Agreement Self Employed Form 1099

Description

How to fill out Stone Contractor Agreement - Self-Employed?

Well-structured official documentation is one of the critical assurances for preventing problems and legal disputes, but obtaining it without the help of an attorney may require time.

Whether you need to swiftly locate an updated Agreement Self Employed Form 1099 or any other templates for employment, family, or business situations, US Legal Forms is always available to assist.

The procedure is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button next to the chosen file. Furthermore, you can retrieve the Agreement Self Employed Form 1099 at any time, as all documents previously obtained on the platform are accessible within the My documents section of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

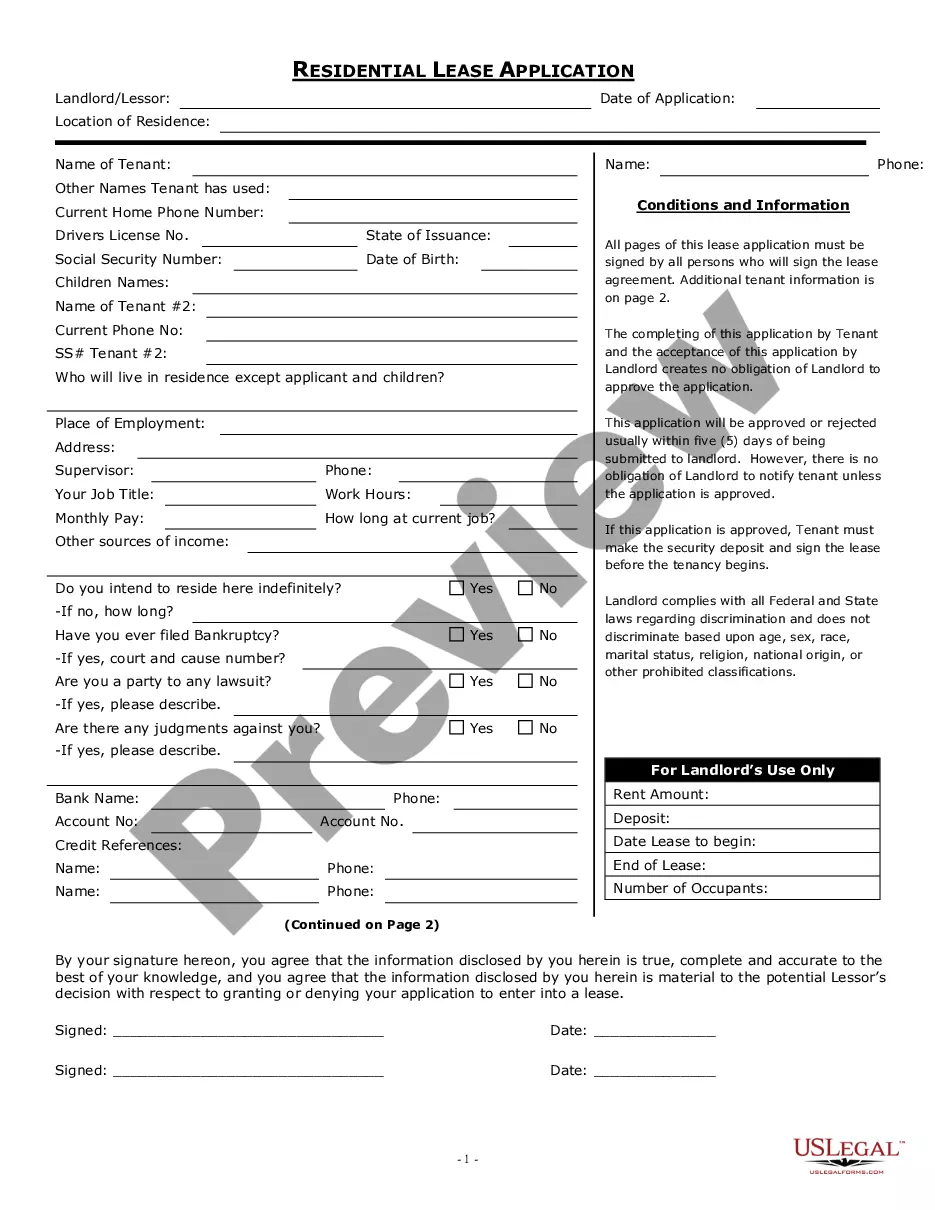

- Ensure that the form is appropriate for your situation and area by verifying the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Click on Buy Now once you identify the suitable template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Opt for PDF or DOCX file format for your Agreement Self Employed Form 1099.

- Hit Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

If you are self-employed and an independent contractor, your compensation is reported on Form 1099-MISC or Form 1099-NEC (along with rents, royalties, and other types of income).

You should have the following on hand to fill out the 1099-MISC form:Payer's (that's you!) name, address, and phone number.Your TIN (Taxpayer Identification Number)Recipient's TIN.Recipient's name and address.Your account number, if applicable.Amount you paid the recipient in the tax year.

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship).Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.You may need to make estimated tax payments.