This guide provides an overview of relinquishing and terminating parental rights. Topics discussed include reasons for termination or relinquishment of parental rights, due process issues, evidentiary matters, and more.

Child Parent Terminate With Parent

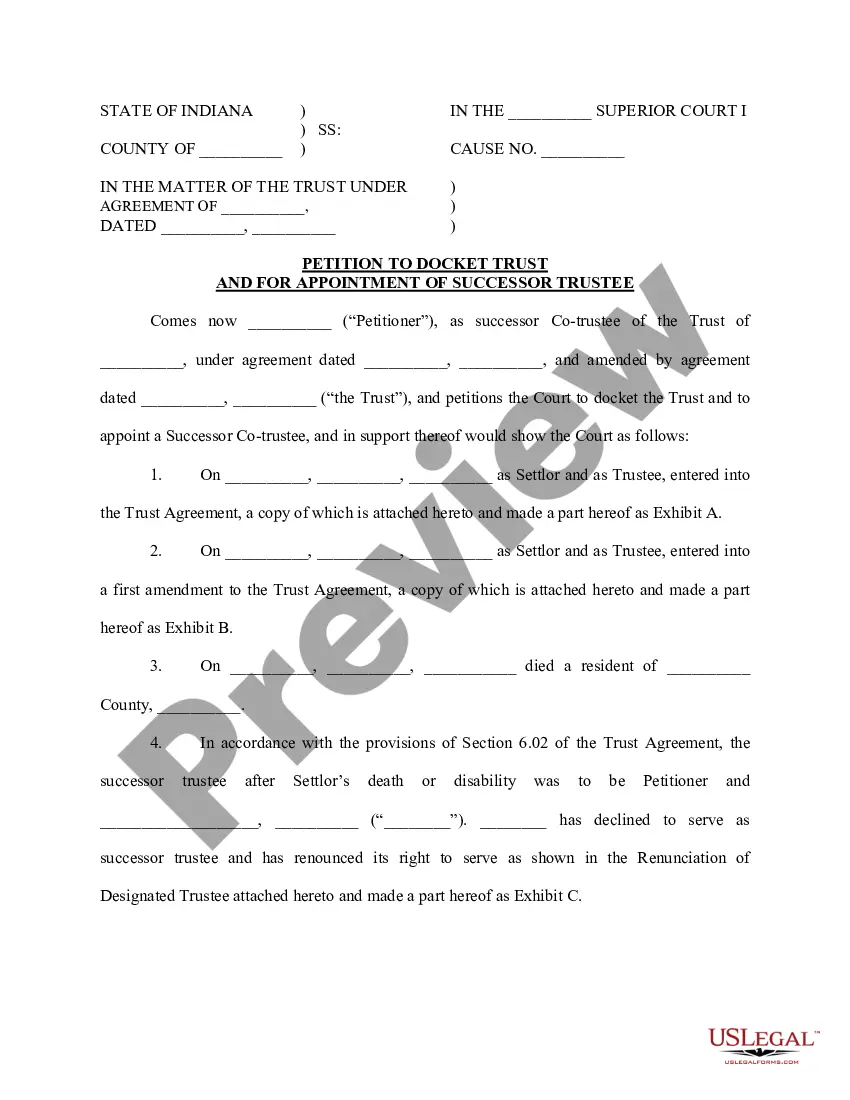

Description

How to fill out USLegal Guide To Giving Up And Signing Over Parental Rights?

Getting a go-to place to access the most recent and relevant legal samples is half the struggle of working with bureaucracy. Finding the right legal papers calls for precision and attention to detail, which is why it is vital to take samples of Child Parent Terminate With Parent only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the details concerning the document’s use and relevance for the circumstances and in your state or region.

Consider the listed steps to finish your Child Parent Terminate With Parent:

- Use the catalog navigation or search field to find your template.

- View the form’s information to ascertain if it suits the requirements of your state and county.

- View the form preview, if there is one, to ensure the template is definitely the one you are searching for.

- Go back to the search and find the right template if the Child Parent Terminate With Parent does not fit your requirements.

- If you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Select the pricing plan that suits your needs.

- Go on to the registration to complete your purchase.

- Finalize your purchase by picking a transaction method (credit card or PayPal).

- Select the document format for downloading Child Parent Terminate With Parent.

- Once you have the form on your gadget, you may modify it using the editor or print it and complete it manually.

Eliminate the headache that accompanies your legal paperwork. Explore the comprehensive US Legal Forms collection where you can find legal samples, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

How To Reinstate A Rhode Island Corporation Submit all documents and fees that you failed to file. Pay penalties for each year your were revoked. Letter of good standing from the Rhode Island Division of Taxation (RIDT). If your name isn't available, you'll need to file a name change amendment.

LLCs in Rhode Island are taxed as pass-through entities by default. Rather than paying taxes at the entity level, LLCs pass profits and losses on to their members, who then pay taxes at the individual level. In Rhode Island, LLC members are subject to both federal and state personal income tax.

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number). This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

The Name. This state was named by Dutch explorer Adrian Block. He named it "Roodt Eylandt" meaning "red island" in reference to the red clay that lined the shore. The name was later anglicized when the region came under British rule.

Rhode Island LLC Processing Times Normal LLC processing time:Expedited LLC:Rhode Island LLC by mail:3-4 business days (plus mail time)Not availableRhode Island LLC online:3-4 business daysNot available

Name your Rhode Island LLC. You'll need to choose a name to include in your articles before you can register your LLC. ... Choose your registered agent. ... Prepare and file articles of organization. ... Receive a certificate from the state. ... Create an operating agreement. ... Get an Employer Identification Number.

The main cost associated with starting an LLC in Rhode Island is the $150 fee to file your articles of organization, which officially register your business with the state. You'll also have a yearly recurring fee of $50 to file your LLC's annual report.

To start a corporation in Rhode Island, you must file Articles of Incorporation with the Division of Business Services. You can file the document online, by mail or in person. The Articles of Incorporation cost $230 to file. Once filed with the state, this document formally creates your Rhode Island corporation.