Title: Example Letter Explaining Financial Hardship: Comprehensive Guide and Sample Templates Introduction: Financial hardship is a challenging situation that many individuals and families may face at some point in their lives. When dealing with such circumstances, it's crucial to communicate your financial difficulties effectively, especially to creditors, lenders, or relevant institutions. In this article, we will provide a detailed description of what an example letter explaining financial hardship entails, important keywords to include, and different types of letters you may encounter. I. Understanding a Letter Explaining Financial Hardship: — Definition and Purpose: An example letter explaining financial hardship is a formal document that communicates your current financial constraints and provides a comprehensive explanation of the challenges you are experiencing. The intent is to seek leniency, understanding, or assistance from relevant parties such as lenders, creditors, landlords, or employers. — Key Elements: A well-crafted letter should include essential elements such as a clear introduction, an explanation of the financial hardship, supporting documentation (if applicable), proposed solutions, and a polite closing. II. Essential Keywords and Phrases: 1. Financial Hardship: Describe your financial difficulties in detail, including income loss, medical emergencies, job loss, natural disasters, etc. 2. Impact: Highlight how these financial challenges have affected your ability to meet financial obligations or maintain stability. 3. Commitment to Resolution: Emphasize your commitment to overcoming the hardship by explaining any proactive steps you have taken or plan to take to address the situation (budgeting, seeking employment, cutting expenses, etc.). 4. Seeking Assistance: Express your willingness to work with the recipient in finding a mutually beneficial solution, be it through a loan modification, forbearance, or alternative payment arrangements. 5. Supporting Documentation: Depending on the situation, provide relevant supporting documents, such as medical bills, termination notices, pay stubs, or bank statements, to validate your claims. III. Different Types of Example Letters: 1. Mortgage Hardship Letter: Used when requesting assistance from a mortgage lender, explaining financial struggles to impact timely mortgage payments. 2. Credit Card Hardship Letter: Written to credit card companies or financial institutions, explaining the inability to pay credit card debts due to financial hardship, seeking leniency, or alternative debt repayment plans. 3. Rental Hardship Letter: Addressed to landlords or property management companies, explaining financial challenges that prevent timely rent payments, requesting a temporary reduction or revised payment schedules. 4. Student Loan Hardship Letter: Sent to student loan services or financial aid offices, explaining financial difficulties affecting regular loan repayment, requesting restructuring, forbearance, or loan forgiveness options. 5. Medical Bill Hardship Letter: Used to communicate financial burdens resulting from medical emergencies or high medical bills, seeking medical debt forgiveness, extended payment terms, or financial aid. Conclusion: Crafting an effective example letter explaining financial hardship is crucial when seeking understanding, assistance, or leniency from relevant parties. By utilizing appropriate keywords, addressing specific situations, and providing necessary documentation, you can increase the chances of finding an amicable resolution. Use the types of letters mentioned above as templates and customize them according to your specific situation. Remember to remain polite, concise, and professional throughout the letter.

Example Letter Explaining Financial Hardship

Description

How to fill out Example Letter Explaining Financial Hardship?

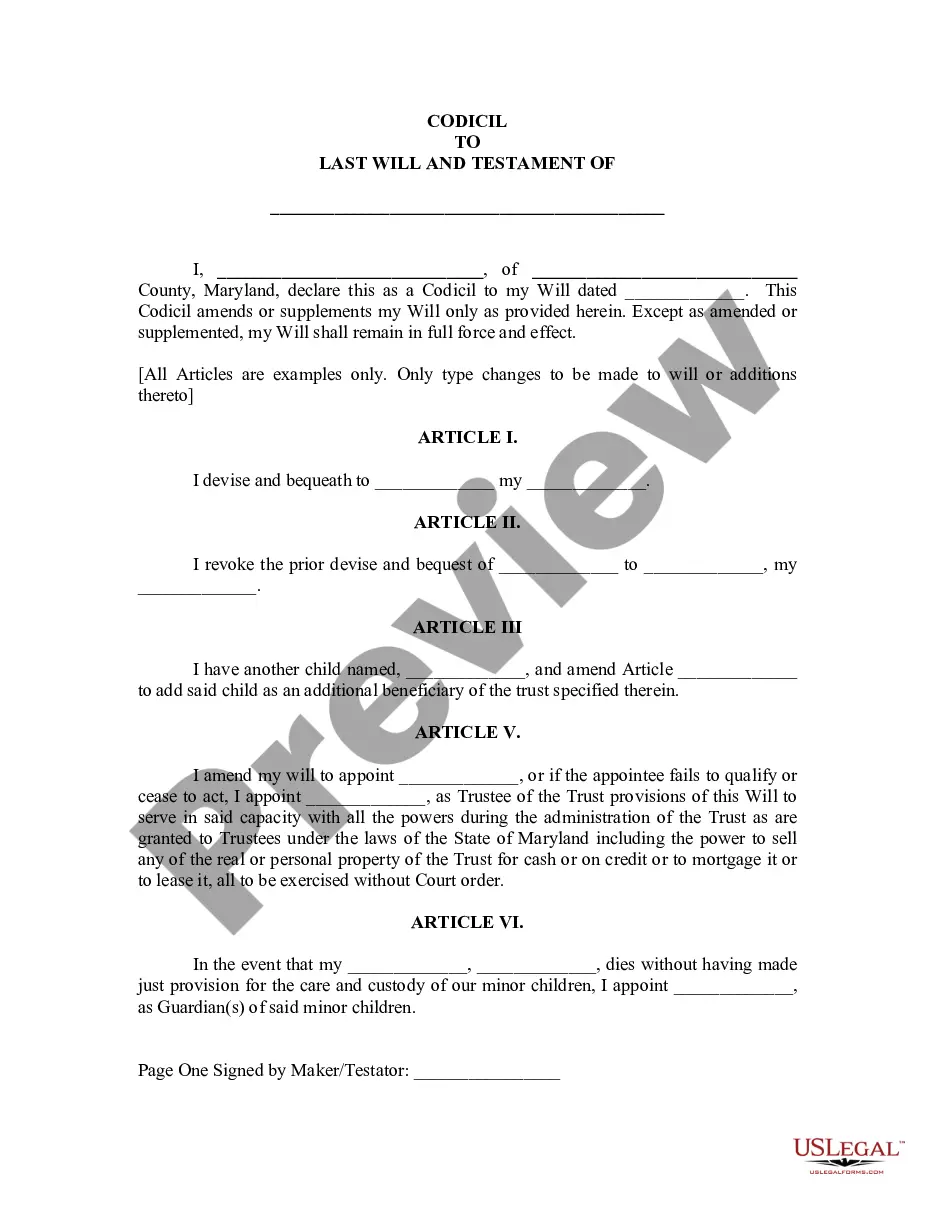

Getting a go-to place to take the most recent and appropriate legal templates is half the struggle of working with bureaucracy. Discovering the right legal papers demands precision and attention to detail, which is why it is vital to take samples of Example Letter Explaining Financial Hardship only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and view all the information about the document’s use and relevance for your situation and in your state or county.

Consider the following steps to finish your Example Letter Explaining Financial Hardship:

- Make use of the library navigation or search field to find your template.

- View the form’s information to check if it suits the requirements of your state and region.

- View the form preview, if available, to make sure the template is the one you are looking for.

- Go back to the search and locate the right document if the Example Letter Explaining Financial Hardship does not suit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Complete your purchase by picking a payment method (credit card or PayPal).

- Choose the file format for downloading Example Letter Explaining Financial Hardship.

- Once you have the form on your gadget, you can alter it with the editor or print it and finish it manually.

Get rid of the hassle that comes with your legal documentation. Explore the extensive US Legal Forms library to find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

Example letter I am sorry that I am unable to keep up my monthly payments to your company. I'm sick and unable to work. I've claimed benefits and I'm waiting to hear the outcome of my claim. My situation is unlikely to improve for at least 3 months.

Keep your hardship letter brief and to the point: four paragraphs is ideal, and no more than two pages. Be sure to include: Homeowner name(s), address(s), and phone number(s) and relevant loan number(s). Relevant details about the loan or property, such as the number of months delinquent, property value, or equity.

To Whom It May Concern: I am writing this letter to explain my unfortunate set of circumstances that have caused us to become delinquent on our mortgage. We have done everything in our power to make ends meet but unfortunately we have fallen short and would like you to consider working with us to modify our loan.

Keep your hardship letter brief and to the point: four paragraphs is ideal, and no more than two pages. Be sure to include: Homeowner name(s), address(s), and phone number(s) and relevant loan number(s). Relevant details about the loan or property, such as the number of months delinquent, property value, or equity.

Lenders may use them to determine whether or not to offer relief through reduced, deferred, or suspended payments. Hardship Examples. ... Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan.