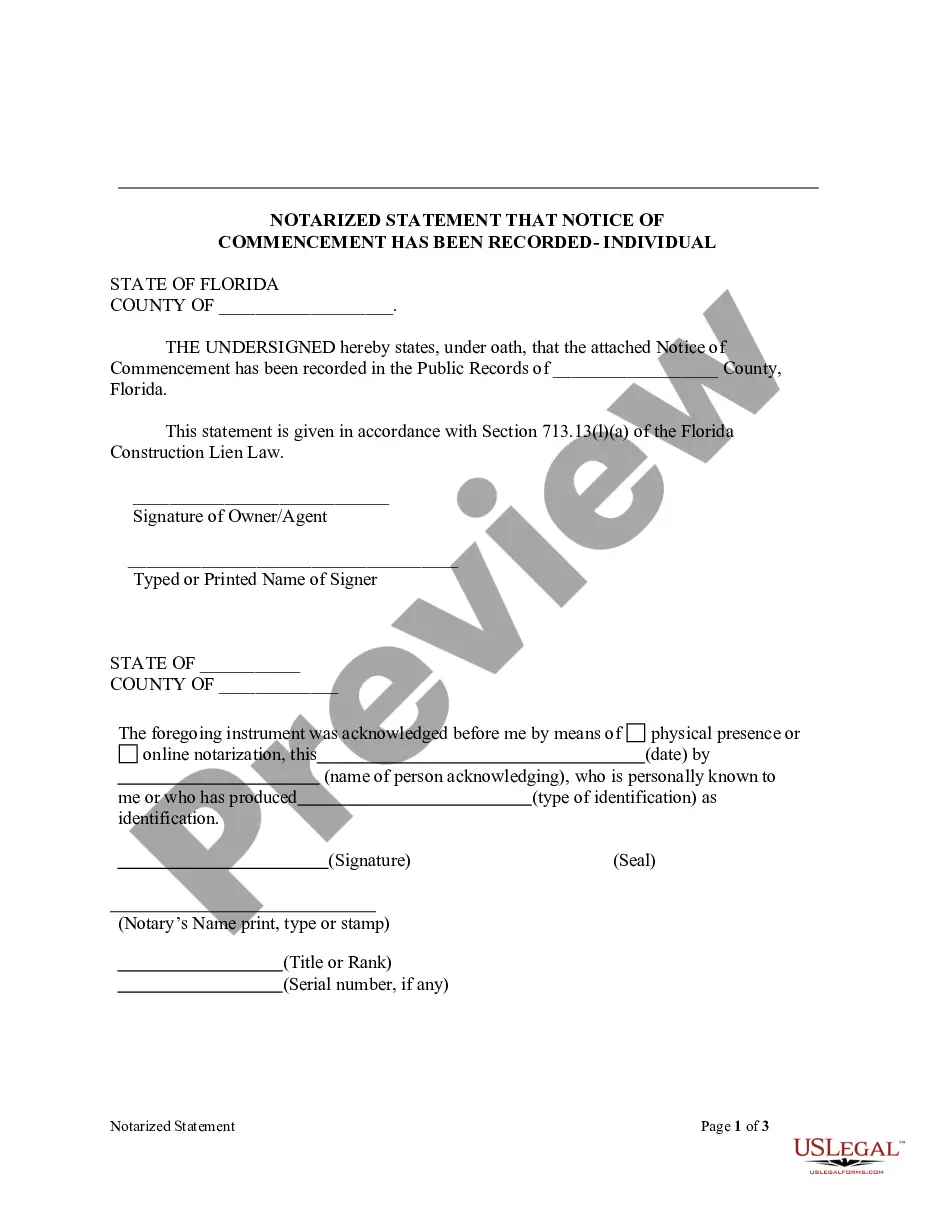

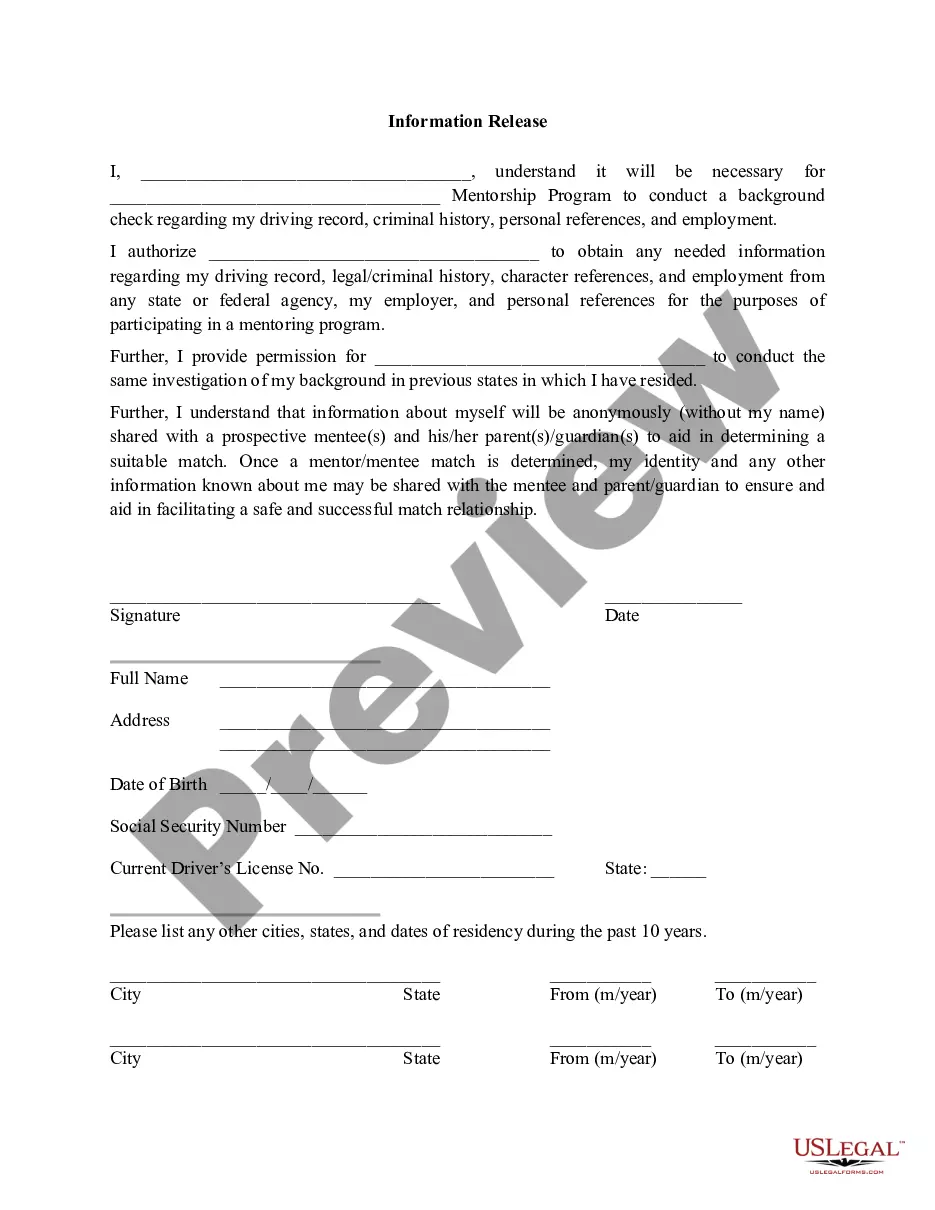

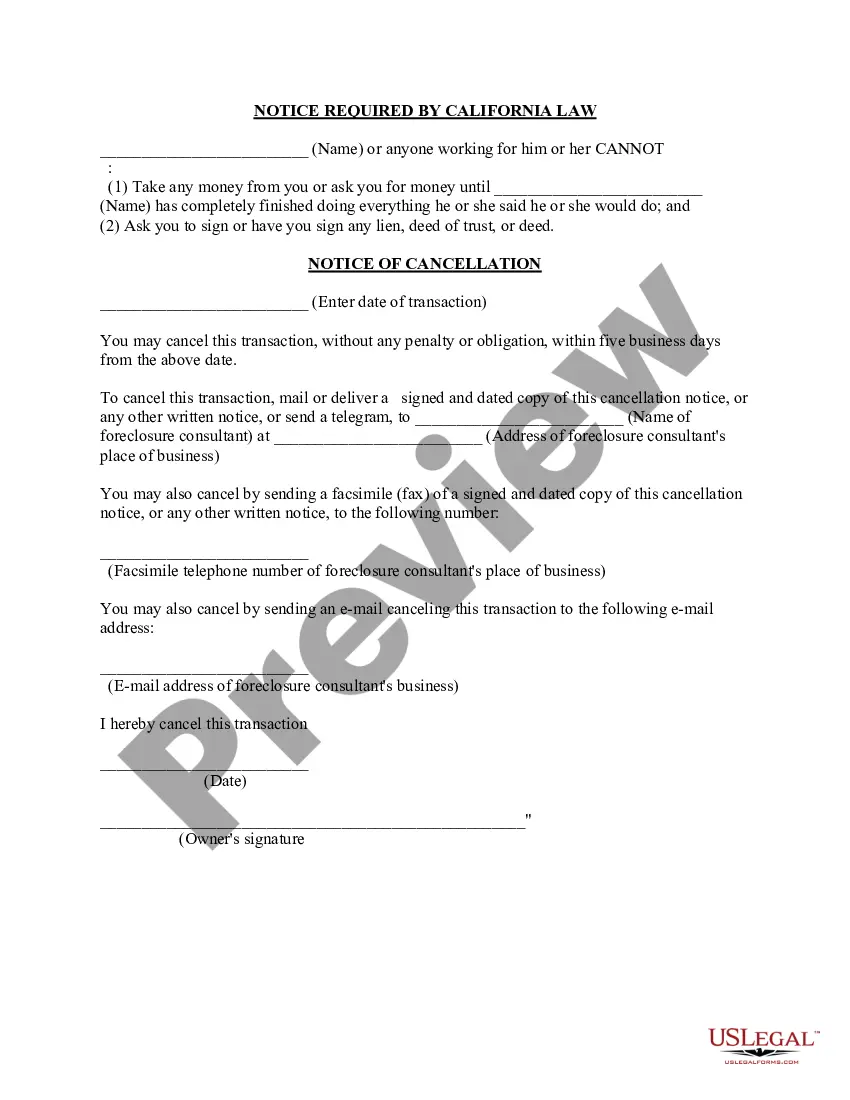

Required Foreclosure With Mortgage

Description

How to fill out Statutory Notices Required For California Foreclosure Consultants?

It’s common knowledge that you cannot transform into a legal expert instantly, nor can you swiftly learn to prepare Required Foreclosure With Mortgage without a specialized background.

Assembling legal documents is a labor-intensive task necessitating particular training and expertise. So why not delegate the preparation of the Required Foreclosure With Mortgage to the professionals.

With US Legal Forms, one of the most extensive legal document collections, you can discover anything from court filings to templates for internal communication.

You can regain access to your documents from the My documents section at any time.

If you’re a current client, you can simply Log In and find and download the template from the same section. No matter the purpose of your forms—whether financial, legal, or personal—our website has you covered. Give US Legal Forms a try now!

- Locate the form you need by utilizing the search bar at the top of the page.

- View it (if this feature is available) and read the accompanying description to ascertain whether Required Foreclosure With Mortgage is what you’re looking for.

- Initiate your search again if you require any additional template.

- Create a free account and select a subscription plan to purchase the form.

- Click Buy now. Once the payment is completed, you can download the Required Foreclosure With Mortgage, fill it out, print it, and send it or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

Typically, being just one payment behind can lead to notices from your lender, but foreclosure usually occurs after three to six missed payments. It's vital to respond to any notices and communicate with your lender to explore options. Delaying action may result in a required foreclosure with mortgage. Utilizing the resources available through US Legal Forms can help you manage your situation effectively.

The 37 day foreclosure rule is a guideline that states you may receive a notice of default after missing your mortgage payment for 37 days. This is a critical point in the foreclosure process, as it marks the beginning of formal notification. Understanding this timeline is essential for taking appropriate action to address your mortgage issues. US Legal Forms offers tools and information to help you deal with the required foreclosure with mortgage process.

Most lenders allow you to miss about three payments before initiating foreclosure proceedings. However, this varies by lender and state regulations. Missing payments can lead to a serious risk of losing your home, so it's best to act quickly if you're struggling. Resources from US Legal Forms can guide you through the required foreclosure with mortgage steps to avoid this situation.

You can generally go about three to six months without paying your mortgage before facing serious consequences. After this period, your lender may initiate the foreclosure process. However, communicating with your lender can sometimes lead to alternatives that may prevent foreclosure. Using tools from US Legal Forms can help you navigate the required foreclosure with mortgage situation effectively.

The timeline for foreclosure can vary significantly depending on state laws and your lender's policies. Typically, the foreclosure process may begin after you have missed several payments, often around three to six months. It's crucial to understand that once the process starts, it may take several months to complete. Engaging with resources like US Legal Forms can provide clarity on the required foreclosure with mortgage process.

You cannot purposely foreclose on a house as a means of financial strategy. A foreclosure occurs when a lender takes possession of a property due to the borrower's failure to meet mortgage payments. However, if you are facing financial difficulties, you may explore options like a required foreclosure with mortgage assistance. Platforms like US Legal Forms can help you navigate these options legally and effectively.

Yes, you can obtain a mortgage to buy a foreclosure, but it may require some additional steps. Lenders may have specific requirements for properties in foreclosure, including an appraisal and inspection. Using a platform like USLegalForms can help you navigate the documentation needed for a required foreclosure with mortgage, making the process smoother.

Typically, a lender may start the foreclosure process after a homeowner has missed three to six months of mortgage payments. The timeline can vary based on state laws and lender policies. It is critical to address any financial difficulties early on to avoid the required foreclosure with mortgage and explore alternatives.

A home typically goes into foreclosure when the homeowner cannot make their mortgage payments for an extended period. Factors such as job loss, medical emergencies, or unexpected expenses can lead to missed payments. Once a homeowner defaults, the lender may initiate a required foreclosure with mortgage to reclaim the property.