Agreement For Independent Contractor Services

Description

How to fill out Grant Writer Agreement - Self-Employed Independent Contractor?

- If you're a returning user, log into your account and click the Download button to retrieve the needed form template. Make sure your subscription is current; renew it if required.

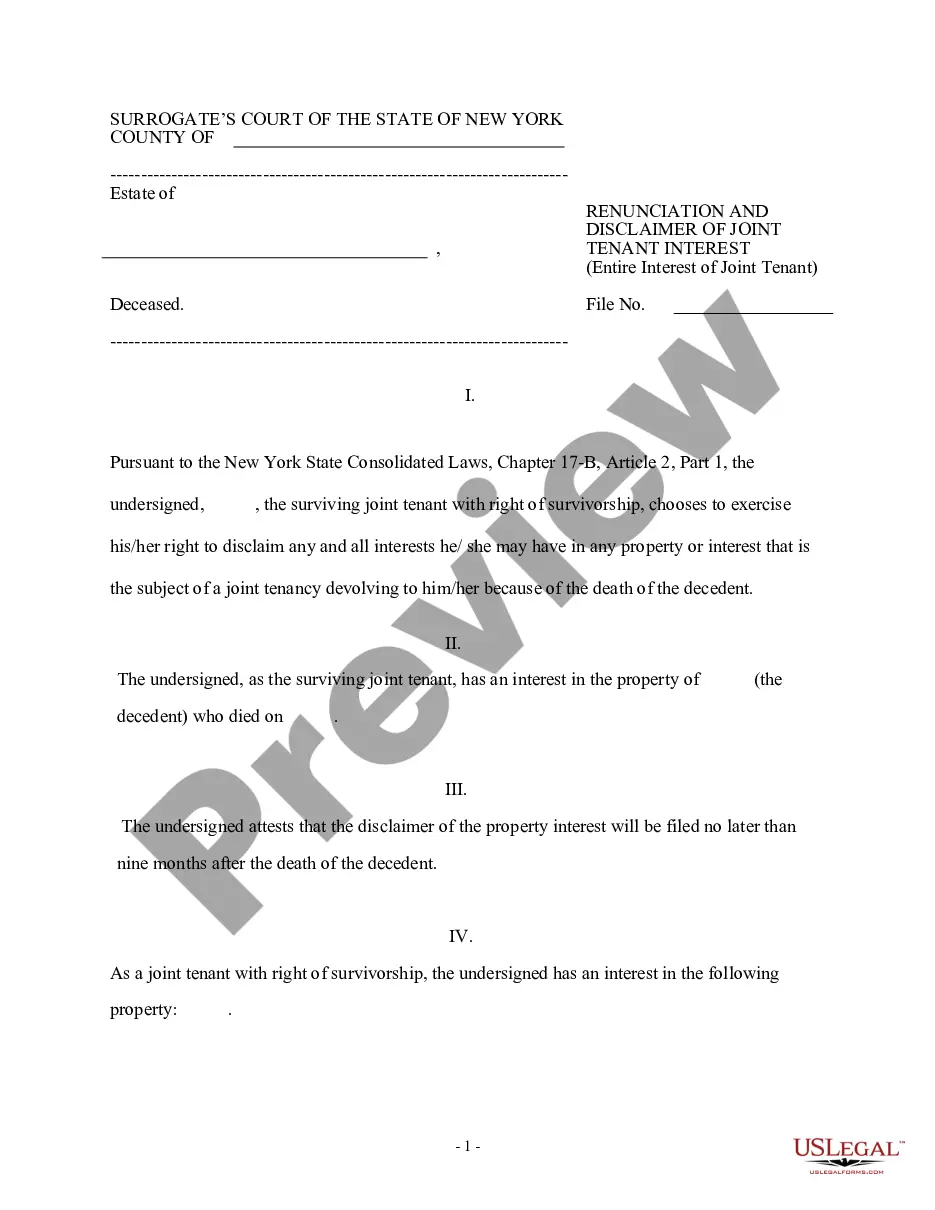

- For first-time users, begin by checking the Preview mode for the form description to confirm you've selected the right template that aligns with your jurisdiction's regulations.

- If you encounter any issues with the form or need a different document, utilize the Search tab at the top to find alternative templates that better suit your needs.

- Once satisfied with your choice, purchase the document by clicking on the Buy Now button and selecting your preferred subscription plan. Register for an account to access the form library.

- Complete your transaction. Enter your credit card information or opt for PayPal to finalize your subscription payment.

- Download the form to your device, allowing you to fill it out at your convenience. You can also access it later via the My Forms menu in your profile.

US Legal Forms enables both individuals and legal professionals to swiftly create valid legal documents, backed by the largest collection of forms available online.

In conclusion, acquiring your Agreement for independent contractor services through US Legal Forms is straightforward and efficient. Take advantage of their vast resources and start crafting your legal documents today!

Form popularity

FAQ

The new law for 1099 reporting has introduced changes aimed at increasing transparency for payments made to independent contractors. Under this law, businesses must report payments exceeding a certain threshold through Form 1099. This requirement reinforces the need for clear agreements for independent contractor services, outlining payment terms. Using tools like US Legal Forms can simplify the process of creating compliant agreements and assisting with reporting.

Similar to the 2 year contractor rule, the 2 year independent contractor rule emphasizes the importance of keeping detailed records for independent contractors over a two-year period. This rule supports transparency and protects both parties involved in the agreement for independent contractor services. Business owners should stay informed about this requirement to manage their workforce effectively. Resources like US Legal Forms can assist in crafting the necessary documentation.

The 2 year contractor rule requires businesses to maintain certain records of independent contractors' engagement for two years. This period is crucial for compliance with regulations related to tax and labor laws. An agreement for independent contractor services should explicitly outline terms, ensuring clarity during this timeframe. Utilizing a platform like US Legal Forms can help streamline this process by providing customizable templates.

The new federal rule for contractors aims to clarify the classification of workers as employees or independent contractors. This change impacts how businesses should handle agreements for independent contractor services. It is essential for businesses to interpret this rule accurately to avoid penalties and maintain compliance. Consulting with legal professionals can provide guidance tailored to your specific situation.

To structure an independent contractor agreement, start with an introductory section that identifies both parties. Follow this with sections detailing the scope of work, payment terms, confidentiality clauses, and termination conditions. A well-organized Agreement for independent contractor services ensures clarity and helps prevent disputes.

Typically, an independent contractor agreement does not require notarization unless specified by state law or a specific contract requirement. However, having an Agreement for independent contractor services can enhance credibility and provide added protection. It's wise to check local laws or consult with a legal expert to determine if notarization is beneficial in your case.

To fill out an independent contractor agreement, start by including both parties' legal names and contact details. Next, clearly define the project scope, payment terms, and timeline for completion. Incorporating an Agreement for independent contractor services helps protect your rights and sets clear expectations for the work to be performed.

Filling out a service agreement requires clear communication of the project's scope, payment structure, and deadlines. Begin by detailing the services provided, followed by the agreed payment terms. It is crucial to incorporate an Agreement for independent contractor services to ensure both parties understand their commitments and protections.

An independent contractor must typically complete a W-9 form to provide their taxpayer identification information. Additionally, it is essential to have an Agreement for independent contractor services that outlines the terms of the contract. This paperwork ensures clarity on payment terms, project expectations, and liability responsibilities.

Typically, the hiring party creates the independent contractor agreement, but it’s beneficial for both parties to review and understand the document. This ensures that everyone is on the same page regarding the terms and conditions. If you're unsure about how to draft it, turn to USLegalForms, which can provide templates for your agreement for independent contractor services, making the process easier for you.