Independent Contractor For Atm

Description

How to fill out Self-Employed Independent Contractor Construction Worker Contract?

The Freelance Agreement For Atm you observe on this page is a reusable official template created by expert attorneys in compliance with national and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal professionals with more than 85,000 validated, state-specific documents for any commercial and personal scenario. It’s the quickest, easiest, and most reliable method to acquire the paperwork you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Enroll in US Legal Forms to access verified legal templates for all of life's situations at your fingertips.

- Search for the document you need and verify it.

- Sign up and Log In.

- Acquire the editable template.

- Complete and sign the documents.

- Download your documents one more time.

Form popularity

FAQ

Yes, you can privately own an ATM machine. Owning an ATM provides you with a great opportunity to earn passive income through transaction fees. As an independent contractor for ATM, you can decide where to place your machine, manage its operations, and keep all the profits generated. US Legal Forms can help you navigate the legal requirements and paperwork necessary for owning and operating an ATM.

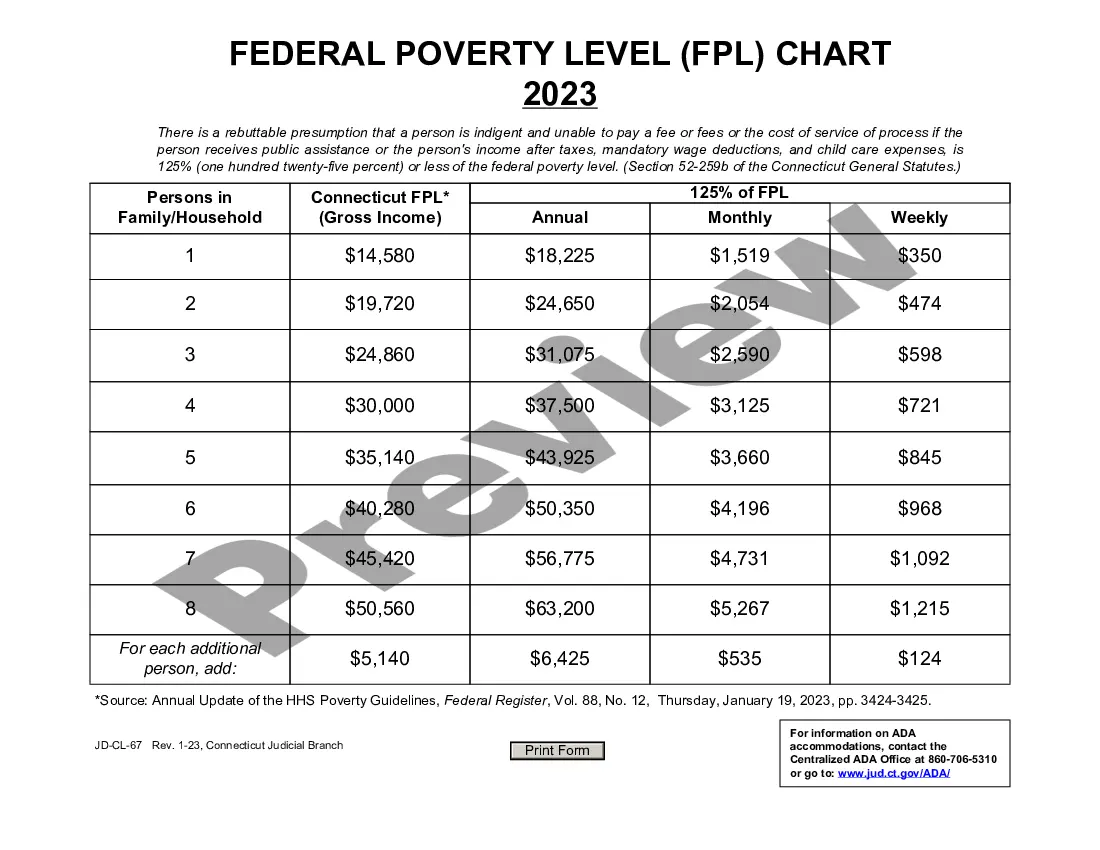

To declare independent contractor income for ATM services, you need to report all income earned on your tax return. This includes any payments received from clients, regardless of whether you received a 1099 form. Proper documentation and record-keeping are vital to ensure you declare your earnings accurately. Using US Legal Forms can help simplify the process of tracking and declaring your income.

Filing a 1099 as an independent contractor for ATM services involves receiving the form from the business you worked with if your earnings exceeded $600. This form must be filed with the IRS by January 31 of the following year. Make sure to keep a copy for your records. If you are the payer, you must complete the form and send it to both the contractor and the IRS using the correct filing method.

To report income as an independent contractor for ATM services, you will typically use Schedule C (Form 1040) when filing your tax return. This form allows you to report your earnings and deduct eligible business expenses. Additionally, you may need to file a Schedule SE to calculate self-employment taxes. Accurate reporting is essential to avoid penalties and ensure compliance with IRS regulations.

While forming an LLC is not legally required to start an ATM business, it offers significant advantages. Operating as an LLC protects your personal assets from business liabilities and simplifies tax management. Additionally, it can enhance your credibility with banks and partners as an independent contractor for ATM services. If you are serious about starting an ATM business, consider the benefits of forming an LLC for better legal and financial protection.

Obviously, ATMs at banks will be refilled by the bank itself. However, for standalone ATMs, there are a few different options when it comes to the responsibility of refilling the machine. If a business is the outright owner of its ATM, they have the option of refilling the machine on their own.

When people use an ATM, they typically pay a fee between $2 and $3, which is how businesses make most of their money through these machines. ?When a business allows an ATM to be placed at their location, they have the opportunity to earn a commission,? said Paul Carriere, an attorney at Favret Carriere Cronvich.

The contract should specify the location where the ATM will be installed and the responsibilities of each party related to the installation, maintenance, and repair of the machine. This may include requirements for electrical and phone line connections and any necessary permits or approvals.

You can also own an ATM business, while still working a part-time or full-time job since it requires so little time! You can get started into the ATM business for a very low cost. For as little as $2,099, you can purchase your first machine. You can stock the machine with as little as $500 or as much as $16,000+.

The ATM replenishment meaning, is the process when a third party hired by the bank removes the leftover money in the machine and replaces it with a fresh load. The bank notes go into cassettes based on their denomination.