreement - Self-Employed Independent Contractor?

Creating legal documents from the ground up can often be overwhelming.

Certain situations may entail extensive research and significant financial investment.

If you seek a more direct and cost-effective method of crafting Self Employed Bookkeeper Fort Worth Tx or any other papers without unnecessary complications, US Legal Forms is readily accessible.

Our online collection of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs.

Review the form preview and descriptions to confirm that you have located the document you're seeking.

- With merely a few clicks, you can swiftly obtain state- and county-specific forms meticulously assembled for you by our legal experts.

- Utilize our platform whenever you require dependable services to quickly locate and download the Self Employed Bookkeeper Fort Worth Tx.

- If you’re familiar with our site and have registered an account with us before, just Log In to your account, find the form, and download it or re-download it anytime from the My documents section.

- Not registered yet? No problem. It only takes a few minutes to sign up and browse the catalog.

- However, before proceeding directly to download the Self Employed Bookkeeper Fort Worth Tx, keep these recommendations in mind.

Form popularity

FAQ

The income of a self-employed bookkeeper in Fort Worth, TX, varies based on experience, clientele, and services offered. On average, self-employed bookkeepers earn between $30,000 and $70,000 annually. Factors like specialization and the number of clients can significantly impact your earnings. By leveraging platforms like USLegalForms, you can access tools to help you establish competitive rates and grow your business.

To set up as a self-employed bookkeeper in Fort Worth, TX, you should first choose a business structure, such as sole proprietorship or LLC. Next, register your business with the state and obtain any necessary licenses or permits. Additionally, invest in accounting software and build a client base by networking and marketing your services. USLegalForms offers resources to help you navigate the legal requirements and set up your business efficiently.

Bookkeepers are not required to be registered in Texas unless they provide regulated services. If you are a self employed bookkeeper in Fort Worth, TX, registration may not be necessary, but establishing a solid reputation is crucial. Using platforms like USLegalForms can help you set up your business correctly and provide you with the necessary templates and documents to ensure compliance.

In Texas, you typically do not need a specific business license to operate as a bookkeeper. As a self employed bookkeeper in Fort Worth, TX, you may need to register your business name and obtain a general business license, depending on your local jurisdiction. It’s wise to consult with local authorities or legal resources to ensure you meet all regulatory requirements.

Generally, a license is not required solely for bookkeeping services. If you are a self employed bookkeeper in Fort Worth, TX, you can provide bookkeeping without formal licensing. However, if you expand your services to include tax preparation or financial consulting, you may need additional certifications or licenses. Always verify the specific requirements in your state to stay informed.

Yes, you can perform bookkeeping without a license in most cases. Many self employed bookkeepers in Fort Worth, TX operate without formal certification, focusing instead on their skills and experience. However, if you plan to offer services that involve tax preparation or financial advice, licensing may be required. It's essential to check local regulations to ensure compliance.

A bookkeeper primarily manages financial records, but many also offer tax preparation services. If you work with a self-employed bookkeeper Fort Worth TX, they can help you navigate tax filing, ensuring you take advantage of deductions and credits available to you. This collaborative approach can provide peace of mind and help you focus on growing your business.

Proving your income as a self-employed individual can be done through several methods, such as providing bank statements, invoices, or profit and loss statements. You can also use tax returns from previous years as documentation of your earnings. Engaging a self-employed bookkeeper Fort Worth TX can simplify this process, ensuring you maintain organized records and can easily demonstrate your income when needed.

Yes, even if you earn less than $10,000, you may still be required to file a federal tax return if you have self-employment income. It's important to report all income, as failing to do so can lead to penalties. A self-employed bookkeeper Fort Worth TX can help clarify your specific filing requirements and assist you in preparing your taxes accurately.

As a self-employed individual in Fort Worth, TX, you generally need to file a tax return if you earn $400 or more in net earnings. This applies regardless of whether you operate as a sole proprietor or through a business entity. To ensure you meet all tax obligations, consider consulting a self-employed bookkeeper Fort Worth TX, who can provide tailored advice based on your earnings.