Employees With Retirement Plan

Description

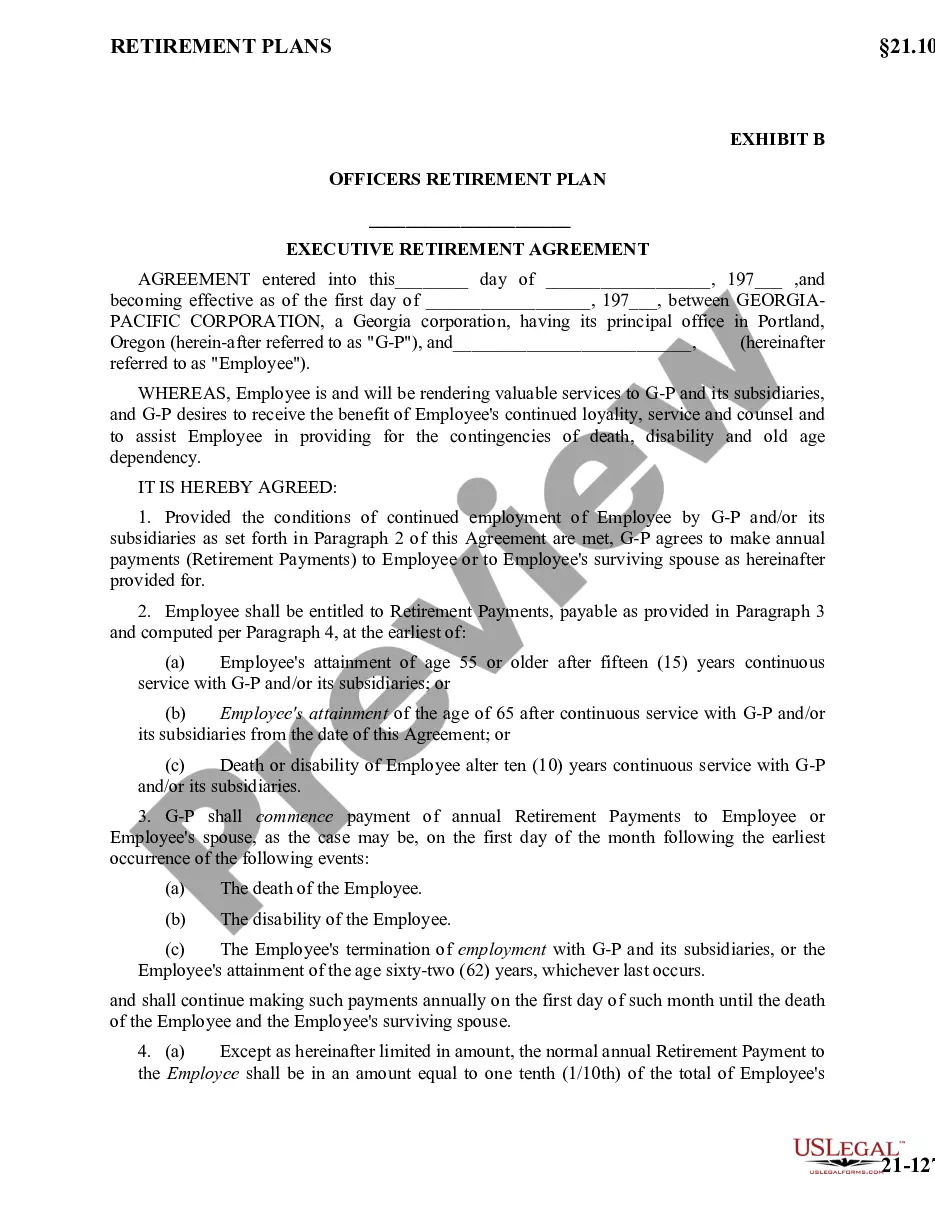

How to fill out Employee Retirement Agreement?

It’s clear that you cannot become a legal expert right away, nor can you easily learn how to promptly prepare Employees With Retirement Plan without possessing a specific set of abilities. Crafting legal documents is a lengthy process that necessitates certain education and expertise. So why not entrust the setup of the Employees With Retirement Plan to the specialists.

With US Legal Forms, one of the most all-encompassing libraries of legal documents, you can find anything from court filings to templates for in-office correspondence. We understand how crucial compliance and conformity with federal and state laws and regulations are. That’s why, on our site, all templates are location-specific and current.

Here’s how you can begin using our website and obtain the form you require in just a few moments.

- Search for the document you need by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to ascertain if Employees With Retirement Plan is what you’re looking for.

- Start your search anew if you need another form.

- Create a free account and choose a subscription plan to purchase the form.

- Click Buy now. After the transaction completes, you can download the Employees With Retirement Plan, complete it, print it, and deliver it by mail to the necessary individuals or organizations.

Form popularity

FAQ

If your job does not have a pension plan, consider creating a personal retirement strategy by exploring options like individual retirement accounts or other investment vehicles. You can consult with financial advisors for tailored advice on how to build a stable retirement fund. Additionally, advocate for your employer to consider implementing a pension plan, as complete employee support can make a difference.

If your employer does not offer a retirement plan, focus on building your own savings through products like IRAs or Roth IRAs. Also, research community resources or workshops that may help you learn more about personal finance and investing. It’s beneficial to seek alternatives that can provide security for employees with retirement plans even if their employer does not offer one.

To offer retirement plans to employees, employers should first assess their budget and define the type of plan that aligns with their goals. Next, they can research different plans available, such as 401(k)s or simple IRAs, and seek assistance from financial advisors. Finally, it’s vital to communicate the details and benefits effectively to employees with retirement plans, ensuring they understand the value of participation.

Yes, it is generally legal for employers to ask employees about their retirement plans, but it should be approached with care. Understanding an employee's retirement timeline can help employers with succession planning and resource allocation. However, it is essential to maintain a respectful dialogue and ensure that employees feel comfortable discussing their future.

Employers are not legally required to provide retirement plans for their employees, but many do so to attract and retain talent. Offering a retirement plan can also provide financial security for employees with retirement plans, making a workplace more competitive. If your employer offers such plans, take advantage of the benefits they provide.

If your employer does not have a retirement plan, it can impact your long-term savings. You still have options, such as setting up an individual retirement account (IRA) where you can save independently. Additionally, consider speaking to your employer about the benefits of offering a retirement plan to employees, as it can enhance their overall compensation package.

You generally need to report distributions from your retirement plan on your taxes. If you make withdrawals or receive payments, these should be included in your taxable income. Employees with retirement plans need to understand reporting requirements to ensure they meet tax obligations and avoid penalties.

To report requirements of a qualified retirement plan, you need to file Form 5500 with the IRS. This form outlines plan details, such as participant numbers and financial conditions. Employees with retirement plans should ensure compliance with these requirements to maintain tax advantages and protect their benefits.

Yes, you typically receive a tax form for retirement plans, such as a 1099-R for distributions from retirement accounts. This form provides crucial information on how much you withdrew, making it easier to file your taxes accurately. Employees with retirement plans should carefully review these forms to ensure accuracy.

Yes, you need to report your retirement earnings on your taxes. This includes any withdrawals from your retirement plan, which can be subject to income tax. Employees with retirement plans should keep accurate records to report all income obtained from these sources.