Independent Contractor Form Agreement For Accountant And Bookkeeper

Description

How to fill out Self-Employed Independent Contractor Esthetics Agreement?

There's no longer a requirement to waste hours searching for legal documents to adhere to your local state obligations.

US Legal Forms has gathered all of them in one location and enhanced their accessibility.

Our platform offers over 85,000 templates for any business and individual legal situations categorized by state and area of use.

Using the search bar above to find another sample if the previous one didn't meet your needs. Click Buy Now next to the template name when you identify the correct one. Select the most suitable pricing plan and either create an account or sign in. Conclude payment for your subscription using a card or via PayPal to proceed. Choose the file format for your Independent Contractor Form Agreement For Accountant And Bookkeeper and download it to your device. Print out your form to fill it out in writing or upload the template if you prefer to utilize an online editor. Preparing official documents under federal and state regulations is quick and effortless with our platform. Experience US Legal Forms today to keep your documentation organized!

- All forms are properly crafted and verified for credibility, so you can trust in obtaining an updated Independent Contractor Form Agreement For Accountant And Bookkeeper.

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all saved documents at any time by opening the My documents tab in your profile.

- If you have never utilized our platform before, additional steps are needed to finalize the process.

- Here's how new users can find the Independent Contractor Form Agreement For Accountant And Bookkeeper in our library.

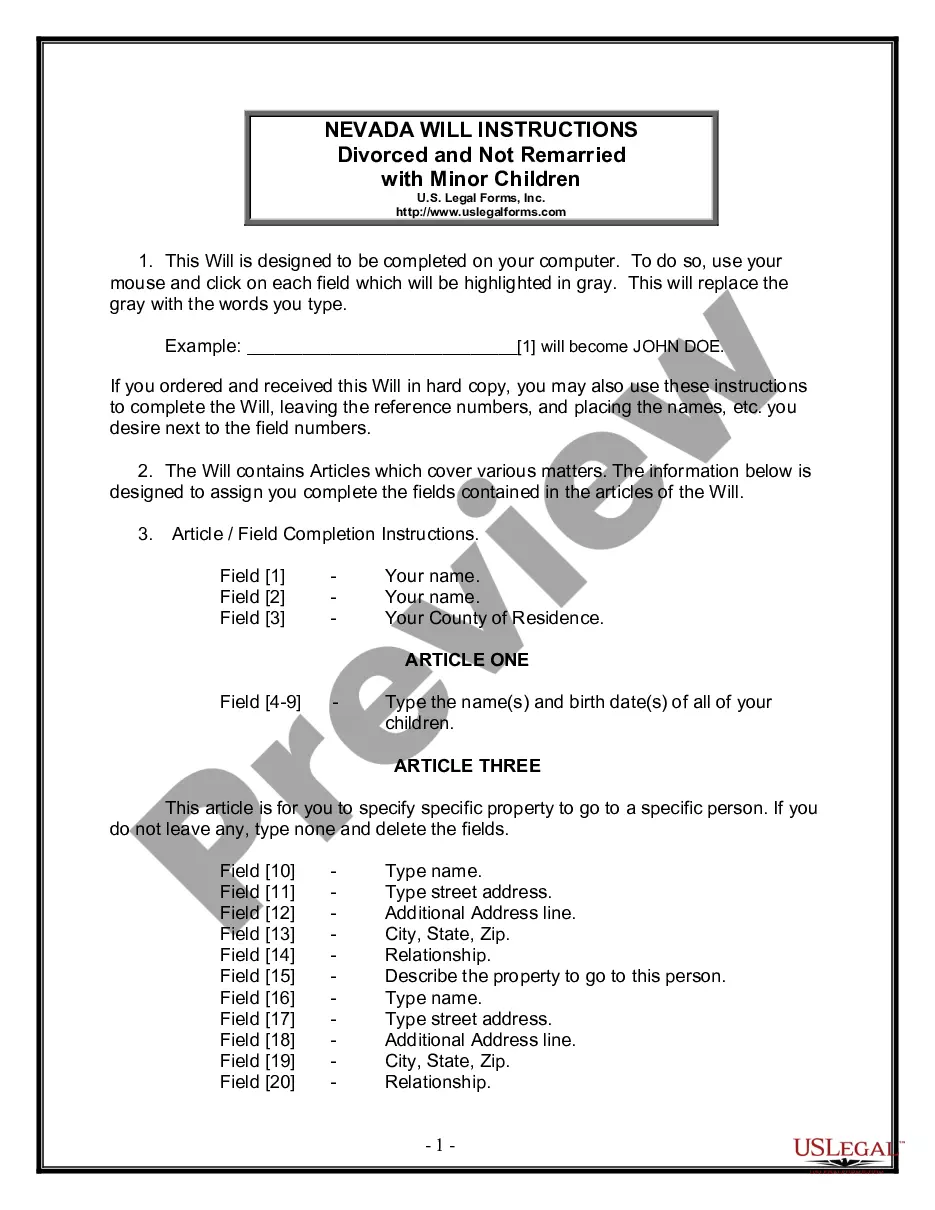

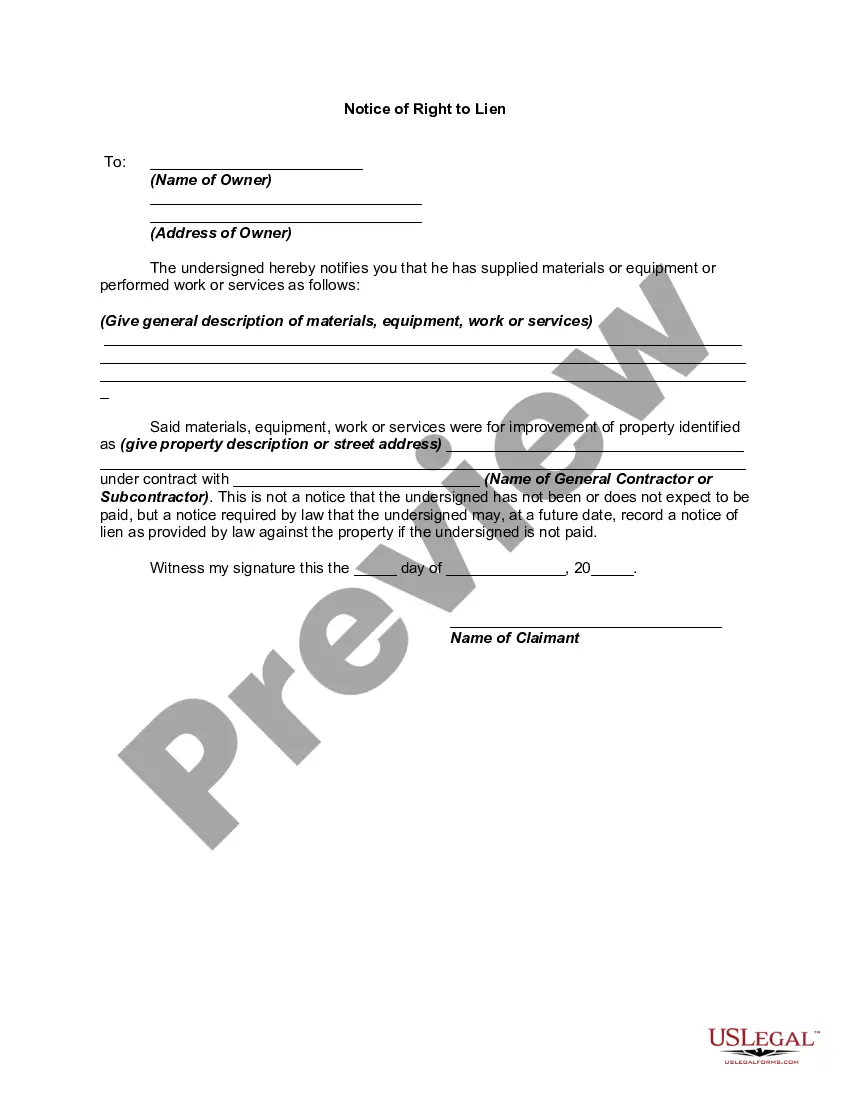

- Carefully read the page content to confirm it contains the example you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Yes, the company should send you a 1099. Its easy to forget to include yourself when you're doing the books! All you need to do is print out a blank form 1099 (from IRS.gov), fill it out, check the "Corrected" box, and mail to the IRS.....and keep your copy of course!

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.