Sample Hardship Letter For Loss Of Income For Rent

Description

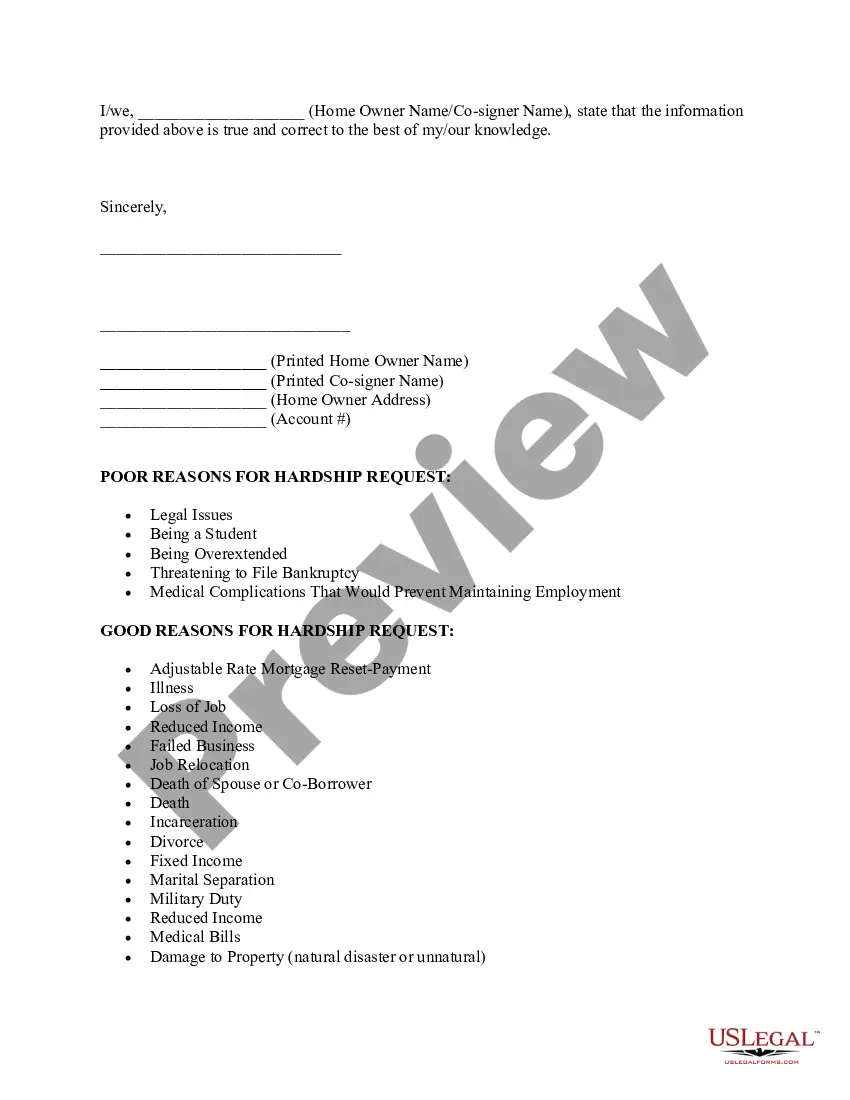

How to fill out Hardship Letter To Mortgagor Or Lender To Prevent Foreclosure?

Getting a go-to place to access the most current and appropriate legal samples is half the struggle of working with bureaucracy. Finding the right legal documents requirements precision and attention to detail, which is why it is crucial to take samples of Sample Hardship Letter For Loss Of Income For Rent only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You can access and see all the information regarding the document’s use and relevance for the situation and in your state or county.

Take the following steps to complete your Sample Hardship Letter For Loss Of Income For Rent:

- Use the library navigation or search field to locate your template.

- View the form’s description to see if it suits the requirements of your state and area.

- View the form preview, if available, to make sure the form is the one you are searching for.

- Go back to the search and find the correct document if the Sample Hardship Letter For Loss Of Income For Rent does not suit your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Select the pricing plan that fits your preferences.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by selecting a transaction method (credit card or PayPal).

- Select the document format for downloading Sample Hardship Letter For Loss Of Income For Rent.

- When you have the form on your gadget, you can modify it using the editor or print it and finish it manually.

Remove the hassle that comes with your legal paperwork. Check out the extensive US Legal Forms library where you can find legal samples, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Tennessee is a deed of trust state. However, a mortgage is enforceable. The trustee must be a resident of Tennessee or a corporation domiciled in Tennessee.

Tennessee is a deed of trust state. However, a mortgage is enforceable. The trustee must be a resident of Tennessee or a corporation domiciled in Tennessee.

Formatting Requirements for Tennessee Deeds Paper. Tennessee deeds should be printed on paper not smaller than 8½ × 11 inches (letter size) and not larger than 8½ × 14 inches (legal size). ... Text. ... Margins. ... English Language. ... Legibility. ... Title. ... Current Owner and New Owner Identifying Information. ... Granting Clause.

Capp (1893) 99 Cal. 153, 157.) Next, the Statute of Frauds requires that the document be signed by the party whom the document is being enforced against. Therefore, a deed of trust needs to be signed by the trustor.

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

There are three parties involved in a deed of trust: Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

Signing the Deed of Trust Everyone who is on the title of the property is required to sign the deed of trust. There are exemptions. In a "purchase money mortgage" transaction in which only one spouse owns the property, the other spouse is not required to sign the deed of trust.