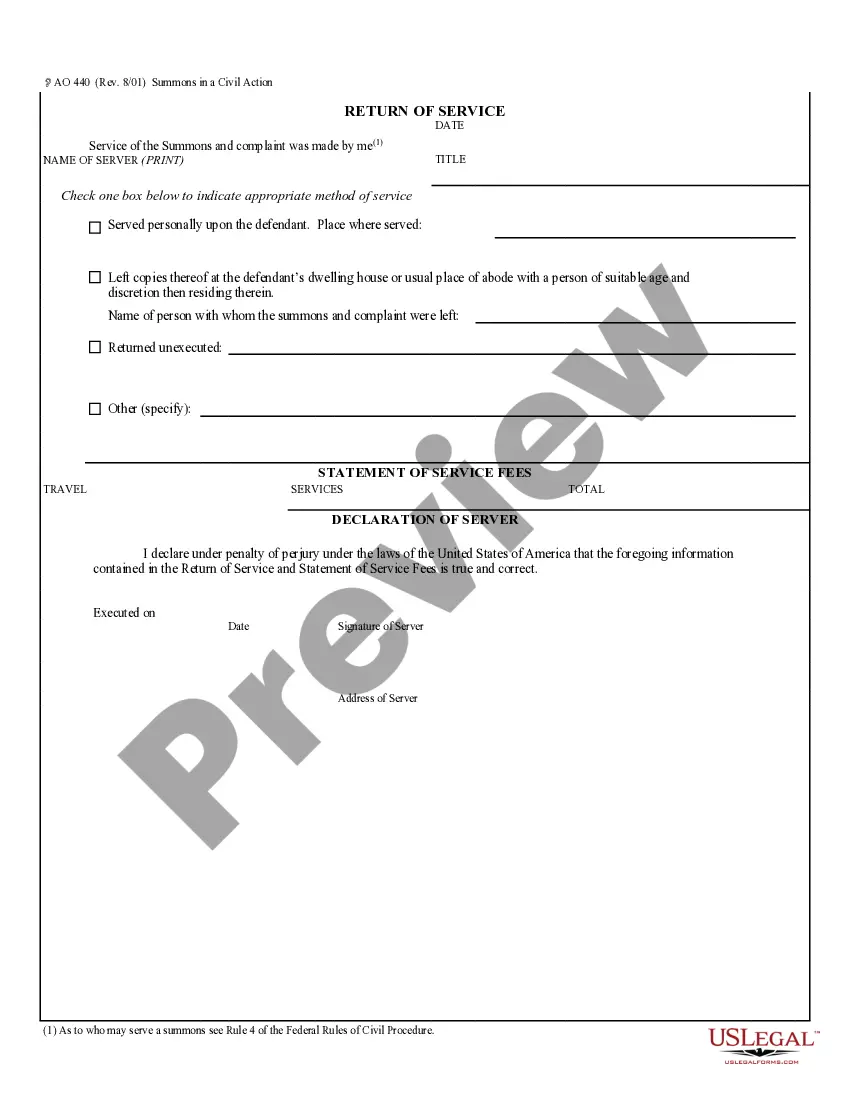

Ao 440 Withholding Tax

Description

How to fill out AO-440 Summons In A Civil Action?

Managing legal documents can be daunting, even for the most experienced professionals.

When you are in search of an Ao 440 Withholding Tax and lack the time to invest in finding the accurate and current version, the process may be challenging.

Benefit from a valuable repository of articles, guides, handbooks, and resources related to your situation and needs.

Save effort and time in searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Review feature to obtain the Ao 440 Withholding Tax.

Enjoy the US Legal Forms online repository, backed by 25 years of experience and trustworthiness. Streamline your daily document management in a seamless and user-friendly manner today.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents section to view the documents you have previously saved and manage your folders as needed.

- If it is your first time using US Legal Forms, create an account and gain unlimited access to all the features of the library.

- Here are the steps to follow after downloading the required form.

- Confirm that this is the correct document by previewing it and examining its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any requirements you may have, from personal to business paperwork, all in one location.

- Utilize cutting-edge tools to fill out and oversee your Ao 440 Withholding Tax.

Form popularity

FAQ

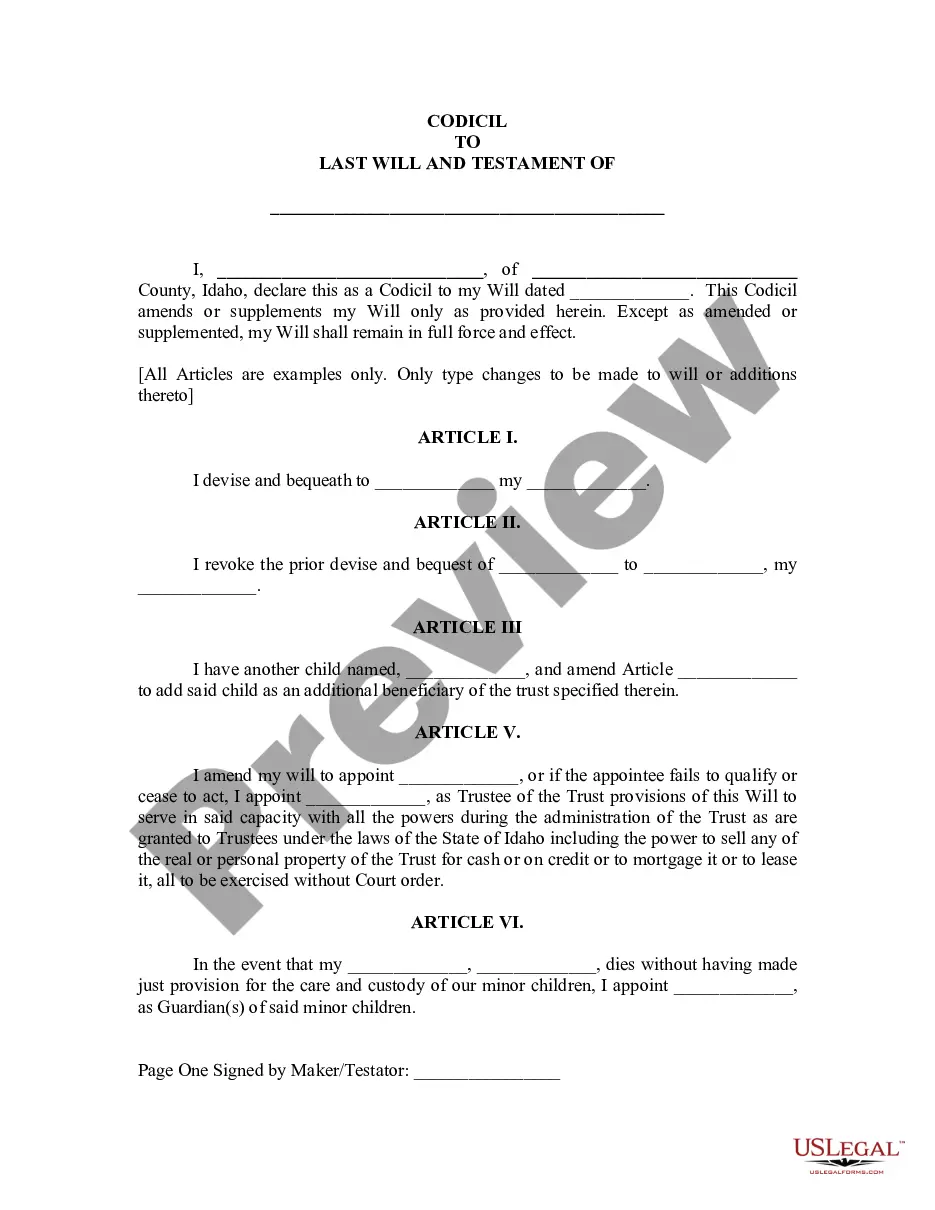

In order to properly write a cause of action, several things must be included. The names of the Plaintiff and Defendant. The legal means by which the Plaintiff is bringing the lawsuit. Be sure to only include the facts, not opinions. ... Offer expert opinions and lay out the evidence. ... Request of relief.

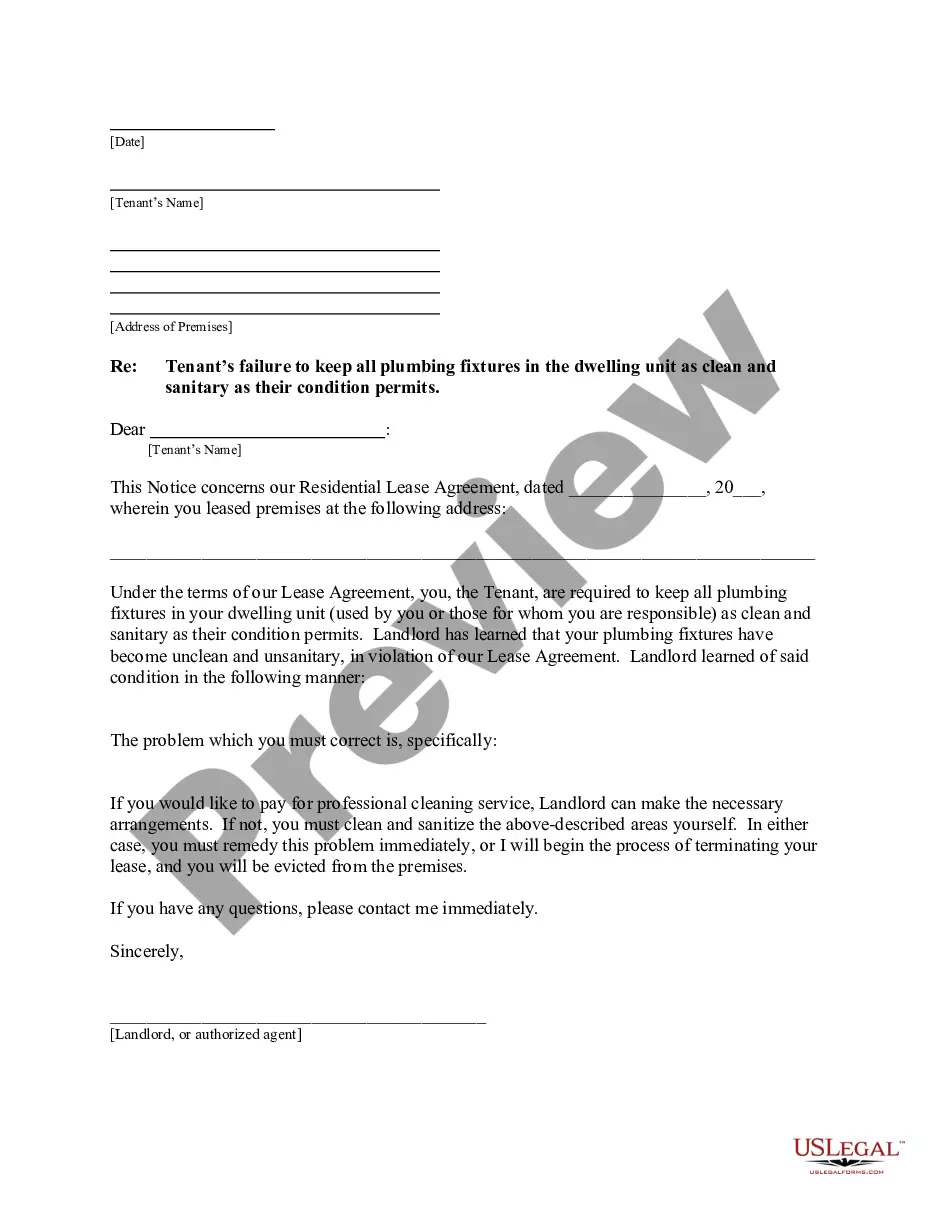

Service upon an officer, sued in his/her official capacity, or upon an agency or corporation of the United States is accomplished by serving the United States (see USAM 4-2.310), and by sending a copy of the summons and of the complaint by registered or certified mail to the officer, agency, or corporation. See Fed. R.

Without personal jurisdiction over a party, a court's rulings or decrees cannot be enforced upon that party, except by comity; i.e., to the extent that the sovereign which has jurisdiction over the party allows the court to enforce them upon that party.

In many lawsuits there are several causes of action stated separately, such as fraud, breach of contract, and debt, or negligence and intentional destruction of property.

You must fill out an Answer, serve the plaintiff, and file your Answer form with the court. Generally, this is due within 30 days after you were served. If you don't, the plaintiff can ask for a default. If there's a default, the court won't let you file an Answer and can decide the case without you.