Self-employed Contractor On

Description

How to fill out Geologist Agreement - Self-Employed Independent Contractor?

Utilizing legal document examples that adhere to federal and state guidelines is essential, and the web provides a myriad of choices to select from.

However, what is the purpose of squandering time looking for the properly drafted Self-employed Contractor On sample online if the US Legal Forms digital library has such templates compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates crafted by lawyers for various business and personal circumstances.

Examine the template using the Preview feature or through the text description to verify it satisfies your needs. Search for an additional sample using the search bar at the top of the page if necessary. Click Buy Now when you have identified the correct form and choose a subscription plan. Create an account or Log In and process your payment via PayPal or credit card. Select the format for your Self-employed Contractor On and download it. All templates accessed through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents section in your profile. Enjoy the most comprehensive and user-friendly legal documentation service!

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our experts keep up with legislative modifications, ensuring that your form is always current and compliant when obtaining a Self-employed Contractor On from our site.

- Acquiring a Self-employed Contractor On is simple and swift for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in your preferred format.

- If you are a newcomer to our website, adhere to the instructions below.

Form popularity

FAQ

700-050-68- These forms are is designed to be used by the Contractor for MOT Pavement Markings (all 710 pay items). The Contractor is now responsible to maintain measurements/counts for these items. MOT Painted Pavement Markings Daily Worksheet, Form No.

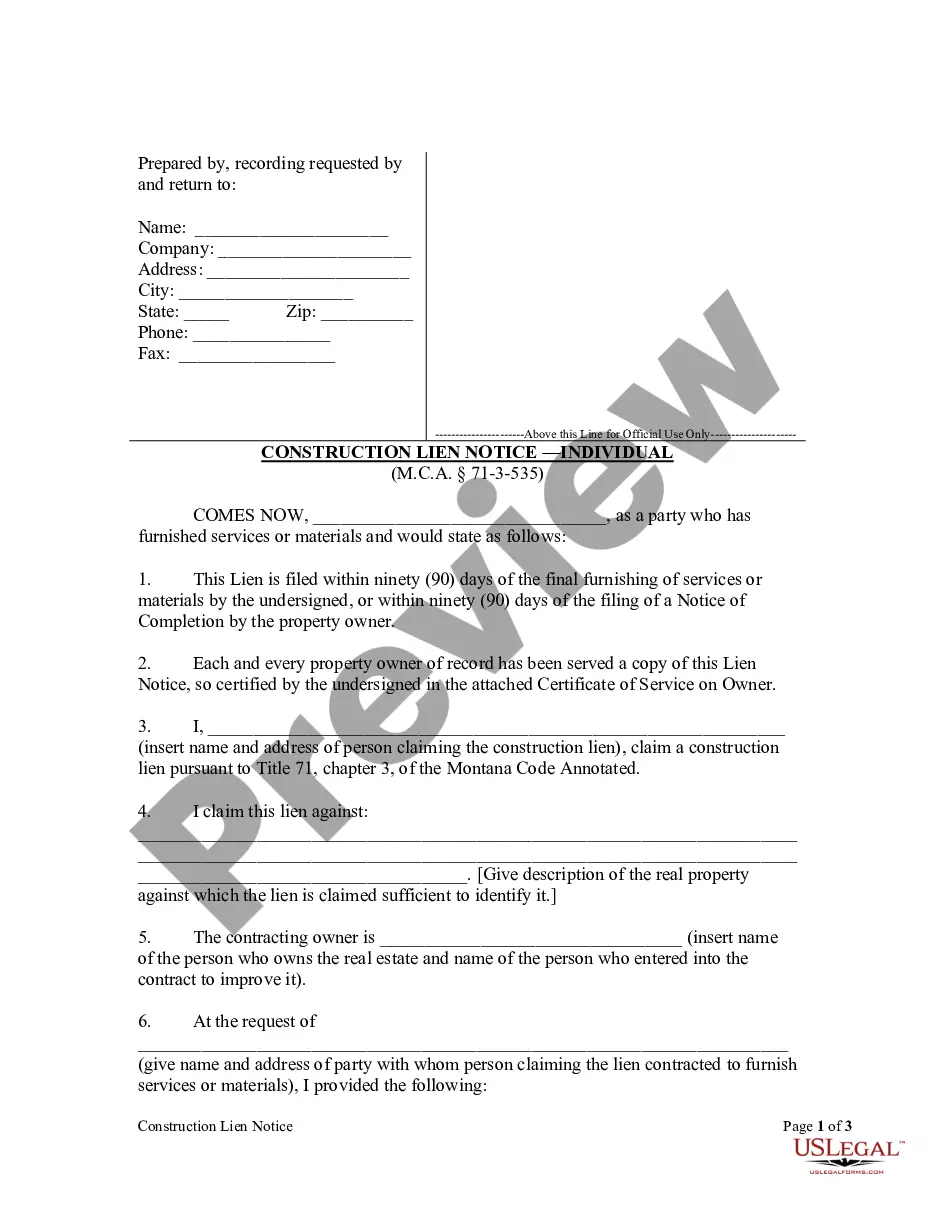

Per Florida Statutes 713.16, the sworn statement of account is a written statement that documents the nature of the labor or services performed or to be performed, materials supplied or to be supplied, current amount paid on the account, amount due and amount to become due as stated by the lienor.

ING TO FLORIDA'S CONSTRUCTION LIEN LAW (SECTIONS 713.001-713.37, FLORIDA STATUTES), THOSE WHO WORK ON YOUR PROPERTY OR PROVIDE MATERIALS AND SERVICES AND ARE NOT PAID IN FULL HAVE A RIGHT TO ENFORCE THEIR CLAIM FOR PAYMENT AGAINST YOUR PROPERTY. THIS CLAIM IS KNOWN AS A CONSTRUCTION LIEN.

Florida Statute (713.06), requires that a Notice to Owner be served on the improvement owner not later than 45 days from the date of first labor, services, or materials delivered to the job site as a prerequisite to secure the sender's right to lien the property in the event the sender is not properly paid for work ...

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

Service-provider (independent contractor): First name, middle initial, and last name. Social Security number. Address. Start date of contract (if no contract, date payments equal $600 or more) Amount of contract, including cents (if applicable) Contract expiration date (if applicable)

Form W-9. If you've made the determination that the person you're paying is an independent contractor, the first step is to have the contractor complete Form W-9, Request for Taxpayer Identification Number and Certification.

There is no W-2 self-employed specific form that you can create. Instead, you must report your self-employment income on Schedule C (Form 1040) to report income or (loss) from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit.