Participation Agreement Form For Lending Money

Description

How to fill out Plan Participation Agreement Between Blue Cross Blue Shield Assoc. And Blue Cross Blue Shield Of MO Regarding Healthcare Benefit Provisions?

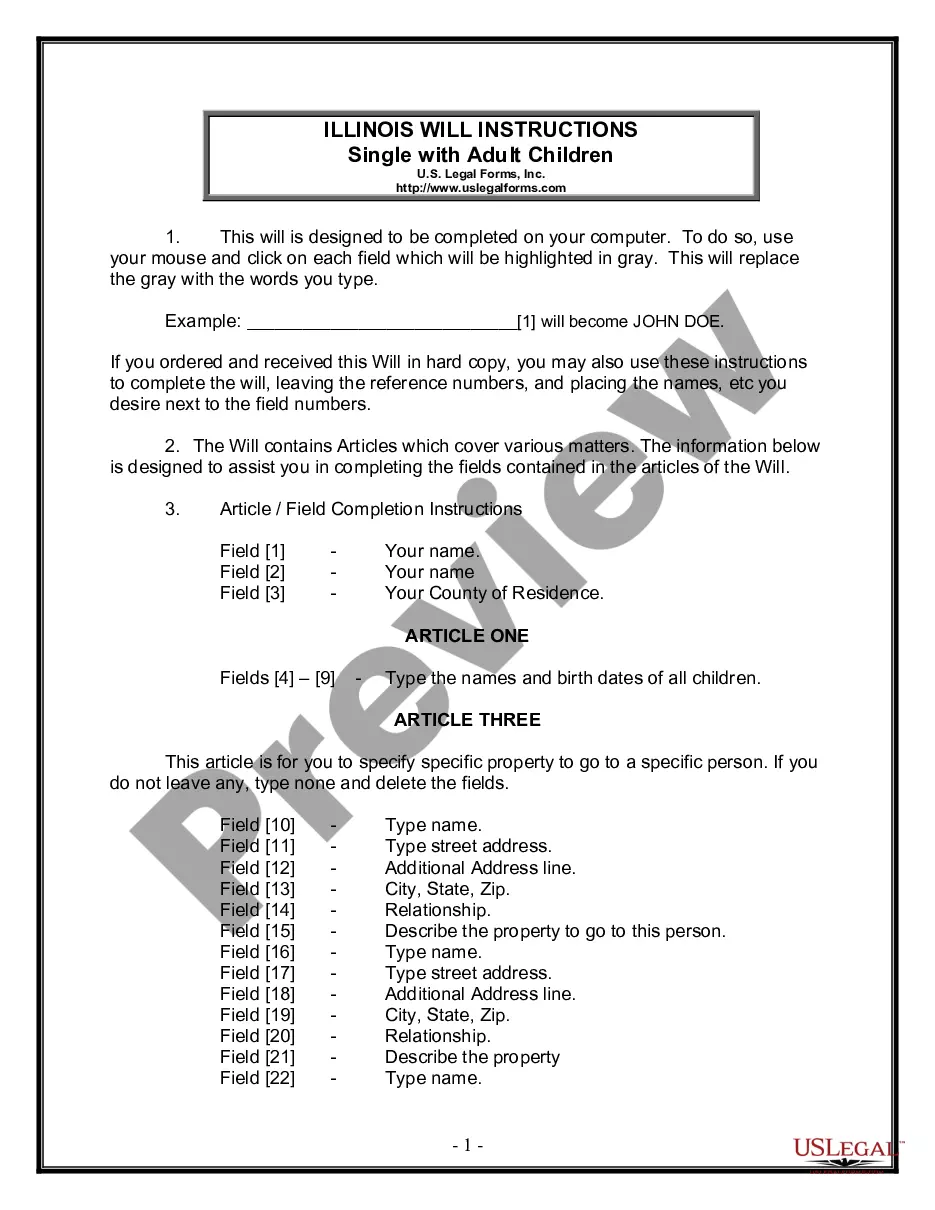

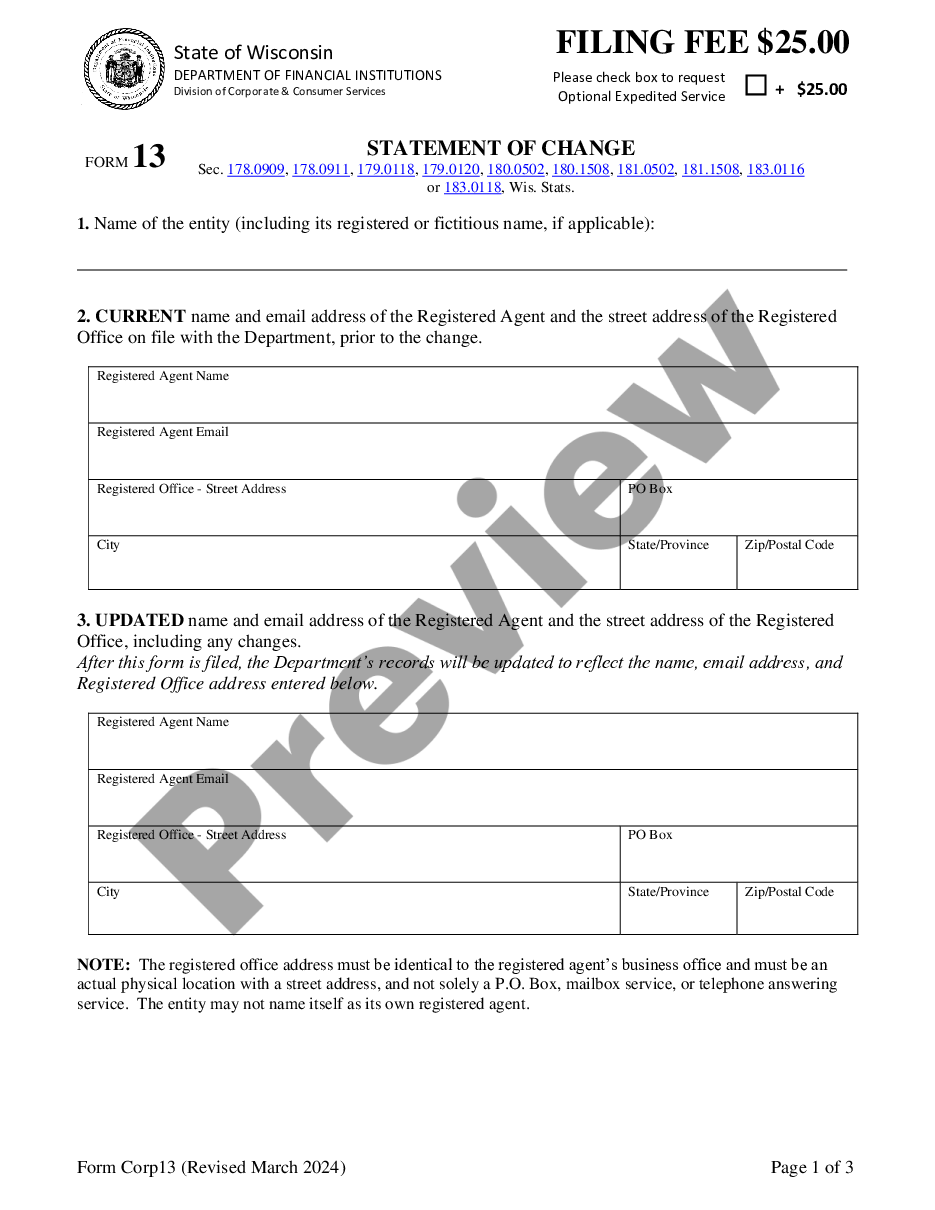

How to obtain professional legal documents that comply with your state laws and prepare the Participation Agreement Form for Lending Money without hiring a lawyer.

Many online services provide templates to address a variety of legal situations and requirements.

However, it may take time to determine which available samples meet both your usage needs and legal criteria.

Download the Participation Agreement Form for Lending Money by clicking the appropriate button next to the file name. If you do not possess an account with US Legal Forms, follow the instructions below.

- US Legal Forms is a dependable platform that assists you in locating official documents created in line with the latest state law revisions and helps you save on legal fees.

- US Legal Forms is not just any regular document library.

- It contains over 85,000 verified templates for various business and personal circumstances.

- All documents are categorized by area and state to facilitate a faster and more efficient search process.

- It also offers integration with advanced tools for PDF editing and eSignature, enabling users with a Premium subscription to swiftly complete their documentation online.

- Minimal effort and time are required to acquire the necessary paperwork.

- If you have an account already, Log In and confirm that your subscription is current.

Form popularity

FAQ

Participation mortgages reduce the risk to participants and allow them to increase their purchasing power. Many of these mortgages, therefore, tend to come with lower interest rates, especially when multiple lenders are also involved.

A loan participation involves a sharing or selling of ownership interests in a loan between two or more financial institutions. Normally, but not always, a lead bank originates the loan, closes the loan and then sells ownership interests to one or more participating banks.

Loan Participation Funds generally purchase loans made by banks and other financial institutions that pay interest based on a floating rate that adjusts periodically based on a publicly available, short-term, referenced interest rate.

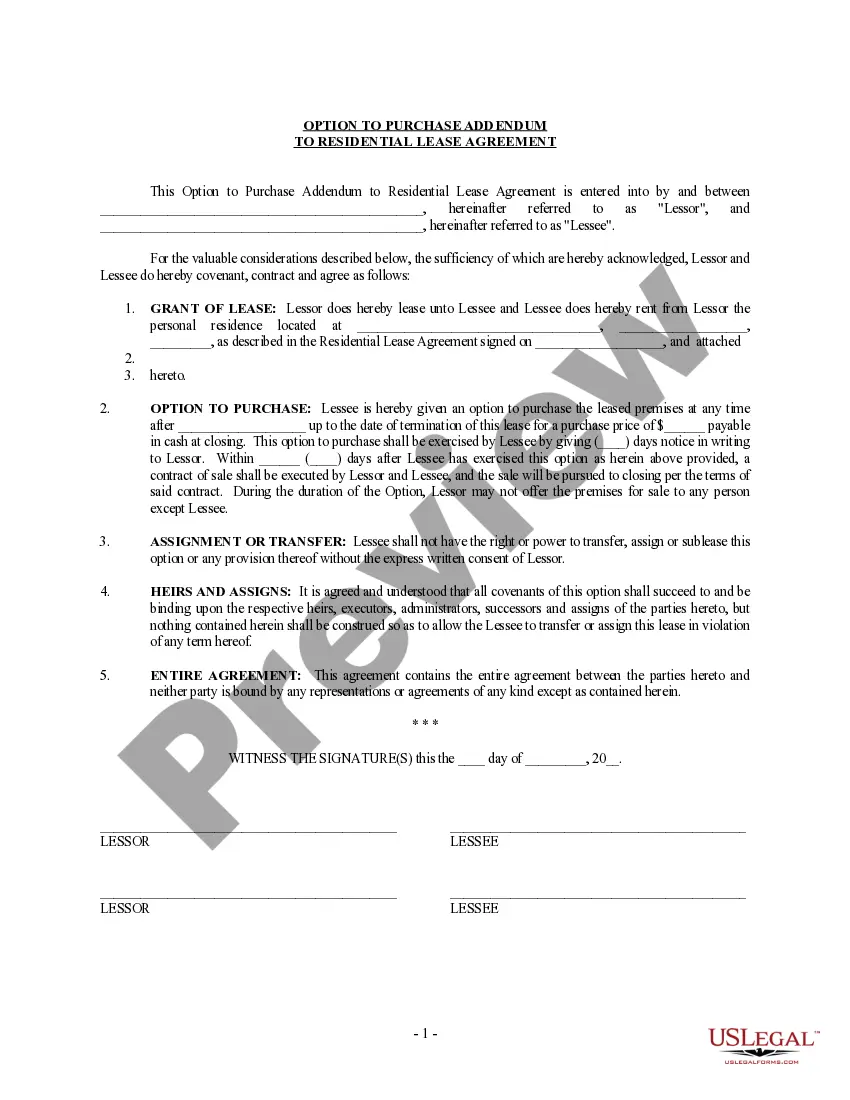

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

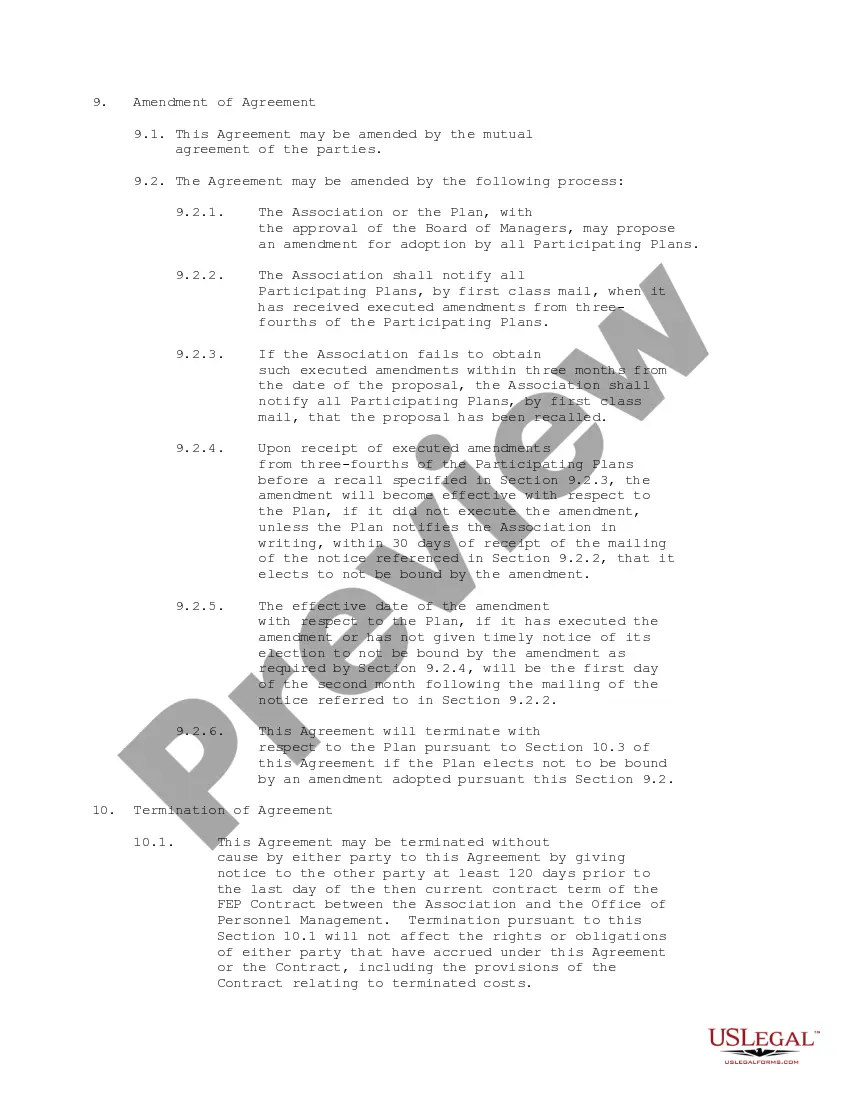

Generally, participation agreements involve one or more participants who purchase an interest in the underlying loan, but a single lender, the lead lender, retains control over the loan and manages the relationship with the borrower.